How do you calculate Medicare wages?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form. These matching numbers show that the Medicare tax is based on 100% of an employee’s earnings.

What wages are subject to Medicare tax?

What are Medicare Wages and Tips (W-2)? The “Medicare wages and tips” portion is box number 5 on the W-2 form. It indicates the total wages and tips that are subject to Medicare tax withholding. The number that is indicated in this Medicare wages and tips on box number 5 is typically the same as the “wages, tips, other compensation” section.

What percent of wages goes to Medicare?

Nov 24, 2003 · Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax. 2 Employers also...

Why are Medicare wages higher than wages?

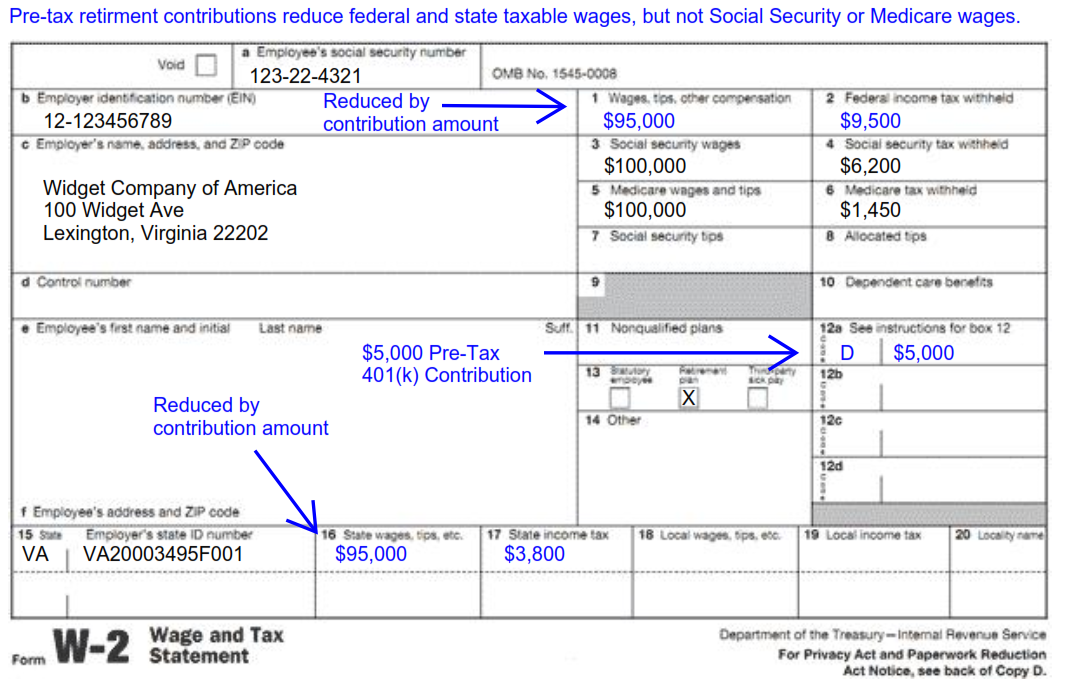

Jun 03, 2019 · The medicare wages and tips box of your W-2 is supposed to be the same your wages, tips, other compensation box. All this means is that your medicare tax is based on 100% of your earnings. Now, if there is a difference, it could be that you have a 401K, or 403K. If you add the amount from your 401 or 403 to box 1, it would probably equal box 5.

What is included in Medicare wages and tips?

Medicare wages and tips: The total wages, tips and other compensation that are subject to Medicare taxes. There is no limit on the amount of wages that are subject to Medicare taxes. Medicare tax withheld: The amount of Medicare tax withheld from your Medicare taxable wages, tips and other compensation.

What is Medicare wages and tips in w2?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes. The rate is 1.45% of the Medicare wage base.

What is excluded from Medicare wages and tips?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.Oct 31, 2018

Why are my Medicare wages higher than my actual wages?

The most common questions relate to why W-2 Wages differ from your final pay stub for the year, and why Federal and State Wages per your W-2 differ from Social Security and Medicare Wages per the W-2. The short answer is that the differences relate to what wage amounts are taxable in each case.

What are wages and tips?

Definition. Wages, tips and other compensation describes the total federal taxable income reported by your employer. The total dollar mount is a combination of your gross pay, plus any cash you received, plus any noncash benefits.

What is the difference between Medicare wages and gross wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

Does Medicare wages and tips include 401k?

However, certain pretax deductions are exempt from the FICA tax, which includes Social Security and Medicare taxes. These pretax deductions include retirement contributions, like 401(k) accounts and individual retirement accounts, as well as life insurance premiums.

Why are my Medicare wages lower than my regular wages?

There is no maximum wage base for Medicare taxes. Medicare wages are reduced by pre-tax deductions such as health/dental/vision insurances, parking and flex spending but not reduced by your contributions to a retirement plan (403b or 457.)

Is wages tips and other compensation gross or net?

All wages, salaries and tips you received for performing services as an employee of an employer must be included in your gross income.Feb 3, 2022

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is a 401(k) plan?

A 401 (k) is a qualified employer-sponsored retirement plan into which eligible employees can make salary deferral contributions. Earnings in a 401 (k) accrue on a tax-deferred basis.

What college did Julia Kagan graduate from?

She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. Learn about our editorial policies. Julia Kagan. Reviewed by.

Is there a limit on Medicare tax?

4 . Unlike the Social Security tax, there is no income limit on the Medicare tax.

What is Medicare payroll tax?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the "Medicare tax.". Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to retirees and the.

How is Medicare calculated on W2?

How are Medicare wages calculated on w2? It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee's Medicare wages as Medicare tax and submit a matching amount to cover the costs of the Medicare program. Click to see full answer.

What is the Social Security base for 2019?

The Social Security Wage Base for 2019 was $132,900. To determine Social Security and Medicare taxable wages on your W-2, again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable:

What to call if your W-2 does not match Social Security?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2, call Central Payroll, 617-495-8500, option 4 for assistance.

What to call if your W-2 does not match Box 1?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 1 Federal Wages and Box 16 State Wages on your W-2, call Central Payroll, 617-495-8500, option 4, for assistance.

What is Medicare wages and tips?

Medicare wages and tips: The total wages, tips and other compensation that are subject to Medicare taxes. There is no limit on the amount of wages that are subject to Medicare taxes. 6. Medicare tax withheld: The amount of Medicare tax withheld from your Medicare taxable wages, tips and other compensation.

What is HCRA contribution?

Health care (HCRA) and Dependent care (DepCare) contributions. All other pre-tax contributions. 2. Federal income tax withheld: The total amount of federal income tax that was withheld from your wages, tips, and other compensation. 3. Social security wages: Total wages that are subject to social security tax. 4.