Full Answer

What is the true cost of Medicare administration?

Sanders said, "Private insurance companies in this country spend between 12 and 18 percent on administration costs. The cost of administering the Medicare program, a very popular program that works well for our seniors, is 2 percent. We can save approximately $500 billion a year just in administration costs."

What percentage of federal budget is spent on Medicare?

Medicare is the second largest program in the federal budget. In 2018, it cost $582 billion — representing 14 percent of total federal spending.1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending.

What are administrative costs in health insurance?

Administrative costs are the expenses incurred by medical insurers that are not strictly medical, such as marketing, customer service, billing, claims review, quality assurance, information technology and profits. Is the gap between private and public health insurance providers’ administrative costs really that high?

How much does Medicare spend on Medicare Advantage plans?

As a percent of total Medicare benefit spending, payments for Part A and Part B benefits covered by Medicare Advantage plans increased by nearly 50 percent between 2008 and 2018, from 21 percent ($99 billion) to 32 percent ($232 billion), as private plan enrollment grew steadily over these years (Figure 3).

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

What is administrative cost?

Administrative costs are the expenses incurred by medical insurers that are not strictly medical, such as marketing, customer service, billing, claims review, quality assurance, information technology and profits. Is the gap between private and public health insurance providers’ administrative costs really that high?

Why are administrative expenses higher in commercial markets?

Historically, administrative expenses were much higher in the commercial market because insurers did a lot of underwriting, or using the health status of individuals or groups to determine their premiums. The Affordable Care Act was designed to curb that spending.

What do private insurers do?

In addition, private insurers create provider networks, which is where they determine which doctors will offer which services under each plan and negotiate reimbursement rates. They also review which drugs will be most effective and affordable.

Is Medicare Advantage competitive with Medicare?

Glied pointed out that private Medicare Advantage plans are "pretty competitive with traditional Medicare," but also tend to operate at higher administrative costs. "They bring costs down in other ways but they have to use administrative spending to do that," Glied said.

Is Medicare a single payer?

Experts told us that a single-payer system for the United States would have lower administrative costs than today’s private insurance, but it likely wouldn’t be able to achieve administrative costs as low as the existing Medicare program.

Does Medicare piggyback on Social Security?

But because much of Medicare piggybacks off Social Security, other administrative costs such as enrollment, payment and keeping track of patients are left to the Social Security system.

Why is administrative cost lower in Medicare?

Expressing administrative costs as a percentage of total costs makes Medicare's administrative costs appear lower not because Medicare is necessarily more efficient but merely because its administrative costs are spread over a larger base of actual health care costs. Administrative Costs per Person.

What percentage of health insurance premiums are administrative costs?

In recent years, these so-called "administrative costs" have accounted for 11.4--13.2 percent of total health insurance premiums. [7]

What is Medicare beneficiary?

Medicare beneficiaries are by definition elderly, disabled, or patients with end-stage renal disease. Private insurance beneficiaries may include a small percentage of people in those categories, but they consist primarily of people are who under age 65 and not disabled.

How much does Medicare cost?

Advocates of a public plan assert that Medicare has administrative costs of 3 percent (or 6 to 8 percent if support from other government agencies is included), compared to 14 to 22 percent for private employer-sponsored health insurance (depending on which study is cited), or even more for individually purchased insurance.

What are administrative costs?

Administrative costs can be divided broadly into three categories: 1 Some costs, such as setting rates and benefit policies, are incurred regardless of the number of beneficiaries or their level of health care utilization and may be regarded as "fixed costs." 2 Other costs, such as enrollment, record-keeping, and premium collection costs, depend on the number of beneficiaries, regardless of their level of medical utilization. 3 Claims processing depends primarily on the number of claims for benefits submitted.

How much higher was Medicare in 2005?

In the years from 2000 to 2005, Medicare's administrative costs per beneficiary were consistently higher than that for private insurance, ranging from 5 to 48 percent higher, depending on the year (see Table 1).

How are administrative costs measured?

In the case of private insurance, administrative costs are measured by the difference between premiums collected and claims paid. The result is that this includes some costs that are not really "administrative.".

What percentage of healthcare spending was administrative in 1999?

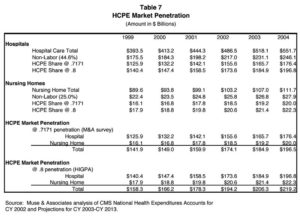

Administration had been 31 percent of health care spending in 1999. Three-quarters of the increase in administrative costs stems from high overhead in commercial Medicare and Medicaid managed-care plans.

How much does Medicare save?

Medicare for All would eliminate almost three-quarters of these costs and save more than $600 billion a year.

How much would the US save a year if the US were at Canada's level?

If per person administrative costs in the US were at Canada’s level, $551 a person rather than $2,497, the US would save more than $600 billion a year.

How much did the US spend on healthcare in 2017?

In 2017, the US spent about one in three health care dollars (34.2 percent) on health care administration, $812 billion. In dollar terms, administrative costs added more than $2,497 to health care spending per person. Compared to Canada, which spent $551 per person on health care administration, the US spent almost five times more.

Which is higher, Medicare or Medicaid?

Commercial Medicare and Medicaid health insurance plans have far higher administrative costs than the public traditional Medicare program. Medicare Advantage plans, for example, spend about 12% of their premiums on health care administration, easily $1,155 per person more than traditional Medicare.

Do health insurance companies make profit?

On top of that, the overwhelming majority of health insurers make a significant profit.

How are administrative costs calculated?

Administrative costs are calculated using faulty arithmetic. But most important, because Medicare patients are older, they are substantially sicker than the average insured patient — driving up the denominator of such calculations significantly.

What are the government agencies that administer Medicare?

First, other government agencies help administer the Medicare program. The Internal Revenue Service collects the taxes that fund the program; the Social Security Administration helps collect some of the premiums paid by beneficiaries (which are deducted from Social Security checks); the Department of Health and Human Services helps to manage accounting, auditing, and fraud issues and pays for marketing costs, building costs, and more. Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost. In addition, Medicare's massive size leads to economies of scale that private insurers could also achieve, if not exceed, were they equally large.

Is Medicare tax exempt from state taxes?

Private insurers obviously don't have this kind of outside or off-budget help. Medicare's administration is also tax-exempt, whereas insurers must pay state excise taxes on the premiums they charge; the tax is counted as an administrative cost.

Is Medicare more expensive than private insurance?

And by that measure, even with all the administrative advantages Medicare has over private coverage, the program's administrative costs are actually significantly higher than those of private insurers.

What percentage of Medicare claims are administrative costs?

One of the most common, and least challenged, assertions in the debate over U.S. health care policy is that Medicare administrative costs are about 2 percent of claims costs, while private insurance companies’ administrative costs are in the 20 to 25 percent range.

Is Medicare more efficient than private insurance?

One of the most common, and least challenged, assertions in the debate over U.S. health care policy is that Medicare is much more efficient than the private sector. Critics of the private sector health insurance industry like to boast that Medicare administrative costs are about 2 percent of claims costs, while private insurance companies’ administrative costs are in the 20 to 25 percent range — or more.1 That assertion is nearly always followed by a policy recommendation: Switch everyone to a government-financed health care system — or just put everyone in Medicare — and the country will save so much in administrative costs that it can cover all of the 46 million uninsured with no additional health care spending.2 Sound too good to be true? It is.

Is Medicare administrative cost hidden?

The primary problem is that private sector insurers must track and divulge their administrative costs, while most of Medicare’s administrative costs are hidden or completely ignored by the complex and bureaucratic reporting and tracking systems used by the government.

Is Medicare getting more efficient?

Is Medicare Getting More “Efficient”? Based on Tables 1 and 2, one can see that the administrative cost figure for Medicare has been decreasing and is estimated to continue downward — making Medicare look as if it is getting even more “efficient” as time passes. Higher costs in early years were partly due to startup program costs — which private insurers also have — but the primary reason for the decrease is clearly the acceleration in Medicare benefits (averaging about 8 percent growth per year) versus the estimated increase in program administrative costs (abut 3 percent per year). Using Table 2 as a basis, even with the unreported costs (see Table 1, Medicare ii), Medicare over time looks better and better relative to the private market because private administrative costs will likely remain roughly the same as a percentage of claims. Why are benefits growing faster than administrative costs? There are least two reasons: increased economies of scale and the high, and growing, cost of treating seniors. Private Sector Economies of Scale. Certainly one reason for Medicare’s declining percentage of administrative costs is greater economies of scale, but the private sector also can achieve economies of scale. Large employers have lower administrative cost ratios than small employers, and not much more than Medicare.

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

Summary

Health

Cost

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future inc...

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…