Is FICA the same as Medicaid tax?

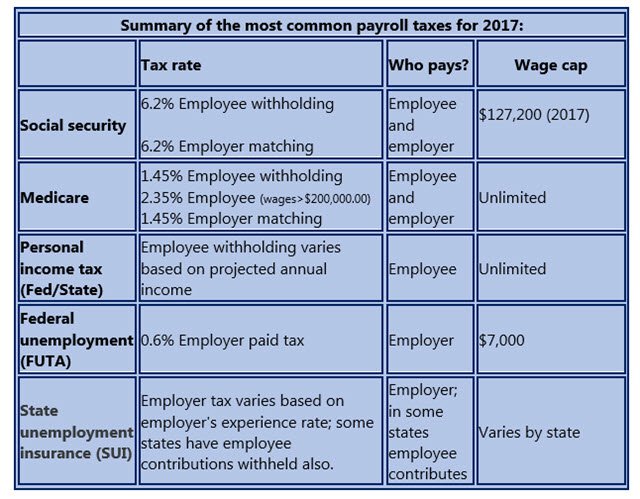

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes. Social Security and Medicare Withholding Rates

Are any pre tax deductions that reduce FICA and Medicare?

Cafeteria Plans are pre tax deductions that reduce FICA and Medicare. Cafeteria Plan means a written plan under which all participants are employees and the participants may choose among 2 or more benefits consisting of cash and qualified benefits. Benefits are group term life insurance, health insurance.

Is Medicare portion of FICA progressive or proportional?

The FICA tax is levied on employers, employees, and certain self-employed individuals.Revenue goes to Social Security and Medicare. In 2014, the employee's contribution to the retirement part of the FICA tax was 6.2 percent of the first $117,000 earned in wages and salaries. (Medicare is withheld on all wages and tips.)

What percentage is taken out for Social Security and Medicare?

The total amount of your contributions goes to two funds. At 6.2 percent of your gross earnings in 2020, AARP notes that the largest portion of this mandatory deduction is for the Social Security fund. Your employer also deducts 1.45 percent of your wages for your contribution to Medicare.

Is Social Security and Medicare Part of FICA?

FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

What percentage of FICA is Medicare?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings.

What percentage of payroll is Social Security and Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do you calculate FICA and Medicare?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How is FICA calculated?

To calculate your FICA tax burden, you can multiply your gross pay by 7.65%. Self-employed workers get stuck paying the entire FICA tax on their own. For these individuals, there's a 12.4% Social Security tax, plus a 2.9% Medicare tax. You can pay this tax when you pay estimated taxes on a quarterly basis.

What is the Social Security and Medicare tax rate for 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax. 1.

What is FICA tax on my paycheck?

The Federal Insurance Contribution Act, introduced in the 1930s, requires employers and employees to contribute to Medicare and Social Security programs. Commonly referred to as FICA, these taxes are automatically deducted from employee paychecks and matched by employers.

What two taxes FICA make up FICA?

FICA is comprised of the following taxes: 6.2 percent Social Security tax; 1.45 percent Medicare tax (the “regular” Medicare tax); and. Since 2013, a 0.9 percent Medicare surtax when the employee earns over $200,000.

What is the Social Security and Medicare tax rate for 2021?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the FICA percentage?

The FICA percentage is the government law that expects you to withhold three separate duties from the wages you pay your representatives. FICA contains a 6.2 percent Social Security assessment; a 1.45 percent Medicare tax (the "customary" Medicare impose.)

What happens when a business withholds FICA?

Once the business has withheld FICA finance tax, the business must store and report the assessments by the tax due dates. To store FICA, the business has to know whether they are a month-to-month or semiweekly investor.

What is FICA tax?

FICA, the Federal Insurance Contributions Act, refers to the taxes that largely fund Social Security retirement, disability, survivors, spousal and children’s benefits. FICA taxes also provide a chunk of Medicare’s budget. Most workers have FICA taxes withheld directly from their paychecks.

What is the maximum amount of income for Medicare in 2021?

In 2021, the threshold is $142,800 ; any earnings above that are not subject to Social Security taxes. The limit is adjusted annually based on national changes in wage levels. There is no comparable earnings maximum for Medicare; the 1.45 percent Medicare tax included in FICA is levied on all of your work income.

What is the maximum taxable income for Social Security in 2021?

In 2021, the threshold is $142,800; any earnings above that are not subject to Social Security taxes. The limit is adjusted annually based on national changes in wage levels.

Does FICA pay for SSI?

FICA and SECA taxes do not fund Supplemental Security Income (SSI) benefits. Those are paid out of general tax revenues (although the program is administered by the Social Security Administration). Updated December 24, 2020.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the difference between FICA and Medicare?

The only difference is that, as with FICA, the employee’s portion is deducted from their wages while the employer pays their share directly. Some employees have to pay an Additional Medicare Tax at 0.9% This tax applies to employees who make more than a set threshold amount each calendar year.

What is FICA tax?

FICA stands for the Federal Insurance Contributions Act. During 1930, the act was introduced to cover Social Security. Medicare was then added at a later stage. Both employers and employees pay FICA and these days, the tax is divided into Medicare tax and Social Security tax.

What does FICA mean for employers?

What this means as an employer is that you’ll have to periodically deposit both your employer’s taxes and the taxes you’ve withheld from your employee’s paychecks. Keep in mind that FICA taxes are calculated based on an individual’s gross annual wages.

Do you have to pay Social Security taxes on wages above $132,900?

If your employees’ wages exceed $132,900, you should no longer withhold social security taxes from their pay. In addition, you also don’t have to pay any employment taxes on wages above that amount.

Can you deduct Social Security from an employee?

Remember that if you don’t follow Social Security, Medicare or FICA instructions carefully, you may deduct too much Social Security tax from an employee. This could be the case if you kept on deducting above the Social Security maximum by mistake. Whatever the reason for the error, it’s critical that the money is refunded to the employee.#N#This kind of scenario is avoidable, especially if you streamline your tax and payroll systems. We offer advice from professional accountants who ensure accurate calculations and no extra hidden fees. Try out our pay stub generator and see for yourself!

Do self employed people pay Medicare tax?

In addition, self-employed people pay both self-employment tax, which means they pay both the employee and employer portions of the Medicare tax.

Do small businesses have to pay FICA taxes?

The IRS has an Electronic Federal Tax Payment System, which small businesses must use to deposit FICA taxes. This is the case unless your FICA tax liability is less than $2,500 a quarter. You won’t just pay your taxes once a year to the IRS, as they operate on a pay-as-you-go system for employment taxes.