What is Medicare’s give Back benefit?

There are currently 48 states in America that have access to a Give Back benefit, so you can likely find one in your area. The easiest way to determine that is by checking your ZIP code and searching for available Medicare Advantage plans in your area. Applying For A Medicare Part B Give Back Benefit

What is a Medicare Part B premium give back?

Sep 16, 2021 · The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost ($148.50 in 2021).

Does Humana have a Medicare give back option?

4 Facts About the Medicare Give Back Benefit. 1. You Need to Be Enrolled in a Medicare Advantage Plan to receive the benefit. According to the official U.S. government website for Medicare, some ... 2. Location Is Key. 3. Your Plan Could Change Its Premiums.

What are the best States for Medicare Part D prescription drug plans?

Dec 13, 2021 · With Medicare Part B premiums jumping to $170.10 in 2022, you may be looking for ways to lower your premiums and save money on your Medicare costs. The new Medicare Advantage giveback plans that provide the give back benefit may be a way to do just that by ‘giving back’ a portion of your Part B premium.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Who qualifies for Medicare premium refund?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What is the get back benefit with Medicare?

The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount. Even though you're paying less for the monthly premium, you don't technically get money back.Jan 14, 2022

Is Medicare Part B ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

Who gets Medicare Part B reimbursement?

Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise?

In 2022, some Social Security recipients will see an additional $200 following the 5.9% COLA increase. Checks started going out Jan. 12, and everyone receiving benefits have seen some sort of boost in their payments. The average increase following the COLA was $92.Jan 16, 2022

Can you have Medicare and Humana at the same time?

Depending on where you live, you may be able to find a Medicare plan from Humana that suits your needs. Unlike Original Medicare (Part A and Part B), which is a federal fee-for-service health insurance program, Humana is a private insurance company that contracts with Medicare to offer benefits to plan members.

You Need to Be Enrolled in a Medicare Advantage Plan

According to the official U.S. government website for Medicare, some Medicare Advantage plans cover part or all of your Medicare Part B monthly premium. In order to enroll in a Medicare Advantage plan, you need to be enrolled in or eligible for both Medicare Part A and B.

Location Is Key

According to the official U.S. government website for Medicare, the Medicare Advantage plans that are available to you differ according to your zip code. This is because Medicare Advantage plans are offered by private insurance companies who determine the specific service areas of their plans.

Your Plan Could Change Its Premiums

The official U.S. government website for Medicare reports that, even though private insurers must follow Medicare's rules for coverage in their Medicare Advantage plans, they each individually set the fees they charge for premiums, deductibles, and services.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

How many people are in Medicare Advantage?

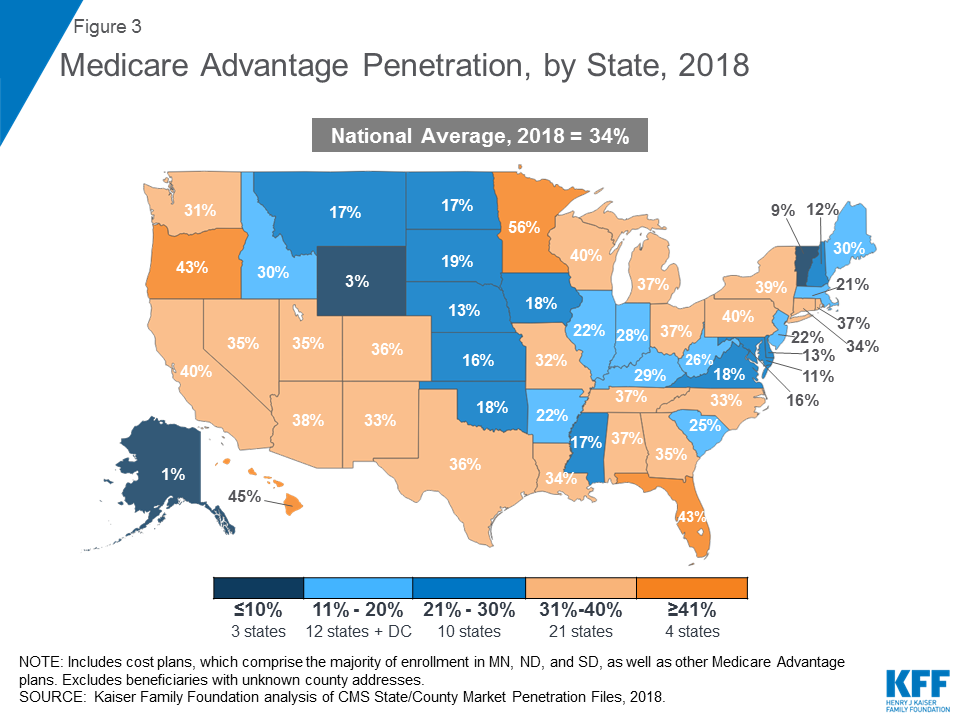

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How many stars does Medicare have?

Quality is important to consumers, and in eight states, at least 75% of their MAPD plans score four stars or better for quality measures by the Centers for Medicare and Medicaid Services.

When does Medicare open enrollment end?

This period, also called the fall Medicare Open Enrollment period, lasts until December 7.

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the Texas PDP deductible?

The average Texas PDP deductible ($342.71 for the year) and average plan premium ($42.44 per month) are roughly in line with national averages, and 19% of Texas PDP plans were rated 4 stars or higher by Medicare.

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How much is the MAPD deductible in Iowa?

Iowa’s MAPD drug deductibles are some of the lowest anywhere, averaging just $80.75, while monthly premiums of $30.94 are also below the national average. Four out of every five plans is rated four stars or higher.

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...