How big is the problem of Medicare fraud?

Roskam said the Medicare fraud rate is 8 to 10 percent. His office pointed us to various documents that analyzed the problem of improper payments, an issue that mixes fraud together with nominally legal activities such as referring patients for more tests than are necessary. This suggested Roskam was using an inflated estimate of fraud.

What is considered Medicare fraud?

Both treatments are considered acupuncture under Medicare and Federal Employees Health Benefit Program (FEHBP) guidelines and are therefore ineligible for reimbursement by the government, according to the U.S. Attorney's Office.

How much fraud is there in Medicare?

What You Need to Know About Medicare Fraud

- Most Common Types of Medicare Fraud. “Medicare fraud” is actually a blanket term encompassing different fraudulent activities related to the Medicare system.

- The Societal Impact of Medicare Fraud. ...

- Individual Effects of Medicare Fraud. ...

- Medicare Fraud: Protecting Yourself Begins by Protecting Your Card. ...

- Even More Ways to Prevent Medicare Fraud. ...

How to spot and report Medicare fraud?

There are many ways of Medicare fraud, but here are the most common ones:

- A health care provider bills Medicare for a service or item that you never received, or that is different from what you actually received

- Somebody uses a beneficiary’s Medicare card to receive medical services, items or supplies

- Medicare covered rental equipment was already returned, but Medicare is still billed for it

How much Medicare fraud is there every year?

approximately $60 billion annuallyMedicare fraud can be a big business for criminals. Medicare loses approximately $60 billion annually due to fraud, errors, and abuse, though the exact figure is impossible to measure.

Is Medicare a fraud?

Medicare fraud occurs when someone knowingly deceives Medicare to receive payment when they should not, or to receive higher payment than they should. Committing fraud is illegal and should be reported. Anyone can commit or be involved in fraud, including doctors, other providers, and Medicare beneficiaries.

What is a major part of Medicare fraud?

Misusing codes on a claim, such as upcoding or unbundling codes. Upcoding is when a provider assigns an inaccurate billing code to a medical procedure or treatment to increase reimbursement. Medicare abuse can also expose providers to criminal and civil liability.

What is the most common type of Medicare abuse?

The most common type of Medicare abuse is the filing of inaccurate or falsified Medicare claims to increase profits.

What are red flags for Medicare fraud?

Some red flags to watch out for include providers that: Offer services “for free” in exchange for your Medicare card number or offer “free” consultations for Medicare patients. Pressure you into buying higher-priced services. Charge Medicare for services or equipment you have not received or aren't entitled to.

Who commits health care fraud?

Health care fraud can be committed by medical providers, patients, and others who intentionally deceive the health care system to receive unlawful benefits or payments. The FBI is the primary agency for investigating health care fraud, for both federal and private insurance programs.

How do people defraud Medicare?

Beneficiaries commit fraud when they… Let someone use their Medicare card to get medical care, supplies or equipment. Sell their Medicare number to someone who bills Medicare for services not received. Provide their Medicare number in exchange for money or a free gift.

Should I give my Medicare number over the phone?

Don't share your Medicare or Social Security number (or other personal information) with anyone who contacts you out of the blue by phone, text or email or shows up unannounced at your door. Don't send or give your old Medicare card to anyone. Impostors may claim you need to return it.

Who fights Medicare fraud?

Have your Medicare card or Medicare Number and the claim or MSN ready. Contacting the Office of the Inspector General. Visit tips.oig.hhs.gov or call 1-800-HHS-TIPS (1-800-447-8477). TTY users can call 1-800-377-4950.

What are the three examples Medicare uses to describe abuse?

Common types of abuse include: Billing for unnecessary services (services that are not medically necessary) Overcharging for services or supplies. Misusing billing codes to increase reimbursement.

How serious is insurance fraud?

Very serious. Insurance fraud is considered a felony, usually punishable by a large fine, and, in some instances, can lead to imprisonment. It's re...

What is the largest area of fraud identified by the insurance industry?

Medicare fraud is the most costly type of insurance fraud in the US. In 2017, it cost taxpayers $60 billion. Out of every $10 budgeted for the Medi...

How is insurance fraud detected?

It is a two-step process that starts with identifying suspicious claims either by using statistical analysis or based on tips from public and insur...

What happens if someone commits insurance fraud?

It depends on the severity of the fraud. For example, if it’s just an exaggerated but otherwise legitimate claim, the insurer will negotiate with t...

What happens if you get in trouble for insurance fraud?

Insurance fraud statistics inform us that insurance fraud is considered a felony punishable by fines, probation, or prison time in 48 states. The e...

What is the Medicare fraud rate?

His office pointed us to various documents that analyzed the problem of improper payments, an issue that mixes fraud together with nominally legal activities such as referring patients for more tests than are necessary. This suggested Roskam was using an inflated estimate of fraud. However, a recent study tends, in the worst-case analysis, to support Roskam’s figures.

Does the JAMA article stop at Medicare?

The JAMA article doesn’t stop at Medicare and Medicaid. It also looks at fraud in the health care sector as a whole, both public and private. The fraud rates don’t change much when the private sector is included.

Why is it important to identify Medicare fraud?

Identifying Medicare fraud and abuse helps to maintain the integrity of the program, keep costs down and prosecute criminals. As a Medicare beneficiary, it is your duty to do your part in helping to combat Medicare fraud for the benefit of all. 1 Schulte, Fred.

What is the number to call for Medicare fraud?

1-800-557-6059 | TTY 711, 24/7. The above scenario is just one example of a recent type of Medicare scam. Let’s take a deeper look at Medicare fraud, including the types of scams to be aware of and how you and your loved ones can stay safe.

What are some examples of Medicare abuse?

One example of Medicare abuse is when a doctor makes a mistake on a billing invoice and inadvertently asks for a non-deserved reimbursement. Medicare waste involves the overutilization of services that results in unnecessary costs to Medicare.

What is Medicare scam?

Medicare scams, like the one described above involving Medicare cards, are when individuals pose as health care providers to gather and use a Medicare beneficiary’s personal information to receive health care or money they are not entitled to.

How to protect yourself from Medicare fraud?

There are some additional things you can do and keep in mind to protect yourself from Medicare fraud: When you receive your new Medicare card in the mail, shred your old one. Also, be aware that Medicare will not contact you to verify information or to activate the card.

How long is the man in jail for Medicare fraud?

The man faces up to 10 years in prison for each of the six counts of fraud. A former health care executive in Texas admitted to her role in a $60 million Medicare fraud scheme that included overdosing hospice patients in order to maximize profits. She faces up to 10 years in prison.

What is the False Claims Act?

The False Claims Act protects the government from being sold substandard goods or services or from being overcharged. It holds people accountable who knowingly submit or cause to be submitted a false or fraudulent Medicare claim.

The Societal Impact of Medicare Fraud

Sure, it may not seem like this is a huge problem, especially with only 15 total Strike Force cases in the news through half of 2018, but it’s important to realize that many of these investigations involve millions upon millions of dollars. Furthermore, this is money that has essentially been stolen from the U.S.

Individual Effects of Medicare Fraud

For starters, it’s simply maddening to think that individuals who commit these types of offenses are bringing in much more than the typical, hard-working family earns just to survive. For instance, Money reports that the median real income is $54,635 for households in Michigan and $57,259 for a household in Ohio.

Medicare Fraud: Protecting Yourself Begins by Protecting Your Card

According to Medicare.gov, you should always “treat your Medicare card like it’s a credit card.” In other words, don’t give the number out to just anybody, because there’s a chance it could be used to open up a fraudulent claim.

Even More Ways to Prevent Medicare Fraud

There are other things you can do to avoid being a victim of Medicare fraud.

What to do if You Are a Medicare Fraud Victim

If you believe that you are a victim of Medicare fraud or if you have unequivocal proof, the first thing you want to do is report it to the authorities. Medicare.gov shares that there are three ways to do this:

Health Insurance Fraud Statistics

Healthcare fraud in the US isn’t as uncommon as one may be led to believe. However, various corrective actions have been taken, and the rate of insurance fraud in the healthcare system has decreased.

Auto Insurance Fraud Statistics

Staged crashes, false or overblown reports, faking information… All these cause harm to insurers and can be extremely dangerous. The most extensive damage, $10 billion a year, is caused by unidentified drivers, people who used fake IDs or lied in other ways to get their cars insured.

Insurance Antifraud Statistics

In 48 states, insurance fraud is defined as a specific crime, while 30 states have insurer fraud defined as a specific insurance crime. Currently, eight US states don’t have dedicated insurance fraud bureaus.

The Bottom Line

It’s evident that insurance fraud hurts a lot of people, not just the “big evil corporations.” As we’ve seen from the statistics about fraud complaints and especially about car insurance fraud, the dangers of evading paying insurance premiums, or worse, staging accidents to collect insurance payouts aren’t just monetary.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

What is the role of third party payers in healthcare?

The U.S. health care system relies heavily on third-party payers to pay the majority of medical bills on behalf of patients . When the Federal Government covers items or services rendered to Medicare and Medicaid beneficiaries, the Federal fraud and abuse laws apply. Many similar State fraud and abuse laws apply to your provision of care under state-financed programs and to private-pay patients.

Is there a measure of fraud in health care?

Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk. The impact of these losses and risks magnifies as Medicare continues to serve a growing number of beneficiaries.

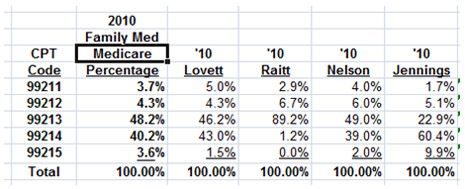

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

Can you give free samples to a physician?

Many drug and biologic companies provide free product samples to physicians. It is legal to give these samples to your patients free of charge, but it is illegal to sell the samples. The Federal Government has prosecuted physicians for billing Medicare for free samples. If you choose to accept free samples, you need reliable systems in place to safely store the samples and ensure samples remain separate from your commercial stock.

Which states have the highest number of Medicaid fraud cases?

7. The five states with the highest number of fraud cases include California, Texas, New York, Ohio and Kentucky. 8.

When was the Medicare fraud strike force formed?

The Medicare Fraud Strike Force was formed by federal officials in 2007. The group visited some 1600 businesses in Miami at random, following up on billing to Medicare for durable medical equipment. Of those businesses, nearly one-third did not exist although they had billed Medicare for $237 million in the past year.

How much money was stolen from Medicare in 2010?

2. In 2010 federal officials arrested some 94 people who had filed false claims through Medicare and Medicaid, for a total of $251 million in fraudulent claims. 3. The Medicare Fraud Strike Force was formed by federal officials in 2007.

How much was Medicare in 2010?

In 2010 the Government Accountability Office or GAO reported that they had found some $48 billion in “improper payments” during the past year for Medicaid and Medicare. This amount was roughly 10% of the $500 billion that was paid out during the year. 11.

How much money did the Consumer Protection Branch get in 2012?

In 2012 the Civil Division Consumer Protection Branch, which files civil suits against those convicted of Medicaid and Medicare fraud, obtained almost $1.5 billion in judgments, fines, and other forfeitures against those convicted of such frauds.

How much did the federal government recover from fraud in 2011?

In 2011, state governments recovered some $1.7 billion from fraudulent payouts. They spent an estimated $208 million to accomplish this. 9. In that same year, the federal government also recovered some $4.1 billion from fraudulent activity, but they too needed to spend hundreds of millions of dollars to do this. 10.

Why are credit card companies so discrepancies?

One reason for this discrepancy is that private insurers and businesses like credit card providers may be more willing to invest in software and other technology that allows them to spot fraud much more quickly than government programs, and to do so before those claims and charges are paid. 15.

How much does health care fraud cost?

The National Heath Care Anti-Fraud Association estimates conservatively that health care fraud costs the nation about $68 billion annually — about 3 percent of the nation's $2.26 trillion in health care spending. Other estimates range as high as 10 percent of annual health care expenditure, or $230 billion.

Is health care fraud a felony in Michigan?

Health care fraud is a felony under Michigan's Health Care False Claims Act, punishable by up to four years in prison, a $50,000 fine and loss of health insurance. It's also a federal criminal offense under the Health Insurance Portability and Accountability Act.

What is Medicare Part D improper payment estimate?

The Medicare Part D improper payment estimate measures the payment error related to inaccurately submitted prescription drug event (PDE) data, where the majority of errors for the program exists . CMS measures the inconsistencies between the information reported on PDEs and the supporting documentation submitted by Part D sponsors including prescription record hardcopies (or medication orders, as appropriate), and detailed claims information. The FY 20202020 Part D improper payment data is representative of PDE data generated from the Calendar Year 2018 payment year.

What is a smaller proportion of improper payments?

A smaller proportion of improper payments are payments that should not have been made or should have been made in different amounts and are considered a monetary loss to the government (e.g., medical necessity, incorrect coding, beneficiary ineligible for program or service, and other errors).

Is the APTC program reporting improper payments?

While a FY 2016 risk assessment concluded that the Advance Payments of the Premium Tax Credit (APTC) program is susceptible to significant improper payments, the program is not yet reporting improper payment estimates for FY 2020. CMS is committed to implementing an improper payment measurement program as required by PIIA. As with similar CMS programs, developing an effective and efficient improper payment measurement program requires multiple, time-intensive steps including contractor procurement; developing measurement policies, procedures, and tools; and extensive pilot testing to ensure an accurate improper payment estimate. CMS will continue to monitor and assess the program for changes and adapt accordingly. In FYs 2017 through 2020, CMS conducted development and piloting activities for the APTC improper payment measurement program and will continue these activities in FY 2021. HHS will continue to update its annual AFRs with the measurement program development status until the reporting of the improper payment estimate.

How much does Medicare cost?

It is massive: The program spends about $700 billion per year serving some 58 million Americans and making payments to 1 million entities.

Is Ryan's claim accurate?

One of them, Malcolm Sparrow, a professor of the practice of public management at Harvard, said that in a general, non-technical sense, Ryan’s claim is accurate.