- Medicare Part C, also known as Medicare Advantage.

- Medicare Part D, which is prescription drug coverage.

- Medicare supplement insurance, also called Medigap.

What types of Medicare coverage do private insurance companies offer?

Applicants can choose Original Medicare or Medicare Advantage. The federal government and its contractors operate the Original Medicare program. Medicare Advantage has private insurance plans. Medicare Supplement is a private insurance program authorized by the state governments. Medicare Part D has ...

What is the difference between Medicare and private insurance?

Part D (Drug coverage): Helps cover the cost of prescription drugs (including many recommended shots or vaccines). You join a Medicare drug plan in addition to Original Medicare , or you get it by joining a Medicare Advantage Plan with drug coverage. Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare.

What is private health insurance and how does it work?

May 06, 2021 · What parts of Medicare are sold by private insurance companies? Medicare Advantage (Part C), Part D, and Medigap are all optional Medicare plans that are sold by private insurance companies....

Is Medicare a private plan or a government run system?

May 28, 2021 · Private insurance companies manage some parts of Medicare, including: Medicare Part C, also known as Medicare Advantage; Medicare Part D, which is …

Which part of Medicare is the private insurance option?

Medicare Advantage (also known as Part C) Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

Is Medicare considered private insurance?

The federal government provides original Medicare, and private companies administer private health insurance and Medicare Advantage plans on behalf of the government. The cost of private insurance varies by plan type and coverage levels.

Is Medicare Part B private insurance?

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D). Refer to Medicare glossary for more details. with drug coverage.

What is a private Medicare plan?

A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, with a few exclusions, for example, certain aspects of clinical trials which are covered by Original Medicare even though you're still in the plan.

How is Medicare different from private health insurance?

The main differences are that Medicare only covers the cost of your treatment as a public patient and a set range of non-hospital health services. Private health insurance can give you more choice about the type of health services used and more coverage for different types of services.Sep 7, 2020

What is Medicare Part C called?

Medicare Advantage PlansMedicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

What is Medicare Part A and B mean?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is Medicare Part C the same as Medicare Advantage?

The takeaway Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

What are 4 types of Medicare Advantage plans?

4 Types of Medicare Advantage PlansHealth Maintenance Organization (HMO) An HMO is a network of doctors, hospitals, and other healthcare professionals. ... Preferred Provider Organization (PPO) ... Private Fee-for-Service (PFFS) ... Medical Savings Account (MSA) ... Choosing a type of plan.Sep 6, 2017

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

How many tiers of private insurance are there?

There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying. Bronze plans cover 60 percent of your healthcare costs. Bronze plans have the highest deductible of all the plans but the lowest monthly premium.

What is deductible insurance?

Deductible. A deductible is the amount that you must pay out of pocket before your insurance company begins paying its share. Generally, as your deductible goes down, your premium goes up. Plans with lower deductibles tend to pay out much faster than plans with high deductibles.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

Is Medicare a government or private insurance?

Medicare is government-funded health insurance that may help you save on your monthly medical costs but does not have a limit on how much you might pay out of pocket each year.

Does Medicare Advantage have a monthly premium?

Part C. In addition to paying Part A and Part B costs, a Medicare Advantage plan may also have its own monthly premium, yearly deductible, drug deductible, coinsurance, and copayments. These amounts vary based on the plan you choose. Part D.

What percentage of Americans have private health insurance?

Others include Medicaid and Veteran’s Affairs benefits. According to a 2020 report from the U.S. Census Bureau, 68 percent of Americans have some form of private health insurance. Only 34.1 percent have public health insurance, including 18.1 percent who are enrolled in Medicare. In certain cases, you can use private health insurance ...

How does Medicare work with a group plan?

How Medicare works with your group plan’s coverage depends on your particular situation, such as: If you’re age 65 or older. In companies with 20 or more employees, your group health plan pays first. In companies with fewer than 20 employees, Medicare pays first. If you have a disability or ALS.

What is the difference between Cobra and tricare?

COBRA allows you to temporarily keep private insurance coverage after your employment ends. You’ll also keep your coverage if you’re on your spouse’s private insurance and their employment ends. TRICARE. TRICARE provides coverage for active and retired members of the military and their dependents.

How to contact the SSA about Medicare?

Contacting the SSA at 800-772-1213 can help you get more information on Medicare eligibility and enrollment. State Health Insurance Assistance Program (SHIP). Each state has its own SHIP that can aid you with any specific questions you may have about Medicare. United States Department of Labor.

What is the process called when you have both insurance and a primary?

When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer. Once the payment order is determined, coverage works like this: The primary payer pays for any covered services until the coverage limit has been reached.

What is health insurance?

Health insurance covers much of the cost of the various medical expenses you’ll have during your life. Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies.

What age do you have to be to be enrolled in Medicare?

are age 65 or over and enrolled in Medicare Part B. have a disability, end stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS) and are enrolled in both Medicare Part A and Part B. have Medicare and are a dependent of an active duty service member with TRICARE.

Who pays first Medicare?

Rules on who pays first. Medicare pays first if you: Have retiree insurance, i.e., from former employment (you or your spouse). Are 65 or more, have group health coverage based on employment (you or your spouse), and the company employs 20 people or less.

How many employees does a group health plan have?

Your group health plan pays first if you: Are 65 or more, have group health coverage based on employment (you or your spouse), and the company employs 20 people or more . Are under 65 and have a disability, have coverage based on current employment (you or a family member), and the company has 100 employees or more.

How does Medicare work?

Examples of how coordination of benefits works with Medicare include: 1 Medicare recipients who have retiree insurance from a former employer or a spouse’s former employer will have their claims paid by Medicare first and their retiree insurance carrier second. 2 Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second. 3 Medicare recipients who are under 65 years of age and disabled with health insurance coverage through employers with less than 100 employees will have their claims paid by Medicare first and by their employer’s health plan second.

What is Medicare coordination?

Coordination of Benefits with Private Insurance Plan. When a Medicare recipient had private health insurance not related to Medicare, Medicare benefits must be coordinated with that plan provider in order to establish which plan is the primary or secondary payer.

How old do you have to be to get Medicare?

Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second.

Does Medigap cover foreign travel?

For certain plans, Medigap adds a few new benefits, such as foreign travel coverage. The monthly premium for one of these plans is separate from the premium paid for Original Medicare. In order to make identifying Medigap plans easier, they follow a letter-name standardization in most states.

Is Part D a part of Part C?

Part D Prescription Drug Plans can be offered as part of a Part C plan which rolls the cost of its monthly premium into the monthly premium it charges, or as a standalone plan paired with Original Medicare where the monthly premium is paid separately from any Original Medicare premiums.

Does Medicare provide expanded benefits?

Through these contractual relationships, Medicare is able to provide recipients with an expanded or enhanced set of benefits in a variety of ways.

What type of insurance is Medicare?

The types of Medicare coverage you can get from Medicare-approved private insurance companies include: Medicare Supplement (Medigap) insurance to help cover out-of-pocket Medicare costs, such as deductibles, copayments, and coinsurance. Medicare Advantage plans, which include your Part A (hospital) and Part B ...

What is Medicare Advantage?

Medicare Advantage plans, which include your Part A (hospital) and Part B (medical) insurance in one convenient plan. Medicare Advantage plans also might include added benefits, like prescription drugs, routine vision, routine hearing, and routine dental coverage. No matter which coverage option you may choose, you’re still in the Medicare program.

Is Medicare Part A the same as Medicare Part B?

The Medicare Part A and Medicare Part B premiums are the same regardless of your location in the USA. If you get any type of Medicare coverage from a private insurance company, such as Medicare prescription drug coverage, a Medicare Supplement plan, or a Medicare Advantage plan, these premiums may vary from location to location.

Do you pay premiums for Medicare if you are older?

On the other hand, most people who qualify for Medicare don’t pay a premium for hospital insurance (Part A).

Does Medicare Supplement Plan K have out-of-pocket limits?

Two Medicare Supplement plans, Medicare Supplement Plan K and Plan L, have out-of-pocket limits. Other Medicare Supplement plans may still help you cover Medicare’s out-of-pocket costs. All Medicare Advantage plans are required to have an out-of-pocket limit, protecting you from devastating financial responsibility if you have a serious health ...

Is Medicare a private insurance?

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

Does smoking increase Medicare premiums?

Premiums and other costs may also be different among insurance companies. Tobacco use: igarette use will not increase your Original Medicare (Part A and Part B) premiums. However, according to Medicare.gov, Medicare Supplement plans may offer discounts to non-smokers.

Signing up for Medicare might make sense even if you have private insurance

Jeffrey M. Green has over 40 years of experience in the financial industry. He has written dozens of articles on investing, stocks, ETFs, asset management, cryptocurrency, insurance, and more.

How Medicare Works

Before diving into how Medicare works with your existing health coverage, it’s helpful to understand how it works on its own. Medicare has four main parts: A, B, C, and D. You can also purchase Medicare supplement insurance, known as Medigap.

Medicare Enrollment Periods

Medicare has a few enrollment periods, but the initial enrollment period may be the most important. This is when you first become eligible for Medicare. And if you miss the deadline to sign up for Parts B and D, you could face expensive penalties .

How Medicare Works If You Have Private Insurance

If you have private insurance, you may want to sign up for Parts A, B, D—and possibly a Medicare Advantage plan (Part C) and Medigap, once you become eligible. Or not. There are reasons both for and against. Consider how the following types of coverage work with Medicare to help you decide.

Primary and Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first (up to plan limits) and a secondary payer will only kick in for costs not covered by the primary payer.

Frequently Asked Questions (FAQs)

No, you can delay signing up for Medicare without penalty, as long as you are covered by another type of private insurance. Generally, if you are eligible for premium-free Part A, you should still sign up for it, even if you have additional private insurance coverage. 18

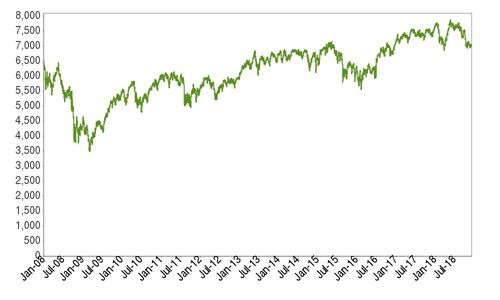

How many people are in Medicare Advantage?

In 2018 alone, nearly 60 million people enrolled in Medicare or Medicare Advantage plans to help cover the cost of their healthcare needs. As the population grows older, that number is only likely to increase.

Is Medicare Advantage a good alternative to private insurance?

That said, Medicare and Medicare Advantage plans can still be a more affordable alternative to private insurance.

Can dependents enroll in Medicare separately?

Dependents Must Enroll Separately. The biggest downside of Medicare vs private health insurance is that you can only enroll for yourself. You’re not permitted to enroll your spouse or other dependents on your policy. This can mean that you’ll end up paying slightly more for coverage.

Is Medicare a part of traditional insurance?

Unfortunately, Medicare coverage isn’t as complete as traditional insurance. You’ll need to buy supplemental plans if you want your coverage to work like private insurance. For example, if you need prescription drug coverage, you’ll need to buy a Part D supplement to avoid paying full price.

Is Medicare cheaper than other insurances?

Medicare Is Usually Cheaper. When you enroll in Medicare, you’re getting the same quality coverage regardless of which insurance provider you’re working with. This is because all Medicare plans offer the same types of coverage and provide the same types of protection. The only difference between policies is the provider you choose to work with ...

Is Medicare the only insurance option?

Though Medicare is the most common insurance option for retirement-aged individuals, it’s not the only option out there. In fact, many people still choose to enroll in private insurance instead. So, which type of insurance is better? How can you choose between Medicare and private insurance for your needs?

Does Medicare penalize older people?

Medicare plans won’t penalize you for being older or having pre-existing health conditions. The plans exist specifically for individuals over the age of 65. They assume that you’ll need more frequent medical care and already need prescription medications to manage existing health conditions.