What are the best Medicare supplement insurance companies?

May 30, 2019 · The Best Way to Sell Medicare Supplements . Just like with selling any health insurance, Medicare comes with rules and regulations. The first step to selling Medicare supplements is obtaining a license to sell Medicare in your state. The second step is to get AHIP certification. While you don’t need AHIP certification to sell Medigap plans ...

What are the best States for Medicare Advantage prescription drug plans?

Feb 15, 2022 · Below is a guide to 10 Medicare Supplement Insurance companies to help you choose the best one for your needs. Comparing Medicare Supplement Insurance Companies. The list below includes some of the companies that sell Medicare Supplement Insurance plans in select states across the U.S.

What companies offer Medigap insurance?

Sep 04, 2019 · All 50 states are ripe for Medicare supplement sales and Medicare Advantage sales but the best states to sell in are Florida, Arizona, Illinois, Texas, Pennsylvania, New Jersey, California, North Carolina, New York, Michigan and Virginia!

What Medicare supplement insurance plans does Medico sell?

Oct 22, 2018 · Selling Medicare Supplements: An Opportunity Outside of Open Enrollment. ... Here’s our abbreviated recap of the current state of the Medicare program. This government-run health insurance program is available primarily to Americans aged 65 and older, as well as certain other folks with specific disabilities or diseases. ... One of the best ...

What states are guaranteed issue for Medicare supplement?

Only four states (CT, MA, ME, NY) require either continuous or annual guaranteed issue protections for Medigap for all beneficiaries in traditional Medicare ages 65 and older, regardless of medical history (Figure 1).Jul 11, 2018

Is selling Medicare lucrative?

Is Selling Medicare Lucrative? In short, yes. The average Medicare Advantage policy pays around $287 a year in commission if the purchase replaces an existing plan. However, you can get approximately double that — $573— if you write up a new Medicare Advantage plan for someone who hasn't had one before.Feb 22, 2022

What is the commission on a Medicare supplement policy?

A recent report indicates that first-year commissions for enrollments in Medigap are approximately 20 percent of annual premiums, but they can vary based on the state or plan type. The commission for subsequent years (i.e., the renewal commission) is set at 10 percent of the premium.Oct 12, 2021

What state has the cheapest Medicare supplement plans?

Meanwhile, the cheapest state in the Union for Medigap plans is sun-soaked Hawaii, where policies are only $1,310 annually — $109.16 on a monthly basis.Jul 31, 2018

How do you make money selling Medicare supplements?

There are really three paths you can take to have a lucrative Medicare business:One sale at a time.Build a field force to sell underneath you.Add Medicare to your current offering (i.e: financial advisors or P&C agencies)Dec 21, 2020

Which type of insurance agents make the most money?

Overview of the Insurance Field While there are many kinds of insurance (ranging from auto insurance to health insurance), the most lucrative career in the insurance field is for those selling life insurance.

What is an FMO?

FMO — Field Marketing Organizations A field marketing organization (FMO) is basically the same as an independent marketing organization (IMO). FMOs are typically top-level organizations that are licensed to sell health insurance products in most, if not all, states.

Which Medicare Supplement plan is the most popular?

Plan G will cover almost everything except the Part B deductible. This means that you would be responsible for paying the entire Medicare Part B deductible — $233 for 2022 — before insurance benefits will begin to pay for your health care. Plan G is the most popular Medicare Supplement for new enrollees.Mar 16, 2022

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

There's No "Magic" State

Before we get into all the comparisons and analysis, I think it's important to say that there's no one magic state to start selling in where you're guaranteed to make a killing.

Medigap Enrollment By State

When considering which states you might want to expand into, looking at Medigap enrollment numbers can be really helpful. The data in this section is from the AHIP State of Medigap 2020 report.

Medicare Advantage Penetration by State

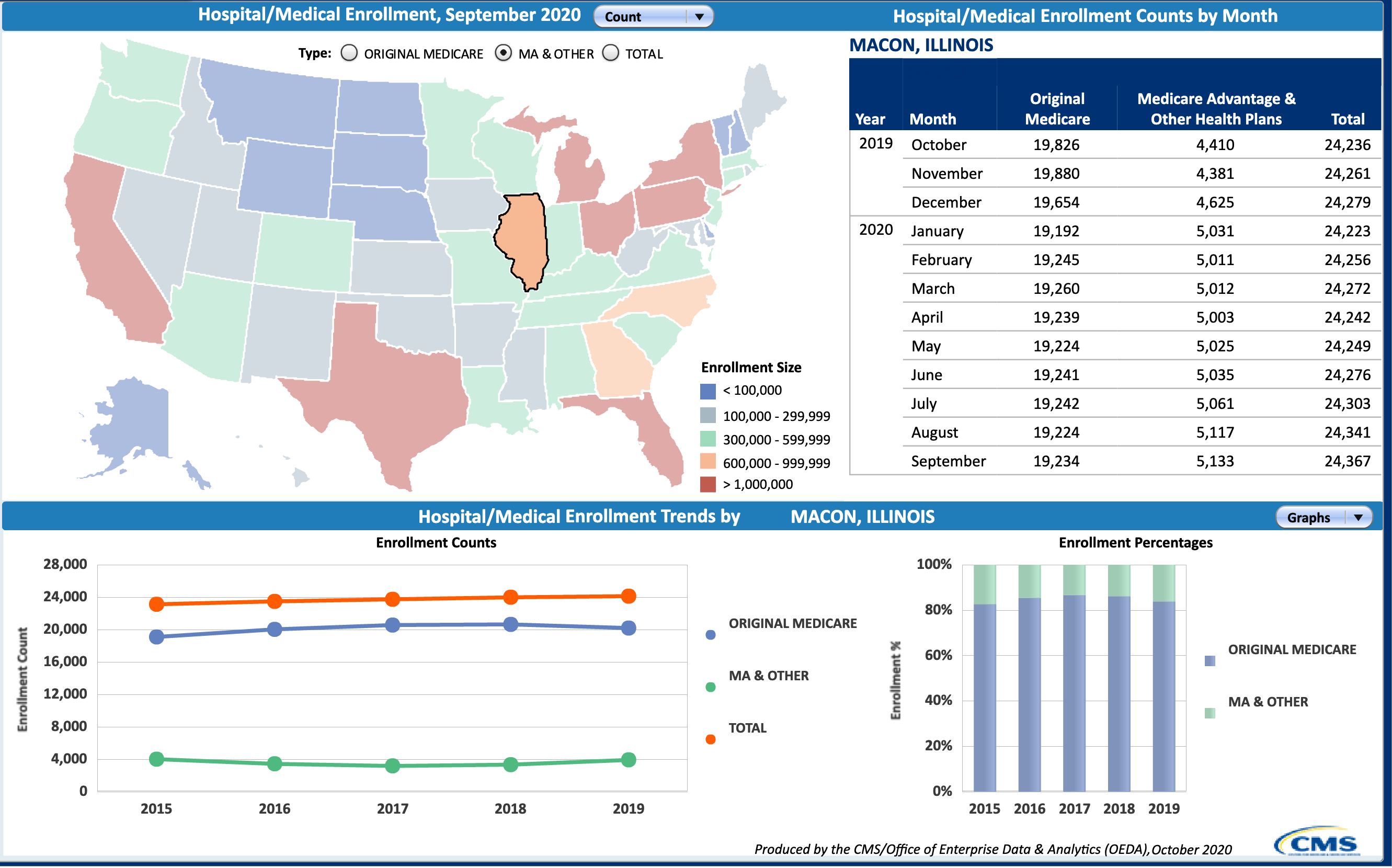

The Medicare Enrollment Dashboard from CMS offers a clear, current picture of what Medicare products are being sold where.

Non-Resident License Fees By State

If you want to expand and serve senior clients in multiple states, you'll need to get your non-resident license. Costs vary by state, and it can be a hassle to compare them all. You have to check each state individually on the NIPR website.

Street Level Commission By State

While every carrier is different, we took a look at our most popular national carrier to compare Medicare Supplement commission rates by state. Street level commission is very similar across the board, but some states do stand out slightly when compared to the rest.

States With Best and Worst Med Supp Rates

When rates are good, there's going to be more interest in Medicare Supplements.

A Note on Indiana

Indiana is a critical state in the Medicare Supplement world. It's a state that every carrier wants to do well in – agents put their best foot forward there. None of us have been able to figure out why carriers battle over Indiana so hard!

How many people are in Medicare Advantage?

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How much is the MAPD premium in Arizona?

Arizona’s MAPD premium average of $16.35 is just half of the national average and the $138.71 drug deductible is nearly $30 lower than average. Plan selection is on the high side (71) while quality is on the low end (just 38% of the plans are rated four stars or higher for plan quality).

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How many MAPD plans are there in Washington?

Also, there are 118 MAPD plans available in Washington (the average is 62 per state), and nearly 70% of all MAPD plans in Washington are ranked 4 stars or higher by Medicare (the average is 59% of plans in each state).

How much is the PDP premium in Nevada in 2021?

The average PDP premium in Nevada is $38.17 in 2021 ($3 lower than the national average), and the average PDP deductible is $349.83 ($7 higher than the national average). 23% of the state's PDPs were rated 4 stars or higher by Medicare, which is well above the national average of 12% of plans per state.

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the MAPD deductible?

The $137.50 average MAPD drug deductible is some $30 lower than the nationwide average. This general affordability of plans is in addition to having 65% of the state’s plans being rated four stars or higher for quality by Medicare, which is comfortably above the national average of 59%.

Overview of Medicare Supplements (Medigap)

Medicare is the public health insurance program created in 1965 allowing retirees to have health insurance even after leaving their employer’s group plan. Anyone aged 65 and older, people diagnosed with ALS or ESRD, and people who’ve received SSDI benefits for at least 25 months are eligible to enroll in Medicare coverage.

Is Selling Medicare Lucrative?

Selling Medicare supplements is a great opportunity to serve the underserved senior population and to make money. The Medigap market is two-thirds bigger than the Medicare Advantage market, and the plans are best-suited for people who travel and are financially stable.

The Best Way to Sell Medicare Supplements

Just like with selling any health insurance, Medicare comes with rules and regulations. The first step to selling Medicare supplements is obtaining a license to sell Medicare in your state. The second step is to get AHIP certification. While you don’t need AHIP certification to sell Medigap plans, it’s a great idea to obtain certification.

Medicare Basics

In order to effectively sell Medicare supplements, you should understand how the plans tie into Medicare as a whole. Here’s a general breakdown of Medicare:

Medicare Supplements Leads for Agents

Use more than one approach to reach potential leads. Email and social media are effective ways to reach your audience if you use the right tactics. Direct mail is still a great way to raise awareness even with the senior population using smartphones now more than ever before.

Start Making Money Selling Medicare Supplements

At Senior Market Advisors, our mission is to serve the underserved. The baby boomer market is all-too-often overlooked, and we want to help seniors live their best lives. When you partner with Senior Market Advisors, not only do you get to make a difference, you get an experienced marketing team, a sales support team and a free CRM to track sales.

Start Earning 6-Figures

Connect with a dedicated specialist in your market to learn how you can become a TRUE Senior Market Advisor.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Medicare Sales Certification and Recertification

If you’re thinking about selling health insurance and only sell home and auto, the process of getting licensed as a Medicare agent is not difficult and can be the path to a lucrative career.

Marketing to Seniors: How Can I Sell More Medicare Policies?

The good news is that e-applications are available to Medicare shoppers so you can sell Medicare supplements over the phone! The leads from SmartFinancial came into your queue because interested seniors filled out an online form and are likely to apply online and buy over the phone. These are the perfect leads!

Know the Senior Insurance Market

If you’re not familiar with the senior market, it’s a good idea to learn about seniors’ needs before you begin haphazardly selling insurance products. This is the most seasoned demographic you’ll ever sell insurance to, so using gimmicks will likely not pan out as easily as it would with a young person.

Medicare Advantage Sales Leads: Do I Need to Buy Them?

Medicare Advantage sales leads are a perfect way to find seniors looking to buy insurance. Some leads from SmartFinancial have a built-in Medicare Advantage sales strategy and others have a built in Medigap insurance strategy.

Medicare Advantage Sales Scripts

Keep in mind that you don’t want to ramble on and get the entire script in, in one shot. Wait and allow the prospect to speak between each section. Pay close attention to what they are saying, and proceed as is appropriate:

Which Are the Best States to Sell Medicare In?

All 50 states are ripe for Medicare supplement sales and Medicare Advantage sales but the best states to sell in are Florida, Arizona, Illinois, Texas, Pennsylvania, New Jersey, California, North Carolina, New York, Michigan and Virginia! There are high concentrations of individuals who hold Medicare supplement policies, and they may be electing to change their coverage during Open Enrollment 2020!.

What age does Medicare cover?

Here’s our abbreviated recap of the current state of the Medicare program. This government-run health insurance program is available primarily to Americans aged 65 and older, as well as certain other folks with specific disabilities or diseases.

What is Medicare Part A?

If a client chooses this route, they will sign up for Medicare Part A. It’s provided free of charge to seniors who paid Medicare taxes during their working years. Part A covers inpatient care and some nursing facility expenses.

Do Medicare leads have a cellphone?

Most of your Medicare leads had a cellphone before today’s high schoolers were even born. Some may have been texting since they were under 50. Twitter, Facebook, and iPhones came out more than ten years ago. This is one way that today’s Medicare customers are different from past customers.

Can seniors apply for Medicare Supplement?

Seniors will still be able to apply for Medicare supplement coverage after this six-month window, however, it could mean they will pay a higher premium for coverage, or if they have serious medical issues, they could be turned down for coverage. Thus, for seniors looking for affordable and reliable benefits, earlier is better.

Is Medicare supplement coverage regulated?

Medicare supplement coverage is regulated at the state level, and so this means insurance agents often target leads within a particular state or a few states.

Do Medicare leads read fine print?

Today’s Medicare leads also aren’t afraid of reading the fine print, with their reading glasses, of course, and asking you pointed questions. These consumers like to make well-informed buying decisions.

Why do people get into the Medicare supplement market?

In sum, there are three great reasons to get into the Medicare Supplement market: There are lots of prospects. Medicare is standardized. There's a built-in need for a secondary insurance with Medicare. Back to top.

How much does Medicare cover?

Medicare Supplements are standardized. No networks. Medicare covers about 80% , and the supplement covers about 20%. Here are the two plans I'd recommend for you, and here's how they work.

What is the Medicare Part B deductible for 2021?

When you have a Plan G, everything is covered except the Medicare Part B deductible, which is $203 in 2021. There are no other costs – it’s 100% coverage from there.

What is the difference between a Plan G and a Plan F?

There's a little bit of a premium savings when you sign up for a Plan G versus a Plan F. Plan G has a small deductible (Medicare Part B deductible) while Plan F does not.

How many seniors turn 65 every day?

There are a ton of prospects in the Medicare market. Ten thousand seniors turn 65 every single day – that's a lot of prospects that need Medicare Supplements. When we look at a person that is going onto Medicare, it's pretty confusing and overwhelming. Seniors get a ton of Medicare-related mail.

What to do if you've made it this far?

If you've made it this far, hats off to you . There's a lot of information you need to take in when you're learning about Medicare, but once you've got it down pat, you're off to the races.

Does Medicare Supplements include prescription drug insurance?

Medicare Supplements helps with doctor and hospital costs only – it does not include prescription drug insurance. CMS puts out a publication each year called the Medicare & You Handbook. In the 2019 version, you can refer to pages 69-72 while explaining Medicare Supplements to clients and prospects.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

What is a SHIP program?

13 Also known as SHIP, they provide free local health coverage counseling to people with Medicare.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Best States For Medicare: Overview

2022 National Average Medicare Premiums, Deductibles and Quality

- MAPD plans and Prescription Drug Plans are both reasonably affordable in 2022. 1. The average 2022 MAPD premium is $62.66 per month, though many areas may offer plans that feature $0 monthly premiums. The average deductible for the drug coverage offered by MAPD plans is $292.98 for the year. 2. The average PDP premium is $47.59 per month in 2022, with an averag…

Best States For Medicare: 2022 Average Medicare Costs by State

- Factors in Medicare Advantage Premiums

The national average cost of a Medicare Advantage Prescription Drug plan in 2022 is $62.66 per month. But as you can see from the table above, the cost of an MA-PD plan can vary quite dramatically by location. 1. In Massachusetts, Michigan, Rhode Island and the Dakotas, average … - Medicare Advantage Plan Quality by State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent. The met…

Expert Analysis

- As of October 15, millions of American seniors have the opportunity to purchase a private Medicare insurance plan for the first time or switch to a new coverage option during the Medicare Annual Enrollment Period (AEP). This period, also called the fall Medicare Open Enrollment period, lasts until December 7. We asked a panel of experts for their insight on what Medicare beneficia…

Methodology

- This project used data provided by the Centers for Medicare & Medicaid Services (CMS). The 2022 MA Landscape Source Files and 2022 PDP Landscape Source Fileswere used for analysis.

Fair Use Statement

- Of course we would love for you to share our work with others. We just ask that if you do, please grant us the proper citation with a link to this study so that we may be given credit for our efforts.

Research and Reports

- Our research reports analyze a number of issues important to seniors, from health perceptions, medical communication, health habits, and more. 1Every year, Medicare evaluates plans based on a 5-star rating system.