What percentage of federal budget is spent on Medicare?

Medicare is the second largest program in the federal budget. In 2018, it cost $582 billion — representing 14 percent of total federal spending.1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending.

How much does Medicare spend on Medicare Advantage plans?

As a percent of total Medicare benefit spending, payments for Part A and Part B benefits covered by Medicare Advantage plans increased by nearly 50 percent between 2008 and 2018, from 21 percent ($99 billion) to 32 percent ($232 billion), as private plan enrollment grew steadily over these years (Figure 3).

What is the average growth rate of Medicare spending?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

How much does Medicare cost the United States?

That's $11,582 per person. This figure accounted for 17.7% of gross domestic product (GDP) that year. If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019...

What percentage of healthcare spending is Medicare?

20 percentMedicare spending (3.5 percent growth) reached $829.5 billion in 2020, accounting for 20 percent of total national health care expenditures. Total Medicare spending increased at a slower rate in 2020, at 3.5 percent compared with 6.9 percent growth in 2019.

How much of the US budget goes to Medicare and Medicaid?

Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

How much did the US spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.

How much did the US spend on Medicare in 2021?

$696 billionIn FY 2021 the federal government spent $696 billion on Medicare.

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What are the 5 largest federal expenses?

Military (Discretionary)Social Security, Unemployment, and Labor (Mandatory)Medicare and Health (Mandatory)Government (Discretionary)Education (Discretionary) Whether you owe money to the IRS or you have a State tax debt, our staff of Enrolled Agents and Tax Professionals can help you!

Is Medicare subsidized by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

What percentage of healthcare is paid by the government?

Government Now Pays For Nearly 50 Percent Of Health Care Spending, An Increase Driven By Baby Boomers Shifting Into Medicare. A new CMS report projects that U.S. health care spending will surpass $5.9 trillion in 2027, growing to represent more than 19 percent of the economy.

What percentage of GDP is spent on healthcare in US?

19.7%In 2020, U.S. national health expenditure as a share of its gross domestic product (GDP) reached an all time high of 19.7%. The United States has the highest health spending based on GDP share among developed countries. Both public and private health spending in the U.S. is much higher than other developed countries.

Why is US healthcare so expensive?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Which country spends the most on healthcare?

the U.S. The United StatesHealth Expenditure in the U.S. The United States is the highest spending country worldwide when it comes to health care. In 2020, total health expenditure in the U.S. exceeded four trillion dollars. Expenditure as a percentage of GDP is projected to increase to 19 percent by the year 2025.

How much has Covid cost the US government?

How is total COVID-19 spending categorized?AgencyTotal Budgetary ResourcesTotal OutlaysDepartment of Labor$726,058,979,281$673,702,382,650Department of Health and Human Services$484,524,400,000$279,893,610,481Department of Education$308,328,604,971$127,408,234,7359 more rows

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

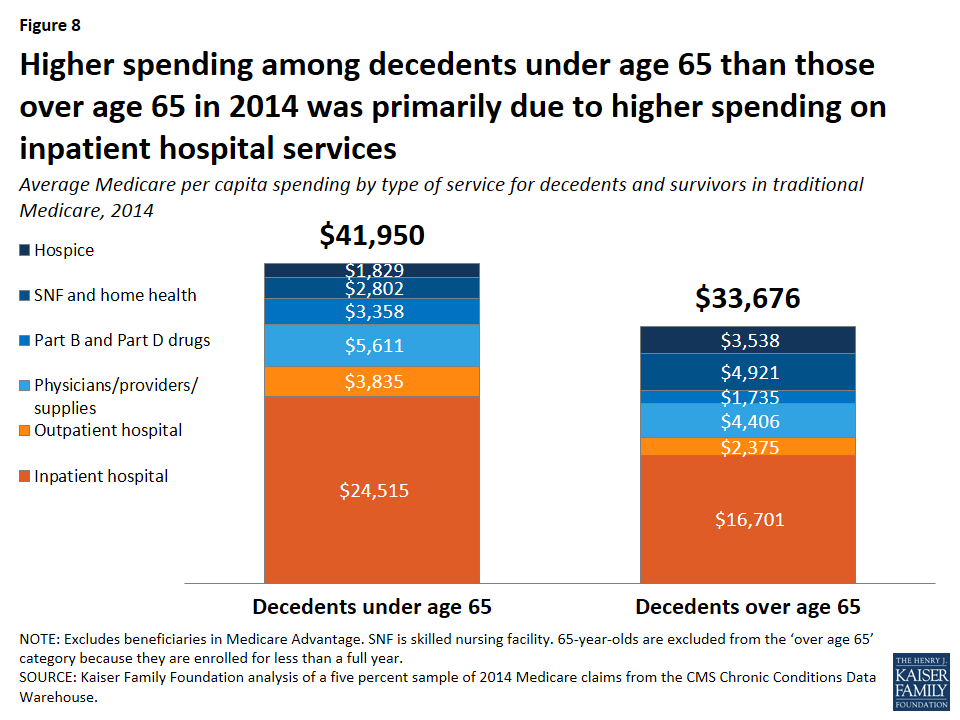

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much did Medicaid spend in 2019?

Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE. Private health insurance spending grew 3.7% to $1,195.1 billion in 2019, or 31 percent of total NHE. Out of pocket spending grew 4.6% to $406.5 billion in 2019, or 11 percent of total NHE.

What was the per person spending for 2014?

In 2014, per person spending for male children (0-18) was 9 percent more than females. However, for the working age and elderly groups, per person spending for females was 26 and 7 percent more than for males. For further detail see health expenditures by age in downloads below.

How much did hospital expenditures grow in 2019?

Hospital expenditures grew 6.2% to $1,192.0 billion in 2019, faster than the 4.2% growth in 2018. Physician and clinical services expenditures grew 4.6% to $772.1 billion in 2019, a faster growth than the 4.0% in 2018. Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018.

How much did prescription drug spending increase in 2019?

Prescription drug spending increased 5.7% to $369.7 billion in 2019, faster than the 3.8% growth in 2018. The largest shares of total health spending were sponsored by the federal government (29.0 percent) and the households (28.4 percent). The private business share of health spending accounted for 19.1 percent of total health care spending, ...

How much did Utah spend on health care in 2014?

In 2014, per capita personal health care spending ranged from $5,982 in Utah to $11,064 in Alaska. Per capita spending in Alaska was 38 percent higher than the national average ($8,045) while spending in Utah was about 26 percent lower; they have been the lowest and highest, respectively, since 2012.

Which region has the lowest health care spending per capita?

In contrast, the Rocky Mountain and Southwest regions had the lowest levels of total personal health care spending per capita ($6,814 and $6,978, respectively) with average spending roughly 15 percent lower than the national average.

How much did the NHE increase in 2019?

NHE grew 4.6% to $3.8 trillion in 2019, or $11,582 per person, and accounted for 17.7% of Gross Domestic Product (GDP). Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

How much did Medicare Part D spend in 2016?

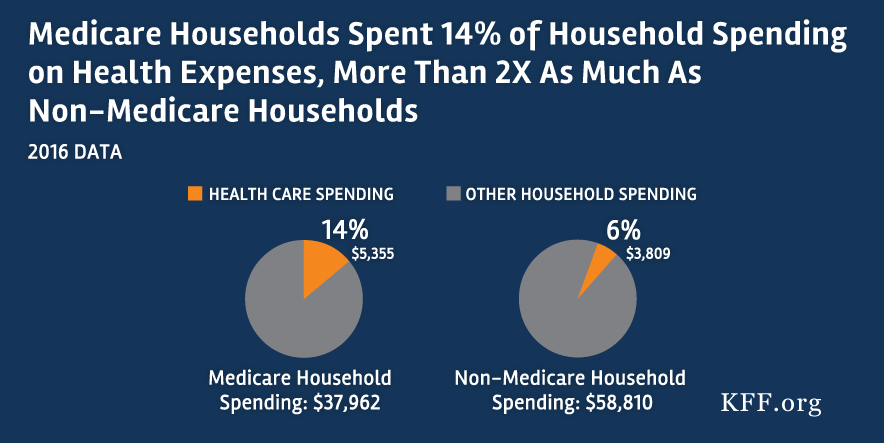

Medicare Part D enrollees who did not receive low-income subsidies spent about $500 out of pocket on their prescriptions in 2016, on average, but 1 million enrollees with spending above the catastrophic threshold spent nearly $3,200 out of pocket. 8.

How much of Medicare was covered by prescription drugs in 2016?

Prescription drugs covered under both Part B and Part D accounted for 19% of all Medicare spending in 2016. 3. Ten drugs accounted for 17% of all Part D spending in 2016 (including both Medicare and out-of-pocket spending). 4.

Can Medicare Part D pay out of pocket?

Medicare Part D enrollees can pay thousands of dollars out of pocket for specialty tier drugs, with the majority of costs for many specialty drugs occurring in the catastrophic phase of the benefit. 10. Many proposals to reduce prescription drug costs enjoy broad support among Democrats and Republicans.

Is Medicare a private insurance?

Medicare is second only to private insurance as a major payer for retail prescription drugs. The program’s share of the nation’s retail prescription drug spending has increased from 18% in 2006 to 30% in 2017.

What is Medicare recurring?

Recurring Publications. Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program ...

What percentage of prescriptions were brand name drugs in 2015?

In 2015, brand-name specialty drugs accounted for about 30 percent of net spending on prescription drugs under Medicare Part D and Medicaid, but they accounted for only about 1 percent of all prescriptions dispensed in each program.

How much did Medicaid increase in 2014?

The ACA Medicaid expansion’s effect on spending is evident in 2014. Medicaid spending increased by 11 percent—the largest single year increase since 2001—and its share of spending increased from 15.5 percent to 16.4 percent.

What are the changes in Medicare and Medicaid?

Changes in the share of spending paid for by Medicare and Medicaid are tied to changes in program expansion and payment policy as well as economic cyclical factors for Medicaid. Private health insurance has historically been the largest source of funds for health care spending since the 1970s.

What is a close look at national health expenditures?

A close look at national health expenditures can offer physicians a clearer vision of the total costs and funding that are required each year to keep the health care system functioning. A new analysis (log in) from the AMA sheds light on health care spending. How our health care dollars are spent.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the m…

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

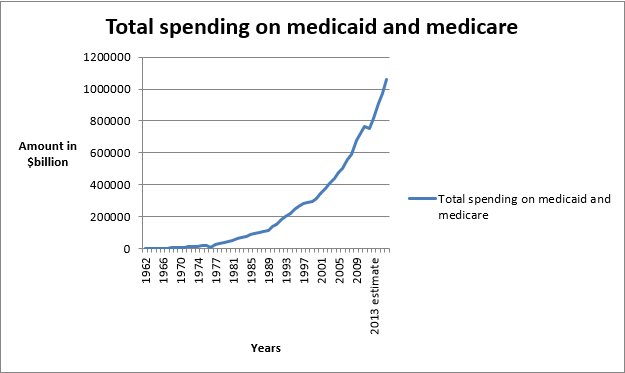

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…