How do you calculate Medicare payment?

May 06, 2021 · Medicare Part B: Original Medicare plus Medicare Supplement: Medicare Advantage: Cardiologist visit: 20% of $180 = $36: $0 (under most standardized Medicare Supplement insurance plans). Medicare Supplement Plan N might charge a copayment up to $20. You’re likely to pay a coinsurance or copayment (the amount may vary among plans).

Does Medicare have copayments?

Apr 02, 2020 · The Internal Revenue Service determines the percentage of your income that will be taxed for Medicare. The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also …

How does Medicare calculate my premium?

The total cost of Medicare is 2.9 percent of your allowable taxable income. If you are self-employed or your employer does not withhold taxes from your check, you will be responsible for the full 2.9 percent due to the federal government.

Is there a copay with Medicare?

Jan 04, 2022 · Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2022 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

What is Medicare tax?

The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

When was Medicare enacted?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs.

How much does Medicare cost per week?

If you make $1,000 per week, you will be paying $14.50 each week in Medicare taxes. Your employer will also be paying an equal amount.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two sources. You and your employer share the burden of this federal program. Each party will submit 1.45 percent of your income each paycheck into the system. The total cost of Medicare is 2.9 percent of your allowable taxable income. If you are self-employed or your employer does not withhold taxes ...

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What are the benefits of the Cares Act?

On March 27, 2020, former President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES (Coronavirus Aid, Relief, and Economic Security) Act, into law. 7 It expands Medicare's ability to cover treatment and services for those affected by COVID-19. The CARES Act also: 1 Increases flexibility for Medicare to cover telehealth services. 2 Authorizes Medicare certification for home health services by physician assistants, nurse practitioners, and certified nurse specialists. 3 Increases Medicare payments for COVID-19–related hospital stays and durable medical equipment.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is the Social Security tax rate for 2021?

For 2021, the rate for the Social Security tax is 6.2% for the employee and 6.2% for the employer, or 12.4% total—the same as 2020. The tax applies to the first $142,800 of income in 2021. The Social Security tax rate is assessed on all types of income that an employee earns, including salaries, wages, and bonuses. 4 .

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is the Medicare tax rate for 2021?

In 2021, the Medicare tax on a self-employed individual’s income is 2.9%, while the Social Security tax rate is 12.4%. 5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically ...

What percentage of Medicare Part B is paid?

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What percentage of your paycheck goes to Medicare?

1.45 percent of your paycheck will be deducted and routed toward Medicare. Much like Social Security, this is a non-negotiable element of taxation that cannot be dodged through the use of a W-4.

How much is deducted from paycheck for Medicare?

In every paycheck, 1.45 percent is deducted and routed toward Medicare programs. When it comes to federal taxes, the amount being taken from each paycheck will depend not only on the amount of income being earned by the employee but also the specific withholdings they have requested on their employer W-4.

Who is Ryan Cockerham?

Ryan Cockerham is a nationally recognized author specializing in all things business and finance. His work has served the business, nonprofit and political community. Ryan's work has been featured on PocketSense, Zacks Investment Research, SFGate Home Guides, Bloomberg, HuffPost and more. Related Articles.

What is the wage base limit for Social Security in 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

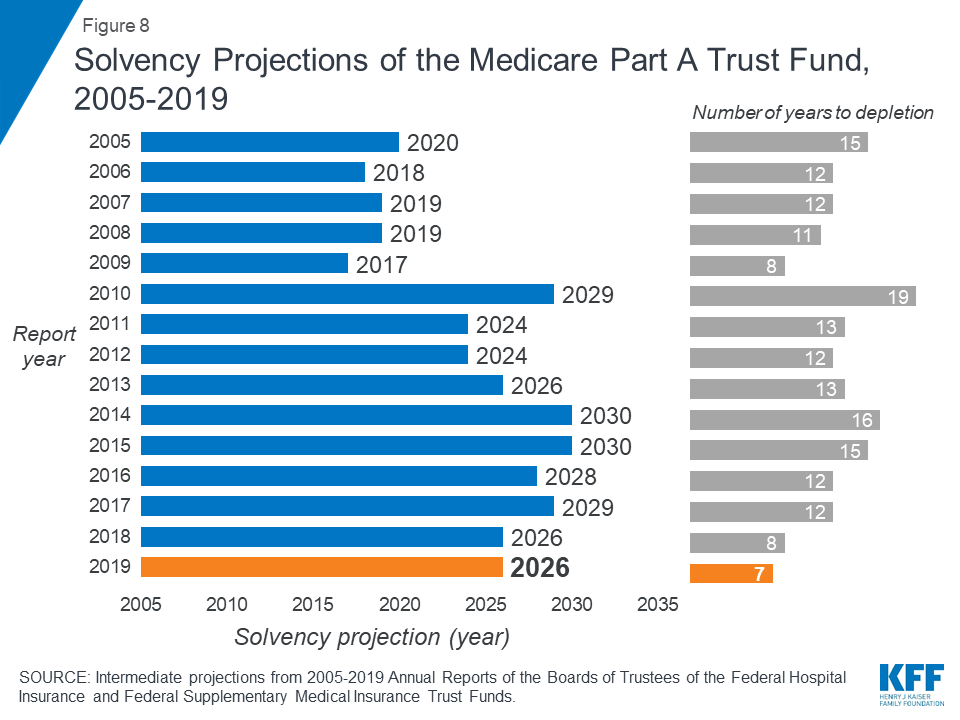

How much did Medicare pay in 2018?

In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 50 percent to 41 percent, spending on Part B benefits (mainly physician services and hospital outpatient services) increased from 39 percent to 46 percent, and spending on Part D prescription drug benefits increased from 11 percent to 13 percent.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Is Medicare spending going up?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis. According to CBO’s most recent long-term projections, net Medicare spending will grow from 3.0 percent of GDP in 2019 to 6.0 percent in 2049.

Does Medicare Advantage cover Part A?

Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium.