According to Title 1 TAC §355.8281, the Medicaid rate for NPs and CNSs is 92 percent of the rate paid to a physician (doctor of medicine [MD] or doctor of osteopathy [DO]) for the same service and 100 percent of the rate paid to physicians for laboratory services, X-ray services, and injections.

Full Answer

What is the reimbursement rate for Medicare and Medicaid?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1 Not all types of health care providers are reimbursed at the same rate.

How do I find Medicare reimbursement rates?

You can also find Medicare reimbursement rates if you know the CPT or HCPCS code for the service or item being billed and have access to the Medicare Physician Fee Schedule, which is essentially a master list of all reimbursement rates. The MPFS is updated on a quarterly basis to reflect the most recent changes to reimbursement rates.

What percentage of Medicare reimbursement do nurses receive?

For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1 Medicare uses a coded number system to identify health care services and items for reimbursement. The codes are part of what’s called the Healthcare Common Procedure Coding System (HCPCS).

What percentage of Medicare reimbursement goes to specialty care?

For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1 Medicare uses a coded number system to identify health care services and items for reimbursement.

What percentage does Medicare reimburse?

The rate at which Medicare reimburses health care providers is generally less than the amount billed or the amount that a private insurance company might pay. According to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill.

How are Medicare reimbursements calculated?

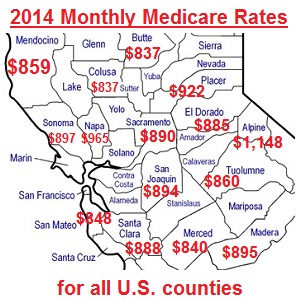

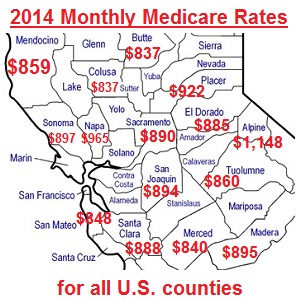

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

What is Medicare reimbursement fee schedule?

A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis.

How much does Medicare reimburse for a 99213?

The most common codes a doctor will use for follow up office visits are 99213 (follow up office visit, low complexity) and 99214 (follow up office visit, moderate complexity). A 99213 pays $83.08 in this region ($66.46 from Medicare and $16.62 from the patient).

What is the reimbursement rate for?

Reimbursement rates means the formulae to calculate the dollar allowed amounts under a value-based or other alternative payment arrangement, dollar amounts, or fee schedules payable for a service or set of services.

What is reimbursement percentage?

Reimbursement Percentage This is the percentage of covered costs you'll get back after you meet your deductible.

How Much Does Medicare pay for 99214 in 2021?

$132.94By Christine Frey posted 12-09-2020 15:122021 Final Physician Fee Schedule (CMS-1734-F)Payment Rates for Medicare Physician Services - Evaluation and Management99213Office/outpatient visit est$93.5199214Office/outpatient visit est$132.9499215Office/outpatient visit est$185.9815 more rows•Dec 9, 2020

How much can you charge for a 99214?

Prices for Standard Primary Care ServicesCPT CodeCostDescription99212$70Standard 5-10 Minute Office Visit99213$95Standard 10-15 Minute Office Visit99214$130Standard 20-25 Minute Office Visit99215$180Standard 30-45 Minute Office Visit

What is the amount reimbursed for 99214?

99214 Reimbursement Rates – MedicaidCPT CodeService TimeRate9921210 minutes$31.369921315 minutes$43.239921425 minutes$66.809921540 minutes$99.95

How much does Medicare pay for medical services?

The Medicare reimbursement rates for traditional medical procedures and services are mostly established at 80 percent of the cost for services provided. Some medical providers are reimbursed at different rates. Clinical nurse specialists are paid 85 percent for most of their billed services and clinical social workers are paid 75 percent ...

Why use established rates for health care reimbursements?

Using established rates for health care reimbursements enables the Medicare insurance program to plan and project for their annual budget. The intent is to inform health care providers what payments they will receive for their Medicare patients.

How many specialists are on the Medicare committee?

Medicare establishes the reimbursement rates based on recommendations from a select committee of 52 specialists. The committee is composed of 29 medical professionals and 23 others nominated by professional societies.

What is the original objective of Medicare?

The original objective was to establish a uniform payment system to minimize disparities between varying usual, customary, and reasonable costs. Today, Medicare enrollees who use the services of participating health care professionals will be responsible for the portion of a billing claim not paid by Medicare.

How much can Medicare increase from current budget?

By Federal statute, the Medicare annual budget request cannot increase more than $20 million from the current budget.

Does Medicare accept all recommendations?

While Medicare is not obligated to accept all of the recommendations, it has routinely approved more than 90 percent of the recommendations. The process is composed of a number of variables and has been known for lack of transparency by the medical community that must comply with the rates.

Do reimbursement rates take into consideration variable factors?

While the reimbursement rates do take into consideration a number of variable factors, those differences are factored into the reimbursement projections for enrollees living in different geographical locations.

Background Information

Each year, TDI collects health care reimbursement rate information under Insurance Code Chapter 38, Subchapter H. This subchapter requires the department to collect health benefit plan reimbursement rate information in a uniform format.

Instructions and Data Template

Please make sure that you are using version 5.0 of the reporting form by checking the version number in the ‘Introduction’ worksheet of the reporting template. Do not submit data on previous versions of the form.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

What is the Medicare reimbursement code for 99487?

The Medicare reimbursement for CPT codes 99487, 99489, 99490, 99491, and G2058 can be claimed by care providers who offer chronic care management to their patients suffering from two or more chronic conditions.

How much does a medical practitioner charge per session?

Medical practitioners can charge roughly $92 per session and this code can be claimed once a month for each patient. The 60 minutes scheduled should cover ongoing oversight, direction, and management of care plans.

Can you bill CPT 99491 and 99491 in the same month?

The billing is roughly double that of CPT 99490 as it involves twice the allocated time (30 minutes vs 15 minutes). CPT 99491 and CPT99490 cannot be billed in the same calendar month.

Can you use CPT 99490 with other CPT codes?

It is not necessary to use this code for sessions that are 21-40 minutes in length. As this code is being paired with CPT99490, it cannot be paired with any other CPT codes during the same calendar month. The following table lists the 2020 Chronic Care Management reimbursement rates for CPT 99490 across various states or regions in the US. REGION.

What is Medicare reimbursement rate?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare ...

How much more can a health care provider charge than the Medicare approved amount?

Certain health care providers maintain a contract agreement with Medicare that allows them to charge up to 15% more than the Medicare-approved amount in what is called an “excess charge.”.

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

Is it a good idea to check your Medicare bill?

It’s a good idea for Medicare beneficiaries to review their medical bills in detail. Medicare fraud is not uncommon, and a quick check of your HCPCS codes can verify whether or not you were correctly billed for the care you received.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.