Medicare Supplement Insurance (also called Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What is the best Medicare supplement insurance plan?

- United Healthcare: 26%

- Humana: 18%

- BCBS plans: 15%

- CVS (Aetna): 11%

- Kaiser Permanente: 7%

- Centene: 4%

- Cigna: 2%

- Other companies: 18%

What are the top Medicare supplement plans?

Plan F and Plan G are the most comprehensive Medicare Supplement Insurance plans ...

Are Medicare supplement insurance plans worth it?

To help answer it for yourself, it would be wise to compare Medicare Supplement plans to the other two options available to you: Doing nothing, and sticking with Original Medicare, and; Medicare Advantage plans; If you can afford the monthly premiums, Medicare Supplement plans may very well be worth the price. This is because it can limit, or eliminate, your out-of-pocket medical costs.

Are supplemental Medicare plans worth the cost?

So to answer the question – yes, Medicare supplement insurance is usually worth the cost. There are several different plans to choose from and each will fill in most or all of the gaps in Medicare. In this way, you can know exactly what your out-of-pocket exposure is each year.

Are Medicare Supplement plans the same in every state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Does Nevada offer Medicare Advantage plans?

There are four types of plans available in Nevada's Medicare Advantage program: Health maintenance organization (HMO), preferred provider organization (PPO), private fee-for-service (PFFS), and special needs plan (SNP). Each offers a different level of flexibility in your network of care providers and varies in price.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

What Medicare Supplement plans are no longer available?

In 2010, Plans E, H, I, and J became no longer available on the market due to the Medicare Improvements for Patients and Providers Act of 2008 (MIPPA). In 2020, Plans C, F, and High Deductible F became unavailable to newly eligible beneficiaries per the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

What is the phone number for Medicare?

(800) 633-4227Centers for Medicare & Medicaid Services / Customer service

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Why is Medigap F going away?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

How much does AARP Medicare Supplement plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How old do you have to be to get Medicare in Nevada?

Nevada Medicare Supplement plans require you to be at least 65 years of age. Also, you need to be beginning Part B coverage and not enrolled in an advantage plan. The Medicare Supplement Open Enrollment Period is six months long and begins when Part B and the first day of your birthday month occur. People that retire after 65 may be eligible ...

How many Medigap plans are there?

Various private insurance carriers offer up to 10 different Medigap Plans. Regardless of which company you choose to enroll with, the insurance benefits stay the same. The most commonly purchased policies are Plan N, Plan G, and Plan F. These plans are standard across the country because they offer the same benefits in every state.

Why are Medigap plans standard across the country?

These plans are standard across the country because they offer the same benefits in every state. Beneficiaries of Medigap have access to doctors in any state that accepts Medicare. With Medigap, you can go straight to a specialist with any issue or concern.

Can you leave Medigap if you have employer group coverage?

If you have employer group coverage that is primary to Medicare, you can voluntarily leave the Plan and use Guaranteed Issue rights to purchase a Medigap policy.

Is Medicare available for people under 65?

Medigap Eligibility for Disabled Individuals Under 65. In some states, individuals with End-Stage Renal Disease are eligible for disability under the age of 65. Those receiving SSDI benefits for 24-months are also eligible for Medicare. Insurance companies for Medigap don’t tailor coverage to beneficiaries under age 65.

Does Nevada have Medicare Supplement?

Nevada Medicare Supplement Plans exist to provide extra coverage alongside Medicare. Private insurance companies offer these supplemental plans in Nevada. The benefit of carrying a Medigap Plan is that it provides coverage for what Original Medicare won’t. Medigap coverage is the policy most agents are recommending to seniors on Medicare.

Does smoking increase your health insurance premium?

Smoking can also increase your health insurance premium. Premiums will go up as you age and if overall claim expenses are higher than anticipated. Insurance companies can base rates on the age you buy the policy, your current age, or on geographical factors. All 3 rating methods are used in this state.

How long does Medicare coverage last in Nevada?

Open Enrollment for Medicare Supplement plans in Nevada begins the month you are both age 65 or older and enrolled in Part B, and extends for six months. During this period, you have guaranteed issue rights, meaning you can buy any plan sold in Nevada, and you can’t be charged a higher premium based on your health status.

What is community rated insurance?

Community rated—Everyone pays the same premium regardless of age. Issue-age rated—Your premium is based on your age when you buy the plan. Attained-age rated—The premiums typically start out lower than community- or issue-age-rated plans, but as you get older, they get progressively more expensive.

Does Medicare cover out of pocket expenses in Nevada?

In fact, there’s no maximum limit on your out-of-pocket expenses under Original Medicare.

Does Medicare cover Nevada?

All of the Medicare Supplement plans in Nevada generally cover 100% of your Medicare Part A hospital coinsurance amounts, plus an extra 365 days after your Part A benefits ...

Is there a maximum amount of Medicare Supplements in Nevada?

In fact, there’s no maximum limit on your out-of-pocket expenses under Original Medicare. That’s where Medicare Supplement plans in Nevada come in. If you’re considering Medicare Part A and Part B for your Medicare coverage, a Medicare Supplement plan may help you better budget for your health care expenses.

Does Medicare Supplement pay for out-of-pocket expenses?

Note, however, that none of the plans cover your Medicare Part A or Part B premiums, or any out-of-pocket expenses associated with prescription drugs or Part D out-of-pocket expenses. Medicare Supplement plans generally only pay for expenses associated with covered services under Medicare Part A and Part B.

What is Medicare Supplement Plan Nevada?

Medicare Supplement plans in Nevada help Medicare beneficiaries control the ever-rising cost of health care. Medicare Supplemental Insurance, also called Medigap health plans, pays for out-of-pocket costs such as deductibles and copays that the federal Medicare program doesn’t cover.

Can you sell Medicare Supplement insurance?

As of Jan. 1, 2020, federal law changed. A Medicare insurance company cannot sell a Medicare Supplement insurance policy that covers the Part B deductible (such as Medicare Plan F) to a beneficiary who is newly eligible for coverage. That means that Medigap Plan G is now the gold standard for new enrollees because it offers the broadest coverage at a reasonable price. There is not a deductible on Medicare Plan G, you are simply required to pay the Medicare Part B deductible before outpatient care is covered. For 2021, the Part B deductible is $203.00.

NV Medigap Enrollment Statistics

According to AHIP, 26.6 percent of Medicare beneficiaries in Nevada were also enrolled in a Medigap plan in 2015. Certain Medigap plans sold in Nevada are more popular than others.

Medicare Supplement Insurance Pricing Methods

Medigap pricing methods are important because they dictate how your premiums may increase in future years. There are 3 different pricing methods:

Under-65 Enrollment Rules

Although Medicare Supplement insurance is primarily for senior citizens, it’s also available to disabled people and those with end-stage renal disease (ESRD) in some states. Each state’s insurance department dictates the rules governing Medicare beneficiaries under the age of 65.

Learn More

To learn more about Medicare Supplement Insurance, read through the guides below.

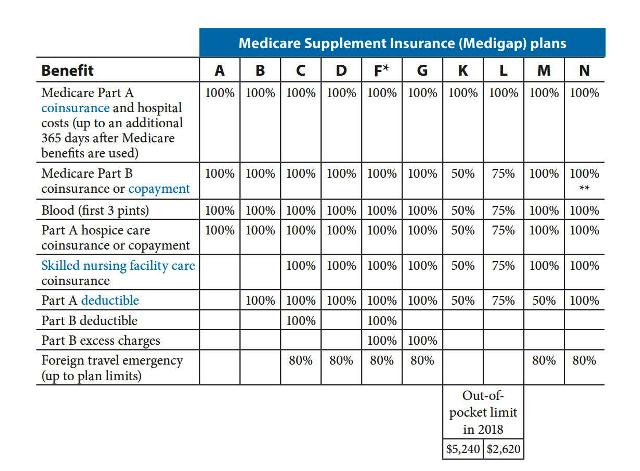

Medigap Benefits by Plan Type

Altogether, there are 10 different Medigap plans available in Nevada, and each of these plans includes an identical foundation of benefits, including coverage for:

Medigap Plan Popularity

Medigap plans vary in popularity, but Plans F, G and N top the list in many places. That’s probably because these policies often cost less than other Medigap plans, which can make them appealing to beneficiaries who aren't sure supplemental insurance fits into their budget.

Choosing the Best Medigap Plan for You

When choosing the best Medigap plan, you should always consider the following elements:

What Happens When the Open Enrollment Period Ends?

The Medigap open enrollment period is the only time Medigap coverage is guaranteed to all applicants at premiums that aren’t determined by the quality of the applicant's health.

In this Article

When Can You Enroll? Most Popular Plans How Do You Choose? How Much It Costs Want to Change Your Policy? What Are Alternatives? Resources Next Steps

What Are Medicare Supplement Plans in Nevada?

Nevada Medicare Supplement plans (also known as Medigap policies) help pay for medical costs that aren’t covered by Original Medicare ( Medicare Parts A and B ). Original Medicare has deductibles and coinsurance that can leave you with significant out-of-pocket costs unless you also have a Medigap policy.

When Can You Enroll in Medigap?

You can enroll in Medicare Supplement insurance at any time. The best time to enroll, however, is during your Medigap Open Enrollment Period. This period lasts for six months and starts when you are both age 65 or older and enrolled in Medicare Part B .

What Are the Most Popular Medicare Supplement Plans?

Nevada doesn’t require insurers to sell plans to people under age 65, so if you’re younger than that and have Medicare due to a disability or end-stage renal disease (ESRD), you may not be able to purchase a Medigap policy until you turn 65.

How Do You Choose a Medicare Supplement Plan?

The first step in choosing a Medigap plan is to decide which lettered plan you might want, A through N. Since the plans are standardized by letter, they will have the same benefits regardless of which insurance company you choose. However, the prices of the plans will differ from company to company.

How Much Do Medigap Policies Cost?

Here are examples of the price of monthly premiums for popular Medicare Supplement plans in Nevada.

What If You Want to Change Your Medigap Policy?

You can change your Medigap policy at any time. Keep in mind that unless you have guaranteed issue rights, insurance companies can use your medical history to decide whether or not to accept your application, and if they do accept it, they can also charge you more based on the status of your health.

What is Medicare Supplement?

Plans are standard, so different companies all offer the same benefits, but the premiums do vary based on a number of factors. Consider these facts in deciding if Medicare Supplement insurance for hospital and medical coverage is right for you:

What you should know

Every company offering Medicare Supplement insurance must offer Plan A. In addition, companies may have some, all, or none of the other plans . Plans are standardized, so different companies all offer the same benefits, but the premiums do vary based on a number of factors.

Additional Tip

Therefore, beneficiaries shop around to find a Supplement plan that is right for both their medical and financial needs. Starting Jan. 1, 2013, Medicare beneficiaries also have a yearly opportunity to compare supplement prices and switch companies. They must keep the same plan type or choose one with lesser benefits.