Those sunny numbers mirror overall trends in Medicare Advantage enrollment figures, which have shown steady adoption among seniors: The public-private plans now cover 34% of all eligible beneficiaries, according to the most recent set of data from the Kaiser Family Foundation.

How many people are covered by Medicare?

Medicaid provides health coverage to 7.2 million low-income seniors who are also enrolled in Medicare. Medicaid also provides coverage to 4.8 million people with disabilities who are enrolled in Medicare. In total, 12 million people are "dually eligible" and enrolled in both Medicaid and Medicare, composing more than 15% of all Medicaid enrollees. Individuals who are enrolled in …

How many Americans are on Medicare?

Oct 30, 2017 · Washington, D.C. — According to a national Morning Consult poll released by Better Medicare Alliance (BMA), 65 percent of seniors enrolled in Traditional Medicare are unfamiliar with Medicare Advantage or Medicare Part C- the public-private managed care option under Medicare. Currently, 58 million beneficiaries are enrolled in the Medicare program — of which …

Is Medicare good for seniors?

Jul 26, 2021 · The hyper-growth medical practice reports third-party survey results showing 84 percent of seniors ages 65 and older feel it is very important for their doctors and medical care teams to be COVID ...

Is Medicare free for seniors?

Nov 18, 2019 · Those sunny numbers mirror overall trends in Medicare Advantage enrollment figures, which have shown steady adoption among seniors: The public-private plans now cover 34% of all eligible beneficiaries, according to the most …

Does Medicare always pay 80 percent?

What percentage does Medicare pay?

Who benefits most from Medicare?

Are seniors happy with Medicare?

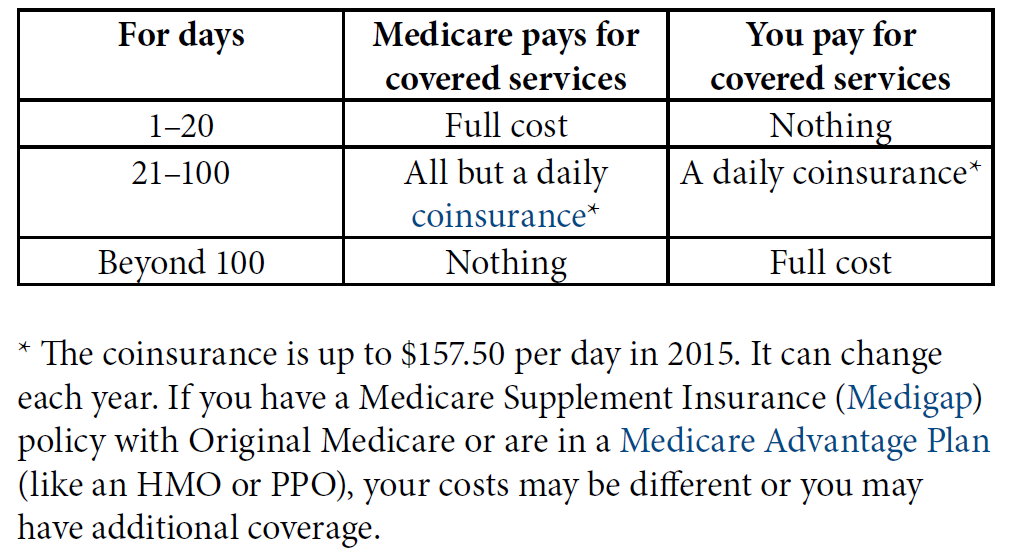

Does Medicare Part A pay 100 percent?

Is Medicare Part A and B free?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

Does Medicare cover dental?

Does Medicare come out of Social Security?

Do I automatically get Medicare when I turn 65?

What state has the most Medicare recipients?

...

Top 10 U.S. states based on number of Medicare beneficiaries in 2020.

| Characteristic | Number of Medicare beneficiaries |

|---|---|

| California | 6,411,106 |

| Florida | 4,680,137 |

What is an Advantage plan for seniors?

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

How is Medicare's financial condition assessed?

Medicare’s financial condition can be assessed in different ways, including comparing various measures of Medicare spending—overall or per capita—to other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How many seniors are satisfied with Medicare?

94% of Seniors Satisfied with Medicare Advantage — But Many Still Don’t Know About Managed Care. Medicare Advantage, a frequent source of headaches for skilled nursing operators, remains overwhelmingly popular among seniors, according to a new poll — and its growth has come even as many enrollees remain unaware of their options when they turn 65.

When do you switch to supplemental MA?

People tend to switch to a supplemental MA plan after a few years of traditional FFS enrollment, a situation that Schwartz ascribed to a general lack of information promoting the plans to seniors. For instance, incoming beneficiaries receive a notification regarding their Medicare Advantage options three months before they turn 65, she said, while the Social Security Administration directs enrollees to a website without providing any additional information.

Can seniors get Medicare Advantage?

But for many seniors, the chance to enroll in a Medicare Advantage plan — which can potentially bring them savings in the form of lower co-pays and an out-of-pocket cost cap — is difficult to pass up.

Is Medicare Advantage growing?

The Better Medicare Alliance survey also revealed that the significant recent growth in Medicare Advantage has come despite the fact that seniors aren’t immediately aware of their supplementary options. About 45% reported not knowing about MA when they initially turned 65 and became eligible for the plans, and a third enrolled in regular Medicare said they wish they’d known more about MA from the start.

Does Medicare pay for skilled nursing?

That trend hasn’t necessarily been good news for skilled nursing operators , as Medicare Advantage plans generally pay lower daily rates for post-acute care services, while also enforcing substantially shorter lengths of stay, than traditional fee-for-service Medicare. The rise of such plans has been blamed for the financial headwinds currently buffeting the skilled nursing industry, along with declining Medicaid reimbursements and a persistent staffing shortage.

How much will Medicare premiums go up in 2020?

But even with legislation to keep the Medicare Part B flat, the Part B premium still went up 2.6% over 2020, twice as much as the annual cost-of-living adjustment (COLA.). This trend of Medicare costs increasing several times faster than Social Security benefits creates chronic headaches for retirees, as the Medicare Part B premium consumes ...

How much of Social Security is Medicare Part B?

They estimate that Medicare Part B and Part D premiums, as well as cost sharing for both programs, currently equals just 24 percent of the level of the average Social Security benefit.

Why does Medicare Part B cost more than COLA?

Because Medicare Part B premiums and out-of-pocket costs grow several times faster than the annual COLA , healthcare costs take a rapidly growing share of Social Security benefits in retirement. The situation can leave older households without adequate income and dwindling savings just a few years after retiring.

What is the replacement for 1.3 percent COLA?

The Senior Citizens League is supporting the Emergency Social Security COLA for 2021 Act, which would replace the 1.3 percent COLA with a more adequate 3 percent COLA in 2021.

What is the Medicare premium for 2021?

January 6, 2021. By Mary Johnson, editor. The Centers for Medicare and Medicaid Services recently announced that the standard Medicare Part B premium will be $148.50 in 2021, an increase of $3.90 per month from $144.60 in 2020.

Is the 2021 retirement survey live?

Our 2021 Retirement Survey is live. SPEAK OUT NOW! And help shape TSCL’s legislative agenda.

Will Medicare Part B increase in 2021?

The 2021 Part B increase comes at the same time beneficiaries are receiving one of the lowest COLAs ever paid. The annual inflation adjustment will increase the average Social Security benefit by only $20.00 per month. Because Medicare Part B premiums and out-of-pocket costs grow several times faster than the annual COLA, ...

How Much of Your Social Security Will You Spend on Medicare Costs?

Medicare Trustees recently said that in 2017, Medicare Part B and Part D premiums and out-of-pocket costs would take about one-fourth of the average Social Security benefits. A recent survey by TSCL indicates that a substantial number of older households may be spending far more.

Emergency Senior Stimulus

The Senior Citizens League will collect both online and print petitions and bring a collective voice to members of Congress urging them to issue a $1,400.00 stimulus check to Social Security recipients. Sign the Emergency Senior Stimulus Petition today!

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How many parts are there in self employed tax?

The self-employed tax consists of two parts:

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who can help with Medicare enrollment?

If you’d like more information about Medicare, including your Medicare enrollment options, a licensed insurance agent can help.

What is the surtax rate for 2021?

The additional tax (0.9% in 2021) is the sole responsibility of the employee and is not split between the employee and employer. If you make more than $200,000 per year in 2021, the 0.9 percent surtax only applies to the amount you make that is over $200,000.

Summary

Health

Cost

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future inc...

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…