When Medicare supplements its deductibles and copayments must align with benefits?

When Medicare adjusts its deductibles and copayments, Medicare supplement policies must align benefits with the adjustments. Which product supplements Medicare by offering benefits delivered through a network of health care providers? Medicare SELECT plan long-term care insurance Medicaid tax-qualified long-term care

What is a Medicare supplement insurance policy?

These supplemental plans may include those that are provided by an employer, Medigap plans, or supplemental health care coverage through Medicaid. Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance.

Why do Medicare select plans charge lower premiums than supplement policies?

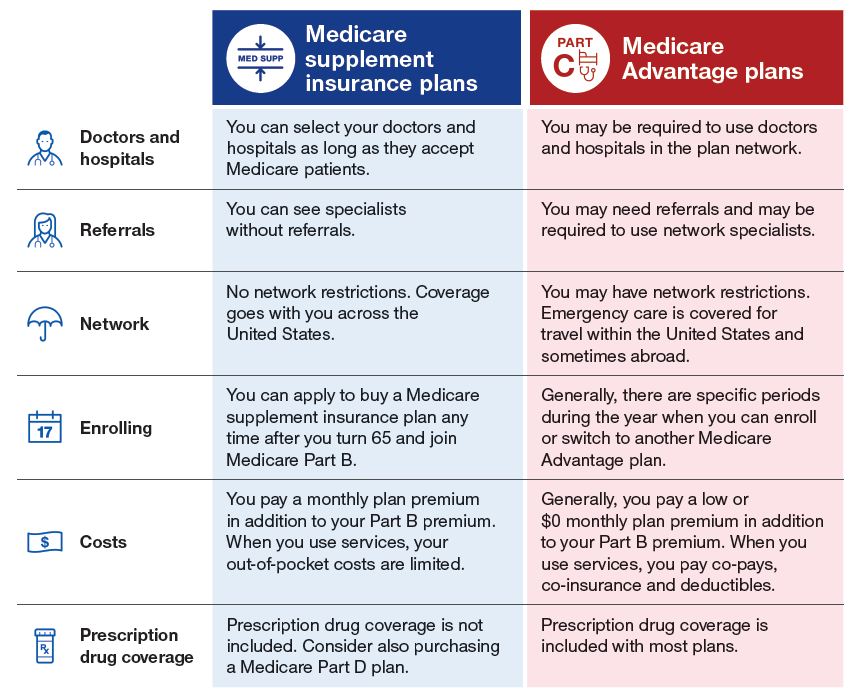

Even though they offer the same benefits as Medicare supplement policies, why do Medicare SELECT plan's charge a lower premium? Medicare supplement policies are guaranteed renewable. Medicare SELECT policies do not cover nursing home or custodial care. Medicare SELECT plans deliver health care through a network of providers.

How do Medicare supplement plans work?

Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service. After this is paid, your supplement policy pays your portion of the remaining cost.

Do Medicare supplements cover deductibles?

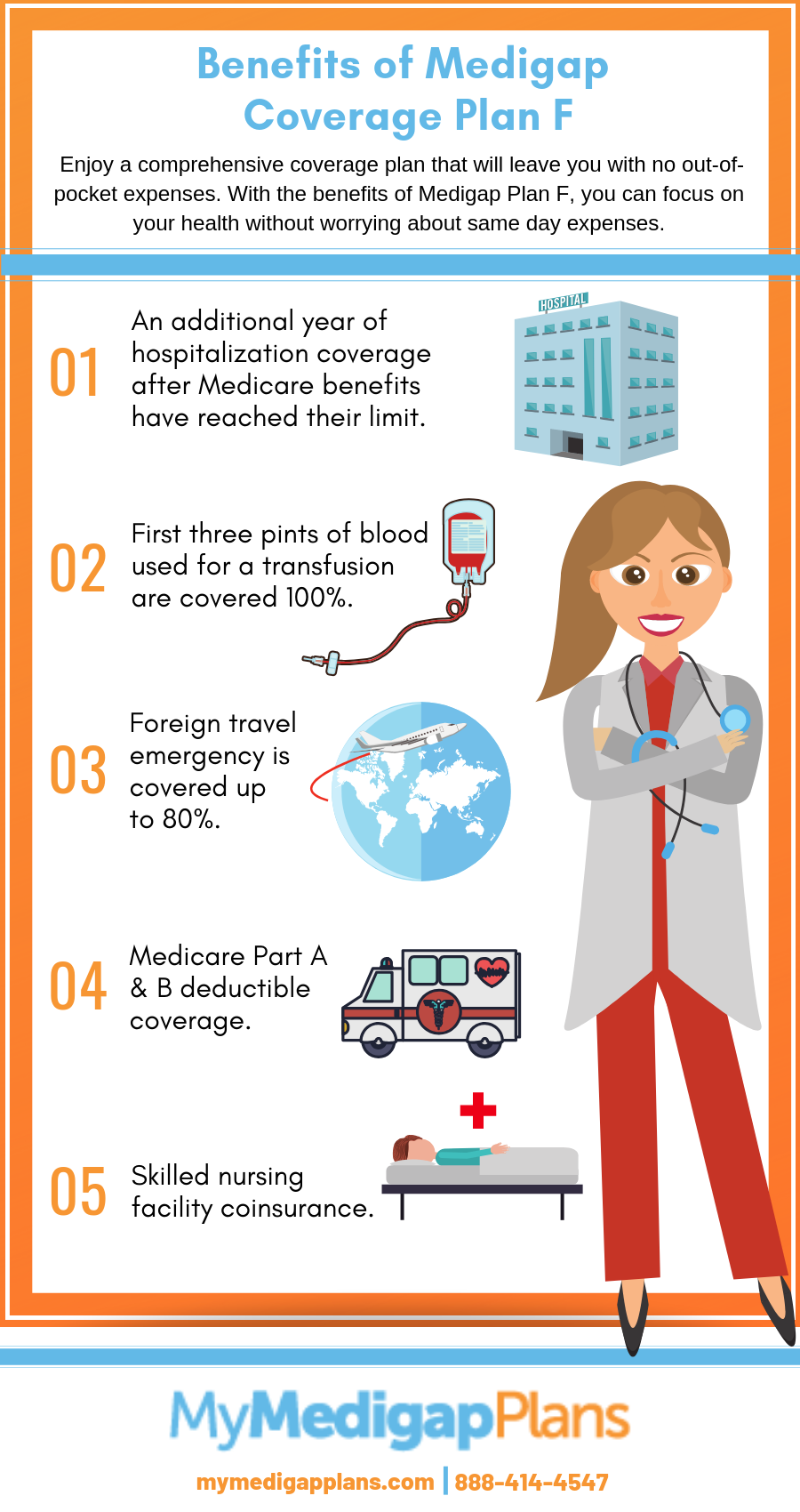

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

How are Medicare Supplement plans regulated?

The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies.

Do Medicare Supplement plan benefits automatically update?

As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

Which Medicare deductible is no longer covered under Supplement plans?

But as a result of legislation just passed by Congress, starting in 2020 Medigap plans will no longer be allowed to offer coverage of the Medicare Part B deductible, which is currently $203 (in 2021).

Who regulates Medicare Supplement?

The California Department of Insurance (CDI)Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost. The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies.

Which renewal provision must all Medicare Supplement policies contain?

A Medicare Supplement Policy must contain a 30-day Free Look Provision on the first page of the policy in bold print. Answer B is correct. The remaining choices could be approved as Long-Term Care facilities.

When a consumer enrolls in a Medicare Supplement plan are they automatically disenrolled from their Medicare Advantage plan?

How to switch. If you're already in a Medicare Advantage Plan and want to switch, follow these steps: To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins.

When a Medicare Supplement policy is replaced?

When you switch from one Medicare Supplement insurance plan to another, you typically get 30 days to decide if you want to keep it. This 30-day free look period starts when you get your new Medicare Supplement insurance plan. You'll need to pay the premiums for both your new plan and your old plan for one month.

Can Medicare Supplement plans be changed at any time?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Why does Medigap no longer cover Part B deductible?

note: As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

Do any Medicare Supplement plans cover Part B deductible?

All Medicare Supplement insurance plans cover Medicare Part A coinsurance and hospital costs at 100%. Beyond this one benefit the plans differ in what extent they cover certain benefits and what benefits they cover. For example, only Medicare Supplement insurance Plans C and F cover the Part B deductible*.

Does Medicare Supplement plan N Cover Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.

What Medicare Supplement Plans Cover

Medicare presents a number of situations in which patients may be faced with paying out of their own pocket for certain services and products. Medicare Supplement Insurance focuses on nine such areas. Below is a list of the nine benefit areas that Medigap plans may help cover (all costs noted are for 2022).

What Medigap Costs

Medicare Supplement Insurance is sold by private insurance companies, meaning the cost of these plans will differ from one place to the next. There are several factors that can affect the cost of a plan:

Shopping for Medicare Supplement Insurance

The best way to shop for a Medicare Supplement Insurance is to leverage the help of a professional. A licensed agent can help you analyze your health care needs and assist with selecting a Medigap plan that is most compatible with those needs.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

What percentage of Medicare supplement is paid?

After this is paid, your supplement policy pays your portion of the remaining cost. This is generally 20 percent. Some policies pay your deductibles The deductible is a set amount which you must pay before Medicare begins covering your health care costs.

How many people does Medicare Supplement cover?

Keep in mind that, just like Medicare, Medicare Supplement plans are individual insurance policies. They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan.

How long does it take to get a Medigap plan?

When you turn 65 and enroll in Part B, you will have a 6-month Initial Enrollment Period to purchase any Medigap plan sold in your state. During this time, you have a “guaranteed issue right” to buy any plan available. They are required to accept you and cannot charge you more due to any pre-existing conditions.

How long does Medicare cover travel?

Each plan varies in what it covers, but all plans pay for Medicare Part A (hospital insurance) coinsurances for up to 365 days beyond the coverage that Medicare offers. Some of the plans cover a percentage of the cost for emergency health care while traveling abroad.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

How long does Medicare cover a supplement?

12 months. 6 months. 3 months. 24 months. A Medicare supplement policy can exclude benefits during the first six months of coverage on the basis of a pre-existing condition for which the insured received treatment or was diagnosed during the six months before the effective date of coverage.

What is Medicare Select Plan?

tax-qualified long-term care. Medicare supplement coverage offered in this way is called a Medicare SELECT plan. Like other managed care plans, a Medicare SELECT plan requires the insured to use health care providers within its network to be eligible for full benefits.

How long does Medicare Part A cover hospital expenses?

After the deductible is paid, the insured can expect Medicare Part A to cover all eligible hospital expenses without a copayment for up to: 60 days. 45 days. 10 days. 30 days. After the insured pays the deductible, Part A pays all eligible hospital costs without a copayment from the insured for up to 60 days.

What is Medicaid assistance?

Medicaid assistance is principally spent on long-term care for the elderly. Medicaid assistance is limited to those who cannot get Medicare coverage. For many elderly Medicare recipients, Medicaid reduces the financial burden of long-term nursing home care and catastrophic illness.

How long does it take for Medicare to pay for skilled nursing?

Medicare pays for 100% of all covered expenses for skilled nursing facility care for the first 20 days. For the next 80 days, the patient is required to pay a daily co-amount. After 100 days, Medicare pays nothing, and the patient is responsible for all charges.

What is Medicare coverage?

a person who has amyotrophic lateral sclerosis. Medicare coverage is available to U.S. citizens and certain permanent residents who are at least 65 years old or have received Social Security disability benefits for at least two years, have end-stage renal disease, or have amyotrophic lateral sclerosis.

What is Part A coinsurance?

Part A coinsurance for days 21 through 100 of skilled nursing facility care. Part B coinsurance is covered. Plan A covers only the core benefits, and Part B coinsurance is the only one of the core benefits among the choices given. Geraldine is applying for Medicare supplement Plan C.

When do hospitals report Medicare beneficiaries?

If the beneficiary is a dependent under his/her spouse's group health insurance and the spouse retired prior to the beneficiary's Medicare Part A entitlement date, hospitals report the beneficiary's Medicare entitlement date as his/her retirement date.

Does Medicare pay for the same services as the VA?

Veteran’s Administration (VA) Benefits - Medicare does not pay for the same services covered by VA benefits.

Does Medicare pay for black lung?

Federal Black Lung Benefits - Medicare does not pay for services covered under the Federal Black Lung Program. However, if a Medicare-eligible patient has an illness or injury not related to black lung, the patient may submit a claim to Medicare. For further information, contact the Federal Black Lung Program at 1-800-638-7072.

Is Medicare a primary or secondary payer?

Providers must determine if Medicare is the primary or secondary payer; therefore, the beneficiary must be queried about other possible coverage that may be primary to Medicare. Failure to maintain a system of identifying other payers is viewed as a violation of the provider agreement with Medicare.