Does Social Security and Medicare count as federal income tax?

While a person may need to pay income tax on Social Security benefits, Medicare premiums and out-of-pocket costs are tax deductible. Original Medicare comprises of Part A, hospital insurance, and Part B, medical insurance.

How to calculate Medicare and Social Security tax?

Social Security And Fica

- The Social Security portion of FICA is 6.2% of the maximum taxable wages.

- If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year.

- The maximum taxable wage for Social Security is adjusted each year. ...

What is the tax rate for FICA and Medicare?

FICA tax is a 6.2% Social Security tax and 1.45% Medicare tax on earnings. Employers remit withholding tax on an employee's behalf. See how FICA tax works in 2022.

Who is exempt from Social Security and Medicare withholding?

Who is exempt from Social Security and Medicare withholding? The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 ...

What percentage of wages is Social Security?

6.2 percentSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What percentage of wages is Medicare?

1.45%The employee tax rate for Medicare is 1.45% — and the employer tax rate is also 1.45%. So, the total Medicare tax rate percentage is 2.9%. Only the employee portion of Medicare taxes is withheld from your paycheck. There's no wage-based limit for Medicare tax.

How are Social Security and Medicare wages calculated?

For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. Their Medicare contribution would be: $700.00 x 1.45%= $10.15. These are also the amounts the employer would pay.

What percent of taxes are taken out of paycheck?

Overview of California TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

How much is FICA and Medicare withholding?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Why are Medicare wages higher than wages?

How is that possible? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5.

Why is SS wages higher than wages?

Your social security wages can be higher than your wages if you are making contributions to a 401k plan or have other items taken out of your check "pre-tax". You are paying social security tax on these items but not income tax.

What is the percentage of federal taxes taken out of a paycheck 2021?

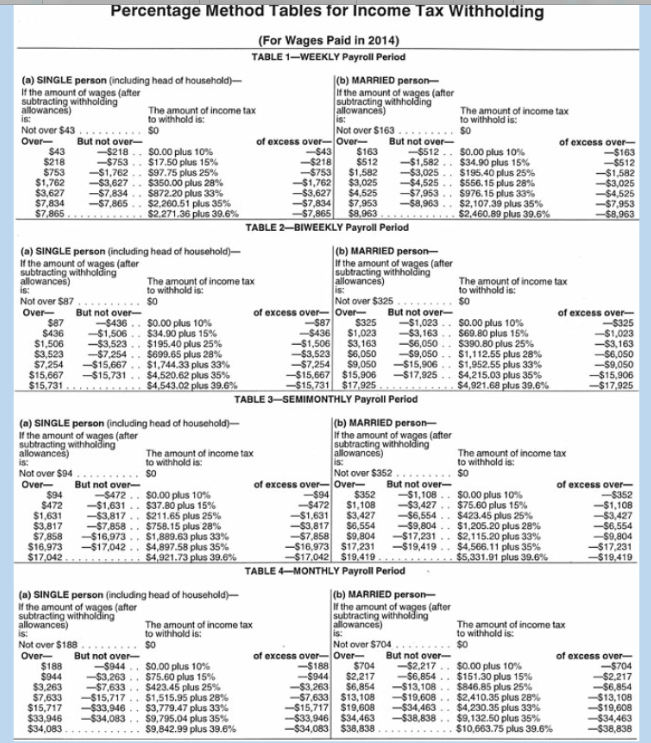

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

What is the wage base limit for 2020?

The 2020 wage-base limit is $118,500. If you earn more than that with one employer, you should only have Social Security taxes withheld up to that amount. If you have more than one employer and you earn more than that amount, you’ll receive an adjustment of any overpaid Social Security taxes on your return. The employee tax rate for Medicare is ...

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.

What Are Social Security Wages?

Social Security wages are the portion of earnings that are subject to the FICA tax. These wages are used by the Social Security Administration to determine Social Security benefit calculations at retirement, and they're subject to the Social Security portion of the FICA tax.

How much is Social Security taxed in 2021?

It applies to all earnings. Social Security is taxed only on the first $137,700 in earnings annually as of 2020 and $142,800 in 2021. The instructions for completing Form W-2 have a list of payments that must be included for federal income tax purposes.

What are the taxes that employers must withhold from wages?

Employers must withhold Social Security and Medicare taxes from wages paid to both hourly and salaried employees. These two taxes are collectively known as Federal Insurance Contributions Act ( FICA) taxes. FICA taxes are due on wages paid for "services performed as an employee in the United States, regardless of the citizenship or residence ...

What is the total withholding for FICA taxes?

The total withholding for FICA taxes is 15.3% of the employee's gross pay. The employee and the employer each contribute half.

What is gross pay amount?

The gross pay amount is used to calculate withholding for federal and state income taxes based on the employee's W-4 form.

What is self employment tax?

These taxes are called self-employment taxes when applied to independent contractors, sole proprietors, and other self-employed individuals. They're based on the net income of a business. The types of income that are included in Social Security wages are not relevant to self-employment taxes.

When do you report Social Security wages on W-2?

You must report both wages subject to income tax and Social Security wages on the W-2 form you provide to employees and file with the IRS in January of each year. These can be different amounts and they must be entered correctly on the employee's W-2 form.

How much do you pay for Social Security?

Workers and employers pay for Social Security. Workers pay 6.2 percent of their earnings up to a cap, which is $127,200 a year in 2017. (The cap on taxable earnings usually rises each year with average wages.) Employers pay a matching amount for a combined contribution of 12.4 percent of earnings. Self-employed persons pay both the employee and employer share for a total 12.4 percent. (Half of this contribution, the employer share, is a deductible business expense for income tax purposes.) Also, higher-income Social Security beneficiaries pay federal income taxes on their benefit income, and these taxes help pay for Social Security.

How much did Social Security premiums decrease in 2011?

The lost revenue from this “payroll tax holiday”—$103 billion in 2011 and $114 billion in 2012—was made up from the government's general fund.

How much did the average person make in 2015?

In 2015 the average worker made $48,099 a year, according to the Social Security Administration. This worker and his or her employer will each pay $2,982 this year. Approximately 6 percent of all workers will earn more than the $127,200 tax cap. Earnings above the cap now account for 18 percent of the aggregate pay of all workers who pay into Social Security.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

What does Medicare pay for?

Medicare pays for many different types of medical expenses . Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits , you’ll get a bill from Medicare that you’ll need to pay via:

What are the tax rates for Social Security and Medicare?

Social Security has a tax rate of 6.2% and Medicare has a tax rate of 1.45%. In the example above, Bob’s Social Security taxes would be calculated as follows:

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What are the big amounts that come out of our paychecks?

Some big amounts that come out of our paychecks are for Social Security and Medicare taxes. How are they calculated? Read on for a complete guide.

How much is Bob's semi monthly salary?

Example: Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Is 401(k) income taxable?

For Social Security and Medicare, deferred income (401k, 403b, Simple IRA’s, etc.) is considered taxable and not subtracted from gross pay. Using Bob again as our example:

How much is Social Security 2020?

If an employee's 2020 wages, salaries, etc. exceed $137,700, the amount in excess of $137,700 is not subject to the Social Security tax.

What is the Social Security payroll tax rate for 2021?

The employer's Social Security payroll tax rate for 2021 (January 1 through December 31, 2021) is 6.2% of each employee's first $142,800 of wages, salaries, etc. (This amount is identical to the employee's Social Security tax that is withheld from the employee's wages, salaries, etc.) If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax. Hence, the maximum amount of the employer's Social Security tax for each employee in 2021 is $8,853.60 (6.2% X $142,800).

What is the maximum Social Security tax for 2020?

exceed $137,700, the amount in excess of $137,700 is not subject to the Social Security tax. Hence, the maximum amount of the employer's Social Security tax for each employee in 2020 is $8,537.40 (6.2% X $137,700).

Is $142,800 a Social Security amount?

If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax.

Does an employer have to pay payroll tax on Social Security?

Since employees also have the Social Security payroll tax withheld from their wages, salaries, etc., the employer is in effect matching each employee's Social Security payroll tax. The employer must remit both the amounts withheld from employees' wages and the employer's matching amount to the U.S. government.