What is the difference between Medicare Part A and B?

Medicare pays the insurance company to administer your Part A and B benefits through the Medicare Advantage plan. While all plans must cover the same services as Parts A and B, different Medicare Advantage plans will have different networks, copays, and drug formularies.

Should I Choose Medicare Advantage or Original Medicare?

It’s also easy to find providers since Original Medicare’s network is nationwide. For budgeting purposes, many people are attracted to Medicare Advantage with a built-in Part D drug plan. It’s also convenient. You get all your Medicare benefits in one simple plan with one monthly premium.

Can I have a Medicare Advantage plan without part a and B?

However, this term is misleading because although with a Medicare Advantage plan, you’ll pay according to your plan’s benefits, rather than Original Medicare, you still must be enrolled in Original Medicare to obtain a plan. To put it simply, you can’t have a Medicare Advantage plan without first having Part A and Part B.

What types of Medicare Advantage plans do seniors have?

Although most seniors are enrolled in Original Medicare, the number enrolled in Medicare Advantage plans has tripled since 2003 to 19 million. This represents about one-third of all Medicare beneficiaries. There are several different types of Medicare Advantage plans. The two most popular are: Health Maintenance Organizations (HMOs).

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

What percentage of people on Medicare have Medicare Advantage?

42 percentIn 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

What are the disadvantages of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Who benefits most from Medicare?

People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Is Medicare Advantage becoming popular?

In 2005, 13 percent of enrollees chose the MA option, and the growth has been steady ever since; enrollment in Advantage plans rose 10 percent between 2020 and 2021 alone. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Why are more people choosing Medicare Advantage?

Higher Quality and Better Outcomes. Medicare Advantage provides beneficiaries with personalized, higher-quality care that leads to better outcomes. Research shows: Hospital readmission rates are 13% to 20% lower in Medicare Advantage than in Medicare Fee-For-Service.

What's the big deal about Medicare Advantage plans?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

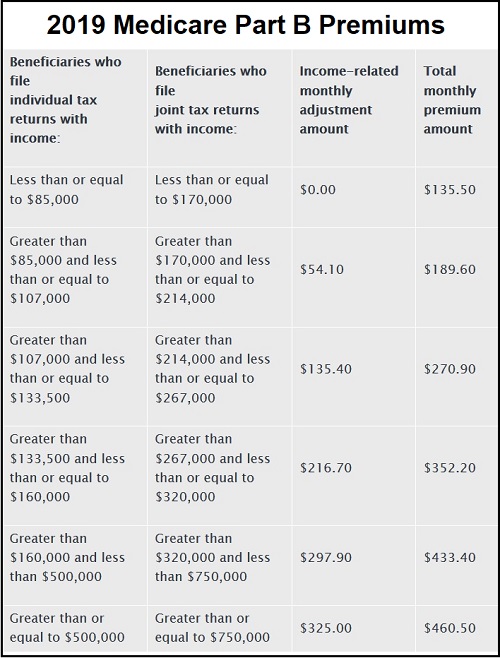

How do rich people get Medicare?

Millionaires Pay More for Medicare There's the additional 0.9% tax on income above $200,000 for individual filers and $250,000 for joint filers, and the 3.8% tax on investment income of more than $200,000/individual and $250,000/joint. Once you turn 65, you can sign up for Medicare no matter how rich you are.

What kind of health insurance do wealthy people get?

For wealthy people, it's especially important to make sure they are fully covered, because they typically have a lot of assets to protect. As a result, many high-income people buy a special type of insurance called umbrella insurance.

Does Medicare Advantage cost more than Medicare?

Medicare spending for Medicare Advantage enrollees was $321 higher per person in 2019 than if enrollees had instead been covered by traditional Medicare. The Medicare Advantage spending amount includes the cost of extra benefits, funded by rebates, not available to traditional Medicare beneficiaries.

What are the 4 types of Medicare?

Part A covers any inpatient hospital care at no cost to those who have paid into the system through their employers. This coverage can be purchased...

How do Medicare Advantage Plans work?

Medicare Advantage plans are structured like employer-offered insurance plans and can be obtained by paying a monthly premium. Many cover all the s...

Is Medicare Advantage better than traditional Medicare?

Your unique circumstances determine whether Medicare Advantage is the right choice for you. Coverage is often more comprehensive, and your medical...

What are the pros and cons of Medicare Advantage plans?

Pros: All-in-one coverage, including prescriptions, vision and dental Familiar for seniors who have been covered under employer-offered insurance M...

Who is eligible for Medicare Part C?

Medicare Part C is available to anyone who qualifies for and enrolls in Medicare Parts A and B.

How and when should I enroll in a Medicare Advantage plan?

Enrollment in a Medicare Advantage plan can be done through the government Medicare program, via their website or over the phone, through a third-p...

How Does Original Medicare Work?

Under Original Medicare, you get your benefits directly from the federal government. Original Medicare includes two parts, Part A and Part B, that...

Your Costs With Original Medicare

Here’s a quick look at your 2018 costs if you enroll in Original Medicare:There is one thing to keep in mind if you choose Original Medicare. There...

Who Is A Good Fit For Original Medicare?

Most people who choose Original Medicare plus a Medigap plan value freedom of access to Medicare’s entire network. Medicare’s network offers ultima...

How Does Medicare Advantage Work?

Before the 2003 Medicare Modernization Act, seniors didn’t have the option to enroll in Medicare Advantage. There was no choice between Original Me...

Your Costs With Medicare Advantage

It’s difficult to give a snapshot of your costs with a Medicare Advantage plan because each one is different. Each company that offers a plan can c...

Who Is A Good Fit For Medicare Advantage?

Medicare Advantage plans appeal to many people because they are convenient. Since most plans have Part D included you don’t have to have a separate...

Is Original Medicare Or Medicare Advantage Right For You?

Everyone’s situation is different, so it’s tough to give a standard answer. Both types of coverage offer reputable Medicare insurance. You just nee...

What is Medicare for seniors?

For many seniors over the age of 65, Medicare provides the health insurance necessary to ensure regular access to the medical professionals and treatments they need. Those who collect Social Security benefits are often enrolled automatically unless they choose to opt out and take the appropriate steps.

Why do Medicare Advantage plans require a primary care provider?

Because many Medicare Advantage plans require the identification of a primary care provider, this could also be beneficial to someone with complex health issues by creating a single physician to help coordinate the efforts of multiple specialists.

How long do you have to wait to enroll in Medicare Part B?

If seniors choose to wait to enroll in Medicare Part B due to existing coverage through an employer, they have a Special Enrollment Period (SEP) of eight months after they lose this coverage to enroll in Medicare. They can enroll in Medicare Advantage once they have enrolled in both Part A and B coverage.

How long does Medicare Advantage last?

The Initial Enrollment Period (IEP) includes your 65th birth month and the three months before and after, adding up to seven months in total.

How to enroll in Medicare Advantage?

You have a few enrollment options once you’ve made your decision: 1 You can enroll directly with the insurance provider you choose, either online or by contacting them over the phone. 2 You can enroll from the Medicare.gov website or by contacting a customer service representative using the number above. 3 You can choose a third-party independent health insurance agency to help you select and enroll in a Medicare Advantage plan.

What are the pros and cons of Medicare?

Pros and Cons of Medicare. One of the biggest benefits of Medicare is the guaranteed availability of healthcare coverage for seniors who couldn’t otherwise afford private health insurance.

When is the fall enrollment period for Medicare?

This period is open every year from October 15 through December 7.

What is the difference between Medicare Advantage and Original?

There is one very important difference between Original Medicare vs Medicare Advantage, however. Medicare Advantage plans have a maximum out-of-pocket limit or MOOP. Once you hit your MOOP, you pay nothing for covered healthcare for the rest of that calendar year.

What are the two parts of Medicare?

Original Medicare benefits include two parts, Part A and Part B , that provide your hospital and medical insurance. If you have a qualifying work history, your Part A benefits are premium-free. Medicare Part B premiums are set each year by the federal government and most people pay the same standard rate.

What is the MOOP for Medicare Advantage 2021?

In 2021, the mandatory MOOP for Medicare Advantage is $7,550, although many plans choose to set theirs much lower. In 2021, only about 20% of Medicare Advantage had the mandatory MOOP of $7,550. This means that many plans offer a lower MOOP, which is good for you.

How much does Medicare Advantage pay for doctor visits?

Medicare Advantage enrollees usually pay a copayment when they get healthcare. This is usually between $10 and $20 for doctor visits and up to $75 for emergency room and urgent care visits. There is often a tiered copayment system for prescription drugs.

Why is it so hard to give a snapshot of your Medicare Advantage plan?

It’s difficult to give a snapshot of your costs with a Medicare Advantage plan because each one is different . Each company that offers a plan can choose what to charge for premiums, deductibles, and copayment amounts.

How much is a MOOP with Medicare?

Some people like the security of a MOOP with Medicare Advantage. However, even with a MOOP below $7,550, you’d have some heavy spending before you reach that cap.

Is Medicare deductible in 2021?

This article has been updated for 2021. For many people, costs are a major concern when it comes to choosing your health insurance. Besides premiums, there are deductibles, coinsurance, and copayments to consider in calculating your total Medicare spending.

How to compare Medicare Advantage plans?

Compare Medicare Advantage plans that may be available in your area and speak with a licensed insurance agent who can help you sign up for a Medicare Advantage plan that’s right for you. Compare Medicare Advantage plans in your area. Compare Plans. Or call. 1-800-557-6059.

What is Medicare Part A and Part B?

Original Medicare (Medicare Part A and Part B) is the federal health insurance program for people age 65 and older and people younger than 65 who have a qualifying disability or certain medical conditions. Medicare Advantage plans (Medicare Part C) are sold by private insurers as an ...

How much does Medicare Advantage pay for a day after day 90?

After that, you pay $0 coinsurance for days 1-60, $371 per day for das 61-90 and $742 per day for each lifetime reserve day after day 90. After your lifetime reserve days are used, you are responsible for paying all costs. Medicare Advantage plan coinsurance amounts vary depending on the specific plan you enroll in.

How much is coinsurance for Medicare?

If you’re enrolled in Original Medicare you typically pay a 20 percent Part B coinsurance for covered services after you meet your Part B deductible, and Medicare pays the remaining 80 percent. For inpatient hospital stays in 2021, you first have to meet your Part A deductible for the benefit period.

How long do you have to be on Medicare before you turn 65?

You will typically be automatically enrolled in Original Medicare if one or more of the following applies to you: You get benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65. You’ve been getting disability benefits for at least 24 months.

How much will Medicare pay in 2021?

If you do have to pay a Part A premium, you could pay up to $471 a month in 2021.

When do you have to enroll in Medicare Advantage?

Some people are automatically enrolled in Original Medicare three months before their 65th birthday , and some people must manually sign up for Medicare.

Why do baby boomers enroll in Medicare Advantage?

One line of thinking has been that the Baby Boom Generation will enroll in Medicare Advantage plans over traditional Medicare at much higher rates than prior generations because they have had more experience with managed care during their working years.

What states have Medicare Advantage?

In two states (Oregon and Minnesota) and Puerto Rico, more than 40 percent of new beneficiaries enrolled in Medicare Advantage in 2016. However in five states (Delaware, Maryland, Nebraska, New Hampshire, and Vermont) and the District of Columbia, less than 11 percent of new beneficiaries enrolled in Medicare Advantage plans, ...

How much will Medicare enrollment increase in 2029?

While the Congressional Budget Office is projecting a steady increase in Medicare Advantage enrollment, rising to 47 percent by 2029, even with an aging Baby Boom Generation, the majority of new beneficiaries are opting for traditional Medicare in the year they first go on Medicare.

What percentage of Medicare beneficiaries were covered in 2016?

Most new beneficiaries (71 percent) were covered under traditional Medicare for their first year on Medicare.

Is Medicare Advantage enrollment rising?

The relatively low enrollment rates among new beneficiaries with high needs may warrant further scrutiny. While Medicare Advantage enrollment among new beneficiaries is rising, these findings suggest that ongoing attention to traditional Medicare is needed to meet the needs of the lion’s share of the Medicare population.

What is Medicare Advantage?

Medicare Advantage takes the place of original Medicare add-ons, such as Part D and Medigap. Instead of having multiple insurance plans to cover medical costs, a Medicare Advantage plan offers all your coverage in one place.

How much is Medicare 2021?

You’ll have certain set costs associated with your coverage under parts A and B. Here are some of the costs associated with original Medicare in 2021: Cost. Original Medicare amount. Part A monthly premium. $0, $259, or $471 (depending on how long you’ve worked) Part A deductible. $1,484 each benefit period.

Is Medicare a government or private insurance?

Original Medicare is a government-run option and not sold by private insurance companies. Medicare Advantage is managed and sold by private insurance companies. These companies set the prices, but Medicare regulates the coverage options. Original Medicare and Medicare Advantage are two insurance options for people age 65 and older living in ...

Does Medicare Advantage save money?

For some people, Medicare Advantage plans can help save money on long-term medical costs, while others prefer to pay for only what they need with Medicare add-ons. Below you’ll find an estimated cost comparison for some of the fees associated with Medicare Advantage in 2021: Cost. Medicare. Advantage amount.

Does Medicare cover dental and vision?

Medical services. If you’re someone who rarely visits the doctor, Medicare and Medicare add-ons may cover most of your needs. However, if you’re someone who wants coverage for yearly dental, vision, or hearing exams, many Medicare Advantage plans offer this type of coverage.

Does Medicare cover all your needs?

For example, Medicare may not cover all your needs, but a Medicare Advantage Special Needs Plan could help with long-term costs.

Do you pay Medicare premiums monthly?

If you have Medicare, you’ll pay a monthly premium for Part A (if you don’t qualify for premium-free Part A) and Part B, yearly deductibles for parts A and B, and other costs if you buy add-on coverage.

What Is Medicare Advantage?

Medicare Advantage (also known as Part C) plans are provided by private insurers and essentially replace Original Medicare as your primary insurance. They cover all Medicare-covered benefits and may also provide additional benefits like some dental, hearing, vision and fitness coverage.

What Are the Benefits of Medicare Advantage?

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, some dental, hearing and wellness programs like gym memberships.

How Much Does Medicare Advantage Cost?

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: “If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 [or higher, depending on your income].”

What Is Medicare Supplement?

Medicare Supplement plans (commonly known as Medigap plans) are sold by private insurance companies to help fill the gaps of Original Medicare coverage.

What Are the Benefits of a Medicare Supplement Plan?

A Medicare Supplement plan makes your out-of-pocket costs more predictable and easier to budget.

How Much Does a Medicare Supplement Plan Cost?

The estimated average monthly premium (the amount you pay monthly) for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Sources

NORC at the University of Chicago. Innovative Approaches to Addressing Social Determinants of Health for Medicare Advantage Beneficiaries. Better Medical Alliance. Accessed 9/6/21.

What percentage of doctors accept Medicare?

According to the Kaiser Family Foundation, 93 percent of primary physicians participate in Medicare. That means chances are pretty good that any doctor you are currently seeing will accept Medicare and you won't have to change providers.

What are the elements of Medicare?

Under original Medicare, to get the full array of services you will likely have to enroll in four separate elements: Part A; Part B; a Part D prescription drug program; and a supplemental or Medigap policy. Physicians and hospitals have to file claims for each service with Medicare that you'll have to review.

What is Medicare Part B?

Under original Medicare, the federal government sets the premiums, deductibles and coinsurance amounts for Part A (hospitalizations) and Part B (physician and outpatient services ). For example, under Part B, beneficiaries are responsible for 20 percent of a doctor visit or lab test bill. The government also sets maximum deductible rates for the Part D prescription drug program, although premiums and copays vary by plan. Many beneficiaries who elect original Medicare also purchase a supplemental – or Medigap – policy to help defray many out-of-pocket costs, which Medicare officials estimate could run in the thousands of dollars each year. There is no annual cap on out-of-pocket costs.

Is Medicare Advantage a PPO or HMO?

Medicare Advantage employs managed care plans and, in most cases, you would have a primary care physician who would direct your care, meaning you would need a referral to a specialist. HMOs tend to have more restrictive choices of medical providers than PPOs.

Does Medicare cover dental?

While Medicare will cover most of your medical needs, there are some things the program typically doesn't pay for -— like cosmetic surgery or routine dental, vision and hearing care. But there are also differences between what services you get help paying for.

Does MA have a copay for doctor visits?

But instead of paying the 20 percent coinsurance amount for doctor visits and other Part B services, most MA plans have set copay amounts for a physician visit , and typically that means lower out-of-pocket costs than original Medicare. MA plans also have an annual cap on out-of-pocket expenses.

Is Medicare Advantage based on out-of-network providers?

Medicare Advantage plans are based around networks of providers that are usually self-contained in a specific geographic area. So, if you travel a lot or have a vacation home where you spend a lot of time, your care may not be covered if you go to out-of- network providers, or you would have to pay more for care.