- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Montana

Full Answer

Which states have year-round Medicare Advantage plans?

Connecticut – Connecticut is a guaranteed year-round state, permitting you to make changes to your policy throughout the year. Maine – Those in Maine have an extension on the standard Medicare Advantage “trial right.” In other states, you have only one year to switch to a supplement when you try an Advantage plan.

What are the different states for Medigap coverage?

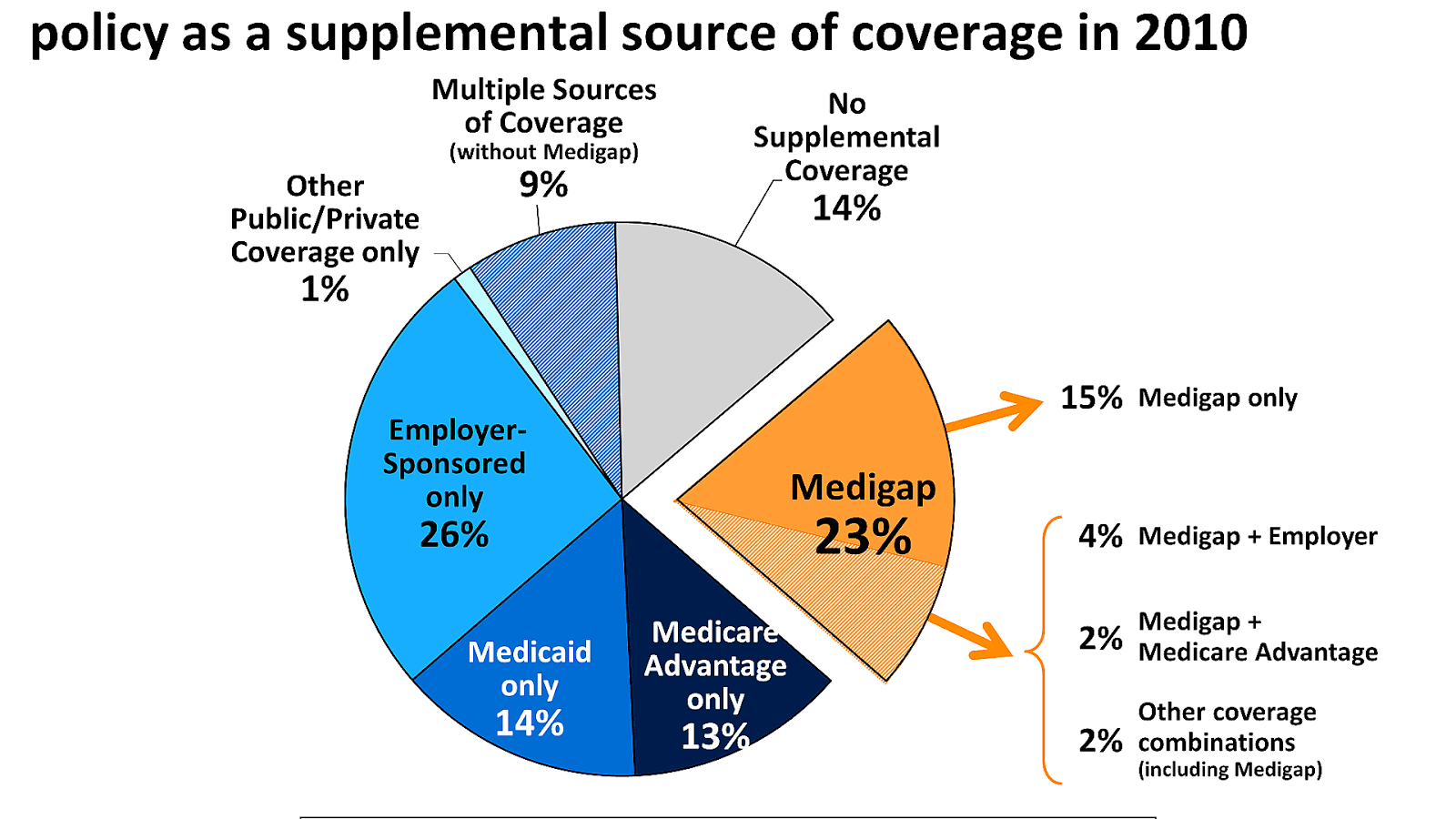

Medigap state variation. Medigap coverage can be priced in one of three ways: community rating, issue-age rating, or attained-age rating. As of 2013, eight states (Arkansas, Connecticut, Massachusetts, Maine, Minnesota, New York, Vermont, and Washington) require carriers to use community rating.

Are Medicare plans different in each state?

But while these provisions apply nationwide, plan availability and prices are different from one state to another. Medicare uses a star rating system for Medicare Advantage and Part D plans, and the availability of high-quality plans is not the same in every state.

What are the best States for Medicare Part D prescription drug plans?

Best States for Medicare Part D Prescription Drug Plans (PDP) State Overall Rank # Plans Available Average Premium Average Drug Deductible Alabama 39 32 $43.79 $344.06 Alaska 4 25 $37.84 $366.80 Arizona 15 32 $40.98 $335.63 Arkansas 48 31 $40.52 $331.77 46 more rows ...

How many states have Medicare?

50 statesState Differences in Medicare Advantage The federal government requires them to cover everything Original Medicare covers in all 50 states. But Medicare Advantage plans may also offer benefits beyond what Original Medicare covers, such as dental, vision, prescription drug and hearing benefits.

Which states are opposed to Medicaid expansion?

Nonexpansion states include 12 states that have not expanded Medicaid: Alabama, Florida, Georgia, Kansas, Mississippi, North Carolina, South Carolina, South Dakota, Tennessee, Texas, Wisconsin, and Wyoming. Data: Urban Institute's Health Insurance Policy Simulation Model (HIPSM), 2021.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Why did Florida not expand Medicaid?

Florida has set below-average limits for the mandatory coverage groups, and since the state has not accepted federal funding to expand Medicaid, the eligibility rules have not changed with the implementation of the ACA.

Why did Tennessee not expand Medicaid?

In Tennessee, the only able-bodied, non-elderly adults enrolled in Medicaid are those who have dependent children and income that doesn't exceed 101% of the poverty level, since the state has steadfastly rejected federal funding to expand its Medicaid program to cover more low-income adults.

What states require health insurance?

Which states have individual healthcare mandates? To date, California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have passed state individual mandates.

What are the disadvantages of Medicaid?

Disadvantages of Medicaid They will have a decreased financial ability to opt for elective treatments, and they may not be able to pay for top brand drugs or other medical aids. Another financial concern is that medical practices cannot charge a fee when Medicaid patients miss appointments.

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

Can you have Medicare and Medicaid?

Some Americans qualify for both Medicare and Medicaid, and when this happens, it usually means they don't have any out-of-pocket healthcare costs. Beneficiaries with Medicare and Medicaid are known as dual eligibles – and account for about 20 percent of Medicare beneficiaries (about 12.3 million people).

What is the income limit for Florida Medicaid?

$2,523.00Effective Jan 1, 2022, the applicant's gross monthly income may not exceed $2,523.00 (up from $2,382.00). The applicant may retain $130 per month for personal expenses. However, even having excess income is not necessarily a deal-breaker in terms of Medicaid eligibility.

Does Florida have free health insurance?

Quick Info. Medicaid provides free or low-cost health coverage to eligible needy persons.

Do you automatically get Medicaid if you get SSI in Florida?

Florida residents who are eligible for Supplemental Security Income (SSI) are automatically eligible for Medicaid coverage from the Social Security Administration.

Why did some states refuse to adopt Medicaid expansion quizlet?

Why did some states refuse to adopt Medicaid expansion? They were concerned about funding it.

What are the pros and cons of Medicaid expansion?

List of Medicaid Expansion ProsNot every low-income individual actually qualifies for Medicaid. ... Expansion would support local economies. ... It offers people a level of financial protection. ... Medicaid expansion drops the uninsured rate. ... The cost of expansion is minimal for the states.More items...•

Is Arizona a Medicaid expansion state?

On January 1, 2014, Arizona officially implemented ACA, expanding Medicaid eligibility for all children up to 133% FPL, childless adults up to 100% FPL, and adults up to 133% FPL. As of June 2019, total Medicaid expansion enrollment is 464,000.

Did Oklahoma expand Medicaid?

Oklahoma has successfully expanded Medicaid, as more than 210,000 Oklahomans have enrolled in expansion and there have been substantial declines in the uninsured rate across all demographics.

What is Medicare Advantage?

Medicare Advantage plans, Medicare Prescription Drug Plans, and Medigap plans are offered through private insurance companies that contract with Medicare, so availability, benefits, and costs will vary by state.

Does Medicare Advantage cover dental?

Or, if you like the convenience of getting all of your Medicare coverage under one plan, Medicare Advantage plans provide the same Part A and Part B benefits and may cover additional benefits, such as routine vision and dental , or prescription drugs.

How long does it take to switch Medigap plans?

Missouri – If you have a Medigap policy, you can switch plans within 60 days of your enrollment anniversary . New York – You can enroll in a Medigap policy without underwriting throughout the year. Washington – Allows Medigap enrollees to change Medigap plans (except for Plan A) at any point.

What is guaranteed issue rights?

Guaranteed Issue rights are in place to ensure you can obtain a Medigap policy. Companies must offer you an option, even if you have pre-existing health conditions. For example, Susan lives with COPD, Guarantee Issue rights allow her to get a policy without fear of denial!

How long can you change your Medigap plan?

Some states allow the “Birthday Rule,” which allows a 30-day timeframe for you to change your Medigap plan after your birthday every year. Also, you can change plans without underwriting as long as the policy benefits are equal to or less than your current plan.

How long can you switch Medicare Advantage plan in Maine?

But, in Maine, you can “try” the Advantage plan for three years, and you have 90 days after dropping the policy to switch to a supplement with Guaranteed Issue ...

What does voluntary group termination mean?

Voluntary group termination means you decide to end your group insurance plan. Sometimes, people pay more for their group insurance than they would pay for Medicare. If this is your current situation, group termination may be beneficial to your pocketbook.

Is Medicare open enrollment in 2021?

Updated on July 15, 2021. Even though Medicare is a Federal program, some states have different terms for Open Enrollment, Guaranteed Issue Rights, excess charges, disability, etc. Below, we’ll highlight what states have their own unique rules.

When does the birthday rule end?

The birthday rule begins 30 days before your birthday and ends 30 days after. Oregon – The birthday rule also applies to the state of Oregon. Connecticut – Connecticut is a guaranteed year-round state, permitting you to make changes to your policy throughout the year. Maine – Those in Maine have an extension on the standard Medicare Advantage ...

How much is the MAPD premium in Arizona?

Arizona’s MAPD premium average of $16.35 is just half of the national average and the $138.71 drug deductible is nearly $30 lower than average. Plan selection is on the high side (71) while quality is on the low end (just 38% of the plans are rated four stars or higher for plan quality).

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How many MAPD plans are there in Washington?

Also, there are 118 MAPD plans available in Washington (the average is 62 per state), and nearly 70% of all MAPD plans in Washington are ranked 4 stars or higher by Medicare (the average is 59% of plans in each state).

How much is MAPD in Virginia in 2021?

The average MAPD premium in Virginia is $23.18 in 2021 ($10 lower than the national average), and the average MAPD drug coverage deductible is $176.80 for the year (the national average is $167.31 per year). There are 69 MAPD plans available in Virginia in 2021, with 59% of plans rated 4 stars or higher by Medicare.

How much is the PDP premium in Nevada in 2021?

The average PDP premium in Nevada is $38.17 in 2021 ($3 lower than the national average), and the average PDP deductible is $349.83 ($7 higher than the national average). 23% of the state's PDPs were rated 4 stars or higher by Medicare, which is well above the national average of 12% of plans per state.

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the MAPD deductible?

The $137.50 average MAPD drug deductible is some $30 lower than the nationwide average. This general affordability of plans is in addition to having 65% of the state’s plans being rated four stars or higher for quality by Medicare, which is comfortably above the national average of 59%.

What is Medicare Advantage?

Medicare Advantage is the private portion of Medicare, covering everything that Original does (by law) plus additional benefits that vary by plan. Since these plans are sold by private companies, coverage varies widely. Where you live determines your plan options.

What is the number to call for Medicare?

1-800-810-1437 TTY 711. You’ve got options for health insurance as you get older that go beyond Original Medicare. As a reminder, Original Medicare, which is also called traditional Medicare, is made up of two parts: Part A (hospital insurance) and Part B (medical insurance).

Can I supplement my original Medicare?

You can supplement Original with a Medigap policy (for picking up out-of-pocket costs, not covering added benefits), buy a Part D plan for prescription drugs or enroll in Medicare Advantage as an alternative. Medicare Advantage is the private portion of Medicare, covering everything that Original does ...

Do Advantage plans charge a premium?

But some Advantage plans don’t charge a premium. You can get all the benefits of Original, plus the added benefits offered by a private plan, without any extra money per month. That’s because Advantage is still partly funded by the federal government even though it’s the private portion of Medicare.

How much of Medicare will be burdened?

While health care costs in the US continue to rise, most Medicare beneficiaries can expect Medicare to shoulder 80–90% of the burden. But depending on the procedure, your bill could still be in the thousands. People over 65 and those approaching retirement would do well to sock away some extra savings for medical costs if possible—even if they’re perfectly healthy today.

Who is Kat Casna?

Kat Casna. Kathryn is a Medicare and geriatric specialist who has appeared on Baby Boomers, OppLoans, and Best Company. Her readers don’t need a degree in government-speak to get the right coverage because Kathryn sifts through Medicare’s parts, plans, and premiums to distill only the most useful information.

Which state has the lowest Medicare coverage?

None of the ten states with the most retirees made it into the top ten for Medicare coverage. 2. Washington, DC, received the lowest coverage in the nation at 77.29%. The only state that fell below the 80% mark was Utah, with coverage at 78.74%.

When is Medicare going to be rising?

Licensed Insurance Agent and Medicare Expert Writer. February 25, 2020. It's painfully obvious: the cost of health care in the US is rising. You feel it every time you visit the doctor, pick up a prescription, and pay your insurance premiums.

What is a preferred provider organization?

Preferred Provider Organization (PPO) plans. Preferred Provider Organization (PPO) plans also feature a network of participating providers, but they typically have fewer restrictions than HMO plans on which providers you may see. You may pay more to receive care outside of your Medicare Advantage PPO network.

What is Medicare participation?

Medicare participation in any state can be broken down into three categories: Participating providers. A health care provider who participates in Medicare accepts Medicare assignment, which means the provider has agreed to accept the Medicare-approved amount as full payment for services or medical devices.

What are the different types of Medicare?

Medicare participation in any state can be broken down into three categories: 1 Participating providers#N#A health care provider who participates in Medicare accepts Medicare assignment, which means the provider has agreed to accept the Medicare-approved amount as full payment for services or medical devices.#N#Medicare beneficiaries typically pay 20 percent of the Medicare-approved amount for qualified Part B services after meeting the Part B deductible ( $203 per year in 2021). Medicare pays the remaining 80 percent. 2 Non-participating providers#N#A non-participating provider may still accept the Medicare-approved amount as full payment for some services, but they retain the ability to charge up to 15 percent more for other (or all) services.#N#This extra 15 percent cost is called a Medicare Part B excess charge. 3 Opted-out providers#N#A provider who opts out of Medicare does not accept Medicare insurance, and beneficiaries will receive no coverage for services.

How much does Medicare pay for a B deductible?

Medicare beneficiaries typically pay 20 percent of the Medicare-approved amount for qualified Part B services after meeting the Part B deductible ( $203 per year in 2021). Medicare pays the remaining 80 percent. Non-participating providers.

What is the extra 15 percent charge for Medicare?

This extra 15 percent cost is called a Medicare Part B excess charge. Opted-out providers.

What is HMO plan?

Health Maintenance Organization (HMO) plans feature a network of providers who participate in the plan. These networks can be local or regional, so they can span multiple states in some cases. In order to use the plan’s benefits, you must visit one of these participating providers. Be sure to check with your plan to ensure you can use your Medicare ...

How to change address on Medicare?

If you are a Medicare beneficiary and move to another state, you can change your address that's on file with Medicare by contacting the Social Security Administration (SSA). Call 1-800-772-1213 (TTY 1-800-325-0778) to speak with an SSA representative Monday-Friday, 7 a.m. to 7 p.m.

Best States For Medicare: Overview

2022 National Average Medicare Premiums, Deductibles and Quality

- MAPD plans and Prescription Drug Plans are both reasonably affordable in 2022. 1. The average 2022 MAPD premium is $62.66 per month, though many areas may offer plans that feature $0 monthly premiums. The average deductible for the drug coverage offered by MAPD plans is $292.98 for the year. 2. The average PDP premium is $47.59 per month in 2022, with an average drug plan deductible of $367.80 per year. The highest Par…

Best States For Medicare: 2022 Average Medicare Costs by State

- Factors in Medicare Advantage Premiums

The national average cost of a Medicare Advantage Prescription Drug plan in 2022 is $62.66 per month. But as you can see from the table above, the cost of an MA-PD plan can vary quite dramatically by location. 1. In Massachusetts, Michigan, Rhode Island and the Dakotas, average Medicare Advantage premium rates are north … - Medicare Advantage Plan Quality by State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent. The metrics used in scoring a plan include: 1. Preventive c…

Expert Analysis

- As of October 15, millions of American seniors have the opportunity to purchase a private Medicare insurance plan for the first time or switch to a new coverage option during the Medicare Annual Enrollment Period (AEP). This period, also called the fall Medicare Open Enrollment period, lasts until December 7. We asked a panel of experts for their insight on what Medicare beneficiaries should keep in mind when they consider changing their …

Methodology

- This project used data provided by the Centers for Medicare & Medicaid Services (CMS). The 2022 MA Landscape Source Files and 2022 PDP Landscape Source Fileswere used for analysis.

Fair Use Statement

- Of course we would love for you to share our work with others. We just ask that if you do, please grant us the proper citation with a link to this study so that we may be given credit for our efforts.

Research and Reports

- Our research reports analyze a number of issues important to seniors, from health perceptions, medical communication, health habits, and more. 1Every year, Medicare evaluates plans based on a 5-star rating system.