How many people have Medicare Part A and Part B only?

The analysis excludes Medicare beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (4.7 million people) and beneficiaries who had Medicare as a secondary payer to employer or other coverage (1.7 million people).

What is the Medicare Part B subsidy for higher income beneficiaries?

Medicare Part B Coverage. Starting in 2007, higher income beneficiaries began to receive a reduced subsidy which will be fully phased in by 2009. At that time, subsidies for higher income beneficiaries will range from about 65 percent to 20 percent of the total premium. This change will affect only about four percent of all Medicare beneficiaries.

How much is the Medicare Part B deductible?

In 2020, you pay $198 ($203 in 2021) for your Part B Deductible. After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy. Durable medical equipment (DME)

What are the advantages of Medicare Part B?

There are some advantages to enrolling in Part B: You must be enrolled in Parts A and B to join a Medicare Advantage plan. You have the advantage of coordination of benefits (described later) between Medicare and your FEHB plan, reducing your out-of-pocket costs.

What percentage of people have Medicare Part B?

People who do not meet the employment criteria can pay a monthly premium for Part A coverage; about 1 percent of Part A enrollees pay their own premiums. Most people (93 percent) enroll in both programs, while 6 percent enroll in Part A only and 1 percent enroll in Part B only.

How many Medicare Part B beneficiaries are there?

Standard Monthly premiums: The standard Part B premium is $144.60....Number of People Receiving Medicare (2019): *Total Medicare beneficiaries • Aged • Disabled61.2 million • 52.6 million • 8.7 millionPart C (Medicare Advantage) beneficiaries22.2 millionPart D (Prescription Drug Benefit) beneficiaries47.2 million2 more rows•Aug 24, 2020

Do most people buy Medicare Part B?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Does everyone have Medicare Part B?

Some people may get Medicare Part A “premium-free,” but most people have to pay a monthly premium for Medicare Part B.

What percentage of US population is on Medicare?

18.4%Medicare is a federal health insurance program that pays for covered health care services for most people aged 65 and older and for certain permanently disabled individuals under the age of 65. An estimated 60 million individuals (18.4% of the U.S. population) were enrolled in Medicare in 2020.

What percentage of Medicare is Medicare Advantage?

In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do most federal retirees take Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits.

Can I opt out of Medicare Part B?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Why is Medicare Part B required?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

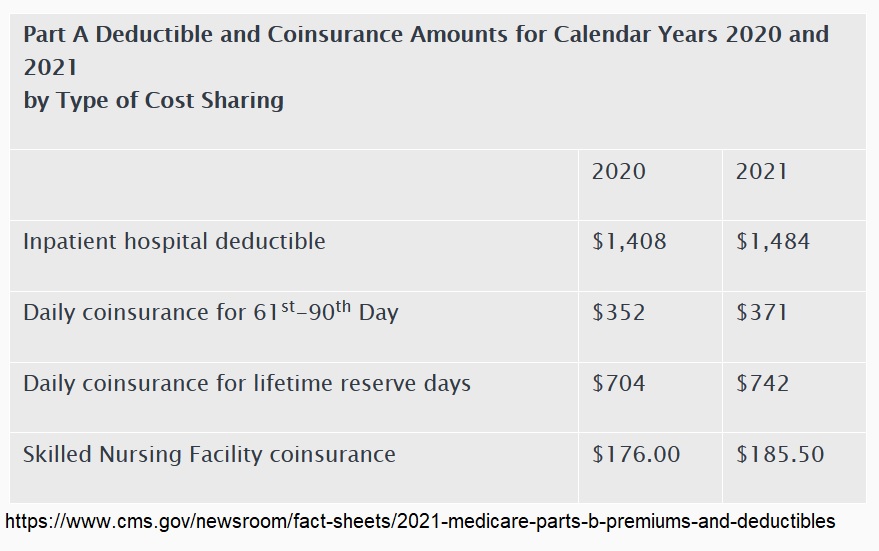

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

When does Medicare Part B start?

If you do not enroll in Medicare Part B during your initial enrollment period, you must wait for the general enrollment period (January 1- March 31 of each year) to enroll, and Part B coverage will begin the following July 1 of that year. If you wait 12 months or more, after first becoming eligible, your Part B premium will go up 10 percent ...

How long does it take for Part B to go up?

If you wait 12 months or more, after first becoming eligible, your Part B premium will go up 10 percent for each 12 months that you could have had Part B but didn't take it. You will pay the extra 10 percent for as long as you have Part B.

Is orthopedic covered by Part B?

Some services covered under Part B might not be covered or only partially covered by your plan, such as orthopedic and prosthetic devices, durable medical equipment, home health care, and medical supplies (check your plan brochure for details).

Do I have to take Medicare Part B?

Medicare Part B Coverage. Do I Have to Take Part B Coverage? You don't have to take Part B coverage if you don't want it, and your FEHB plan can't require you to take it . There are some advantages to enrolling in Part B: You must be enrolled in Parts A and B to join a Medicare Advantage plan.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What percentage of Medicare beneficiaries were covered in 2016?

Most new beneficiaries (71 percent) were covered under traditional Medicare for their first year on Medicare.

Why do baby boomers enroll in Medicare Advantage?

One line of thinking has been that the Baby Boom Generation will enroll in Medicare Advantage plans over traditional Medicare at much higher rates than prior generations because they have had more experience with managed care during their working years.

How much will Medicare enrollment increase in 2029?

While the Congressional Budget Office is projecting a steady increase in Medicare Advantage enrollment, rising to 47 percent by 2029, even with an aging Baby Boom Generation, the majority of new beneficiaries are opting for traditional Medicare in the year they first go on Medicare.

What states have Medicare Advantage?

In two states (Oregon and Minnesota) and Puerto Rico, more than 40 percent of new beneficiaries enrolled in Medicare Advantage in 2016. However in five states (Delaware, Maryland, Nebraska, New Hampshire, and Vermont) and the District of Columbia, less than 11 percent of new beneficiaries enrolled in Medicare Advantage plans, ...

Is Medicare Advantage enrollment rising?

The relatively low enrollment rates among new beneficiaries with high needs may warrant further scrutiny. While Medicare Advantage enrollment among new beneficiaries is rising, these findings suggest that ongoing attention to traditional Medicare is needed to meet the needs of the lion’s share of the Medicare population.

How many Medicare beneficiaries have employer sponsored retirement?

Employer-sponsored Retiree Health Coverage. In total, 14.3 million of Medicare beneficiaries – a quarter (26%) Medicare beneficiaries overall — also had some form of employer-sponsored retiree health coverage in 2018. Of the total number of beneficiaries with retiree health coverage, nearly 10 million beneficiaries have retiree coverage ...

How many people are covered by Medicare Supplement?

Medicare supplement insurance, also known as Medigap, provided supplemental coverage to 2 in 10 (21%) Medicare beneficiaries overall, or 34% of those in traditional Medicare (roughly 11 million beneficiaries) in 2018. As with other forms of supplemental insurance, the share of beneficiaries with Medigap varies by state.

What is Medicare Advantage?

Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits.

How is supplemental coverage determined?

Sources of supplemental coverage are determined based on the source of coverage held for the most months of Medicare enrollment in 2018. The analysis excludes beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2018 (n=4.7 million) and beneficiaries who had Medicare as a secondary payer ...

Does Medicare have supplemental coverage?

No Supplemental Coverage. In 2018, 5.6 million Medicare beneficiaries in traditional Medicare– 1 in 10 beneficiaries overall (10%) or nearly 1 in 5 of those with traditional Medicare (17%) had no source of supplemental coverage. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing ...

Does Medigap increase with age?

While Medigap limits the financial exposure of Medicare beneficiaries and provides protection against catastrophic expenses for services covered under Parts A and B, Medigap premiums can be costly and can rise with age, depending on the state in which they are regulated.

Does Medicare Part B cover Part B?

As of January 1, 2020, Medigap policies are prohibited from covering the full Medicare Part B deductible for newly-eligible enrollees; however, older beneficiaries who are already enrolled are permitted to keep this coverage.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.