If you’re 65 or older, still working and are covered by employer health insurance, it can make sense to sign up for Medicare now. Enrollment might reduce your out-of-pocket costs. Millions find themselves in this situation.

Can you get Medicare if you are still working?

You can get Medicare if you’re still working and meet the Medicare eligibility requirements. You become eligible for Medicare once you turn 65 years old if you’re a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if you’re covered by an employer medical plan.

Does Medicare coverage change if you return to work?

Yes, this will apply to you. Promptly report any changes in your work activity. This way you can be paid correctly, and we can tell you how long your Medicare coverage will continue after you return to work. I have Medicare hospital Insurance (Part A) and medical insurance (Part B) coverage.

Will Medicare contact me when I turn 65?

When enrolling in Medicare, you should be aware that neither Social Security nor Medicare calls you to get information. Should any issue arise in which Medicare or Social Security needs any information from you, they’ll ALWAYS send you a letter to notify you.

What will Medicare cost me when I turn 65?

The amount you could need to cover premiums and out-of-pocket prescription drug costs from age 65 on could be $130,000 if you're a man and $146,000 if you're a woman, according to one study.

Is it a good idea to get Medicare if you're still working at 65?

If you have health insurance through a company with fewer than 20 employees, you should sign up for Medicare at 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

Can I delay Medicare if still working?

As long as you have health insurance from a company that employs 20 or more people where you or your spouse actively works, you can delay enrolling in Medicare until the employment ends or the coverage stops, whichever happens first.

What happens if you plan to keep working after age 65?

If you continue to work, your employer's insurance pays first. And, if you've already left the company and have a retiree plan or COBRA, those plans typically become the primary payer until you turn age 65. Otherwise, you will be the primary payer until your Medicare coverage begins.

Do I have to switch to Medicare when I turn 65?

when you turn 65, you can continue contributing to your HSA. Medicare will not force you to sign up at 65, and you'll get a special enrollment period to sign up later as long as you have a group health plan and work for an employer with 20 or more people.

How does working affect Medicare?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work. Generally, if you have job-based health insurance through your (or your spouse's) current job, you don't have to sign up for Medicare while you (or your spouse) are still working.

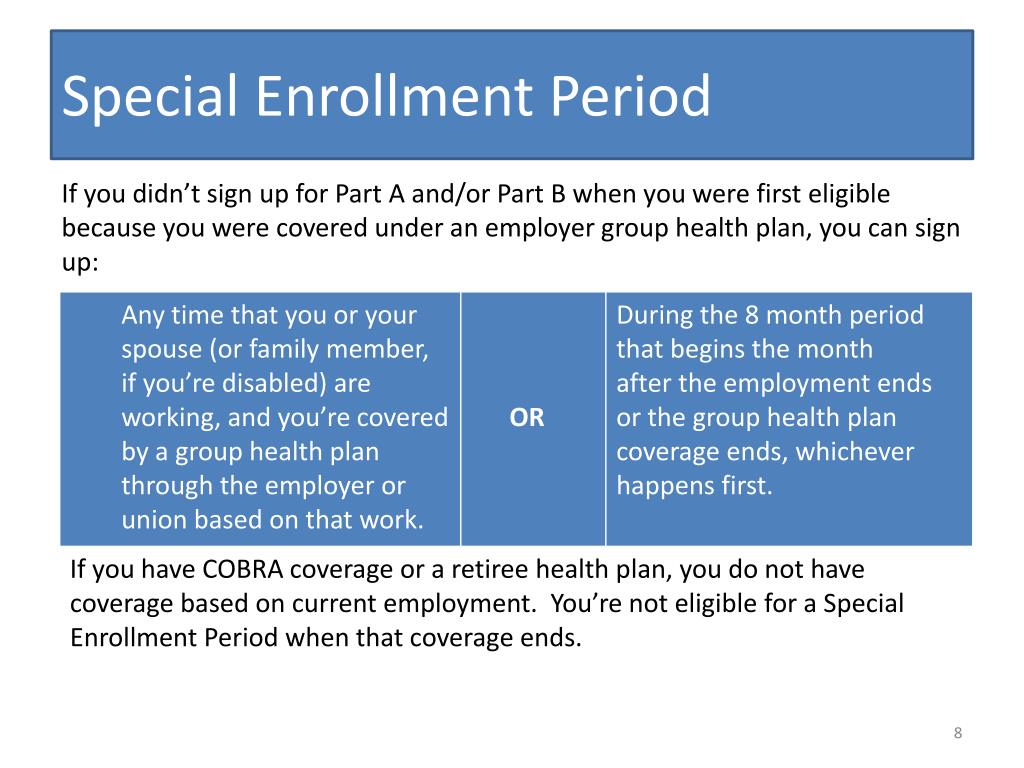

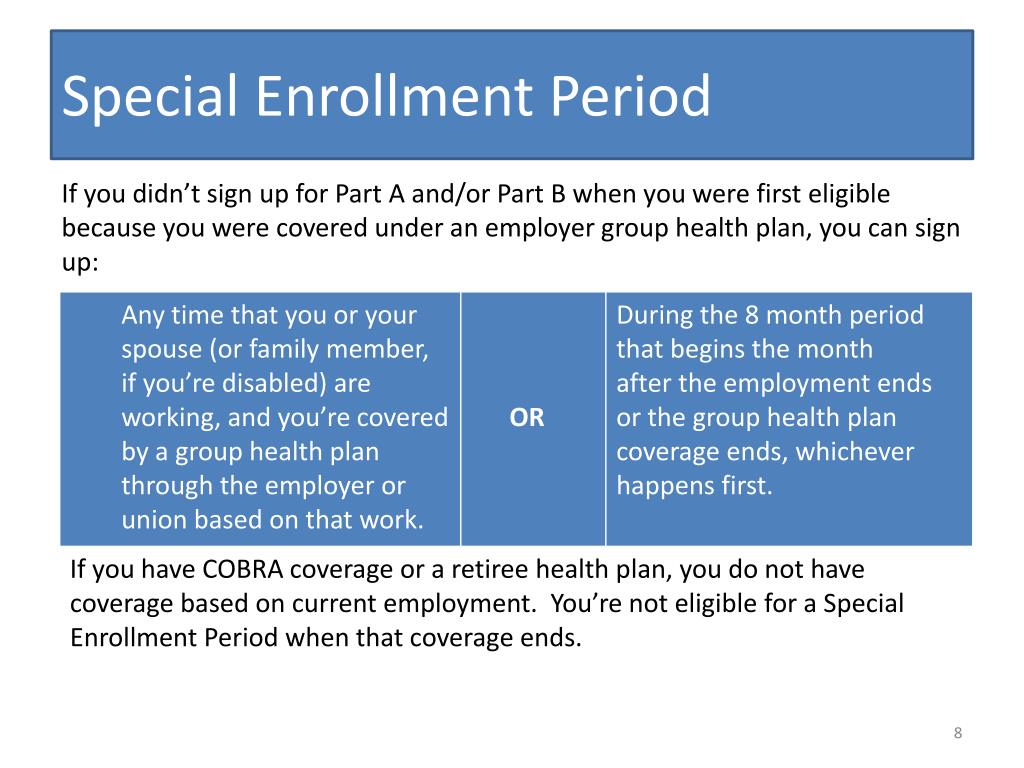

Can I add Medicare Part B anytime?

Special Enrollment Period If you are eligible for the Part B SEP, you can enroll in Medicare without penalty at any time while you have job-based insurance and for eight months after you lose your job-based insurance or you (or your spouse) stop working, whichever comes first.

Can you retire and still work full time?

You can get Social Security retirement or survivors benefits and work at the same time. However, there is a limit to how much you can earn and still receive full benefits. If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount.

At what age can you earn unlimited income on Social Security?

If you will reach full retirement age in 2022, the limit on your earnings for the months before full retirement age is $51,960. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

What is the maximum amount you can earn while collecting Social Security in 2021?

Once you have turned your full retirement age, there is no limit on how much you can earn while collecting Social Security payments. Your full retirement age is based on the year you were born. The full retirement age for anyone born between 1943 and 1954 is 66 years old.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

When do you get Medicare if you leave your job?

In that case, you’ll get an eight-month special enrollment period to sign up for Medicare if and when you leave your job or your employer stops offering coverage. It will start the month after you separate from your employer, or the month after your group health coverage ends – whichever happens sooner.

What happens if you don't sign up for Medicare?

Specifically, if you fail to sign up for Medicare on time, you’ll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible.

How long does it take to get Medicare?

Learn how to make sure they have health insurance once you’re enrolled. Medicare eligibility starts at age 65. Your initial window to enroll is the seven-month period that begins three months before the month of your 65th birthday and ends three months after it. Seniors are generally advised to sign up on time to avoid penalties ...

Do you have to double up on Medicare?

No need to double up on coverage. Many seniors are no longer employed at age 65, and thus rush to sign up for Medicare as soon as they’re able. But if you’re still working at 65, and you have coverage under a group health plan through an employer with 20 employees or more, then you don’t have to enroll in Medicare right now.

Does Medicare pay for Part A?

That said, it often pays to enroll in Medicare Part A on time even if you have health coverage already. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your primary insurance (in this case, your work health plan) doesn’t cover.

How long does Medicare enrollment last?

The general rule for Medicare signup is that unless you meet an exception, you get a seven-month enrollment window that starts three months before your 65th birthday month and ends three months after it. Having qualifying insurance through your employer is one of those exceptions. Here’s what to know.

Can a 65 year old spouse get Medicare?

Some 65-year-olds with younger spouses also might want to keep their group plan. Unlike your company’s option, spouses must qualify on their own for Medicare — either by reaching age 65 or having a disability if younger than that — regardless of your own eligibility.

Can I delay Medicare if I lose my group insurance?

The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). Many people with large group health insurance delay Part B but sign up for Part A because it’s free. “It doesn’t hurt you to have it,” Roberts said.

Does Medicare have a premium?

Part A has no premium as long as you have at least a 10-year work history of contributing to the program through payroll (or self-employment) taxes.

Do you have to sign up for Medicare at age 65?

Medicare may not be top of mind if you’re nearing the eligibility age of 65 and already have health insurance through your employer. However, it probably deserves some attention. While not everyone must sign up, many are required to enroll unless they want to face life-lasting late-enrollment penalties.

What to do if you are 65 and still working?

If you’ll hit age 65 soon and are still working, here’s what to do about Medicare 1 The share of people age 65 to 74 in the workforce is projected to reach 30.2% in 2026, up from 26.8% in 2016 and 17.5% in 1996. 2 If you work at a company with more than 20 employees, you generally have the choice of sticking with your group health insurance or dropping the company option to go with Medicare. 3 If you delay picking up Medicare, be aware of various deadlines you’ll face when you lose your coverage at work (i.e., you retire).

How old do you have to be to sign up for Medicare?

While workers at businesses with fewer than 20 employees generally must sign up for Medicare at age 65 , people working for larger companies typically have a choice: They can stick with their group plan and delay signing up for Medicare without facing penalties down the road, or drop the company option and go with Medicare.

How long does Medicare last?

Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient and medicare equipment coverage). You get a seven-month window to sign up that starts three months before your 65th birthday month and ends three months after it.

What happens if you delay picking up Medicare?

It’s becoming a common scenario: You’re creeping closer to your 65th birthday, which means you’ll be eligible for Medicare, yet you already have health insurance through work.

How many employees can you delay signing up for Medicare?

If you work at a large company. The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

What happens if you don't sign up for Part A?

If you don’t sign up when eligible and you don’t meet an exception, you face late-enrollment penalties. Having qualifying insurance — i.e., a group plan through a large employer — is one of those exceptions. Many people sign up for Part A even if they stay on their employer’s plan.

Can you continue taking a specialty drug under Medicare?

On the other hand, if you take a specialty drug that is covered by your group plan, it might be wise to continue with it if that drug would be more expensive under Medicare. Some 65-year-olds with younger spouses also might want to keep their group plan.

How long do you have to work to get Medicare Part A?

If by the time you reach 65 you’ve worked a total of approximately 10 years over your career, you’re entitled to premium-free Medicare Part A, which pays for in-patient hospital charges and more.

How many employees do you have to have to have Medicare Part B?

If the employer has fewer than 20 employees: If your or your spouse's employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part B, which will be your primary insurance. If you have an HSA and want to keep contributing: If you have an HSA ...

What is Medicare Part A?

If the employer has fewer than 20 employees: If your or your spouse's employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part A, which will be your primary insurance. “Primary” means that Medicare pays first, and then the employer insurance kicks in ...

What happens if you overlook Medicare enrollment rules?

Medicare processes and rules are complex and rife with exceptions; if you overlook something in the enrollment rules, you may pay a high price in terms of both penalties and gaps in coverage. So you should consult with Medicare and with the benefits administrator for your employer coverage — before you enroll or decide to delay enrollment.

How long do you have to keep HSA contributions?

Stop making contributions to your HSA at least six months before you sign up for Part B. And you’ll want to sign up for Medicare at least a month before you stop work ...

Does Medicare Part A cover my employer?

Because in some cases, Medicare Part A may cover what your employer plan does not. But as with so many aspects of Medicare, there are caveats, exceptions and potential pitfalls. If the employer has 20 or more employees: If your or your spouse's employer has 20 or more employees and a group health plan, you don't have to sign up for Medicare ...

Is Medicare cheaper than group health insurance?

If your employer (or your spouse’s employer) requires you to pay a large portion of the premium on your group health insurance, you may find Medicare cheaper and the coverage adequate. So compare your current coverage and out-of-pocket expenses — including premiums, deductibles, copays and coinsurance — with your costs and benefits under Medicare, which may also pay some expenses not covered by your group plan.

What age do you have to be to get Medicare?

You'll need to know what your coverage options will be at age 65 and adjust your Medicare enrollment to meet your needs. One other situation that can cause confusion occurs if you leave your job with a "retiree" health care plan or coverage under COBRA (the Consolidated Omnibus Budget Reconciliation Act of 1985).

When do you have to enroll in Medicare?

If you work for an employer with fewer than 20 employees, you need to enroll in Medicare at age 65, during your IEP. Medicare becomes the primary payer and your employer's insurance becomes secondary.

How long can you enroll in Medicare if you don't have insurance?

If you don't enroll during your IEP because you have employer group health insurance coverage, you can enroll at any time you still have employer group coverage or within 8 months after the month your employment or group coverage ends. You'll need to know what your coverage options will be at age 65 and adjust your Medicare enrollment ...

When does Medicare become the primary payer?

Medicare becomes the primary payer for your health care expenses once you reach age 65 and lose your employer group coverage (assuming you work for an employer with more than 20 employees). If you continue to work, your employer's insurance pays first.

What are the pitfalls of working past 65?

5 pitfalls to avoid when working past age 65. 1. Not doing your homework: If you plan to work past age 65, or if your spouse or partner continues to work and covers you, you've got some research to do to make sure you know your options, the costs, and any restrictions. Your employer is required to offer you coverage, but is that your best option? ...

How many employees do you need to be to receive Medicare?

The law requires a large employer — one with at least 20 employees — to offer you (and your spouse) the same benefits that it offers to younger employees (and their spouses). It is entirely your choice (not the employer’s) whether to: accept the employer health plan and delay Medicare enrollment.

What happens if you don't sign up for Medicare?

Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage. It’s therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability.

How long can you delay Medicare?

As long as you have group health insurance from an employer for which you or your spouse actively works after you turn 65, you can delay enrolling in Medicare until the employment ends or the coverage stops (whichever happens first), without incurring any late penalties if you enroll later. When the employer-tied coverage ends, you’re entitled to a special enrollment period of up to eight months to sign up for Medicare.

Is Medicare Part B primary or group?

If you enroll in both the group plan and Medicare Part B, be aware of the consequences. In this situation, the employer plan is always primary, meaning that it settles medical bills first and Medicare only pays for services that it covers but the employer plan doesn’t.

Can you delay Medicare enrollment?

You can’t delay Medicare enrollment without penalty if your employer-sponsored coverage comes from retiree benefits or COBRA — by definition, these do not count as active employment. Nor does it count if you work beyond 65 but rely on retiree benefits from a former employer.

Can you sell a Medigap policy?

Insurance companies are prohibited from refusing to sell you a Medigap policy or charge higher premiums based on your health or preexisting medical conditions, if you buy the policy within six months of enrolling in Part B. Outside of that six-month window, except in very limited circumstances, they can do both.

When do dependents have to enroll in Medicare?

If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare when they turn 65. If you’re not married but living in a domestic partnership and are covered by your partner’s employer health insurance.

When do you have to enroll in Medicare Part B?

When You Must Enroll in Medicare Part B. You may be required to get Medicare Part B even when you’re still working. There are two situations in which you must get Part B when you turn 65. If your employer has fewer than 20 employees. If you’re covered by a spouse’s employer, and the employer requires covered dependents to enroll in Medicare ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long does it take to enroll in Medicare if you lose your employer?

When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you haven’t done so already. You’ll also be able to enroll in a Medicare Advantage (Part C) plan or Part D prescription drug plan in the first two months of this period.

How much does Medicare Part B cost?

Part B is different. Unlike Part A, Medicare Part B has a monthly premium, which can cost $148.50 to $504.90 depending on income. It has a late enrollment penalty for anybody who enrolls without qualifying for a Special Enrollment Period.

Can you avoid Medicare if you file for Social Security?

PHIL: When you file for Social Security, by law you must receive Part A of Medicare. You can't avoid it. If you want to get Social Security benefits, you have to be enrolled in Part A.