What is the current Medicare tax rate?

Jul 06, 2021 · The Medicare tax rate in 2021 is 2.9%. That amount is split evenly between employers and employees, with each side paying 1.45% respectively. The Medicare tax rate has gradually increased over the years since debuting at 0.7% (0.35% for both employer and employee) in 1966. Some may confuse Medicare taxes with Social Security taxes.

What percentage of your paycheck is Medicare?

In 2021, What Will the Medicare Tax Rate Be? The Medicare tax rate for 2021 is 2.9%. In most cases, you are responsible for half of the entire Medicare tax amount (1.45%), and your employer is responsible for the remaining 1.45%. Your Medicare tax is …

How to calculate Medicare tax?

Dec 20, 2021 · The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%). What percentage is Medicare tax? The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.

When do you pay additional Medicare tax?

Dec 07, 2021 · The Medicare tax rate is determined by the IRS and is subject to change. The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%).

What is the Social Security and Medicare tax for 2021?

For 2021, the FICA tax rate for both employers and employees is 7.65% (6.2% for Social Security and 1.45% for Medicare). For 2021, the Social Security tax rate is 6.2% for the employer and employee (12.4% total) on the first $142,800 of employee wages.Oct 20, 2020

What is the rate percentage that you pay for Medicare taxes?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the federal tax rate for 2021?

How We Make MoneyTax rateSingleMarried filing jointly or qualifying widow10%$0 to $9,950$0 to $19,90012%$9,951 to $40,525$19,901 to $81,05022%$40,526 to $86,375$81,051 to $172,75024%$86,376 to $164,925$172,751 to $329,8504 more rows•4 days ago

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.Mar 23, 2021

What Is Medicare Tax?

The Medicare tax, often known as the “hospital insurance tax,” is a federal employment tax that helps to support a portion of the Medicare healthcare program. Moreover, Medicare tax is a deduction from an employee’s paycheck or paid as a self-employment tax, similar to Social Security tax.

What is FICA?

The Federal Insurance Contributions Act, or FICA, was first enacted in 1935. It is a payroll tax that both employees and employers must pay to the IRS, and it consists of two taxes:

Social Security

The Social Security tax rate is a percentage of your pay used to fund the program. This rate will be 6.20% in 2021. Self-employed people will have to pay twice as much. You may be able to pay half of that with proper deductions. You will settle into the program while working, and the program will repay you when you retire.

In 2021, What Will the Medicare Tax Rate Be?

The Medicare tax rate for 2021 is 2.9%. In most cases, you are responsible for half of the entire Medicare tax amount (1.45%), and your employer is responsible for the remaining 1.45%. Your Medicare tax is a part of your paycheck automatically.

Is This a Tax That Everyone on Medicare Has to Pay?

While everyone pays some Medicare taxes, you’ll only pay the additional tax if your income is at or over the threshold. If your income falls below a specific point, you will not be obliged to pay any other taxes.

What Is the Purpose of the Medicare Tax?

The Medicare tax supports Medicare Part A, which provides health insurance to adults 65 and older. Part A of Medicare, generally known as hospital insurance, pays for inpatient hospital stays, skilled nursing care, hospice, and home health services.

When Will I Be Able to Quit Paying Medicare Tax?

FICA taxes will continue to be paid to Social Security and Medicare as long as you have earned income. If you have no source of income, you stop paying Medicare taxes.

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

What is the maximum Medicare withholding for 2021?

The Social Security Administration recently announced that the maximum earnings subject to Social Security tax will increase from $137,700 in 2020 to $142,800 in 2021. For 2021, the FICA tax rate for both employers and employees is 7.65% (6.2% for Social Security and 1.45% for Medicare ).

Did Medicare taxes go up for 2021?

The Medicare tax rate is determined by the IRS and is subject to change. The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%).

What percentage is Medicare tax?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How much Social Security tax do I pay in 2021?

For those who earn a wage or salary, they share the 12.4 percent Social Security tax equally with their employer on their net earnings. The maximum taxable amount for the Social Security tax is $142,800 in 2021.

What is the Medicare tax rate for 2022?

During 2022, this tax will go up from 2021’s $142,800 to $147,000 in 2022. All companies that have employees earning more than that threshold will have to pay the additional amount in 2022. For Medicare, the FICA portion is 1.45% taxes that apply to all taxable compensations. 6

Is Medicare going up 2022?

Medicare Part B monthly premiums will rise 14.5% While it’s a separate program entirely, the SSA’s Medicare program will also see cost increases in 2022. Medicare’s Part B monthly premiums — which pay for medical insurance — stand to increase 14.5% in 2022, going from $148.50 to $170.10. 3

How much Medicare tax do I pay in 2021?

What is the Medicare Tax Rate for 2021? The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

Did Medicare taxes go up for 2021?

The Medicare tax rate is determined by the IRS and is subject to change. The Federal Insurance Contributions Act, or FICA, tax rate for earned income is 7.65% in 2021, which consists of the Social Security tax (6.2%) and the Medicare tax (1.45%).

What income is subject to the 3.8 Medicare tax?

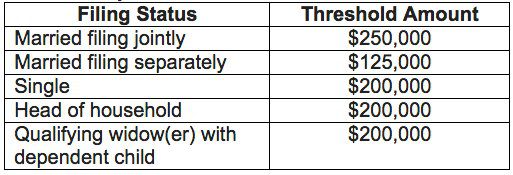

How does the 3.8% Medicare surtax work? Who is affected by the tax? Individual taxpayers with more than $200,000 in modified adjusted gross income (MAGI) or couples with more than $250,000 in MAGI. For trusts and estates, the income threshold is $13,050.

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

Who pays the 3.8 investment tax?

The net investment income tax (NIIT) is a 3.8% tax on investment income such as capital gains, dividends, and rental property income. This tax only applies to high-income taxpayers, such as single filers who make more than $200,000 and married couples who make more than $250,000, as well as certain estates and trusts.

What is the Social Security cap for 2021?

The amount liable to Social Security tax is capped at $142,800 in 2021 but will rise to $147,000 in 2022. The change to the taxable maximum, called the contribution and benefit base, is based on the National Average Wage Index. The increase for 2022, at 2.9 percent, is less than the 3.7 percent increase for 2021.

At what income level does Medicare tax increase?

The regulation has been in place since 2013. Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.