What are the requirements for Medicare in Florida?

Who Qualifies for Medicare in Florida?You are 65 or older.You're under 65, disabled, and receive disability benefits from Social Security or the Railroad Retirement Board.You have end-stage renal disease (ERSD).You have ALS (Amyotrophic Lateral Sclerosis), also known as Lou Gehrig's disease.

What are the 3 requirements for Medicare?

Be age 65 or older; Be a U.S. resident; AND. Be either a U.S. citizen, OR. Be an alien who has been lawfully admitted for permanent residence and has been residing in the United States for 5 continuous years prior to the month of filing an application for Medicare.

What is the income limit for Medicare in Florida?

Income limits: The income limit is $2,349 a month if single and $4,698 a month if married (and both spouses are applying).

Does Florida have free Medicare?

Medicare resources in Florida The program is free to all Florida Medicare beneficiaries and provides one-on-one answers to Medicare questions through specially trained counselors. Their mission is to empower Florida seniors and help them make informed health-care choices.

How do I know if I am eligible for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

Can I get Medicare if I never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

Is Medicare based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

How much assets can you have to qualify for Medicaid in Florida?

$2,000Florida allows an individual to retain less than $2,000 in non-exempt assets, in addition to certain exempt assets.

Who is not eligible for Medicaid in Florida?

Effective Jan 1, 2022, the applicant's gross monthly income may not exceed $2,523.00 (up from $2,382.00). The applicant may retain $130 per month for personal expenses. However, even having excess income is not necessarily a deal-breaker in terms of Medicaid eligibility.

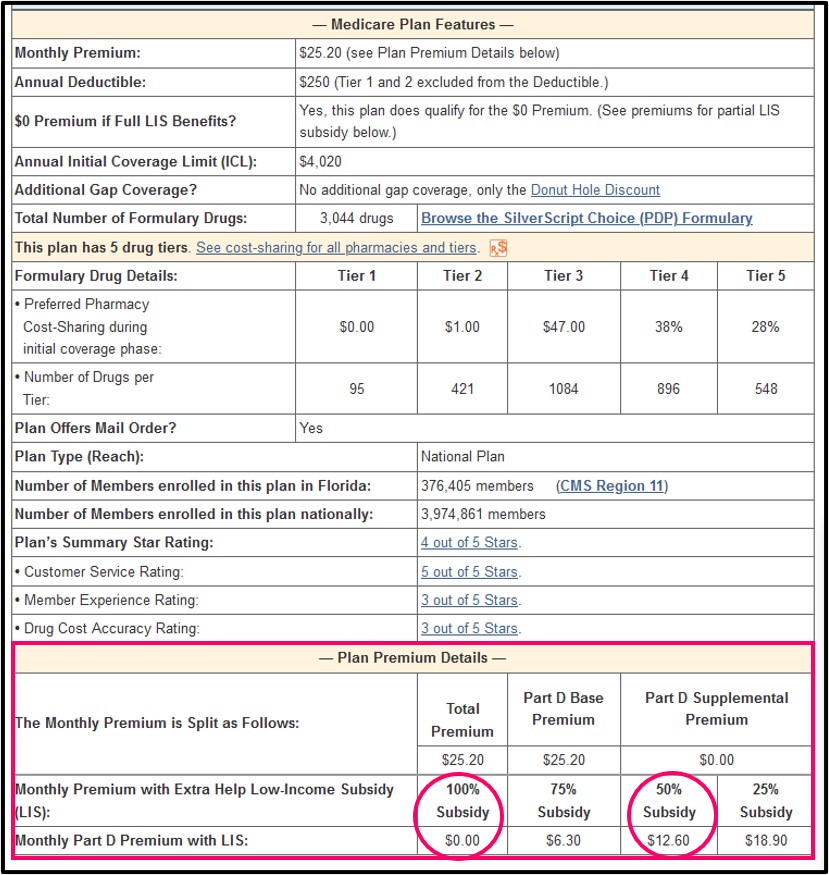

How much does Medicare in Florida cost?

The monthly premium costs of Medicare Advantage plans in Florida range from $0 to $145.50. You'll still have to pay the Part B premium of $148.50, bringing your monthly premium cost to a range of $148.50 to $294. The additional monthly cost of a Medicare Supplement plan in Florida averages $152.58.

How do I know if I qualify for Medicaid in Florida?

Be legal Florida residents, Be a minimum of 65 years of age OR between 18 and 64 years old and designated as disabled by the Social Security Administration, Need “nursing facility level of care”, and. Meet the financial requirements for Florida Medicaid.