Does Medicare cover out-of-pocket costs?

Original Medicare (Medicare Part A and Part B) covers some hospital and medical costs, but you're responsible for certain out-of-pocket costs, such as deductibles, copayments and coinsurance. Medicare Supplement (Medigap) plans can pay for your Medicare out-of-pocket costs.

What are the Medicare Part B out-of-pocket costs?

Other Part B out-of-pocket costs include the annual deductible and coinsurance. In 2022, the Part B deductible is $233. After your deductible has been met, you will typically pay 20% of the Medicare-approved amount for services covered under Part B. Medicare will pay the remaining 80%.

What does Medicare cover for outpatient hospital services?

Outpatient hospital services. Medicare Part B (Medical Insurance) covers Medically necessary diagnostic and treatment services you get as an outpatient from a Medicare-participating hospital. Covered outpatient hospital services may include: Emergency or observation services, which may include an overnight stay in the hospital or outpatient...

How much does Medicare pay for each service?

In Part B, you generally pay 20% of the cost for each Medicare-covered service. An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).

What part of Medicare covers out-of-pocket expenses?

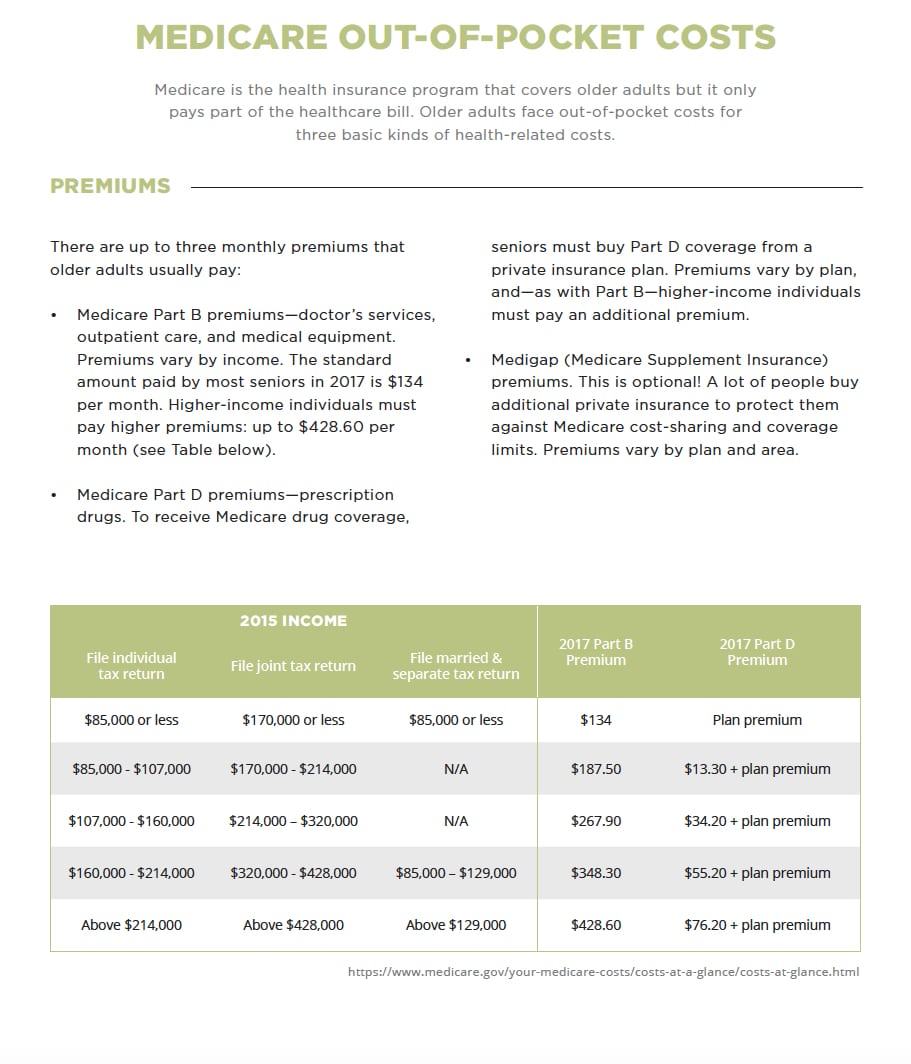

Medicare Part BMedicare Part B out-of-pocket costs Medicare Part B covers outpatient medical care. Monthly premiums apply for this coverage and costs are driven by your income level. You will also pay an annual deductible in addition to the monthly premiums, and you must pay a portion of any costs after you meet the deductible.

What is the difference between Part C and Part D Medicare?

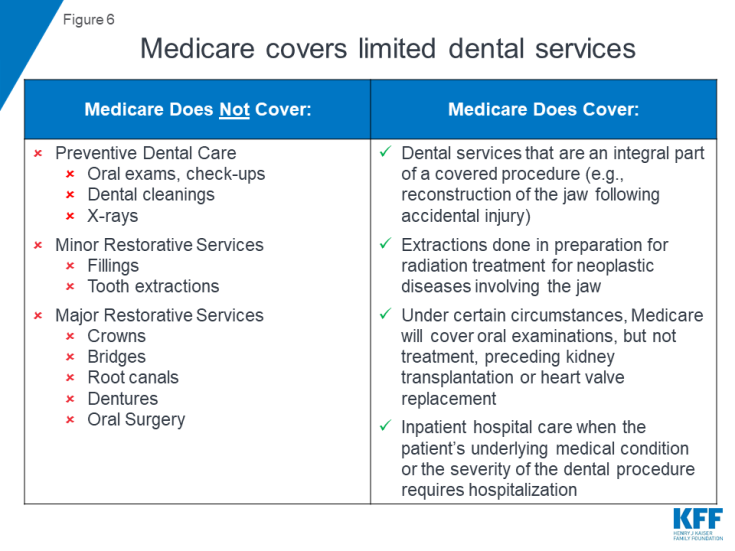

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What are the four parts of Medicare what do they cover?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is covered under Medicare Part A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What does Medicare Part C pay for?

Medicare Part C covers the inpatient care typically covered by Medicare Part A. If you are a Medicare Part C subscriber and are admitted to the hospital, your Medicare Advantage plan must cover a semi-private room, general nursing care, meals, hospital supplies, and medications administered as part of inpatient care.

What's the difference between Medicare Part A and Part B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

What is not covered under Medicare Part A?

Medicare Part A will not cover long-term care, non-skilled, daily living, or custodial activities. Certain hospitals and critical access hospitals have agreements with the Department of Health & Human Services that lets the hospital “swing” its beds into (and out of) SNF care as needed.

What is Medicare Part B mean?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.)

Does Medicare Part B cover 100 percent?

Generally speaking, Medicare reimbursement under Part B is 80% of allowable charges for a covered service after you meet your Part B deductible. Unlike Part A, you pay your Part B deductible just once each calendar year. After that, you generally pay 20% of the Medicare-approved amount for your care.

Is there a copay on Medicare Part B?

Medicare Part B does not usually have a copayment. A copayment is a fixed cost that a person pays toward eligible healthcare claims once they have paid their deductible in full.

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

What is the deductible for Medicare Part A in 2021?

In 2021, the deductible for Medicare Part A is $1,484 per benefit period , and the deductible for Medicare Part B is $203 per year.

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Is Plan F available for Medicare?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020. All 10 standardized Medigap plans provide at least partial coverage for: Medicare Part A coinsurance and hospital costs. Medicare Part B coinsurance or copayment. First three pints of blood.

What is Medicare out of pocket?

Medicare Out-of-Pocket Costs. Original Medicare (Medicare Part A and Part B) covers some hospital and medical costs, but you're responsible for certain out-of-pocket costs, such as deductibles, copayments and coinsurance.

What is Medicare Part A?

Medicare Part A out-of-pocket costs. Medicare Part A (hospital insurance) helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and limited home health care services. Let's take a look at some of the costs associated with Medicare Part A below.

What is Medicare monthly premium?

Your monthly premiums are the amounts you pay each month for your Medicare benefits. Most people do not pay a premium for Medicare Part A, as long as they paid sufficient Medicare taxes while working.

How much is Medicare Part A deductible for 2021?

In 2021, the Medicare Part A deductible is $1,484 per benefit period. Benefit periods under Part A are based on how long you've been discharged from the hospital, which means you could encounter multiple Part A benefit periods in the same calendar year if you're hospitalized more than once.

What is covered by Medicare outpatient?

Covered outpatient hospital services may include: Emergency or observation services, which may include an overnight stay in the hospital or outpatient clinic services, including same-day surgery. Certain drugs and biologicals that you ...

How much does Medicare pay for outpatient care?

You usually pay 20% of the Medicare-approved amount for the doctor or other health care provider's services. You may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office. However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

What is preventive care?

preventive services. Health care to prevent illness or detect illness at an early stage, when treatment is likely to work best (for example, preventive services include Pap tests, flu shots, and screening mammograms). . If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed ...

What is a copayment in a hospital?

An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is a deductible for Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. for each service. The Part B deductible applies, except for certain. preventive services.

Can you get a copayment for outpatient services in a critical access hospital?

If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed the Part A hospital stay deductible. If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed the Part A hospital stay deductible.

Does Part B cover prescription drugs?

Certain drugs and biologicals that you wouldn’t usually give yourself. Generally, Part B doesn't cover prescription and over-the-counter drugs you get in an outpatient setting, sometimes called “self-administered drugs.".

Out of Pocket Costs

Most insurance policies include the following out-of-pocket expenses. Medicare also penalizes people for late enrollment in Part B or Part D coverages. All of the rates listed below are for 2021.

Provider-Related Costs

Your out-of-pocket expenses are directly impacted by the doctor you visit. Make sure to consider that before scheduling any appointments.

Medicare Advantage & Part D Costs

Medicare Advantage plan and Part D coverages have different out-of-pocket costs.