According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1 Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1

Full Answer

How much income can a person have on Medicaid?

The Kaiser Family Foundation website provides in-depth information on key health policy issues including Medicaid, Medicare, health reform, global health, HIV/AIDS, health insurance, the …

Who really pays for Medicaid?

“However, as a condition for receiving federal tax exemption for providing healthcare to the community, not-for-profit hospitals are required to care for Medicare and Medicaid beneficiaries. Also, Medicare and Medicaid account for more than 60 percent of all care provided by hospitals.”

What percentage of the US population is covered by Medicaid?

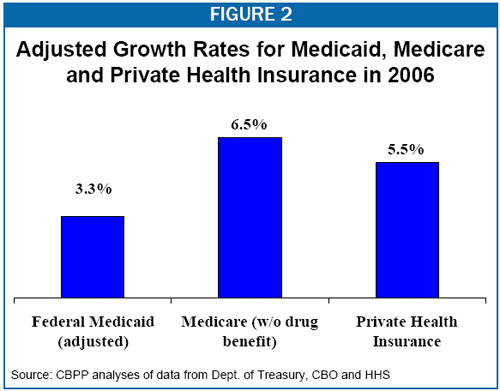

Mar 11, 2022 · If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16%...

What is the annual income limit for Medicaid?

Jan 30, 2020 · State Medicaid expenditures are estimated to have decreased 0.1 percent to $229.6 billion. From 2018 to 2027, expenditures are projected to increase at an average annual rate of 5.3 percent and to reach $1,007.9 billion by 2027. Medicaid expenditures are projected to increase from 3.1 percent of GDP in 2017 to 3.3 percent of GDP in 2027.[6]

How much was Medicare reimbursement in 2015?

At the end of last year, it was reported by the American Hospital Association (AHA) that Medicaid and Medicare reimbursement in 2015 was less than the actual hospital costs for treating beneficiaries by $57.8 billion. That is billion with a “B”.

How much money do community hospitals provide?

Community hospitals provided more than $35.7 billion in uncompensated care to patients. The Centers for Medicare and Medicaid Services (CMS) does assist U.S. hospitals with additional funding. The Disproportionate Share Hospital payments help providers that treat large proportions of uninsured and Medicaid individuals.

Does Medicare cover medical expenses?

The ACA survey results showed that Medicaid and Medicare payments do not cover the amounts hospitals pay for personnel, technology, and other goods and services required to provide care to Medicare and Medicaid beneficiaries. This is critical in areas where the population is largely covered by Medicare and Medicaid.

Can hospitals participate in Medicare?

Despite low Medicaid and Medicare reimbursement rates and high uncompensated care costs, the AHA report pointed out that few hospitals can elect not to participate in federal healthcare programs. “Hospital participation in Medicare and Medicaid is voluntary,” noted the AHA.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare funded?

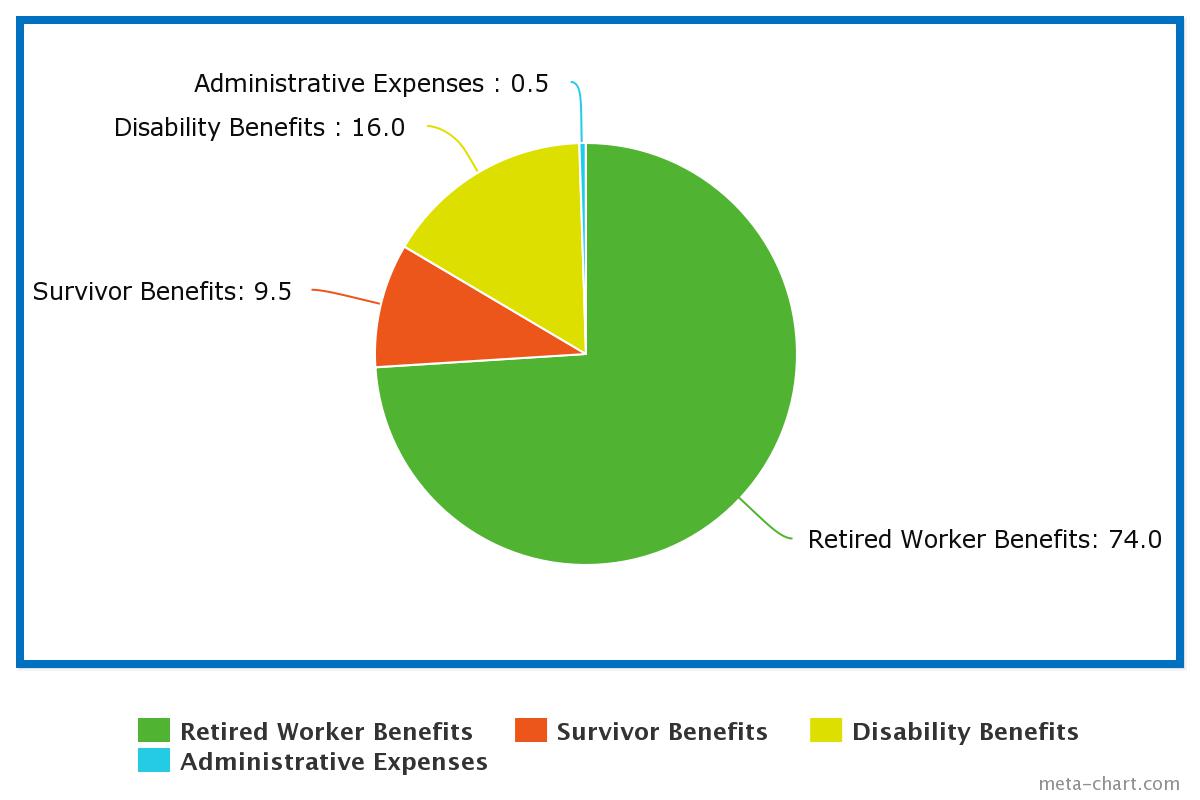

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

What is the federal Medicaid share?

The Federal share of all Medicaid expenditures is estimated to have been 63 percent in 2018. State Medicaid expenditures are estimated to have decreased 0.1 percent to $229.6 billion. From 2018 to 2027, expenditures are projected to increase at an average annual rate of 5.3 percent and to reach $1,007.9 billion by 2027.

What percentage of births were covered by Medicaid in 2018?

Other key facts. Medicaid Covered Births: Medicaid was the source of payment for 42.3% of all 2018 births.[12] Long term support services: Medicaid is the primary payer for long-term services and supports.

What percentage of Medicaid beneficiaries are obese?

38% of Medicaid and CHIP beneficiaries were obese (BMI 30 or higher), compared with 48% on Medicare, 29% on private insurance and 32% who were uninsured. 28% of Medicaid and CHIP beneficiaries were current smokers compared with 30% on Medicare, 11% on private insurance and 25% who were uninsured.

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

Is it a good idea to use HCPCS codes?

Using HCPCS codes. It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How much does Medicare Supplement pay for hospital visits?

(Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

What type of insurance is used for Medicare Part A and B?

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

Does Medicare have a maximum spending limit?

Be aware that Original Medicare has no annual out-of-pocket maximum spending limit. If you meet your Medicare Part A and/or Part B deductibles, you still generally pay a coinsurance or copayment amount – and there’s no limit to what you might pay in a year.

Does Medicare Advantage work?

To answer that question, here’s a quick rundown on how the Medicare Advantage (Medicare Part C) program works. When you have a Medicare Advantage plan, you still have Medicare – but you get your Medicare Part A and Part B benefits through the plan, instead of directly from the government.

Does Medicare cover out of pocket expenses?

Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket spending limits. So, if your Medicare-approved health -care costs reach a certain amount within a calendar year, your Medicare Advantage plan may cover your approved health-care costs for the rest of the year. The table below compares health-care costs ...

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

Does Medicare cover hospital stays?

Medicare Part A can help provide coverage for hospital stays. You’ll still be responsible for deductibles and coinsurance. A stay at the hospital can make for one hefty bill. Without insurance, a single night there could cost thousands of dollars. Having insurance can help reduce that cost.