Are the Social Security and Medicare trust funds off budget?

Specifically, present law mandates that the two Social Security Trust Funds, and the operations of the Postal Service, are formally considered to be "off-budget" and no longer part of the unified federal budget. (The Medicare Trust Funds, by contrast, are once again part of the unified budget.)

What is the Social Security program in the budget?

From the beginning of the Social Security program its transactions were reported by the administration as a separate function in the budget. This is sometimes described in present usage by saying that the Social Security program was "off-budget." This was the budget representation of the Social Security program from its creation in 1935 until 1968.

What percentage of federal budget is spent on Medicare?

Medicare is the second largest program in the federal budget. In 2018, it cost $582 billion — representing 14 percent of total federal spending.1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers.

Is Social Security and Medicare part of the federal budget?

The United States federal budget consists of mandatory expenditures (which includes Medicare and Social Security), discretionary spending for defense, Cabinet departments (e.g., Justice Department) and agencies (e.g., Securities & Exchange Commission), and interest payments on debt.

Which kind of budget item is Social Security?

Social Security Benefits as a Percentage of Total Federal Budget Expenditures. Presently, the Social Security program is the largest single item in the annual federal government budget.

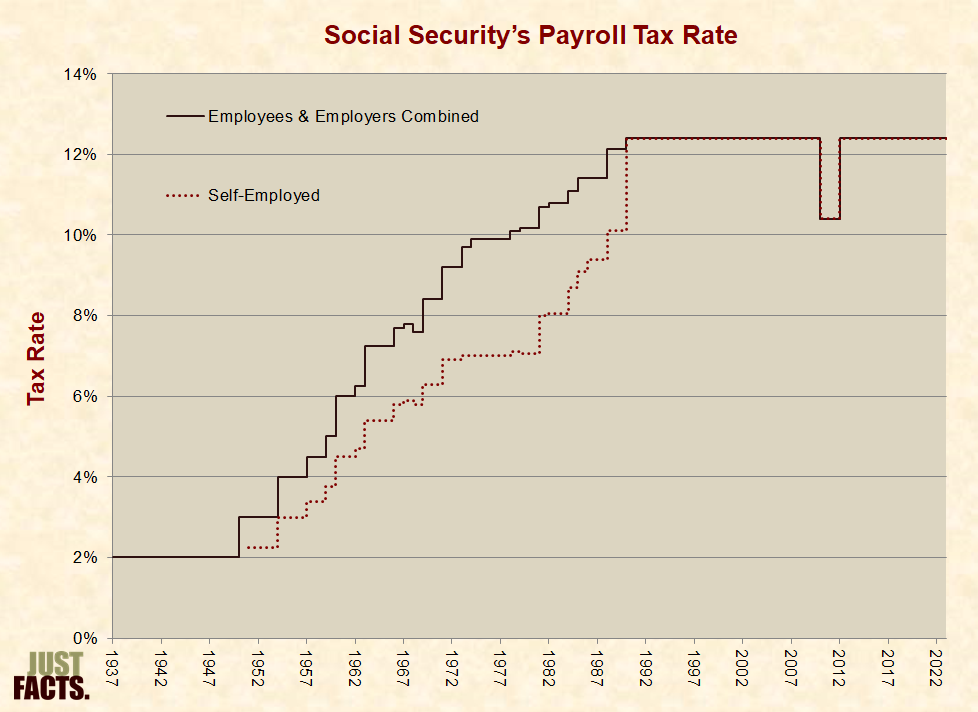

How is Medicare and Social Security funded?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Where does most of the tax money go?

Basically, there are three main categories that your tax money pays for: Interest on government debt (5%)...Social SecurityRetired workers and their families.Disabled workers and their families.Survivors of deceased workers.

What is Medicare budget?

Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

Is Social Security part of the deficit?

Social Security can run a short-run deficit only if it has previously run surpluses. Thus, when it is drawing down trust fund assets to pay for the Baby Boomer retirement, it will be contributing to the unified budget deficit, a measure that includes Social Security.

What are the three largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

What percentage of my taxes go to the military?

In short, roughly 20 percent of the federal budget is dedicated to defense and security, which can be understood as the percent of tax dollars spent on the military. But if you are interested in this topic, make sure you read until the very end of the article to find out everything there is to know!

HOW MUCH OF US taxes go to healthcare?

Government health expenditures in the United States account for a larger share of gross domestic product (11.2% in 2013) than do total health expenditures in any other nation.