What percent of wages goes to Medicare?

· Medicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2020, approximately 18 percent of the U.S. population was covered by Medicare, a slight...

What percent of Americans want Medicare for all?

· Under Part B, the coinsurance amount is usually 20% of the Medicare-approved amount. You may get some services at no cost. For example, if the Medicare-approved amount for a doctor visit is $85, your coinsurance would be around $17, if …

What percentage of gross pay is withheld for Medicare?

Of the subtypes of health insurance coverage, employment-based insurance was the most common, covering 54.4 percent of the population for some or all of the calendar year, followed by Medicare (18.4 percent), Medicaid (17.8 percent), direct-purchase coverage (10.5 percent), TRICARE (2.8 percent), and Department of Veterans Affairs (VA) or Civilian Health and Medical …

What percentage of your check goes to Medicare?

Your Medicare coverage choices. Learn about the 2 main ways to get your Medicare coverage — Original Medicare or a Medicare Advantage Plan (Part C). What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care. What Part B covers

What percentage of healthcare spending is Medicare?

20 percentMedicare spending (3.5 percent growth) reached $829.5 billion in 2020, accounting for 20 percent of total national health care expenditures. Total Medicare spending increased at a slower rate in 2020, at 3.5 percent compared with 6.9 percent growth in 2019.

Does Medicare always pay 80 percent?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

What percent of seniors are on Medicare?

Most Americans are automatically entitled, on reaching age 65, to health insurance benefits under the Medicare program. Today almost 96 percent of the nation's elderly have Medicare coverage.

Is Medicare a 100% coverage?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What is the Medicare 80/20 rule?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

What is the out of pocket max for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

How many Americans are insured by Medicare?

64 million AmericansHow many Americans are covered by Medicare? Nearly 64 million Americans are currently covered by Medicare, and funding for the program accounted for more than 4% of the U.S. gross domestic product in 2020.

How many Americans have no health insurance?

31.6 millionResults—In 2020, 31.6 million (9.7%) people of all ages were uninsured at the time of the interview. This includes 31.2 million (11.5%) people under age 65. Among children, 3.7 million (5.0%) were uninsured, and among working-age adults (aged 18–64), 27.5 million (13.9%) were uninsured.

Who uses the most Medicare?

The U.S. states with the highest percentage of Medicare beneficiaries among their populations were Maine and West Virginia, where 24 and more percent of the population was enrolled. With over 6.2 million, California was the state with the highest number of Medicare beneficiaries.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium.

Does Medicare pay for hospital stay?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

Does Medicare Part B get deducted from Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What is the Medicare increase for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What does Medicare approved amount mean?

The approved amount, also known as the Medicare-approved amount, is the fee that Medicare sets as how much a provider or supplier should be paid for a particular service or item. Original Medicare also calls this assignment.

What percentage of Medicare enrollees are poor?

It is estimated that about 25 percent of Medicare enrollees are in fair/poor health. But there are lots of questions about who should pay for or help with elderly care long-term. In a recent survey of U.S. adults, about half of the respondents said that health insurance companies should pay for elderly care.

What is Medicare Part A?

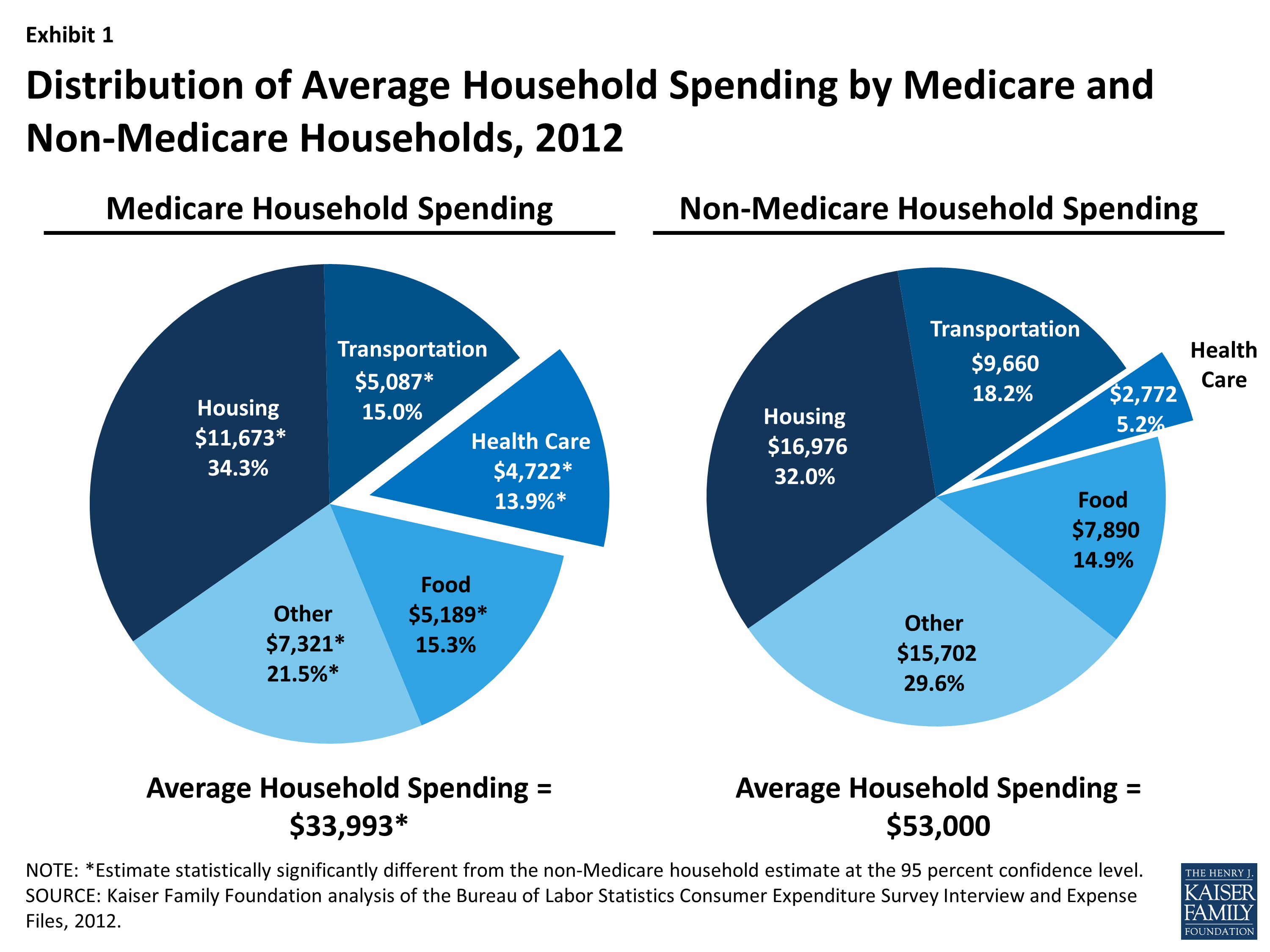

Medicare has two primary parts: Medicare Part A covers hospital care and Medicare Part B covers medical and preventative services. Both parts of Medicare are available to those aged 65 years and older under certain conditions. Medicare premiums are variable and depend on the enrollee’s income. Despite a majority of the Medicare enrollees being above the federal poverty line, there are still several programs in place to help cover the costs of healthcare for the elderly.

Is Medicare a poor program?

Despite a majority of the Medicare enrollees being above the federal poverty line, there are still several programs in place to help cover the costs of healthcare for the elderly. Opinions on elderly care in the U.S. It is estimated that about 25 percent of Medicare enrollees are in fair/poor health.

Is the 2013 survey comparable to 2017?

This statistic was assembled from several editions of the same report. Due to changes in survey methodology, estimates from 2013 through 2017 are not directly comparable to previous years.

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

How much is coinsurance for Medicare?

For example, if the Medicare-approved amount for a doctor visit is $85, your coinsurance would be around $17, if you’ve already paid your Part B deductible.

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

Do you have to go to a doctor for Medicare Advantage?

Some Medicare Advantage plans require you to use doctors and facilities in the plan’s network.

Does Medicare cover out of pocket expenses?

Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket spending limits. So, if your Medicare-approved health -care costs reach a certain amount within a calendar year, your Medicare Advantage plan may cover your approved health-care costs for the rest of the year. The table below compares health-care costs ...

What are the benefits of Medicare Advantage?

Most Medicare Advantage plans include prescription drug coverage, and many plans offer extra benefits. Routine vision and dental services and acupuncture are examples of some of the benefits a Medicare Advantage plan might offer.

Does Medicare Advantage cover coinsurance?

But what about those health-care costs? Since Medicare Advantage plans include Part A and Part B benefits, you know the plans cover them as long as you follow plan rules and Medicare rules. But your cost-sharing portions may vary among plans. There may be an annual deductible, and typically there are copayments or coinsurance amounts as well.

What is the rate of health insurance increase?

Between 2018 and 2020, the rate of public health insurance coverage increased by 0.4 percentage points to 34.8 percent.

How many people will not have health insurance in 2020?

In 2020, 8.6 percent of people, or 28.0 million, did not have health insurance at any point during the year.

When will private health insurance drop?

Private Health Coverage of Working-Age Adults Drops From Early 2019 to Early 2021

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Which states have the highest percentage of Medicare beneficiaries?

The U.S. states with the highest percentage of Medicare beneficiaries among their populations were West Virginia and Maine, where 24 and more percent of the population was enrolled.

Which state has the most Medicare beneficiaries?

With over 6.1 million, California was the state with the highest number of Medicare beneficiaries . The United States spent nearly 800 billion U.S. dollars on the Medicare program in 2019. Since Medicare is divided into several parts, Medicare Part A and Part B combined were responsible for the largest share of spending.

What is Medicare inpatient?

Hospital inpatient services – as included in Part A - are the service type which makes up the largest single part of total Medicare spending. Medicare, however, has also significant income, which amounted also to some 800 billion U.S. dollars in 2019.

What is Medicare 2020?

Research expert covering health, pharma & medtech. Get in touch with us now. , May 15, 2020. Medicare is a federal social insurance program and was introduced in 1965. Its aim is to provide health insurance to older and disabled people. In 2018, 17.8 percent of all people in the United States were covered by Medicare.

Is Medicare a state of poverty?

Unlike Medicaid, Medicare is not bound to lower incomes or a certain state of poverty. There are, however, a significant number of people who meet the criteria to participate in both programs. In 2019, over 61 million people were enrolled in the Medicare program.

When did the uninsured rate drop?

Since the late 1980s, the percentage of people receiving health insurance from private providers has decreased, while the percentage receiving health insurance from government programs like Medicare and Medicaid has increased. The uninsured rate peaked in 1998 and again in 2010 to 16.3% before falling to a low of 7.9% in 2017. Much of that change came after the Affordable Care Act (ACA) went into effect.

Is Medicare for All a single payer plan?

Some Democratic presidential hopefuls have proposed Medicare for All plans: also known as a single-payer plan. While the details are far from solidifying, Medicare for All means the government would operate health insurance coverage for all residents, funded by taxes.

Can you have multiple types of insurance?

An individual may be covered by multiple types of insurance.

Is Medicare for all vague?

Details about Medicare for All are currently vague, and there is no data to show what may or may not happen if the entire country switches to a government-provided health insurance plan. As Americans continue to debate and discuss the concept, it is worthwhile to point to the existing data that shows the demographic difference between who is getting insurance from employers and who is getting it from the government.

Is the population over 65 more likely to have health insurance?

The population over 65 is more likely to be covered by public health insurance, due to Medicare. After those over age 65, children below the age of 5 have the next highest rate of public health insurance coverage, likely due to government programs like Medicaid and the Children’s Health Insurance Program.

Is Medicare growing?

Medicare enrollment has been growing as the 65 and older population increases. Demographic factors like age, income, and education all impact whether someone is more likely to be covered by public or private health insurance. The population over 65 is more likely to be covered by public health insurance, due to Medicare.

Is Medicare a federally run program?

Those changes came over a period in which the share of coverage increased from Medicaid—a joint federal-state program for low-income people—and Medicare—a federally run program predominantly for those 65 and older.

How much did private health insurance cost in 2019?

Private Health Insurance (31 percent share): Private health insurance spending increased 3.7 percent to $1.2 trillion in 2019, which was slower than 5.6 percent growth in 2018. This deceleration was driven by a 7.9-percent decline in the net cost of private health insurance, which primarily resulted from the suspension of the health insurance tax in 2019. Spending on private health insurance benefits increased 5.4 percent in 2019, accelerating from growth of 4.4 percent in 2018. On a per enrollee basis, spending for private health insurance was $5,927 in 2019, an increase of 3.2 percent from 2018.

What percentage of government spending is private?

In 2019, the federal government and households accounted for the largest shares of spending (29 percent and 28 percent, respectively) followed by private businesses (19 percent), state and local governments (16 percent), and other private revenues (7 percent).