Best States for Medicare Advantage Plans and Medicare Part D Plans

| State | Average Monthly Medicare Advantage Premi ... | Average In-Network Out-of-Pocket Spendin ... | Average MA-PD Drug Deductible | Percent of Plans Rated 4 Stars or Higher |

| Alabama | $64.27 | $5,272.78 | $256.83 | 58.6% |

| Alaska | N/A | N/A | N/A | N/A |

| Arizona | $47.15 | $5,244.79 | $321.62 | 56.2% |

| Arkansas | $44.34 | $5,852.87 | $322.18 | 24.6% |

Full Answer

Can Medicare Advantage plans be used out of State?

Can Medicare Advantage Plans be Used out of State? Original Medicare can be used in all 50 states, as well as in the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the Virgin Islands. The same isn’t true for Medicare Advantage plans.

Are Medicare plans different in each state?

But while these provisions apply nationwide, plan availability and prices are different from one state to another. Medicare uses a star rating system for Medicare Advantage and Part D plans, and the availability of high-quality plans is not the same in every state.

What states can you use Original Medicare?

Original Medicare can be used in all 50 states, as well as in the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the Virgin Islands. The same isn’t true for Medicare Advantage plans.

What are the best States for Medicare Advantage prescription drug plans?

Best States for Medicare Advantage Prescription Drug Plans (MAPD) State Overall Rank # Plans Available Average Premium Average Drug Deductible Mississippi 41 36 $17.98 $294.31 Missouri 29 75 $18.10 $107.87 Montana 48 17 $46.36 $350.26 Nebraska 43 27 $20.41 $157.53 45 more rows ...

Is Medicare Advantage in every state?

More than 40 percent of Medicare beneficiaries are enrolled in Medicare Advantage plans in nineteen states (FL, MN, HI, OR, WI, MI, AL, CT, PA, CA, CO, NY, OH, AZ, GA, TN, RI, TX, LA) and Puerto Rico.

Why do some areas not have Medicare Advantage plans?

The increase in the number of counties without a Medicare Advantage plan appears to be primarily due to the withdrawal of Private Fee-For Service (PFFS) plans in relatively rural areas, following new network requirements for these plans.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What's the big deal about Medicare Advantage plans?

Medicare Advantage Plans must offer emergency coverage outside of the plan's service area (but not outside the U.S.). Many Medicare Advantage Plans also offer extra benefits such as dental care, eyeglasses, or wellness programs. Most Medicare Advantage Plans include Medicare prescription drug coverage (Part D).

Who is the largest Medicare Advantage provider?

/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is the best Medicare Advantage plan for 2022?

Best Medicare Advantage Plans in 2022Best for size of network: UnitedHealthcare Medicare Advantage.Best for extra perks: Aetna Medicare Advantage.Best for member satisfaction: Kaiser Permanente Medicare Advantage.Best for low-cost plan availability: Humana Medicare Advantage.More items...•

Can you cancel a Medicare Advantage plan at any time?

No, you can't switch Medicare Advantage plans whenever you want. But you do have options if you're unhappy with your plan. You can jump to another plan or drop your Medicare Advantage plan and change to original Medicare during certain times each year.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Why would someone choose a Medicare Advantage plan?

Consider if you want coverage for dental, vision and other extra benefits. Medicare Advantage plans cover everything Original Medicare covers plus more, so if you want things like dental, vision or fitness benefits, a Medicare Advantage plan may be the right choice. Think about what your total costs could be.

Is Medicare Advantage too good to be true?

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits.

Who is the largest Medicare Advantage provider?

/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What is Medicare Advantage?

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B , and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs. Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

How many people will be on Medicare in 2021?

Close to 63 million Americans are enrolled in Medicare in 2021, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic. 1

Does Alaska offer Medicare Advantage?

Alaska. Compare Alaska Medicare plans online, or get assistance from the state resources below. Alaska does not offer Medicare Advantage plans (Part C), but there are still other options for you to explore your Medicare coverage options and have your questions answered. AARP Public Benefits Guide.

Does Medicare cover HMO?

There is no coverage for care received outside of the plan’s network.

Does Maine have Medicare?

Medicare beneficiaries in Maine have a number of resources at their fingertips. The Pine Tree State offers options for those with low incomes to help pay for their Medicare benefits, as well as resources to help pay for prescription drug costs and to help those with disabilities. State of Maine Bureau of Insurance.

What states require community rating for Medigap?

As of 2018, eight states (Arkansas, Connecticut, Massachusetts, Maine, Minnesota, New York, Vermont, and Washington) required carriers to use community rating.

How many seniors will be covered by Medicare in 2021?

July 7, 2021. facebook2. twitter2. comment. Medicare is a federal program, covering more than 63 million seniors and disabled Americans throughout the country. Medicare beneficiaries in most areas have the option to get their coverage via private Medicare Advantage plans, and more than four out of ten do so.

How long does Medicare coverage last?

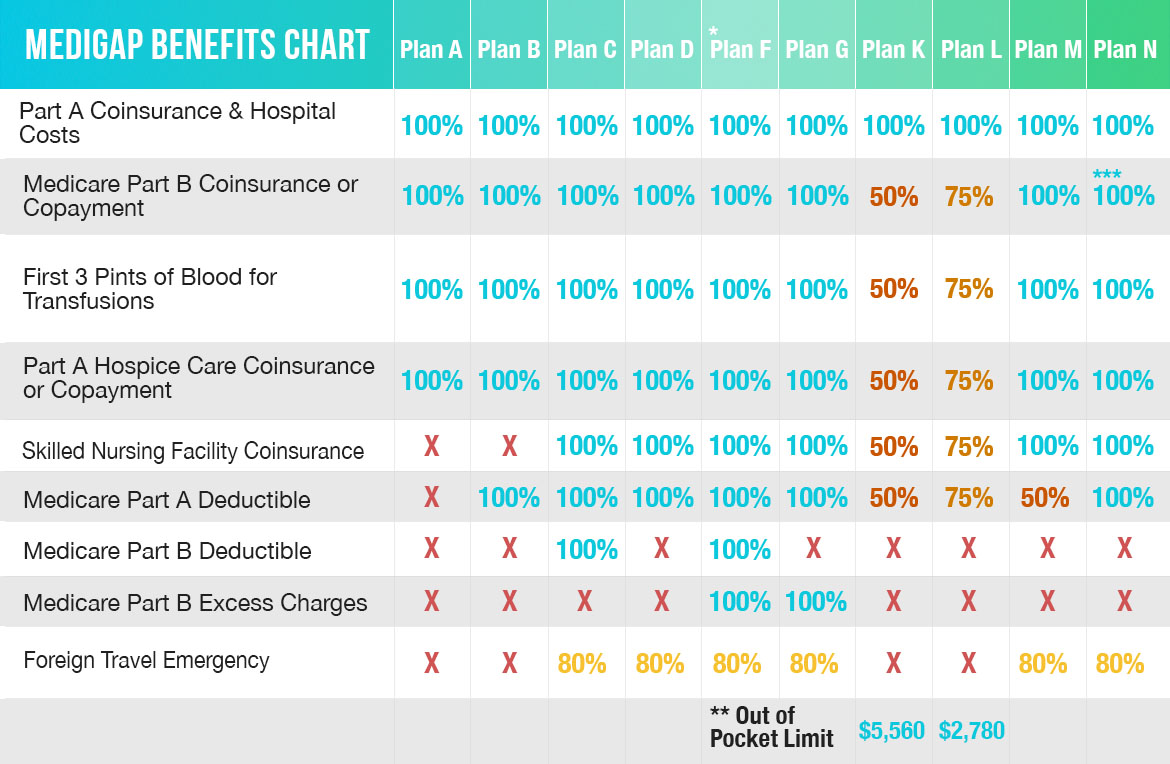

Medigap coverage is guaranteed issue for six months, starting when you’re at least 65 and enrolled in Medicare Parts A and B.

When is Medicare Part D open enrollment?

Federal guidelines call for an annual open enrollment period (October 15 to December 7) for Medicare Advantage and Medicare Part D coverage in every state. And as of 2019, there’s also a Medicare Advantage open enrollment period (January 1 through March 31) that allows people who already have Medicare Advantage to switch to a different Advantage plan or switch to Original Medicare. But while these provisions apply nationwide, plan availability and prices are different from one state to another.

How many Part D prescriptions will be available in 2021?

Part D prescription drug plan availability differs from state to state as well, with the number of plans for sale in 2021 varying from 25 to 35, depending on the region. The number of available premium-free (“benchmark”) prescription plans for low-income enrollees varies from five to ten, depending on the state.

How old do you have to be to enroll in Medigap?

Some states have implemented legislation that makes it easier for seniors to switch from one Medigap plan to another, and for people under age 65 to enroll in Medigap plans.

Does Alaska have Medicare Advantage?

Not surprisingly, the popularity of Medicare Advantage plans varies significantly from one state to another, with only one percent of the Medicare population enrolled in Advantage plans in A laska. (There are no individual Medicare Advantage plans available at all in Alaska.

How many people are in Medicare Advantage?

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How many stars does Medicare have?

Quality is important to consumers, and in eight states, at least 75% of their MAPD plans score four stars or better for quality measures by the Centers for Medicare and Medicaid Services.

How much is the MAPD premium in Arizona?

Arizona’s MAPD premium average of $16.35 is just half of the national average and the $138.71 drug deductible is nearly $30 lower than average. Plan selection is on the high side (71) while quality is on the low end (just 38% of the plans are rated four stars or higher for plan quality).

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How many MAPD plans are there in Washington?

Also, there are 118 MAPD plans available in Washington (the average is 62 per state), and nearly 70% of all MAPD plans in Washington are ranked 4 stars or higher by Medicare (the average is 59% of plans in each state).

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the MAPD deductible?

The $137.50 average MAPD drug deductible is some $30 lower than the nationwide average. This general affordability of plans is in addition to having 65% of the state’s plans being rated four stars or higher for quality by Medicare, which is comfortably above the national average of 59%.

How long can you switch Medicare Advantage plan in Maine?

But, in Maine, you can “try” the Advantage plan for three years, and you have 90 days after dropping the policy to switch to a supplement with Guaranteed Issue ...

How long can you change your Medigap plan?

Some states allow the “Birthday Rule,” which allows a 30-day timeframe for you to change your Medigap plan after your birthday every year. Also, you can change plans without underwriting as long as the policy benefits are equal to or less than your current plan.

Does Medigap cover excess charges?

If you’re looking at purchasing a Medigap policy, you may find that some of the plans cover excess charges. When a doctor doesn’t accept Medicare, excess charges may occur; doctors can only charge 15% above the threshold.

Is Medicare primary or secondary?

If your employer’s health care policy is the primary form of insurance, and Medicare is secondary.

Is Medicare open enrollment in 2021?

Updated on July 15, 2021. Even though Medicare is a Federal program, some states have different terms for Open Enrollment, Guaranteed Issue Rights, excess charges, disability, etc. Below, we’ll highlight what states have their own unique rules.

Is Medicare available in all 50 states?

Search. Page Reviewed / Updated – August 11, 2020. Original Medicare can be used in all 50 states, as well as in the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the Virgin Islands. The same isn’t true for Medicare Advantage plans. These plans have defined service areas and may not cover out-of-state ...

Can Medicare be used out of state?

While some Medicare Advantage plans can be used out of state, these plans usually don’t provide coverage outside of the U.S. Seniors who are traveling out of the country may choose to purchase travel medical insurance. In limited circumstances, Medicare Advantage plans provide coverage outside of the U.S. For example, if seniors are traveling ...

Do seniors have to pay for out of network providers?

Seniors who see out-of-network providers may need to pay the full cost of any services they receive. Some Medicare Advantage plans may offer coverage for out-of-network providers. Depending on the plan’s terms, seniors may pay a higher co-payment or coinsurance for these services. Urgent and emergency situations are exceptions to these rules.

Do Medicare Advantage plans have a network?

Medicare Advantage Plans Have a Provider Network. Generally, seniors need to see doctors who are in their Medicare Advantage plan’s network. Before traveling out of state, seniors should contact their plan to find out if there are any in-network providers at their destination.

Can seniors use their travel benefits outside of their home state?

These benefits may be called visitor or travel benefits, depending on the plan. Seniors who are enrolled in these plans may be able to use their coverage outside of their home state. Visitor or travel benefits may vary between plans. Coverage may only be available in certain areas, and the plan may not cover some types of care.

Does Medicare cover emergency situations?

Urgent and emergency situations are exceptions to these rules. Medicare Advantage plans must cover these situations anywhere in the United States. The plans can’t charge additional costs for these services.

Which states have the same income limit for Medicaid?

New York and Illinois are the only states that use the same income limit for both Medicaid ABD and nursing home benefits. Despite these income limits, nursing home enrollees are not allowed to keep all of their income up to their state’s eligibility limit (or the cost of nursing home care).

How many states have income limits for Medicaid?

As of 2018, 25 states based their income limits for Medicaid ABD on the SSI income limit. Another 16 states and D.C. used a higher Medicaid income limit, while eight states had eligibility limits (for income or assets) that are more restrictive than SSI.

What are the different types of Medicaid?

What these state sections cover: 1 Medicare Savings Programs – the types of programs in each state and the income and asset limits for eligibility 2 Medicaid for the aged, blind and disabled – benefits and eligibility levels by state 3 Medicaid ‘spend down’ programs – income levels and whether long-term care is covered 4 Medicaid nursing home coverage – including eligibility limits 5 Home and Community Based Services waivers – benefits offered and income levels 6 State rules about transferring assets to qualify for Medicaid coverage of long-term care. 7 State financial tools that help beneficiaries to become eligible for Medicaid nursing home coverage or HCBS. 8 State policies that affect estate recovery from Medicaid enrollees who received long-term care. 9 State programs that help Medicare beneficiaries who struggle with the costs of prescription drugs. 10 How you can apply for Medicaid or an MSP in each state.

How many days does Medicare cover nursing home care?

This is why Medicaid covers nursing home care for an unlimited number of enrollees in each state. Medicare covers up to 100 days in a skilled nursing facility (SNF) for enrollees who require skilled nursing care or need physical or occupational therapy in an institutional setting.

When do states have to recover from Medicaid?

States are required to recover from the estates of Medicaid enrollees who received long-term care beginning at the age of 55. The law requires states to recover the cost of LTSS (and related medical and prescription drug costs), but states can also recover what they paid for other Medicaid benefits.

Does Medicare leave out of pocket?

Furthermore, Medicare can leave its enrollees with significant out-of-pocket expenses. The good news is that Medicaid offers a long list of financial assistance options intended to help Medicare enrollees faced with Medicare cost sharing and long-term care expenses.

Does Medicare cover long term care?

In fact, Medicare has never covered long-term services and supports (LTSS) – an array of medical and personal “long-term care” services for people who struggle with self-care due to aging, illness or disability. Furthermore, Medicare can leave its enrollees with significant out-of-pocket expenses.

Best States For Medicare: Overview

2022 National Average Medicare Premiums, Deductibles and Quality

- MAPD plans and Prescription Drug Plans are both reasonably affordable in 2022. 1. The average 2022 MAPD premium is $62.66 per month, though many areas may offer plans that feature $0 monthly premiums. The average deductible for the drug coverage offered by MAPD plans is $292.98 for the year. 2. The average PDP premium is $47.59 per month in 2022, with an averag…

Best States For Medicare: 2022 Average Medicare Costs by State

- Factors in Medicare Advantage Premiums

The national average cost of a Medicare Advantage Prescription Drug plan in 2022 is $62.66 per month. But as you can see from the table above, the cost of an MA-PD plan can vary quite dramatically by location. 1. In Massachusetts, Michigan, Rhode Island and the Dakotas, average … - Medicare Advantage Plan Quality by State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent. The met…

Expert Analysis

- As of October 15, millions of American seniors have the opportunity to purchase a private Medicare insurance plan for the first time or switch to a new coverage option during the Medicare Annual Enrollment Period (AEP). This period, also called the fall Medicare Open Enrollment period, lasts until December 7. We asked a panel of experts for their insight on what Medicare beneficia…

Methodology

- This project used data provided by the Centers for Medicare & Medicaid Services (CMS). The 2022 MA Landscape Source Files and 2022 PDP Landscape Source Fileswere used for analysis.

Fair Use Statement

- Of course we would love for you to share our work with others. We just ask that if you do, please grant us the proper citation with a link to this study so that we may be given credit for our efforts.

Research and Reports

- Our research reports analyze a number of issues important to seniors, from health perceptions, medical communication, health habits, and more. 1Every year, Medicare evaluates plans based on a 5-star rating system.