Are Medicare costs based on your income?

Feb 15, 2022 · After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be. Medicare Part D …

What are the income levels for Medicare?

Nov 16, 2021 · Learn how your income bracket will affect your Medicare costs in 2022. ... In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You ...

What is the income limit for Medicare?

Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60.

How does income affect monthly Medicare premiums?

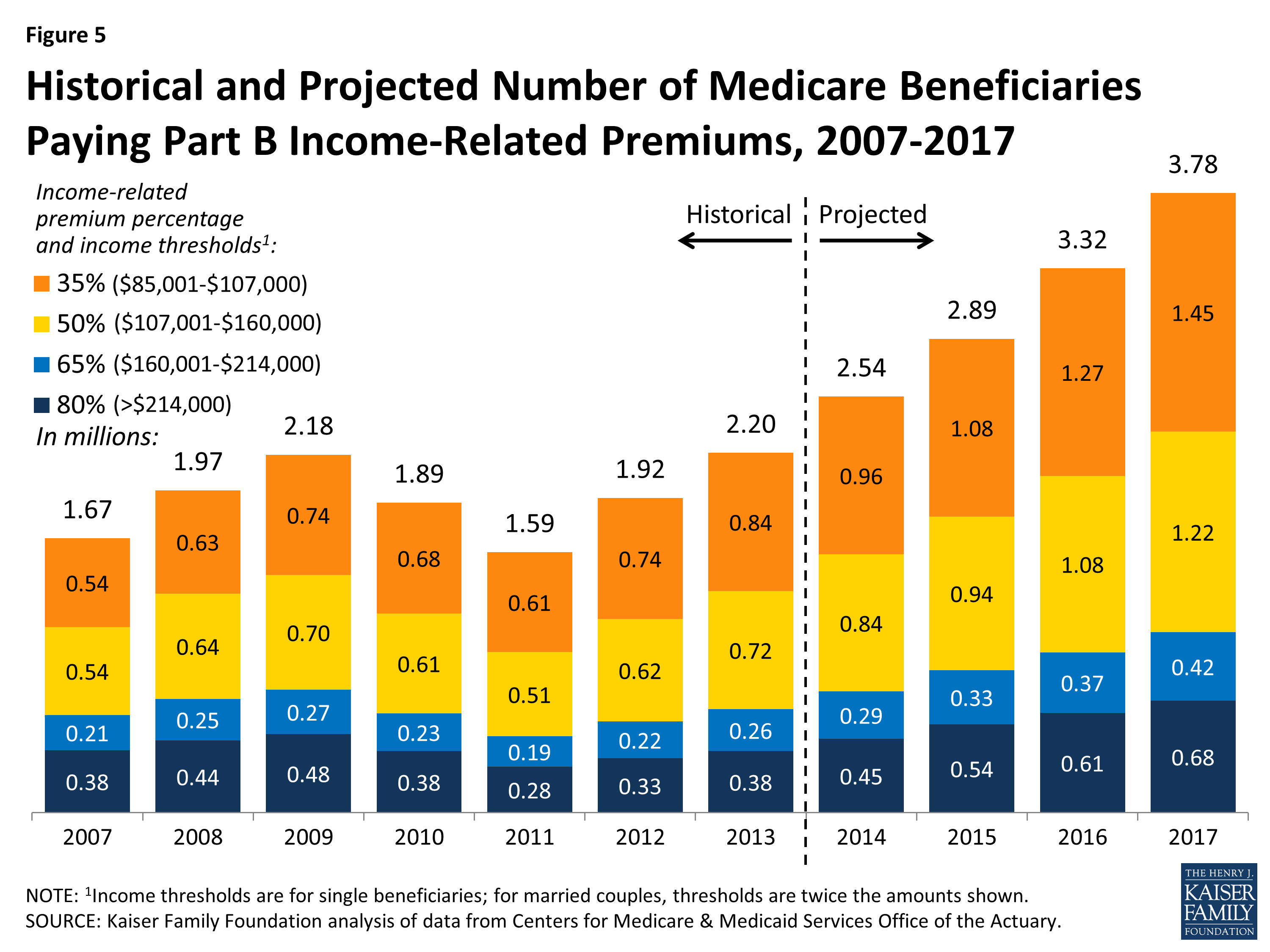

Nov 15, 2021 · There are several tiers depending on how much you make and how you file your taxes. Each tier adds more to your Part B premium, and the amount is based on a percentage. Those percentages are 35%, 50%, 65%, 80%, and 85% of the total Medicare Part B premium. For example, if you’re in the highest tier, the government pays 15% of the Part B premium and you …

What is the Medicare tax for 2021?

How much Medicare tax do I pay in 2020?

How much does the average person pay in Medicare taxes?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

How Medicare tax is calculated?

What is the percentage of federal income tax?

What income is subject to Social Security and Medicare tax?

Is Medicare tax based on gross income?

What percentage is Social Security tax?

Do I have Medicare if I pay Medicare tax?

How do you calculate FICA and Medicare tax 2020?

What is the Medicare tax rate for 2022?

Is there a maximum income for Medicare?

There is not a set maximum income to pay into Medicare. Essentially, the government collects 2.9 percent of all income in America to pay for this program. This is a necessity because every American is eligible when he meets certain age and/or disability requirements. Advertisement.

How much does Medicare cost per week?

If you make $1,000 per week, you will be paying $14.50 each week in Medicare taxes. Your employer will also be paying an equal amount.

Do all workers pay into Medicare?

Nearly every U.S. worker pays into the federal Medicare system. If you are an employee who receives a W-2 form from your employer each year, you are paying into the federal Medicare system. This program helps ensure that elderly and disabled Americans can cover the rising cost of health care.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two sources. You and your employer share the burden of this federal program. Each party will submit 1.45 percent of your income each paycheck into the system. The total cost of Medicare is 2.9 percent of your allowable taxable income. If you are self-employed or your employer does not withhold taxes ...

What percentage of taxes are due on a self employed check?

If you are self-employed or your employer does not withhold taxes from your check, you will be responsible for the full 2.9 percent due to the federal government.

Do self employed individuals file quarterly taxes?

Self-Employed Individuals. You most likely file some sort of quarterly or semi-annual filings to ensure that you are up-to-date on all taxes due to the IRS, so as not to get penalized at the end of the year. You will want to ensure that whoever processes your tax paperwork determines how much your taxable income is and makes ...

Is there a limit on income for Medicare?

There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, regardless of income. However, your income can impact how much you pay ...

Does income affect Medicare?

However, your income can impact how much you pay for coverage. If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change. On the other hand, you might be eligible for assistance paying your premiums if you have a limited income. Share on Pinterest.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Do you pay more for Medicare if you have a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change. On the other hand, you might be eligible for assistance paying your premiums if you have a limited income. Share on Pinterest.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How much is 40 credits for Medicare?

Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

How much is the 2020 tax premium?

In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40.

Is Medicare Part B based on income?

In short, the Medicare Part B premium and Medicare Part D premium are the only two Medicare costs that are based on your income. Everything else, including deductibles to copayments, are going to be standard for everyone. If you need any help signing up for or understanding Medicare, give us a call!

How much will Medicare pay in 2021?

Most people enrolled in Medicare pay $148.50 in 2021 for their Part B premium. That amount is actually only about 25% of the total cost. The government comes in and pays a substantial portion – about 75% – of the total Part B premium.

Is Medicare Part B premium adjusted?

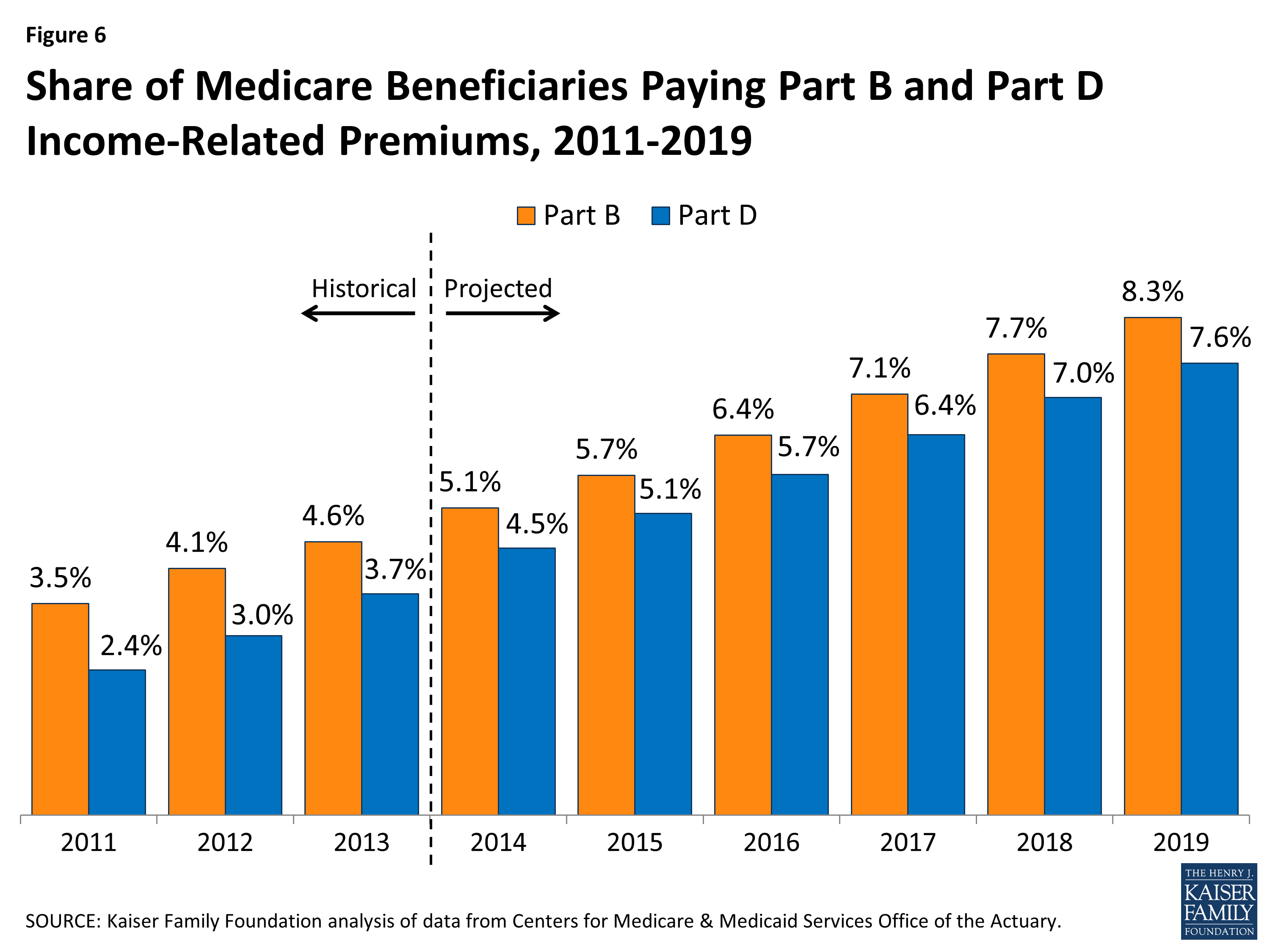

The current law requires your Medicare Part B premium to be adjusted as well as your Medica re prescription drug coverage premium (Part D). . Originally published April 25, 2019. Updated November 10, 2020. This affects less than 7% of all Medicare enrollees, but if you’re part of the 7%, you may want to know just how much more you’ll be forking ...

Does Medicare Part D go up?

Just like with the Medicare Part B premium, your drug premium will go up depending on your income.

How much is the Social Security payment for 2021?

This is announced each year by the Centers for Medicaid and Medicare Services (CMS), and for 2021, it's $43.07. That is going to be totally separate from your individual drug plan’s premium. If you end up having to pay more because of your income, the amount will be deducted from your monthly Social Security check.

What to do if your Social Security income is wrong?

The IRS will provide this return to Social Security, so if something is incorrect or they have the wrong year, you can call or visit your local Social Security office. If your income has gone down and moves you from one tier to another, you’ll also need to contact Social Security to explain the change.

Although Medicare eligibility has nothing to do with income, your premiums may be higher or lower depending on what you claim on your taxes

Unlike Medicaid, Medicare eligibility is not based on income. However, the income you report on your taxes does play a role in determining your Medicare premiums. Beneficiaries who have higher incomes typically pay a premium surcharge for their Medicare Part B and Medicare Part D benefits.

Who Has to Pay the Medicare Surcharge?

Higher-income beneficiaries face the IRMAA surcharge. In this case, "high earner" refers to anyone who claimed an income greater than $91,000 per year (filing individually OR married filing separately) or $182,000 per year (married filing jointly).

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government (i.e. the Medicare program) paying the remaining 75 percent.

The Medicare Part D Premium

Original Medicare (Parts A and B) does not include prescription drug coverage. These benefits are available via a Medicare Part D prescription drug plan.

How Does Social Security Determine Whether You Pay Extra?

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

What Does Modified Adjusted Gross Income Include?

According to Investopedia, your modified adjusted gross income is "your household's adjusted gross income with any tax-exempt interest income and certain deductions added back."

What If Your Income Went Down?

Income levels often fluctuate due to life-changing events, particularly once we retire. If one of the following applies to you AND it caused a permanent reduction in income, inform Social Security. (Temporary changes do not qualify as "life-changing events.")

What percentage of your paycheck goes to Medicare?

1.45 percent of your paycheck will be deducted and routed toward Medicare. Much like Social Security, this is a non-negotiable element of taxation that cannot be dodged through the use of a W-4.

How much is deducted from paycheck for Medicare?

In every paycheck, 1.45 percent is deducted and routed toward Medicare programs. When it comes to federal taxes, the amount being taken from each paycheck will depend not only on the amount of income being earned by the employee but also the specific withholdings they have requested on their employer W-4.

What percentage of Social Security is taxable in 2019?

Social Security and Medicare Tax 2019. Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income level of $132,900 to be directed toward Social Security, and 1.45 percent of their paycheck income to be routed to Medicare. Federal tax deductions from paychecks will ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

Can you get hold harmless if you pay a higher Medicare premium?

Keep in mind. If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up.

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.