What is Medicare’s give Back benefit?

The Give Back benefit is available in 48 states today, so make sure to check for plans in your local area if you decide to get signed up. Frequently Asked Questions How do you qualify for $144 back from Medicare? In 2022, you can qualify for up to $170.10 through the Give Back program. However, this money does not come directly from Medicare.

What are the best States for Medicare Part D prescription drug plans?

Sep 20, 2021 · Currently, there are 48 states in the U.S. that offer this benefit. Keep in mind, give back plans work directly with Social Security, so, no direct payments are sent to you by the carrier. How Much Do I Get Back With a Part B Give Back Plan? The amount you get back varies by plan.

Does Humana have a Medicare give back option?

To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium. 2. Location Is Key. According to …

How much do health insurance plans give back?

Nov 16, 2021 · The average monthly premium for an MAPD plan in Pennsylvania in 2021 is $52.70, which is almost $20 higher than the national average of $33.57 per month. The Keystone State’s Part D Prescription Drug Plans weren't rated as highly by Medicare, with only 6.9% of plans being rated 4 stars or higher.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How do you qualify to get money back on Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.Jan 14, 2022

Is Medicare giving money back?

Give Back Eligibility And Medicare If you enroll in a Medicare Advantage Plan that offers a Give Back benefit, then you will see a reduction in your Part B monthly premium. This will be for every month that you're enrolled in that plan.

What is Medicare Part B give back benefit?

Medicare Part B Give Back plans are special Medicare Advantage (Medicare Part C) plans that return some or all Part B premiums to beneficiaries. These plans are sometimes called Medicare Buy Back plans or Medicare premium reduction plans.Jan 20, 2022

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

What is Social Security give back benefit?

If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check. If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Will Social Security get a $200 raise?

In order for a 5.9% increase to result in an extra $200 per month in benefits, you would have needed to have received at least $3,389 per month in 2021. The maximum benefit for someone who'd retired at age 70 in 2021 was $3,895.Jan 6, 2022

Can you have Medicare and Humana at the same time?

Depending on where you live, you may be able to find a Medicare plan from Humana that suits your needs. Unlike Original Medicare (Part A and Part B), which is a federal fee-for-service health insurance program, Humana is a private insurance company that contracts with Medicare to offer benefits to plan members.

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

How many states will have Medicare Advantage in 2021?

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Is Part B reduction worth it?

Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing . Beneficiaries on a budget should consider High Deductible Plan G or High Deductible Plan F. The premiums are more affordable than the standard versions.

Who is eligible for Part B buy down?

Who is Eligible for the Part B Buy-Down Plan? Those that pay their own Part B premium will be eligible for the Part B buy-down. But, anyone with Medicaid or other forms of assistance that could pay the Part B premium can’t enroll in these plans.

How many people are in Medicare Advantage?

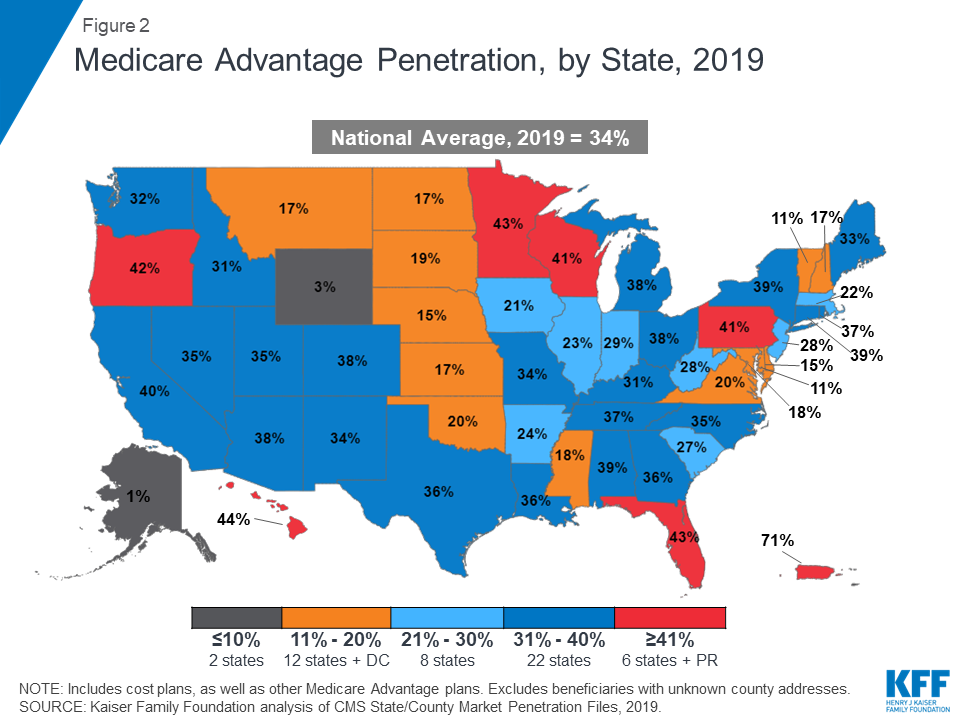

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How many stars does Medicare have?

Quality is important to consumers, and in eight states, at least 75% of their MAPD plans score four stars or better for quality measures by the Centers for Medicare and Medicaid Services.

How much is the MAPD premium in Arizona?

Arizona’s MAPD premium average of $16.35 is just half of the national average and the $138.71 drug deductible is nearly $30 lower than average. Plan selection is on the high side (71) while quality is on the low end (just 38% of the plans are rated four stars or higher for plan quality).

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How many MAPD plans are there in Washington?

Also, there are 118 MAPD plans available in Washington (the average is 62 per state), and nearly 70% of all MAPD plans in Washington are ranked 4 stars or higher by Medicare (the average is 59% of plans in each state).

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

How much is the MAPD deductible?

The $137.50 average MAPD drug deductible is some $30 lower than the nationwide average. This general affordability of plans is in addition to having 65% of the state’s plans being rated four stars or higher for quality by Medicare, which is comfortably above the national average of 59%.

What is a Medicare give back benefit?

A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit helps lower your monthly Part B premium.

How does a Part B give back plan work?

Medicare Advantage plans with the premium reduction benefit work exactly the same as other Medicare Advantage plans. The only difference is that your monthly Part B premium will be reduced by the giveback amount in your plan.

How much will I save with a give back plan?

The premium reduction amount varies widely depending on the plan you choose and where you live. Some giveback plans give back as little as $0.10 each month while others pay the full Part B premium.

Is there an income requirement for the give back benefit?

No, there is no income test for the giveback benefit. Anyone eligible to enroll in Medicare Advantage can buy any Medicare giveback plan sold in their area. However, you must pay your own Part B premium. If you get premium assistance from Medicaid or another source, you aren’t eligible for the giveback benefit.

What should I watch for with the Part B give back benefit?

It’s always a good idea to compare all the costs and benefits of any Medicare plan you are considering. Think of premium reduction as just another extra benefit available with Medicare Advantage.

How can I find a Medicare Advantage giveback plan in my area?

The Boomer Benefits team uses a comprehensive comparison tool to see if a buyback plan is available in your area. We represent the top carriers in the country to be able to present our clients with many options. Talk to a Medicare expert on our team today to see what plan is right for you.

What is the Medicare Part B Giveback Benefit?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans.

How do I receive the Medicare Giveback Benefit?

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

Is the Medicare Giveback Benefit a type of Medicare Savings Program?

No. The Medicare Giveback Benefit is only available to people enrolled in certain Medicare Advantage plans. Medicare Savings Programs (MSPs) are available to people enrolled in Original Medicare who have limited income and resources.

Learn more about Medicare

For more helpful information on Medicare, check out these 10 frequently asked questions about Medicare plans.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

4 kinds of Medicare Savings Programs

Select a program name below for details about each Medicare Savings Program. If you have income from working, you still may qualify for these 4 programs even if your income is higher than the income limits listed for each program.

How do I apply for Medicare Savings Programs?

If you answer yes to these 3 questions, call your State Medicaid Program to see if you qualify for a Medicare Savings Program in your state:.