How is the irmaa calculated for Medicare?

The CMS calculates the IRMAA. When a person makes more than the allowed income amount, Medicare may add an IRMAA to the Part B premium, Part D premium, or both. The amounts are based on a person’s adjusted gross income, and Medicare adds them every month. This amount can change each year based on a person’s income.

What is the irmaa surcharge for Medicare Part B and Part D?

For high-income Medicare beneficiaries, Part B and Part D premiums include an additional charge based on your modified adjusted gross income. Medicare beneficiaries who are being assessed the IRMAA surcharge will receive notice from the Social Security Administration. | Image: fizkes / stock.adobe.com

Why did I get an irmaa notice?

You'll get this notice if you have Medicare Part B and/or Part D and Social Security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you. This notice includes information about Social Security's determination and appeal rights.

Does Social Security count as income for irmaa?

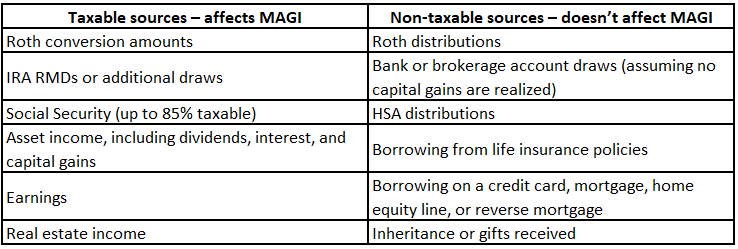

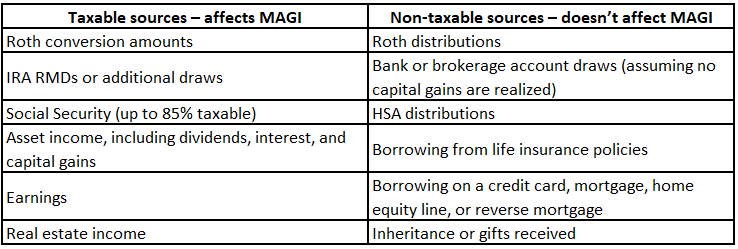

For IRMAA purposes, you don’t include the non-taxable portion of social security for IRMAA. Specifically for Premium ACA tax Credits, however, you add back the non-taxable portion of social security! This means you probably don’t want to claim social security between 62-65 if you want to get Premium ACA tax Credits.

What line on 1040 is Irmaa based on?

line 11The IRMAA amounts are assessed to both spouses on Medicare, individually. What is included in MAGI for IRMAA determination? According to ssa.gov, MAGI is the sum of your adjusted gross income (AGI) found on line 11 of Form 1040 plus all tax-exempt interest income (line 2a of Form 1040).

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

What tax year is used for Irmaa?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

Does Irmaa use AGI or magi?

How Is IRMAA Calculated? The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

How do I get a copy of my Irmaa letter?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: http://www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

What year is 2021 Irmaa based on?

2023Remember, IRMAA is based on your income from two years ago. So, your 2021 Modified Adjusted Gross Income (MAGI) will determine your IRMAA adjustments for 2023.

What line on Form 1040 is magi?

MAGI does not appear as a single line on your tax return, but your AGI can be found on line 11 of your Form 1040 for the 2021 tax year.

What tax year is Medicare premiums based on?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How do you calculate modified adjusted gross income for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

What is the difference between Magi and Irmaa?

However, if your MAGI is above a certain amount, you'll pay the standard premium and an Income Related Monthly Adjustment Amount (or “IRMAA”). The IRMAA is an extra charge added to your standard premium.

What is difference between AGI and Magi?

Modified adjusted gross income (MAGI) is your adjusted gross income after taking certain tax deductions and tax-exempt interest into account. It modifies your AGI by adding back items like foreign earned income, student loan interest, and the excluded portion of adoption expenses.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What line do you add on to 1040?

In line 6 of Form 1040, you add on any income on line 22 from schedule 1. It is best to take a look at lines 1-22 of schedule 1, as it pulls in a lot of different income sources that will be included in you MAGI! This is your so-called total income.

What is above the line deduction on 1040?

This is because they were on the front page of the old 1040 and above the bottom line on that form: the adjusted gross income. Also called “adjustments to your income,” you can look at schedule 1 again to see what they are.

Do HSA contributions go above the line?

There aren’t many above the line adjustments left! Most notably, IRA deductions and HSA contributions go above the line. For the self-employed, ½ of self-employment tax, pre-tax contributions to retirement accounts and health insurance premiums are deducted.

Is qualified dividend included in MAGI?

Qualified dividends are not specifically included in MAGI calculation. This is because they are considered a part of your ordinary dividends and thus already included. Qualified dividends stack on top of your ordinary income when you are paying the Long Term Capital Gains tax. This gets confusing for everyone.

Can you use MAGI twice?

MAGI, however, is used twice by the IRS when trying to help you afford health care. If you plan on retiring prior to Medicare, health care insurance is a huge concern. Many folks will try to get Premium ACA Tax Credits to lower their health insurance bill. In order to get these credits, you need to understand MAGI.

Is 2B included in AGI?

2b includes all your taxable interest (such as savings and money market accounts). Notice that tax exempt interest in line 2a is not included in your AGI. Don’t worry, though, for the ACA it will be added back later when we modify your adjusted gross income and make AGI into MAGI.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

How much is the IRMAA premium for 2021?

In 2021, the standard monthly premium for Part B is $148.50. Depending on your yearly income, you may have an additional IRMAA surcharge. This amount is calculated using your income tax information from 2 years ago. So, for 2021, your tax information from 2019 will be assessed.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

How many people will be covered by Medicare in 2027?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

Can IRMAA decisions be appealed?

IRMAA decisions can be appealed if there’s an error in the tax information used or if you’ve experienced a life changing event that reduced your income. Medicare is a federal health insurance program for people ages 65 and over and those with certain health conditions. It’s made up of several parts.

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

Who calculates IRMAA?

The Centers for Medicare & Medicaid Services ( CMS) calculate IRMAA and publish this amount yearly in the Federal Register. Once the IRMAA calculations are complete, CMS inform the Social Security Administration (SSA). The SSA determine whether a person must pay more than the standard premium.

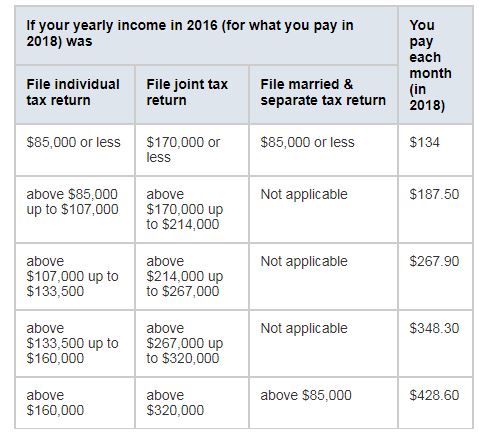

How many income levels are there in IRMAA?

The calculation for IRMAA covers five income levels. There are also three tax filing status levels. The charts below show the five different IRMAA levels for each of the three tax filing status levels for 2021. The examples use the tax year 2019.

What is the Medicare premium for 2021?

In 2021, the standard premium for Part B is $148.50. Medicare Part D premiums vary depending on the plan a person chooses. The amount of an individual’s Part B premium, Part D premium, or both, may change based on their modified adjusted gross income (MAGI), which their Internal Revenue Service (IRS) tax return will report.

What is Medicare Part B?

Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage.

How often does Medicare add to your income?

The amounts are based on a person’s adjusted gross income, and Medicare adds them every month. This amount can change each year based on a person’s income. If a person believes that there is a mistake with the assessment, they can go through an appeal process.

How to get extra help for Medicare?

Extra Help is a program to help pay some of the out-of-pocket costs of Medicare Part D premiums. To get Extra Help, a person must: 1 have Medicare Part A, Part B, or both 2 live in the United States 3 have income and assets below specified limits

Does IRMAA change?

IRMAA may change each year, depending on a person’s income. Medicare is a federal insurance plan for people aged 65 and over. Younger people may be eligible if they have a disability or end stage renal disease (ESRD). Medicare parts include:

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.