What does 20% of Medicare not cover?

Here’s How To Pay The 20% Medicare DOES NOT Cover… Medicare Part B pays only 80% of covered expense for doctors, outpatient services and durable medical equipment; beneficiaries are responsible for the other 20%. Medigap plans pay that 20%, and can also step in and cover lots of other things.

What doesn't Medicare cover?

Medicare doesn't cover everything. Even if Medicare covers a service or item, you generally have to pay your Deductible , Coinsurance, and Copayment . Find out if Medicare covers a test, item, or service you need.

Do you have to pay 20 percent coinsurance for Medicare supplement plans?

So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you. With some Medigap plans, you might have a copay instead of the 20 percent coinsurance. Medicare supplement plans aren't your only option.

Does Medicare cover out-of-pocket costs?

If the service you need is covered by Medicare, it’s likely you will still have to pay something for it in the form of a deductible, coinsurance or copayment. You can consider applying for a Medicare Supplement (Medigap) plan that can help cover these out-of-pocket Medicare costs, which can add up quickly.

What extra benefits does Medicare not cover?

Original Medicare doesn't cover some benefits like eye exams, most dental care, and routine exams. Plans must cover all of the medically necessary services that Original Medicare covers. Most plansoffer extra benefits that Original Medicare doesn't cover--like some vision, hearing, dental, routine exams, and more.

What group is not covered by Medicare?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions.

Does Medicare Plan G pay for everything?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What plan G does not cover?

Medicare Plan G will not cover your original Medicare Part B deductible, which is $233 in 2022. You would pay for medical services — such as outpatient care, preventative care and ambulance services — until you have reached the deductible amount. Then Medicare would cover your health care costs.

What is not covered by Medicaid?

Medicaid is not required to provide coverage for private nursing or for caregiving services provided by a household member. Things like bandages, adult diapers and other disposables are also not usually covered, and neither is cosmetic surgery or other elective procedures.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the difference between Plan F and Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the difference between Plan G and Plan N?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the monthly premium for Plan G?

How Much Does a Medigap Plan G Cost?StateMonthly premium rangeNumber of Plans availableColorado$110 to $375 $32 to $66 high-deductible57 total *49 (attained age) ^4 (community) ~4 (issue age)California$128 to $246 $37 to $81 high-deductible28 total *26 (attained age) ^2 (issue age)1 more row•Apr 12, 2022

What are the different types of Medicare?

If you want Medicare prescription drug coverage, there are two options you may be able to consider: 1 Medicare Part D prescription drug plans (PDPs) 2 A Medicare Advantage (Medicare Part C) plan that covers prescription drugs

How many Medigap plans are there?

There are 10 standardized Medigap plans available in most states. You can use the 2019 Medigap plans comparison chart below to compare the benefits of each type of plan.

How much is Medicare deductible for 2021?

Typically, for services covered under Part A (hospital services), you will have to pay a $1,484 deductible for each benefit period in 2021, as well as possible coinsurance if you are in the hospital for more than 60 days of the benefit period.

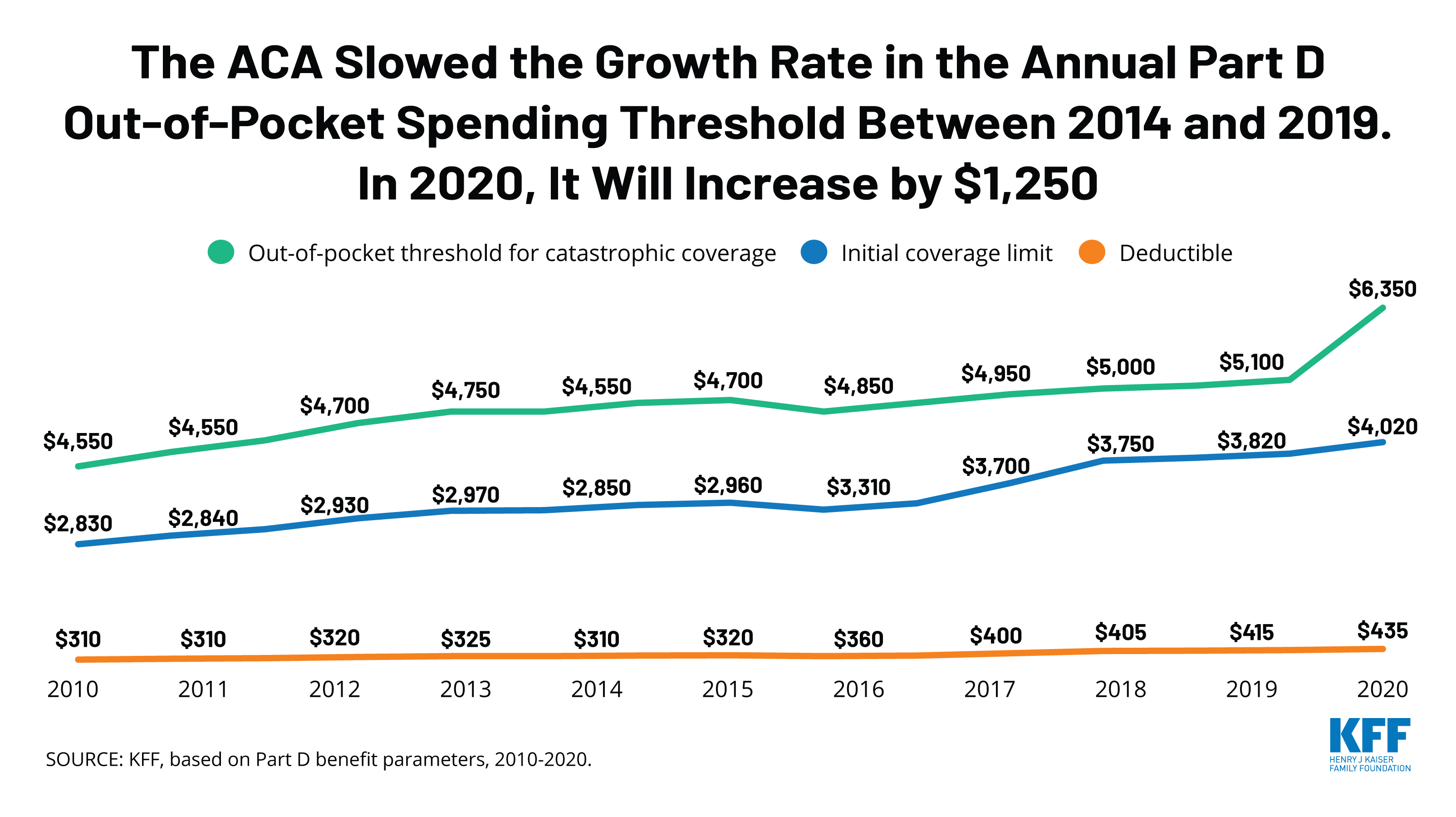

What is Medicare Part D?

If you want Medicare prescription drug coverage, there are two options you may be able to consider: Medicare Part D prescription drug plans (PDPs) A Medicare Advantage (Medicare Part C) plan that covers prescription drugs. Part D plans and Medicare Advantage plans are sold by private insurance companies. Plan availability and the drugs they cover ...

What are non medical services?

Non-medical services. You are responsible for all canceled appointments, private hospital rooms and any other non-medical services. Routine foot care. Routine foot care and some other types of preventive care are not covered. Care in foreign countries.

How to find out if a test is covered by Medicare?

If you are looking to find out if a specific test, item or service is covered by Original Medicare, you can use the search tool found on Medicare.gov.

Does Medicare cover hearing aids?

You pay 100% for hearing aids and hearing aids exams on Original Medicare. Medicare does not cover cosmetic surgery unless it would improve the function of a malformed body part or is required due to an accidental injury. If you have had a mastectomy because of breast cancer, Medicare will cover breast prostheses.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

How many standardized Medigap plans are there?

There are 10 standardized Medigap plans with letter names A through N. Plans with the same letter must offer the same basic benefit regardless of the insurance company providing the plan. For example, all Medigap Plan A policies provide the same benefit, but health insurance company premiums vary based on the way they choose to set rates—community-rated, entry age-rated or attained-age-rated.

How long can you delay Medicare coverage?

Companies could delay coverage up to six months for a pre-existing condition if you didn’t have creditable coverage (other health insurance) before enrolling in Medicare.

What are the requirements to be eligible for a Medigap plan?

To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories:

How long does it take to get a Medigap policy?

To buy a Medigap policy, it’s best to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or older. You can buy any Medigap policy sold in your state during this time, even if you have health problems.

Is Medigap the same as Medicare Advantage?

Medigap plans aren’t the same as Medicare Part C, also known as Medicare Advantage. While a Medicare Advantage plan can serve as an alternative way to get Medicare Part A and Part B coverage, Medigap plans only cover what Part A and Part B do not.

Does Medigap cover prescriptions?

Medigap plans generally don’t cover prescriptions, so you may want to consider enrolling in Medicare Part D, which specifically covers prescription drugs, or a Medicare Advantage plan that includes drug coverage.

Does Medicare cover outpatient care?

Medicare doesn’t cover all of your health care expenses when you turn 65. Medicare Part A covers 80% of inpatient care in hospitals and skilled nursing facilities, and Medicare Part B covers 80% of outpatient care and medically necessary supplies. For the 20% not covered by Medicare, you have the option to purchase Medigap insurance from a private insurance company. Here’s what to know when comparing Medigap plans.

Which insurance pays first, Medicare or No Fault?

No-fault insurance or liability insurance pays first and Medicare pays second.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is a Medigap plan?

Medigap plans. Just like it sounds, a Medigap plan will fill some of the gaps in coverage with Original Medicare. Medigap plans help: Pay copays and coinsurance. Lower the deductible, which is the amount you have to pay out-of-pocket before Medicare pays toward your care.

What is Medicare Part D?

Also known as Medicare Part D, a Prescription Drug Plan will help you pay for prescription medicines. You'll pay an extra fee each month for the plan, but you'll probably save a lot on pharmacy expenses. Private companies sell prescription drug plans, but you can sign up for them through Medicare.

What is Medicare Extra Help?

Medicare Extra Help Program: This program helps low-income Medicare beneficiaries pay for their prescription drugs. If you qualify for QMB, SLMB, QI, or QDWI, as described above, you automatically get Extra Help.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. Available to low-income Medicare beneficiaries. This program helps you pay for your Medicare Part A and Part B premiums, as well as co-insurance, copayments, and deductibles. Contact your state Medicaid office to find out if you qualify.

How to find Medicare shipping number?

Call Medicare at 800-633-4227 to find the number for the SHIP in your state. Or go to Medicare.gov and pick your state in the pull-down menu called "Find someone to talk to."

How often does Medicare Advantage change?

Medicare Advantage plans can change each year. What's covered might change. How much you pay may change, too.

Do you have to have Medicare to get a Medigap plan?

Most don't pay for long-term care, dental care, hearing aids, eye exams, or eyeglasses. To get a Medigap plan, you have to have Original Medicare. As with a Prescription Drug Plan, you also have to pay a monthly fee for a Medigap plan. The plans vary on what they cover and how much they cost.

What is a Medigap plan?

Medigap plans are supplementary coverage that help you cover the costs not covered by Medicare. 10 Medicare Advantage Plans replace Medicare Part A and Part B coverage — but you can also opt for a Medicare Advantage Plan that covers more care than traditional Medicare. 11 Medigap and Medicare Advantage Plans charge additional premiums. Costs vary by plan, and you can only sign up during open enrollment periods each year.

What is Medicare insurance?

Medicare offers health insurance coverage for people age 65 and older, as well as for some people with disabilities. 1 The government provides this health insurance, which is funded by payroll taxes. Medicare is made up of several different parts, such as Medicare Part A, which provides for hospital coverage, 2 and Medicare Part B, which provides for outpatient care. 3

How long do you have to pay hospital bills?

After 90 days, you’ll be responsible for paying all hospital costs. 6

How many days of hospitalization do you have to be in to receive lifetime reserve?

You have a total of 60 “lifetime reserve days,” which begin after 90 days of hospitalization for each benefit period. Once you’ve been hospitalized for 91 days or more, you’ll pay $704 per day for “lifetime reserve days.”

Is foot care covered by exams?

Routine foot care: Neither exams nor corrective care will be covered for most foot problems.

Does Medicare cover senior care?

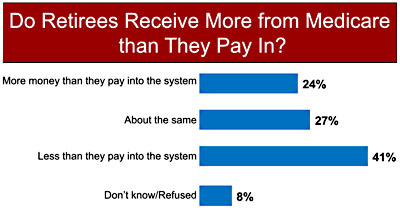

Unfortunately, many people have misconceptions about how Medicare works, what Medicare covers, and what is not covered by Medicare. If you’re looking forward to receiving Medicare benefits, be aware that Medicare does not cover all of the costs of senior healthcare.

What are some health care costs that are not covered by Medicare?

Listed below are some health care costs that are not covered by Medicare but may be covered under Medicare Supplemental Insurance Plans. Dental care. Private nursing care. Health care that is needed outside of the United States. There are certain circumstances where this may not apply. Custodial care. Skilled nursing care that is ...

How much does Medicare cover?

Medicare covers 80% of many health expenses, but 20% will be the responsibility of the beneficiary.

What are the services that Medicare Supplemental Insurance covers?

Cosmetic surgery. Foot care of a routine nature. Hearing aids. Routine eye care. Eyeglasses, unless they are required after cataract surgery. Homemaker services. When you are seeking Medicare Supplemental Insurance Plans, you will want to check out a number of private companies that are offering policies in various price ranges.

Why do people on Medicare have to invest in Supplemental Insurance?

For this reason, many individuals on Medicare will invest in Medicare Supplemental Insurance Plans to help cover those expenses that their original Medicare plan will not pay. Supplemental Plans may also be referred to as Medigap policies, since they help to fill in the gaps that are left with standard Medicare insurance.

What is supplemental medical insurance?

These supplemental plans are designed to assist individuals with medical needs that go above and beyond the coverage provided by Medicare itself.

Who sells Medigap insurance?

Medigap policies are sold by private insurance agencies, and these companies must adhere to federal and state laws. For an individual to be eligible for this type of supplemental policy, he or she must already have Medicare Parts A and B.

Can a spouse be covered by Medicare?

A spouse will not be covered under a Medigap policy, and separate policies must be obtained for each individual. It will be necessary for the beneficiary to pay a premium on Medicare Part B as well as the Medigap plan. If an individual’s income is very low, there is assistance available to help with the payment of premiums. ...

What is a Medigap plan?

These plans are also called Medigap. In return, the plan pays most of your out-of-pocket expenses. So when you go to the doctor, for example, you don't have to pay the 20 percent coinsurance required by Medicare. Your Medigap plan pays it for you.

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

Does Medicare coordinate with Part D?

You coordinate between Medicare, your Medigap plan and your Part D prescription drug plan, if you have one. One company coordinates all your care. Helps pay for costs you have with Original Medicare. Many plans include extra benefits Original Medicare doesn't offer like dental, vision and prescription coverage.

Does Medicare Supplement work?

Medicare supplement plans don't work like most health insurance plans. They don't actually cover any health benefits. Instead, these plans cover the costs you're responsible for with Original Medicare.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

What is Medicare Advantage?

Medicare Advantage plans are sold by private insurance companies as an alternative to Original Medicare. Every Medicare Advantage plan must provide the same hospital and medical benefits as Medicare Part A and Part B , and most plans include Medicare prescription drug coverage.

Does Medicare cover MAPDs?

MAPDs must help cover a number of commercially available vaccines that aren’t covered by Original Medicare when reasonably and medically necessary to prevent illness. However, specific rules of administration and costs (including monthly premiums, deductibles and coinsurance) will vary depending on the Medicare Advantage plan you enroll in.