What is the Medicare tax rate for 2018?

Nov 17, 2017 · An estimated 42 percent of all Part B enrollees are subject to the hold harmless provision in 2018 but will pay the full monthly premium of $134, because the increase in their Social Security benefit will be greater than or equal to an increase in their Part B premiums up to the full 2018 amount. About 28 percent of all Part B enrollees are subject to the hold harmless …

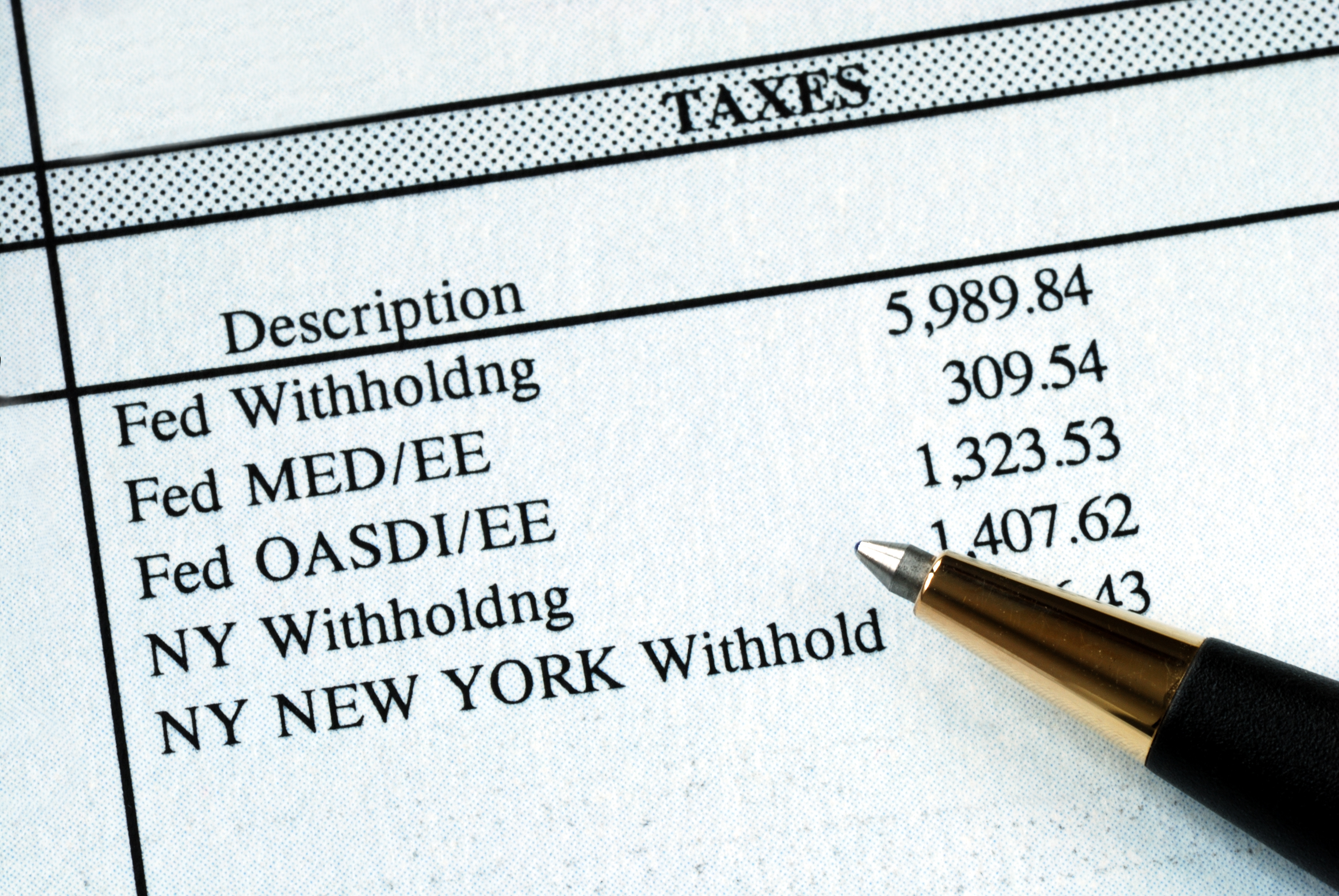

What are the Social Security and Medicare withholding rates?

Dec 18, 2017 · (Maximum Social Security tax withheld from wages is $7,960.80 in 2018). For Medicare, the rate remains unchanged at 1.45% for both employers and employees. Additional Medicare Tax A 0.9% additional Medicare tax must be withheld from an individual’s wages paid in excess of $200,000 in a calendar year.

How much extra tax do I have to withhold for Medicare?

Nov 27, 2017 · Tax Rate 2017 2018 Employee 7.65% 7.65% Self-Employed 15.30% 15.30% NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What are the new tax withholding tables for 2018?

Jan 24, 2018 · The Medicare tax rate also remains at 1.45% for the employer and employee in 2018. The Medicare tax has no wage base limit. In addition to withholding Medicare tax at 1.45%, employers must withhold a 0.9% Additional Medicare Tax from wages more than $200,000 that are paid to an employee in a calendar year.

What is the tax rate for Medicare?

(Maximum Social Security tax withheld from wages is $7,960.80 in 2018). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

What is the tax rate for Social Security?

For Social Security, the tax rate is 6.20% for both employers and employees. (Maximum Social Security tax withheld from wages is $7,960.80 in 2018). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

Tables for Percentage Method of Withholding

The following payroll tax rates tables are from IRS Notice 1036. The tables include federal withholding for year 2017 (income tax), FICA tax, Medicare tax and FUTA taxes.

How to Calculate 2018 Federal Income Tax by Using Federal Withholding Tax Table

1. Find your pay period: weekly, biweekly, semi-monthly, monthly or daily

What is the wage base limit for Social Security in 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

When to use 2018 withholding tables?

Employers are instructed to use the 2018 withholding tables as soon as possible, but not later than February 15, 2018. Until employers make the switch, they're instructed to use the 2017 withholding tables.

When will the 2018 withholding tables be updated?

Employers are instructed to use the 2018 withholding tables as soon as possible, but not later than February 15, 2018.

When will the IRS release the 2018 tax tables?

However, the IRS has not yet released the official 2018 tax tables (expect those at the end of January 2018 ). If you're looking for the rates that you'll use to file your tax returns in 2018, those are the 2017 rates found here. The 2018 filing season will open on January 29, 2018.

When is the tax filing season for 2018?

The 2018 filing season will open on January 29, 2018. Follow me on Twitter or LinkedIn . Check out my website .

What is a payroll withholding table?

Withholding tables are used by payroll service providers and employers to determine how much tax to withhold from your paycheck, given each your wages, marital status, and the number of withholding allowances. The new tables reflect the increase in the standard deduction, repeal of personal exemptions and changes in tax rates and brackets ...

What is the Medicare premium for 2018?

What are Medicare premiums in 2018? The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford. October 12, 2018.

Will Social Security increase in 2018?

But Social Security benefits will be increasing by 2% in 2018, which will cover more of the increase for people protected by the hold-harmless provision. Some 42% of Part B enrollees who are subject to the hold-harmless provision for 2018 will pay the full monthly premium of $134 because the increase in their Social Security benefit will cover ...

Does Medicare Part B change?

The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford.

How much is Medicare Part B?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

Why is Medicare holding harmless?

The reason is rooted in the "hold harmless" provision, which prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits —if their premiums are automatically deducted from their Social Security checks. This applies to about 70% of Medicare enrollees.

How much will hold harmless pay for Medicare?

Another 28% of Part B enrollees who are covered by the hold-harmless provision will pay less than $134 because the 2% increase in their Social Security benefits will not be large enough to cover the full Part B premium increase. Most people who sign up for Medicare in 2018 or who do not have their premiums deducted from their Social Security ...

How much did people pay for hold harmless in 2017?

The cost-of-living adjustment for Social Security benefits for this year was so low (just 0.3%) that people covered by the hold-harmless provision paid about $109 per month, on average, for Medicare premiums in 2017. But Social Security benefits will be increasing by 2% in 2018, which will cover more of the increase for people protected by ...

How much is Social Security tax in 2018?

If you're an employee, the Social Security tax calculation is easy. If you earn less than $128,400 in 2018, simply multiply your earnings by 0.062 to find your Social Security tax. For example, if your salary is $50,000, your 2018 Social Security tax will be $3,100.

What is the payroll tax rate for Social Security?

The payroll tax rate is currently 7.65% and is assessed on both employers and employees. In other words, the payroll tax rate assessed on American workers is technically 15.3%, but you're only responsible for covering half of it. Of the 7.65%, 1.45% goes to Medicare hospital insurance taxes and the other 6.2% goes to Social Security.

What is the payroll tax rate?

The payroll tax rate is currently 7.65% and is assessed on both employers and employees. In other words, the payroll tax rate assessed on ...

What is the maximum amount of Social Security tax?

This maximum amount, known as the Social Security tax "earnings cap," is adjusted annually to keep up with inflation. For 2018, the earnings cap is $128,400.

How much is self employment tax?

15.3% on self-employment income, up to $128,400. 2.9% for Medicare tax on self-employment income above $128,700. Collectively, this is known as the self-employment tax. If you're self-employed, you'll pay this tax on your net self-employment income.

What is the $128,400 cap on payroll taxes?

Finally, it's worth mentioning that the $128,400 taxable earnings cap applies only to the Social Security portion of the payroll tax. Medicare tax is assessed on all earned income -- in fact, high earners pay an additional 0.9% Medicare tax on earned income above a certain threshold.

Is Social Security income earned income?

However, Social Security is only assessed on earned income, such as salaries, bonuses, wages, tips, and income from a business you're actively running. Passive-income sources, such as dividends, rental income, and income from a business you own but don't participate in, are not subject to Social Security tax.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.