Percentage of people covered by Medicare in the United States from 1990 to 2020

| Characteristic | Percentage of population |

| '20 | 18.4 % |

| '19 | 18.1 % |

| '18 | 17.8 % |

| '17 | 17.4 % |

What medications are not covered by Medicare?

Some examples of medications that may not be covered by Medicare include: Weight loss or weight gain medications Medications used to treat cold or cough symptoms Fertility medications Vitamins and minerals (with the exception of prenatal vitamins or fluoride preparation products) Medications used ...

What is not covered by Medicare?

Some of the items and services Medicare doesn't cover include: Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing. Long-term supports and services can be provided at home, in the community, in assisted living, or in nursing homes.

Does everyone pay the same for Medicare?

While Medicare Part A is free to everyone who qualifies for Medicare by having paid into Medicare taxes for 40 quarters, Medicare Part B has a premium. This premium is the same for most people, but not all people. Persons with higher incomes pay proportionately more for Medicare Part B, and as of 2011, higher income Medicare recipients also pay ...

What percent does insurance cover of a medical bill?

The percentage of costs of a covered health care service you pay (20%, for example) after you've paid your deductible. Let's say your health insurance plan's allowed amount for an office visit is $100 and your coinsurance is 20%. If you've paid your deductible: You pay 20% of $100, or $20. The insurance company pays the rest.

Does Medicare ever cover 100%?

Deductibles, coinsurance, and copayments vary based on which plan you join. Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plan's limit, the plan pays 100% for covered health services for the rest of the year.

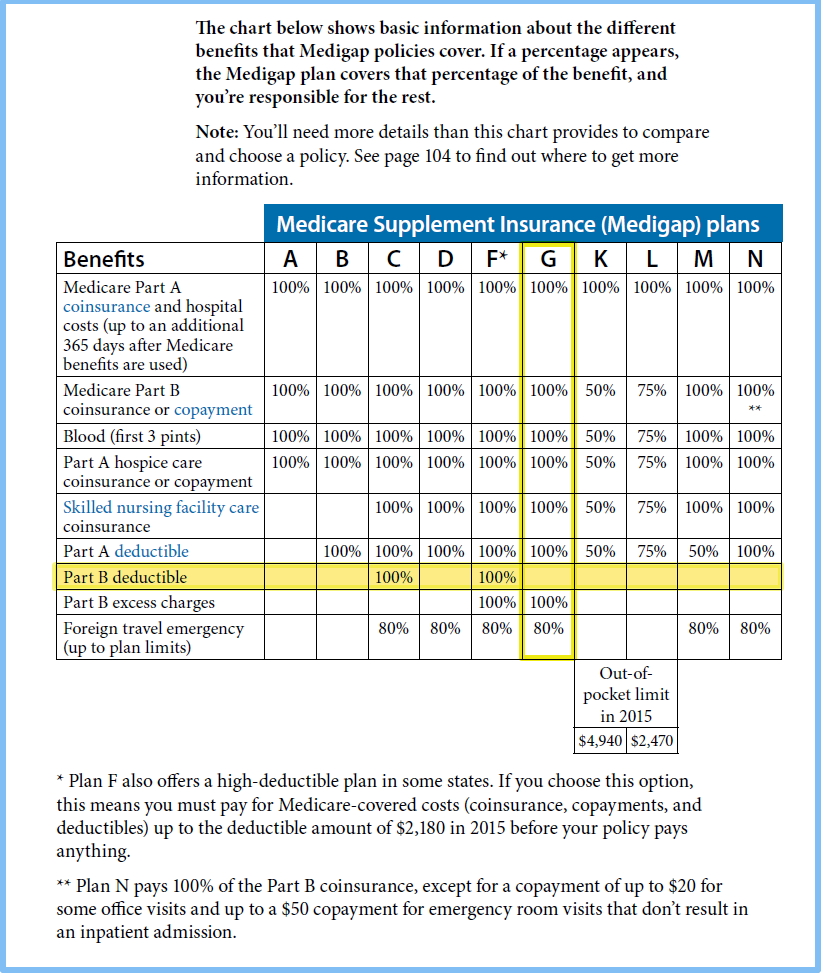

What covers the 20% on Medicare?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan, you'll pay a separate premium for your Medicare drug coverage (Part D).

Does Medicare only covers 80 percent?

Original Medicare only covers 80% of Part B services, which can include everything from preventive care to clinical research, ambulance services, durable medical equipment, surgical second opinions, mental health services and limited outpatient prescription drugs.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What are Medicare costs for 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the maximum out of pocket for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

What is the Medicare 80/20 rule?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

How does 80/20 Health insurance work?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

How does Medicare Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

What percentage of Medicare enrollees are poor?

It is estimated that about 25 percent of Medicare enrollees are in fair/poor health. But there are lots of questions about who should pay for or help with elderly care long-term. In a recent survey of U.S. adults, about half of the respondents said that health insurance companies should pay for elderly care.

What is Medicare 2020?

Get in touch with us now. , Oct 9, 2020. Medicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2019, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year. As of 2018, California, Florida, and Texas had the largest number ...

Is Medicare a poor program?

Despite a majority of the Medicare enrollees being above the federal poverty line, there are still several programs in place to help cover the costs of healthcare for the elderly. Opinions on elderly care in the U.S. It is estimated that about 25 percent of Medicare enrollees are in fair/poor health.

What is Medicare in the US?

Matej Mikulic. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

How many people are on Medicare in 2019?

In 2019, over 61 million people were enrolled in the Medicare program. Nearly 53 million of them were beneficiaries for reasons of age, while the rest were beneficiaries due to various disabilities.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

How much is Medicare Part A deductible?

– Initial deductible: $1,408.

What is Medicare Advantage?

Medicare Advantage (MA): Eligibility to choose a MA plan: People who are enrolled in both Medicare A and B, pay the Part B monthly premium, do not have end-stage renal disease, and live in the service area of the plan. Formerly known as Medicare+Choice or Medicare Health Plans.

Introduction

This report presents statistics on health insurance coverage in the United States based on information collected in the Current Population Survey Annual Social and Economic Supplement (CPS ASEC).

Highlights

In 2020, 8.6 percent of people, or 28.0 million, did not have health insurance at any point during the year.

America Counts Stories

Private Health Coverage of Working-Age Adults Drops From Early 2019 to Early 2021

Visualizations

Figure 1. Percentage of People by Type of Health Insurance Coverage and Change From 2018 to 2020

Tables

Table 1. Number and Percentage of People by Health Insurance Coverage Status and Type: 2018 to 2020

Health Insurance Historical Tables - HHI CPS (2017-2020)

HHI-01. Health Insurance Coverage Status and Type of Coverage--All Persons by Sex, Race and Hispanic Origin: 2017 to 2020

Health Insurance Detailed Tables

The Current Population Survey is a joint effort between the Bureau of Labor Statistics and the Census Bureau.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.