What is the Medicare Max for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

How is Medicare and Social Security calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

What percentage of pay is Medicare?

1.45%Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.Jan 10, 2022

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Does the federal tax rate include Social Security and Medicare?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

What percentage is taken out for Social Security?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How much is federal tax on Social Security?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

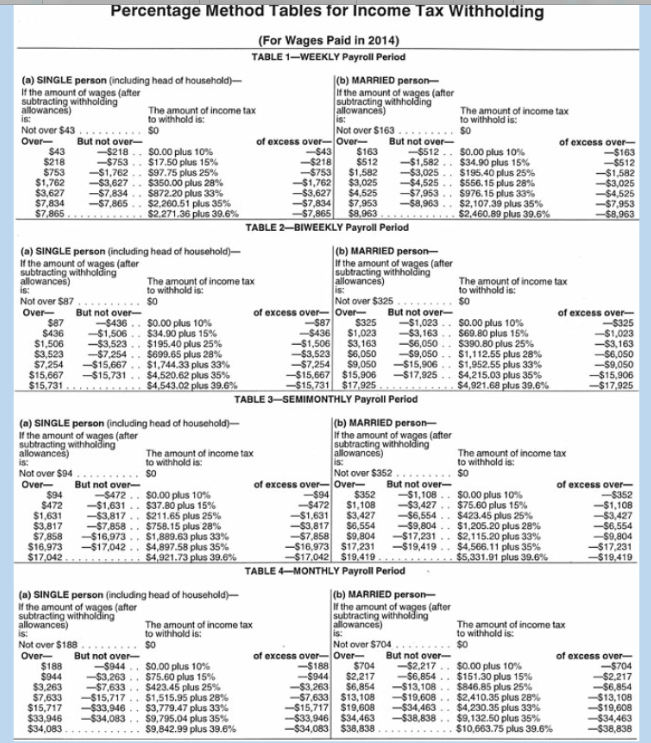

What is the percentage of federal income tax?

For the 2021 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income (such as your wages) will determine what bracket you're in.Mar 15, 2022

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.

How Does A Partnership Pay Taxes?

Partnership tax forms must be filed each year to report income, deductions, gains, losses, etc. from the operations of the partnership. Partner profits or losses are instead passed through to them. Partner is provided with copies of Schedule K-1 (Form 1065) by the partnership.

Who Is Exempt From Paying Social Security And Medicare Tax?

In other words, employers with employees who have been on staff continuously since March 31, 1986, unless there is a Section 218 agreement covering them nor is they covered by social security and Medicare provisions must provide their employees with benefits such as Social Security and Medicare.

Is K1 Income Subject To Medicare Tax?

An S-Corporation filing Form K-1 does not have to make self-employment tax payments, so TurboTax is no longer responsible for generating Schedule SEs. There is no self-employment tax on distributions. There is a 15 percent tax on self-employment paid by sole proprietors. All profits go toward Social Security and Medicare (taxes).

What Taxes Do Partnerships Pay?

The income tax paid by partnerships is not subject to federal taxation. An equity partnership passes its income, losses, deductions, and credits on to itself as a member of the partnership, which uses them in its own tax return in order to pay taxes.

Do Partnerships Pay Payroll Taxes?

Partnerships require their employees to file a Form W-2 with income taxes withheld from their paychecks. To contrast, a partnership does not withhold income tax from contributions to it from the partners’ earnings for services rendered during the partnership (see Wage Withholding and Payroll Taxes).

Do You Pay Social Security Tax On K1 Income?

In most cases, yes. earned income on your Partnership K-1 unless you joined the LLC as a Limited Partner and did not work for it. As a result, you would usually have an item to do with your K-1 along the border, but that would have you on track towards meeting your Social Security earnings goal if you were living beyond full retirement.

Do Partners Pay Social Security?

Neither you nor your spouse are entitled to Social Security or Medicare tax benefits if he or she works for you, rather than for you. Individual who works on behalf of their spouse in a business or trade is subject to withholding income tax, along with Medicare, Social Security, and state sales and income taxes, respectively.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

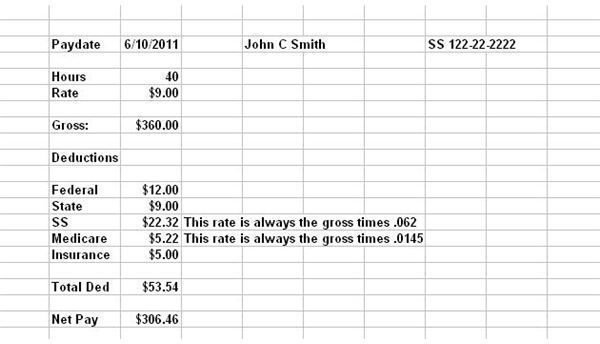

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);

Do self employed people pay FICA?

And so, if you're self-employed, you don't have to pay FICA on all your salary, just on 92.35% of it (92.35 being 100 minus 7.65 - which is the contribution that your employer would have paid, if you had an employer, which you don't).

Does Medicare Part A cover hospitalization?

En español | Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit. Medicare Part A, which covers hospitalization, is free for anyone who is eligible ...

Does Social Security deduct Medicare premiums?

In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.