What are the best Medicare Advantage plans?

What to Know About the Best Medicare Advantage Plans

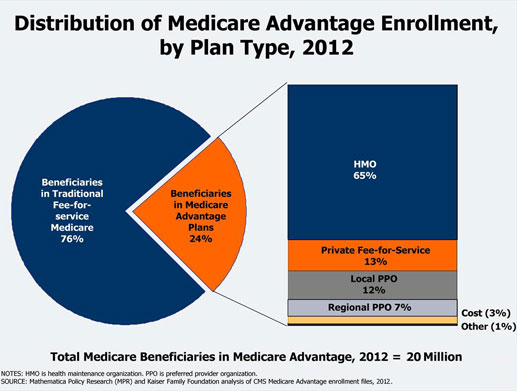

- Most Medicare Advantage plans are PPO and HMO. Most Medicare Advantage plans are either PPO or HMO, representing 46% and 39% of available plans. ...

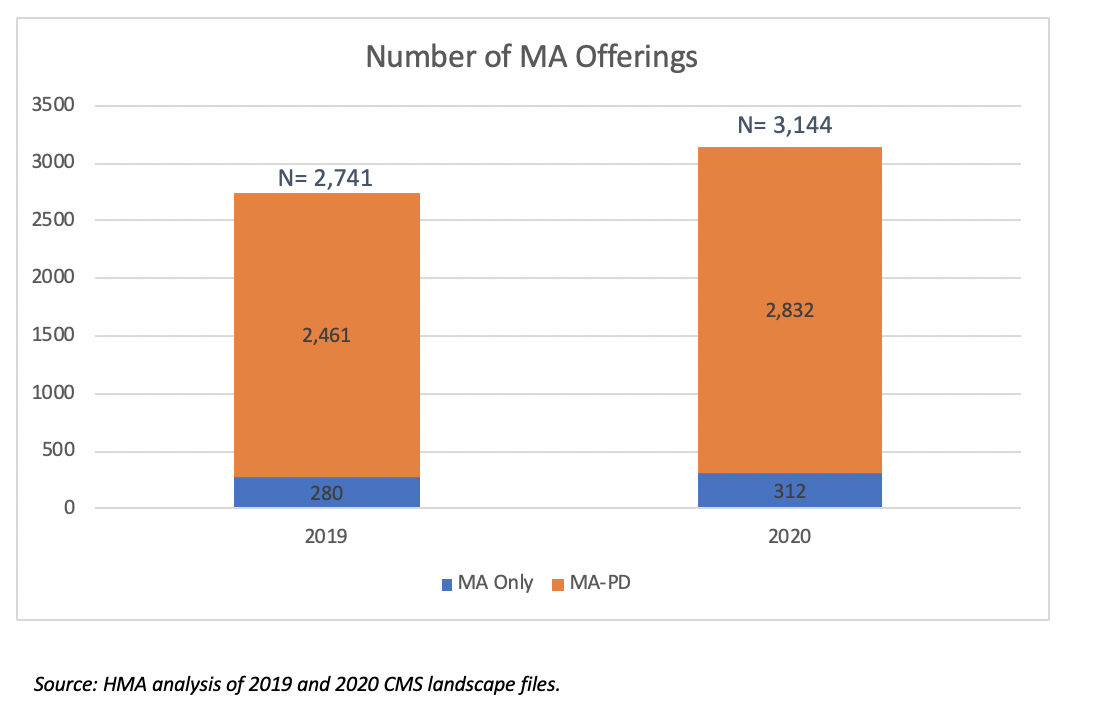

- Most Medicare Advantage plans include prescription drug coverage. ...

- Vision, dental and hearing benefits are widespread. ...

- Just over half of Medicare Advantage plans have $0 premiums. ...

What to consider when comparing Medicare plans?

What to Ask When Comparing Medicare Advantage Plans

- How much are monthly premiums?

- What portion of costs do you have to pay before the plan begins coverage (also known as the deductible)?

- How much of the cost of a doctor’s visit or hospital stay are you required to pay?

- What is the plan’s cap on annual out-of-pocket costs? ...

- Does your current doctor accept the plan? ...

What is the best Medicare plan for You?

Ranking the best medicare supplement plans of 2021

- Humana. Humana is one of the largest providers of healthcare and healthcare insurance in the country. ...

- Mutual of Omaha Medicare Supplement. Mutual of Omaha offers eight Medicare supplement plans that cover most out of pocket expenses most people will incur.

- United Medicare Advisors. ...

- Aetna Medicare Supplement. ...

- Cigna. ...

What are the benefits of Medicare Advantage plans?

- Eye exams and/or eyeglasses: Provided by 98% of plans

- Fitness benefit: 97%

- Telehealth: 95%

- Hearing exams and/or hearing aids: 95%

- Dental benefit: 94%

- Prescription drug coverage: 89%

- Over-the-counter benefits (for items such as adhesive or elastic bandages): 81%

- Meal benefit (such as a cooking class, nutrition education or meal delivery): 67%

What company has the best Medicare Advantage program?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states. Overall, Aetna Medicare ranks the best in the most (23) states.

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What is the average maximum out-of-pocket cost for a Medicare Advantage plan?

In 2021, the weighted average out-of-pocket limit for Medicare Advantage enrollees is $5,091 for in-network services and $9,208 for in-network and out-of-network services combined. For enrollees in HMOs, the average out-of-pocket (in-network) limit is $4,566.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What Medicare Advantage plans do not cover?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare pay for cataract surgery?

Medicare covers cataract surgery that involves intraocular lens implants, which are small clear disks that help your eyes focus. Although Medicare covers basic lens implants, it does not cover more advanced implants. If your provider recommends more advanced lens implants, you may have to pay some or all of the cost.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Does Medicare Advantage have a yearly deductible?

A deductible is the amount you must pay before your plan begins to pay. Some Medicare Advantage plans have separate deductibles for medical care and prescription drugs. If your Medicare Advantage plan has a network, only in-network care may apply towards the deductible.

How much is BlueMedicare Choice HMO?

BlueMedicare Choice HMO has a $42 monthly premium and primary care visits have $10 copay. Specialists have a $45 copay while inpatient hospital facility services are $290 copay per day for days 1 through 5. Urgent care facilities are $50 copay and emergency room visits have a copay of $90, but this may be waived if you are admitted.

Who is Medicare.net?

Medicare.net is powered by Health Network Group, LLC, which is related to Health Compare Insurance Services, Inc., who is a licensed, authorized agent of: Anthem Blue Cross of California, Anthem Blue Cross of Colorado, Anthem Blue Cross of Connecticut, Anthem Blue Cross of Georgia, Anthem Blue Cross of Indiana, Anthem Blue Cross of Kentucky, Anthem Blue Cross of Maine, Anthem Blue Cross of Missouri, Anthem Blue Cross of New Hampshire, Anthem Blue Cross of Nevada, Anthem Blue Cross of New York, Anthem Blue Cross of Ohio, Anthem Blue Cross of Texas, Anthem Blue Cross of Virginia, Anthem Blue Cross of Wisconsin, Blue Cross Blue Shield of Illinois, Blue Cross Blue Shield of Montana, Blue Cross Blue Shield of New Mexico, Blue Cross Blue Shield of Oklahoma, Capital Blue Cross of Pennsylvania, Highmark of West Virginia, Premera in Washington, Premera in Alaska, and Vibra in Pennsylvania.

How much does Aetna pay for medical?

Under the Aetna Medicare Choice Plan, if you are between the ages of 65 and 69 in fair health, the monthly premium is $73, and you can expect to pay approximately $3,738 per year for medical costs, including premiums. There is no deductible if you remain in the network, but if you go outside the network you’ll have to meet a $750 deductible before benefits start. There’s an annual cap on your out-of-pocket costs with this plan of $6,700 (for in-network services). In-network primary care physician copays are $5 and 40 percent outside the network. Specialists are $40 in-network and 40 percent outside the network. Inpatient hospital stays cost $220 per day for the first four days. After that, you won’t have to pay a copay for inpatient stays.

How much is United Health Care Sync?

The monthly premium for the UnitedHealthcare Sync PPO plan is $54. Primary care visits have a $15 copay while specialists have a $50 copay. Routine physicals are free, and there’s no annual deductible for medical services. The maximum you’ll pay for in-network services for the year is $5,900. Inpatient hospital stays require a $400 copay per day for days 1 through 4, but there’s no copay for days 5 through 90. Skilled nursing facility costs are also covered.

What is Humana Gold Choice?

Humana Gold Choice PFFS covers many of the same benefits as all Humana Medicare Advantage plans in 2019, including everything that original Medicare covers along with added features and services. With this plan, the monthly premium is about $94, and there’s a $200 medical deductible whether you get care from an in-network or out-of-network provider (for services not covered under original Medicare). Primary doctors require a $20 copay while specialists will cost $50 per visit. This plan and the other two outlined above require a $25 copay for visits to an urgent care center and a $90 copay for emergency room visits. There’s also an out-of-pocket cap in place for covered services of $6,700.

Is Aetna a PPO?

In 2013, Aetna acquired Coventry Health Care , increasing the number of Medicare Advantage plans available throughout the country. In California, consumers can choose from three Aetna Medicare Advantage plans: Aetna Medicare Choice Plan (PPO), Aetna Medicare Prime Plan (HMO) and Aetna Medicare Select Plan (HMO)

Is there a premium for BlueMedicare?

There is no premium for BlueMedicare Preferred POS. Primary care office visits have a $0 copay while specialists have a $25 copay. Days 1 through 5 of a hospital stay require a copay of $120 per day, and urgent care facilities have a $25 copay. Emergency room services, both in and out-of-network, are $85 but the fee may be waived if you get admitted.

What are the different types of Medicare Advantage plans?

When beginning your search for a Medicare Advantage (Part C) plan, it’s important to know the differences between each type of plan. You’ll probably see some or all of the following types of plans when reviewing your options: 1 Health Maintenance Organization (HMO) plans. These plans are primarily focused around in-network healthcare services. 2 Preferred Provider Organization (PPO) plans. These plans charge different rates depending on whether the services are in network or out of network. (A “network” is a group of providers who contract to provide services for the specific insurance company and plan.) These may provide more options to receive out-of-network care. 3 Private Fee-for-Service (PFFS) plans. These plans let you receive care from any Medicare approved provider who will accept the approved fee from your plan. 4 Special Needs Plans (SNPs). These plans offer additional help for medical costs associated with specific chronic health conditions. 5 Medicare Savings Account (MSA) plans. These plans combine a health plan that has a high deductible with a medical savings account.

How much does Medicare Advantage cost?

The find a plan tool lists the following cost information with the plans: These costs can range from $0 to $1,500 and above, depending on your home state, the plan type, and the plan benefits.

Why do Medicare Advantage plans have 5 star ratings?

The CMS have implemented a 5-star rating system to measure the quality of health and drug services provided by Medicare Advantage and Medicare Part D (prescription drug) plans. Every year, the CMS releases these star ratings and additional data to the public.

What does Medicare Advantage cover?

All Medicare Advantage plans cover what original Medicare covers — this includes hospital coverage (Part A) and medical coverage (Part B). When you choose a Medicare Advantage plan, you first want to consider what type of coverage you need in addition to the coverage above.

What is a PPO plan?

(A “network” is a group of providers who contract to provide services for the specific insurance company and plan. )

How much does Medicare Advantage cost?

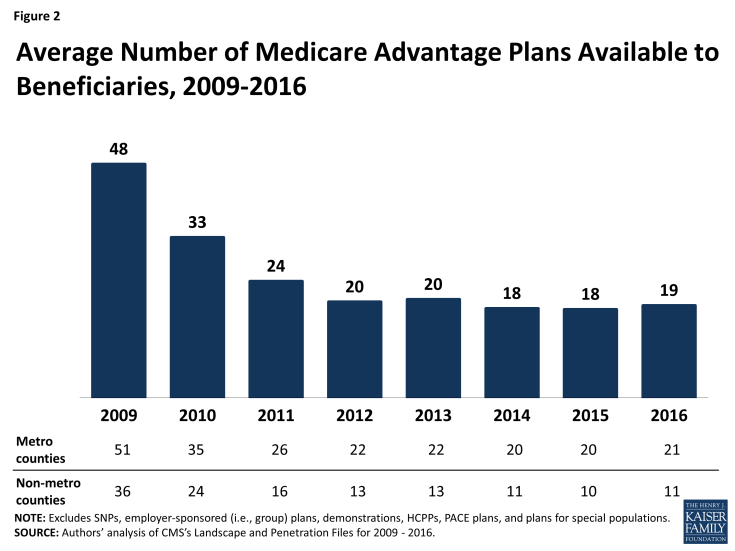

Costs vary depending on coverage, and choosing a Medicare Advantage plan requires careful consideration. The average monthly cost of a Medicare Advantage plan is $21, much lower than the cost of $144 with Original Medicare. 2. And when it comes to Medicare Advantage plans, the number of choices keeps growing, so it can be overwhelming.

What is the benefit of Medicare Advantage?

You get Part A and Part B, as well as in most cases Part D, which is coverage for prescription drugs. Some plans also allow for further coverage, such as dental or vision.

What is AARP Advantage?

AARP Medicare Advantage plans are full of extra benefits, from dental, vision, and hearing to over-the-counter benefits, fitness programs, and wellness programs. AARP offers lots of additional support to help members stay healthy or manage health conditions.

How many stars does Cigna have in 2021?

Cigna Medicare Advantage plans earned an average of 3.88 out of 5.0 Stars from CMS in 2021. 3 On this standard measure of Medicare Advantage quality, Cigna scores better than other large national insurers.

What is the age limit for Medicare?

Original Medicare is the basic Medicare offered to everyone 65 or older, or people who qualify on a basis other than age (e.g., you have a disability ). You may be enrolled in Original Medicare automatically, or you may have to sign up if you’re 65, or almost 65, and do not get Social Security.

When can I switch from Medicare Advantage to Original?

Whether you’re switching from one Medicare Advantage plan to another Medicare Advantage plan, or switching from Medicare Advantage to Original Medicare, you may do so within the two Medicare enrollment periods each year: October 15–December 7 and January 1–March 31 .

When does Medicare open enrollment end?

To enroll in a Medicare Advantage Plan, sign up during your initial enrollment period, which starts three months before the month you turn 65 and ends three months after, or during the annual Open Enrollment for Medicare Advantage, which runs from October 15 through December 7.

How to find Medicare Advantage plan?

To find the right Medicare Advantage plan for you, just enter your name, date of birth, zip code, phone number and email address. From there, ou'll see a confirmation page, notifying you that you'll receive a call from one of their licensed agents.

How long has Aetna been in business?

Not many providers of Medicare Advantage Plans can say that they've been in business for over 100 years. Aetna has been around for more than a century and a half! You'll often find their policies quoted by brokers and referral services, because their coverage area is very broad and their plans are quite popular.

Is GoHealth part of Medicare?

Although GoHealth has only been a part of the Medicare marketplace since 2016, they've been part of the insurance industry since 2001. The company is well-established as a referral service specifically for Medicare Advantage Plans, with 10% of all subscribers nationwide having used GoHealth to sign up for their coverage.

Is Cigna a reliable Medicare Advantage?

Overall, Cigna is a reliable source of Medicare Advantage Plans. Their website makes it straightforward to find out what's available in your area and to comparison shop among the policies they offer. But, for some consumers, Cigna won't be an option due to limited coverage. You may need to work with a different insurer or use a referral service to find more Advantage policies in your area, if nothing comes up for your zip code when using the Cigna site.

Does Cigna have Medicare?

Unfortunately, compared with some insurers, Cigna's coverage may be limited. For example, when we looked for a Medicare Advantage policy for our sample person (a woman in Wisconsin turning 65 in a few months), we found out that there were no plans in her area other than prescription drug coverage. That puts Cigna below many of the other services in our review.

Does SelectQuote have Medicare Advantage?

All of the Medicare Advantage Plans they offer come from insurers that have at least an "A-" rating, giving you only the best possible coverage. SelectQuote has been in operation for nearly 40 years, and the company enjoys an "A+" rating and accreditation from the Better Business Bureau.

Can you use SelectQuote for Medicare?

While we can't put SelectQuote, also known as Tiburon, as one of our highest-ranked sources of Medicare Advantage Plans - because of how many hoops we had to jump through, over multiple days, to actually get a licensed agent and a quote - there are still reasons to consider using this service. You'll probably get a very thorough analysis of your situation, resulting in a policy that is almost perfectly suited to your needs. Plus, you'll have the peace of mind knowing that your agent is still looking out for you well into the future. SelectQuote/Tiburon is worth making a phone call, if you're prepared to be persistent in getting connected with an agent at the outset.

What is the best Medicare Advantage plan for 2020?

The best Medicare Advantage plans for you in 2020 could come from one of a number of insurance companies, such as: Aetna. Humana.

How many Medicare Advantage plans are there?

There are 3,148 Medicare Advantage plans available for individual enrollment in 2020, which marks the largest number of plans ever available. And the average beneficiary will have around 28 plans available to choose from. 5

What are the benefits of Medicare Advantage?

Most Medicare Advantage plans also typically include prescription drug coverage, and some plans may cover additional benefits such as: 1 Routine dental and vision care 2 Hearing care and allowances for items such as hearing aids 3 Memberships to gyms and wellness programs such as SilverSneakers 4 Home modifications to help you age safely in your house, such as bathroom grab bars 5 Non-emergency transportation to places like your doctor’s office 6 Home delivered meals 7 Allowances for over-the-counter (OTC) items

Is Humana Medicare Advantage available?

Humana’s Medicare Advantage plans are available in 83 percent of all U.S. counties in 2020. 5. Humana Inc. was awarded the Best in Customer Service 2020 for health insurance companies, according to Newsweek. 6.

Does Medicare cover Silversneakers?

Medicare Advantage plans from Anthem can cover a number of benefits that may include prescription drug coverage, hearing benefits, preventive care, annual out-of-pocket spending limits and membership to health and wellness programs such as SilverSneakers.

Is the Blue Cross a Medicare Advantage plan?

Over 1.2 million beneficiaries are enrolled in a Medicare Advantage plan from Anthem. 8.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage plans also typically include prescription drug coverage, and some plans may cover additional benefits such as: Plan benefits and availability may vary from one plan and one location to the next .

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

The Best Overall Medicare Advantage Provider

MoneyGeek’s top pick for the best overall Medicare Advantage option is Blue Cross Blue Shield's preferred provider organization plans.

The Best Medicare Advantage Provider for HMO Plans

Among Medicare Advantage HMOs available in at least 25 states, MoneyGeek’s pick for the best carrier overall is UnitedHealthcare based on Medicare Star Ratings and the availability of robust extra benefits.

The Best Medicare Advantage Provider for Plans Without Drug Coverage

Prescription drug coverage is optional for Medicare members and is not included in Original Medicare. Though many Medicare Advantage plans include prescription drug coverage, you can choose a Medicare Advantage plan without drug benefits.

Best Medicare Advantage Provider for Low Out-of-Pocket Cost Plans

Medicare Advantage plans can be relatively low-cost, many with zero premiums. But the trade-off can come in the form of higher out-of-pocket costs. When evaluating the price of a plan, consider all the costs, not just the premiums.

What to Know About the Best Medicare Advantage Plans

It can be hard to determine which Medicare Advantage plan is right for you. Though there are standard quality ratings, the best plan for you will depend on your specific needs.

How to Get The Best Medicare Advantage Plan for You

More than 26 million people — 42% of all Medicare beneficiaries — enrolled in a Medicare Advantage plan in 2021, more than double the number enrolled a decade ago. There are only more Medicare Advantage options for people in 2022.