How to Pay Part A & Part B premiums

| If you pay for: | You’ll get a bill: |

| Part B only | Every 3 months |

| Part A (Hospital Insurance) | Every month |

| Part D income-related monthly adjustment ... | Every month |

Full Answer

How much does Medicare Part a cost?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. Get help with Part A & Part B costs If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays.

How much is the deductible for Medicare Part?

5 rows · 2022 costs at a glance. Part A premium. Most people don't pay a monthly premium for Part A ...

What is included in Medicare Part?

Parts of Medicare. Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care …

What is the deductible for Medicare Part?

4 rows · How to Pay Part A & Part B premiums. Most people don't get a premium bill from Medicare ...

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

How much is Medicare Part A?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1 .

What is Medicare Part A?

Medicare Part A: Hospital Insurance. Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1 .

How many parts are there in Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D. 1 In general, the four Medicare parts cover different services, so it's essential that you understand the options so you can pick your Medicare coverage carefully.

What is the gap in Medicare?

Medicare prescription drug plans have a coverage gap—a temporary limit on what the drug plan will cover. The coverage gap is often called the "doughnut hole," and this gap kicks in after you and your plan have spent a certain amount in combined costs.

Does Part A cover hospice?

For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility. 7 . Additionally, if you're hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day's expenses.

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is Part B insurance?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Pay monthly premiums for both Part A and Part B. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board.

What is the Medicare Part B?

Together with Medicare Part B, it makes up what is known as Original Medicare , the federally administered health-care program.

When do you enroll in Medicare Part A?

If you’re currently receiving retirement benefits from Social Security or the Railroad Retirement Board (RRB), you’re automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65.

Does Medicare cover nursing care?

Medicare Part A only covers nursing care if skilled care is needed for your condition. You must require more than just custodial care (help with daily living tasks, such as bathing, dressing, etc.).

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...

How much is Medicare Part A coinsurance?

Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each lifetime reserve day of each benefit period (you get up to 60 lifetime reserve days) After lifetime reserve days are used up: You pay all costs.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

What is Medicare Part A?

The Medicare program is split into several sections, or parts. These include: Medicare Part A. Medicare Part A covers hospitalization and inpatient care, including hospice and skilled nursing care. This also includes medications you receive while you’re in the hospital.

When do you enroll in Medicare Part A?

You’re automatically enrolled in original Medicare — which is made up of parts A and B — starting on the first day of the month you turn 65 years old.

What is Medicare for people over 65?

Medicare is a government healthcare program that cover s healthcare costs for people ages 65 and over or those with certain disabilities. The Medicare program is split into several sections, or parts. These include:

How old do you have to be to get Medicare?

You’re 65 years old and you or your spouse had Medicare-covered health benefits from a government job. You’re under age 65 and have received Social Security or RRB disability benefits for 24 months. You have end stage renal disease.

How much is the Part A premium for 2021?

If you or your spouse worked for 30 to 39 quarters, the standard monthly Part A premium cost is $259 in 2021. If you or your spouse for worked fewer than 30 quarters, the standard monthly Part A premium cost is $471 in 2021.

How much does hospice cost in 2021?

Medicare Part A covers the full cost of hospice care, but there are specific coinsurance costs for skilled nursing care services. In 2021, these costs are: $0 coinsurance for days 1 through 20 for each benefit period. $185.50 daily coinsurance for days 21 through 100 for each benefit period. all costs for days 101 and beyond in each benefit period.

How much is coinsurance for 2021?

In 2021, these costs are: $0 coinsurance for days 1 through 20 for each benefit period. $185.50 daily coinsurance for days 21 through 100 for each benefit period. all costs for days 101 and beyond in each benefit period.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

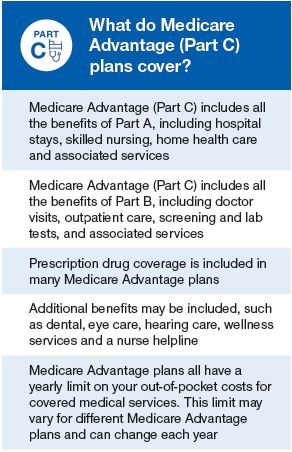

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

Is Medicaid part of Medicare?

Medicare and Medicaid (called Medical Assistance in Minnesota) are different programs. Medicaid is not part of Medicare. Here’s how Medicaid works for people who are age 65 and older: It’s a federal and state program that helps pay for health care for people with limited income and assets.

Does Medicare cover acupuncture?

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesn’t cover costs to live in an assisted living facility or a nursing home.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover eye exams?

Medicare doesn’t cover routine eye exams to check your vision if you wear eyeglasses or contacts. It does cover eye exams if you have diabetes or other medical conditions like glaucoma or cataracts.

Does Medicare cover colonoscopy?

If you had a different screening for colorectal cancer called a flexible sigmoidoscopy, Medicare covers a screening colonoscopy if it is 48 months or longer after that test. Eye exams. Medicare doesn’t cover routine eye exams to check your vision if you wear eyeglasses or contacts.