What are the advantages and disadvantages of PPO?

The Pros and Cons of HMOs and PPOs

- PPOs Typically Give Consumers More Healthcare Freedom. ...

- HMO Members Must Have a Primary Care Physician (PCP) A primary care physician (PCP) oversees and guides a patient’s healthcare decisions. ...

- HMOs Offer Lower Cost Healthcare. ...

- Choosing Between an HMO and PPO. ...

- Canopy Health: An Alternative to Traditional HMOs and PPOs. ...

What does PPO mean for health insurance?

- The PPO is a popular form of managed care organization

- It is among the widely used forms in the Obamacare Exchange system

- The PPO offers more flexibility than the traditional HMO

- The PPO allows consumers to decide when to go outside of the network

- Healthcare companies have developed variations on the PPO

What is the difference between Medicare Advantage HMO and PPO?

Medicare Advantage PPO plans are also provided by private insurance companies. The key difference between PPO and HMO plans is that PPO plans offer more flexibility. Like HMO plans, Medicare PPO plans have a network of healthcare providers that offer discounted services. However, policyholders aren’t limited to this network.

What are PPO health insurance plans?

- Preferred provider organization plans offer more flexibility than other types of plans.

- PPOs are the most common type of employer-sponsored health insurance plans.

- Getting out-of-network care usually costs more and may mean more paperwork for you.

- PPOs have higher premiums than other types of plans.

Is a PPO an example of Medicare Part C?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What does PPO Medicare mean?

Preferred Provider OrganizationPreferred Provider Organization (PPO) | Medicare.

Is Medicare PPO same as Medicare Advantage?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is a PPO plan?

A type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan's network.

What is the difference between a PPO and an Advantage plan?

PPO” contrasts: Although they generally have provider networks, Medicare Advantage PPOs let you see doctors outside the plan network. You might have to pay higher coinsurance or copayments for seeing out-of-network providers. You don't have to choose a primary care provider with a Medicare PPO, but you do with an HMO.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

What is Part A insurance?

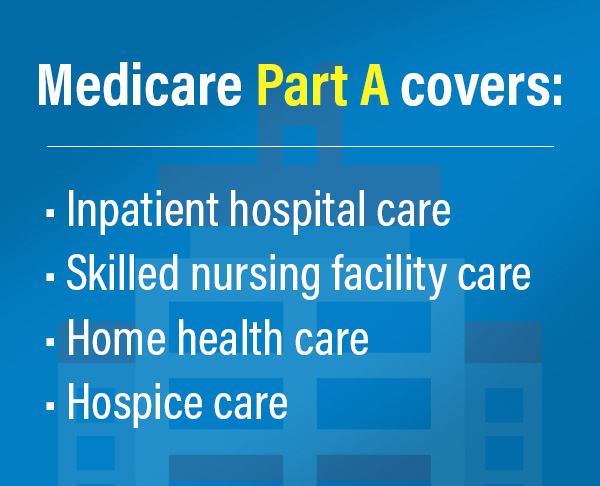

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What is Medicare Part B used for?

Medicare Part B helps cover medically-necessary services like doctors' services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

What is Medicare Part D used for?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

What is Medicare PPO?

by Christian Worstell. February 25, 2021. A Medicare PPO, or Preferred Provider Organization, is just one type of Medicare Advantage plan. What is a Medicare PPO plan, and could a PPO plan be a good fit for your health coverage needs? Learn more about Medicare Advantage PPO insurance plans ...

Why do people choose PPO over Medicare?

A few reasons why some people might prefer a PPO plan over other types of Medicare Advantage plans include: Medicare PPOs typically offer the freedom and flexibility to seek health care services from providers outside of their plan network, though it will typically be at a higher out-of-pocket cost.

How to get information on Medicare PPO?

Get in touch with a licensed insurance agent who can provide information on Medicare PPO plans that may be available in your area . A licensed agent can also help you review the costs and benefits of each available plan where you live and help guide you through the enrollment process. Call. 1-800-557-6059.

What is a PPO plan?

What is a Medicare PPO? A Medicare PPO plan consists of a network of preferred health care providers. These are doctors, facilities, pharmacists and other sources of health care services who have agreed to participate in the PPO plan network.

How to contact a PPO insurance agent?

Speak with a licensed insurance agent. 1-800-557-6059 | TTY 711, 24/7. Unlike some other types of Medicare Advantage health plans, a PPO generally does not require you to utilize a primary care doctor, nor do you need a referral to visit a specialist.

How many people are in a PPO plan in 2017?

In 2017, more than 6.2 million people were enrolled in a local or regional Medicare PPO plan, which represented more than a third of all Medicare Advantage plan holders. 2.

Is hospice covered by Medicare?

Hospice care is still covered by Medicare Part A even if you are enrolled in a Medicare Advantage PPO plan. Where Medicare Advantage plans distinguish themselves is with the extra benefits they each may offer in addition to the required minimum coverage. Prescription drugs, dental, vision and hearing coverage are among the popular extra benefits ...

What is a PPO plan?

It’s different from other Medicare Advantage plans because while you will select one Medicare preferred provider (doctor), you will have the freedom to use other doctors. Your costs will be cheaper if you use doctors, hospitals, and specialists that are within your PPO network, but you do have the freedom to see several different doctors.

Is HMO cheaper than PPO?

As mentioned, HMO (Health Maintenance Organization) plans are generally cheaper than PPOs. They are different because HMOs require you to select one primary physician that you visit for all of your healthcare needs; you won’t be able to visit another doctor without a referral.

Can I qualify for Medicare PPO?

There are very few eligibility limits for Medicare PPO plans. As long as you are eligible for Medicare and reside in an area where a Medicare Advantage PPO plan is available, you probably qualify.

What is a PPO plan?

Medicare PPO plans have a list of in-network providers that you can visit and pay less. If you choose a Medicare PPO and seek services from out-of-network providers, you’ll pay more.

How much is a PPO deductible?

Medicare PPO plans can charge a deductible amount for both the plan, as well as the prescription drug portion of the plan. Sometimes this amount is $0, but it depends entirely on the plan you choose.

What is the difference between a PPO and an HMO?

What is the difference between PPO and HMO plans? Medicare PPOs are different from Medicare HMOs because they allow beneficiaries the opportunity to seek services from out-of-network providers. When you visit out-of-network providers with a PPO plan, you are covered but will pay more for the services.

How much is Medicare Part B coinsurance?

Medicare Part B charges a 20 percent coinsurance that you will out pay out-of-pocket after your deductible has been met. This amount can add up quickly with a Medicare PPO plan if you are using out-of-network providers.

What is Medicare Part A?

Medicare Part A, which includes hospital services, limited skilled nursing facility care, limited home healthcare, and hospice care. Medicare Part B, which includes medical insurance for the diagnosis, prevention, and treatment of health conditions. prescription drug coverage (offered by most Medicare Advantage PPO plans) ...

Does Medicare Advantage have an out-of-network max?

All Medicare Advantage plans have an out-of-pocket maximum amount that you will pay before they cover 100 percent of your services. With a Medicare PPO plan, you will have both an in-network max and out-of-network max. Below is a comparison chart for what your costs may look like if you enroll in a Medicare Advantage PPO plan in a major U.S. city.

Do Medicare Advantage plans charge a premium?

In addition, Medicare PPO plans can charge their own monthly premium, although some “ free ” plans don’ t charge a plan premium at all.

More flexibility

Unlike an HMO, a PPO offers you the freedom to receive care from any provider—in or out of your network. This means you can see any doctor or specialist, or use any hospital.

Higher costs

A PPO health insurance plan provides more choices when it comes to your healthcare, but there will also be higher out-of-pocket costs associated with these plans.

Getting a plan

If you decide a PPO is the way to go, you can find a variety of plans at eHealth.com , opens new window . This website allows you to research plans available in your area and purchase whichever plan you choose.

Is PPO right for you?

A PPO is generally a good option if you want more control over your choices and don’t mind paying more for that ability. It would be especially helpful if you travel a lot, since you would not need to see a primary care physician.

What is Medicare Advantage Plan?

A Preferred Provider Organization (PPO) Medicare Advantage plan gives you access to a network of doctors, hospitals, and healthcare providers, but how does staying in the network save you money?

Do PPOs require a primary care physician?

Offer lower costs for in-network services. Do not route care through a primary care physician. Unlike many HMOs, PPOs do not require you to choose a primary care physician, and you won’t need a referral to receive care from a specialist or a provider out of your plan’s network.

Can I see outside of my network for PPO?

With a PPO plan, you can see healthcare providers outside of your network for services PPOs cover. However, going out of your plan's preferred network of hospitals, doctors, and specialists will usually cost more. Additionally, emergency and urgent care are always covered under Medicare Advantage plans. Drug coverage, or Medicare Part D, is often ...

Does Medicare cover urgent care?

Additionally, emergency and urgent care are always covered under Medicare Advantage plans. Drug coverage, or Medicare Part D, is often included in Medicare Advantage plans like PPOs. You won’t need to sign up for a separate Medicare plan for your prescriptions as long as your PPO plan offers drug coverage. However, if you sign up ...

Does Medicare pay for health care?

Under Original Medicare, the government pays directly for the health care services you receive . You can see any doctor and hospital that takes Medicare (and most do) anywhere in the country. In Original Medicare: You go directly to the doctor or hospital when you need care.

Does Medicare Advantage have network restrictions?

On the other hand, Medicare Advantage Plans typically have network restrictions, meaning that you will likely be more limited in your choice of doctors and hospitals.

Does Medicare Advantage Plan cover Part A?

Each Medicare Advantage Plan must provide all Part A and Part B services covered by Original Medicare, but they can do so with different rules, costs, and restrictions that can affect how and when you receive care. It is important to understand your Medicare coverage choices and to pick your coverage carefully.

Do you have to pay coinsurance for Medicare?

You typically pay a coinsurance for each service you receive. There are limits on the amounts that doctors and hospitals can charge for your care. If you want prescription drug coverage with Original Medicare, in most cases you will need to actively choose and join a stand-alone Medicare private drug plan (PDP).

What is a PPO plan?

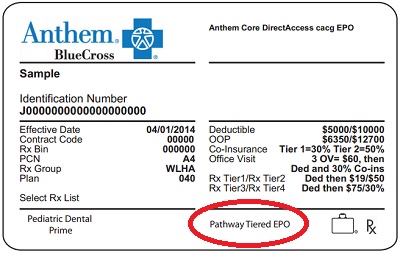

PPO plans typically offer fixed copayments when you use the plan’s network . There are two types of Medicare PPO plan: Regional PPOs, which serve a single state or multi-state areas determined by Medicare. Local PPOs, which serve a single county or group of counties chosen by the plan and approved by Medicare.

How to find out if you have a PPO?

Call 1-800-MEDICARE or your State Health Insurance Assistance Program (SHIP) to find out if there is a PPO available in your area. To enroll in a PPO, call Medicare or the plan directly. Be sure to make an informed decision by contacting a plan representative to ask questions before enrolling.

Do PPOs have the same benefits as Medicare?

Like all Medicare Advantage Plans, PPOs must provide you with the same benefits, rights, and protection s as Original Medicare, but they may do so with different rules, restrictions, and costs. Some PPOs offer additional benefits, such as vision and hearing care.

What does Medicare Part A cover?

Medicare Part A covers the care you receive when you’re admitted to a facility like a hospital or hospice center. Part A will pick up all the costs while you’re there, including costs normally covered by parts B or D.

What are the parts of Medicare?

Each part covers different healthcare services you might need. Currently, the four parts of Medicare are: Medicare Part A. Medicare Part A is hospital insurance. It covers you during short-term inpatient stays in hospitals and for services like hospice.

How long do you have to sign up for Medicare if you have delayed enrollment?

Special enrollment period. If you delayed Medicare enrollment for an approved reason, you can later enroll during a special enrollment period. You have 8 months from the end of your coverage or the end of your employment to sign up without penalty.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, the out-of-pocket maximum for plans is $7,550. Note.

How many people are on medicare in 2018?

Medicare is a widely used program. In 2018, nearly 60,000 Americans were enrolled in Medicare. This number is projected to continue growing each year. Despite its popularity, Medicare can be a source of confusion for many people. Each part of Medicare covers different services and has different costs.

What is Medicare for seniors?

Medicare is a health insurance program for people ages 65 and older, as well as those with certain health conditions and disabilities. Medicare is a federal program that’s funded by taxpayer contributions to the Social Security Administration.

How old do you have to be to get Medicare?

You can enroll in Medicare when you meet one of these conditions: you’re turning 65 years old. you’ve been receiving Social Security Disability Insurance (SSDI) for 24 months at any age. you have a diagnosis of end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) at any age.