Full Answer

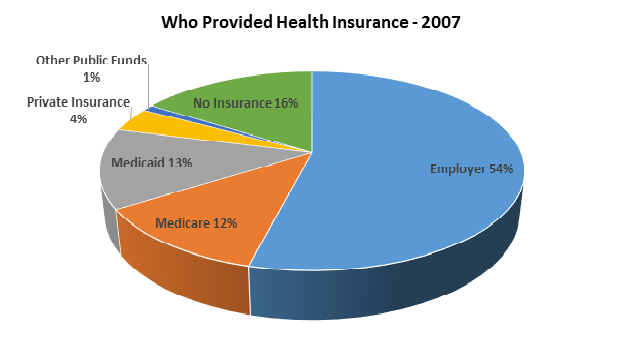

What percentage of the US population is covered by Medicare?

In 2019, Medicare provided benefits to 19 percent of the population. 2 Medicare spending is a major driver of long-term federal spending and is projected to double from 3 percent of GDP in fiscal year 2019 to 6 percent in fiscal year 2049 due to the retirement of the baby-boom generation and the rapid growth of per capita healthcare costs.

How much does Medicare cost the federal government?

In fiscal year 2019, the Medicare program cost $644 billion — about 14 percent of total federal government spending. After Social Security, Medicare was the second largest program in the federal budget last year.

Which states have the most Medicare members?

They are the only three states whose Medicare members exceed four million. Of course, California holding the title of most populous state translates to a higher Medicare population. Nonetheless, nearly 16% of its massive population of 39.5 million has Medicare, totaling about 6.3 million individuals.

Does Medicare cover you in every state?

In short, Medicare provides the same nationwide coverage regardless of which state you live in. The doctors, hospitals, and other healthcare providers under Medicare participate in a network that spans all states and U.S. territories.

What percentage of Medicare is paid by federal government?

As a whole, only 53 percent of Medicare's costs were financed through payroll taxes, premiums, and other receipts in 2020. Payments from the federal government's general fund made up the difference.

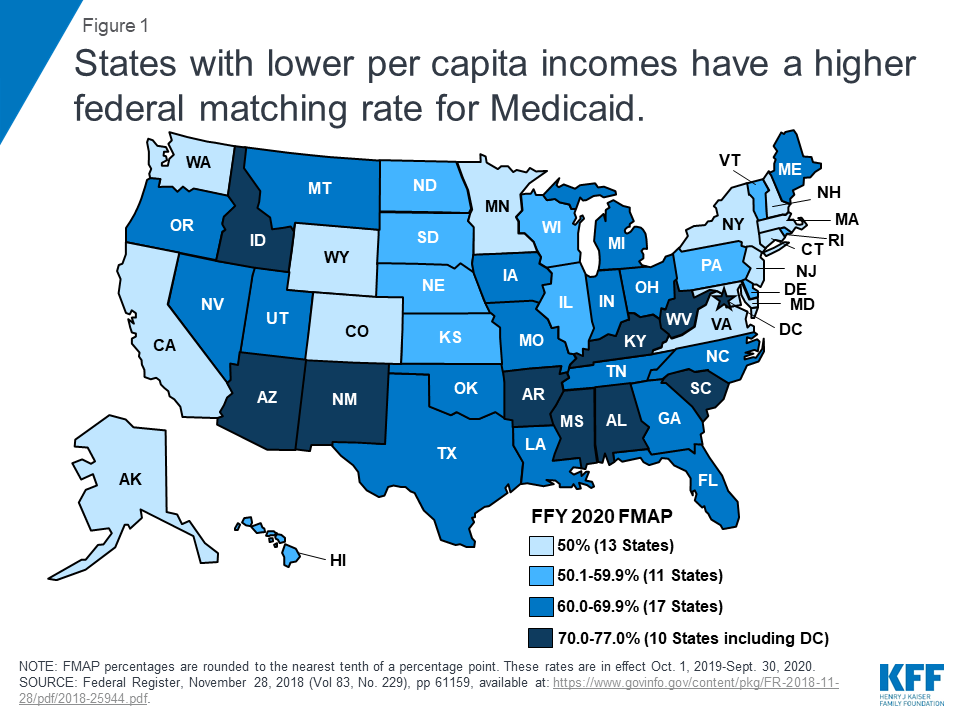

Is Medicare funded by both federal and state governments?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes. It relies on both state and federal funds for financing.

What percent of U.S. health care is paid for by the government?

Government Now Pays For Nearly 50 Percent Of Health Care Spending, An Increase Driven By Baby Boomers Shifting Into Medicare. A new CMS report projects that U.S. health care spending will surpass $5.9 trillion in 2027, growing to represent more than 19 percent of the economy.

How much money is the federal government spending on Medicare Medicaid?

The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children's Health Insurance Pro-gram (CHIP) about $427 billion, and veterans' medical care about $80 billion.

Who is Medicare funded by?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Who pays the most for healthcare in the US?

There are three main funding sources for health care in the United States: the government, private health insurers and individuals. Between Medicaid, Medicare and the other health care programs it runs, the federal government covers just about half of all medical spending.

Who pays the most for healthcare?

AmericansAccording to a study in the January 2019 issue of Health Affairs, Americans pay the highest for healthcare on a per capita basis than any other developed nation. In 2016, the average American spent $9,892 which was 25% higher than second-place Switzerland.

What percent of taxes go to healthcare?

In other words, the federal government dedicates resources of nearly 8 percent of the economy toward health care. By 2028, we estimate these costs will rise to $2.9 trillion, or 9.7 percent of the economy. Over time, these costs will continue to grow and consume an increasing share of federal resources.

How much of the federal budget goes to Social Security?

Today, Social Security is the largest program in the federal budget and typically makes up almost one-quarter of total federal spending.

How much has Covid cost the US government?

How is total COVID-19 spending categorized?AgencyTotal Budgetary ResourcesTotal OutlaysDepartment of Labor$726,058,979,281$673,702,382,650Department of Health and Human Services$484,524,400,000$279,893,610,481Department of Education$308,328,604,971$127,408,234,7359 more rows

How much does the US government spend on Social Security?

Social Security: In 2019, 23 percent of the budget, or $1 trillion, paid for Social Security, which provided monthly retirement benefits averaging $1,503 to 45 million retired workers in December 2019.

How much of Medicare will be burdened?

While health care costs in the US continue to rise, most Medicare beneficiaries can expect Medicare to shoulder 80–90% of the burden. But depending on the procedure, your bill could still be in the thousands. People over 65 and those approaching retirement would do well to sock away some extra savings for medical costs if possible—even if they’re perfectly healthy today.

Who is Kat Casna?

Kat Casna. Kathryn is a Medicare and geriatric specialist who has appeared on Baby Boomers, OppLoans, and Best Company. Her readers don’t need a degree in government-speak to get the right coverage because Kathryn sifts through Medicare’s parts, plans, and premiums to distill only the most useful information.

Which state has the lowest Medicare coverage?

None of the ten states with the most retirees made it into the top ten for Medicare coverage. 2. Washington, DC, received the lowest coverage in the nation at 77.29%. The only state that fell below the 80% mark was Utah, with coverage at 78.74%.

When is Medicare going to be rising?

Licensed Insurance Agent and Medicare Expert Writer. February 25, 2020. It's painfully obvious: the cost of health care in the US is rising. You feel it every time you visit the doctor, pick up a prescription, and pay your insurance premiums.

What percentage of Medicare enrollees are poor?

It is estimated that about 25 percent of Medicare enrollees are in fair/poor health. But there are lots of questions about who should pay for or help with elderly care long-term. In a recent survey of U.S. adults, about half of the respondents said that health insurance companies should pay for elderly care.

What is Medicare 2020?

Get in touch with us now. , Oct 9, 2020. Medicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2019, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year. As of 2018, California, Florida, and Texas had the largest number ...

Is Medicare a poor program?

Despite a majority of the Medicare enrollees being above the federal poverty line, there are still several programs in place to help cover the costs of healthcare for the elderly. Opinions on elderly care in the U.S. It is estimated that about 25 percent of Medicare enrollees are in fair/poor health.

What is the MACPAC?

State and federal spending under the ACA : MACPAC. Home Medicaid and the Affordable Care Act State and federal spending under the ACA.

What was the impact of Medicaid in 2014?

In 2014, high Medicaid spending growth rates nationally reflected the combined effects of increased enrollment as well as increased spending per enrollee. Along with new high-cost drugs and a required increase in primary care payments, expanded coverage for adults was a key driver of spending growth rates. However, spending growth rates were lower for 2015–2017 and are projected to be even lower for 2018 ( CMS 2020 ). This is due, in part, to the initial 2014 surge in enrollment continuing to diminish ( Keehan et al. 2016 ).

How much is Medicaid spending?

In fiscal year (FY) 2018, total Medicaid spending was estimated at $616.1 billion, with spending on the newly eligible adults ( CMS 2020 ). [1]

How much will the US government spend on adult expansion in 2027?

Over the next decade (2018 to 2027), spending on the adult expansion population is expected to grow from $74.2 billion in 2018 to $124.3 billion in 2027. Due to the higher federal matching rate, the vast majority (91 percent) of this spending will be paid for by the federal government ( CMS 2020 ).

Does Medicaid have a higher matching rate for childless adults?

States that expanded Medicaid eligibility to 100 percent of the federal poverty level (FPL) for parents and adults without dependent children prior to the ACA can also receive a higher matching rate for childless adults. Specifically, the traditional matching rate was increased by a transition factor so that in 2020 it is equal to ...

Is Medicaid expansion good for the state budget?

Although the share of Medicaid spending borne by states has increased as states take on a larger share of the costs for the newly eligible, there is some evidence to indicate that Medicaid expansion has been beneficial for state budgets.

Who is eligible for 100 percent matching?

Individuals eligible to receive the 100 percent matching rate included those who would not have been eligible for Medicaid in the state as of December 1, 2009, or who were eligible under a waiver but not enrolled because of limits or caps on waiver enrollment. As of June 2019, there were 14.8 million enrollees in the new group in ...

What is Medicare for older people?

Medicare is the national health services program for older Americans. It has several parts designed to make a comprehensive healthcare system. It provides medical care, prescription drugs, and hospital care. The federal government has a strong legal responsibility when carrying out Medicare. It must keep a rule of medical necessity.

What does Medicare Supplement require?

States require a combination of comprehensive plans along with any limited option plans. The insurance companies can use medical underwriting to determine process, discriminate against applicants and reject applications.

What is Medicare Advantage?

The private insurance plans in Medicare Advantage offer a wide variety of choices for consumers. There is another level of choice, and that is the managed care organizations. The balancing of resources, prices, and consumer costs require trade-offs. High premiums go along with low deductibles and out-of-pocket costs.

What is an HMOPOS?

HMOPOS is an HMO with a flexible option for outside services. The HMO has a primary care doctor and requires referrals for using network services. The point of service option is that the primary care physician can make referrals to outside sources.

What is the massive undertaking to insure a national and diverse population?

The massive undertaking to insure a national and diverse population requires technical expertise and consistency. The Centers for Medicare and Medicaid use several networks of private contractors to process claims and maintain records.

What is a PPO plan?

They feature prevention and wellness programs in addition to a network for medical services. They did not use outside resources. PPO is the preferred provider organization. This form of the plan does not restrict users to network resources; it pays a lower rate of cost sharing for outside resources.

What is managed care?

A managed care approach that helps one user may work against another. The use of networks means that there is a price preference for them and this limits choice or makes choices more costly. The below-itemized managed care types affect consumer choice in Medicare Advantage plans.

Introduction

This report presents statistics on health insurance coverage in the United States based on information collected in the Current Population Survey Annual Social and Economic Supplement (CPS ASEC) and the American Community Survey (ACS).

Visualizations

Figure 1. Percentage of People by Type of Health Insurance Coverage: 2019

Tables

Table 1. Coverage Numbers and Rates by Type of Health Insurance: 2018 and 2019

Health Insurance Historical Tables - HHI CPS (2017-2020)

HHI-01. Health Insurance Coverage Status and Type of Coverage--All Persons by Sex, Race and Hispanic Origin: 2017 to 2020

Health Insurance Historical Tables - HIC ACS (2008-2019)

HIC-4_ACS. Health Insurance Coverage Status and Type of Coverage by State -- All Persons: 2008 to 2019

Health Insurance Detailed Tables

The Current Population Survey is a joint effort between the Bureau of Labor Statistics and the Census Bureau.

Press Release

Median household income in 2019 increased 6.8% from 2018, and the official poverty rate decreased 1.3 percentage points.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...