WellCare (PDP) is a Medicare-approved Part D sponsor. Enrollment in WellCare (PDP) depends on contract renewal. Blue Cross and Blue Shield of Georgia, Inc. is a PDP plan with a Medicare contract.

| Provider | Forbes Health Ratings | CMS rating |

|---|---|---|

| Blue Cross Blue Shield | 5.0 | 3.8 |

| Cigna | 4.5 | 3.8 |

| United Healthcare | 4.0 | 3.8 |

| Aetna | 3.5 | 3.6 |

What are the best Medicare insurance companies?

There is no wonder why Mutual of Omaha is making the top of our list; the company has an A+ rating with A.M. Best and an AA- with S&P. Back in 1909, Mutual of Omaha enters the insurance industry.Mutual of Omaha boasts about paying 98% of Medicare Claims within 12 hours, meaning you don’t need to worry about claim status!

What companies offer Medigap insurance?

But these are not the only companies that may offer Medigap coverage where you live. Some other notable Medicare Supplement Insurance companies you may be able to consider include: Central States Indemnity Company of Omaha (CSI) Gerber Life Insurance Company. Liberty National Life Insurance Company. Medical Mutual.

What does Medicare-approved private insurance cover?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance prescription drug coverage through Medicare Part D plans

Can you use private health insurance and Medicare together?

Only 34.1 percent have public health insurance, including 18.1 percent who are enrolled in Medicare. In certain cases, you can use private health insurance and Medicare together. Keep reading to learn how and when private insurance can work with Medicare. How does private insurance work with Medicare?

Does Medicare pay private insurance companies?

Private insurance and original Medicare plans provide varying benefits and coverage. Most of both types of plans cover hospital care and outpatient medical services, including doctor's visits, physical therapy, and diagnostic tests. However, Medicare may have gaps in coverage that private insurers cover.

What is the best supplemental insurance for Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

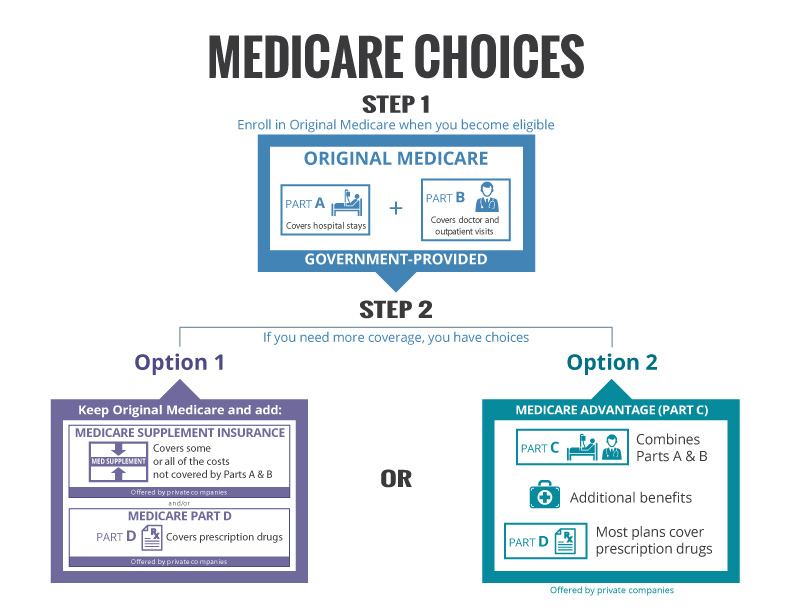

What part of Medicare is private insurers?

Medicare Advantage PlansMedicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

Can someone have Medicare and private insurance at the same time?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

Is private health insurance better?

Privately insured individuals are more likely to report worse access to care, higher medical costs and lower satisfaction than those on public insurance programs like Medicare, suggesting public options may provide more cost-effective care than private ones, according to a new study published in JAMA on Tuesday.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is AARP UnitedHealthcare considered private insurance?

AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B. Supplement plans can help pay for some or all of the costs not covered by Original Medicare — things like coinsurance and deductibles.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.