Medigap

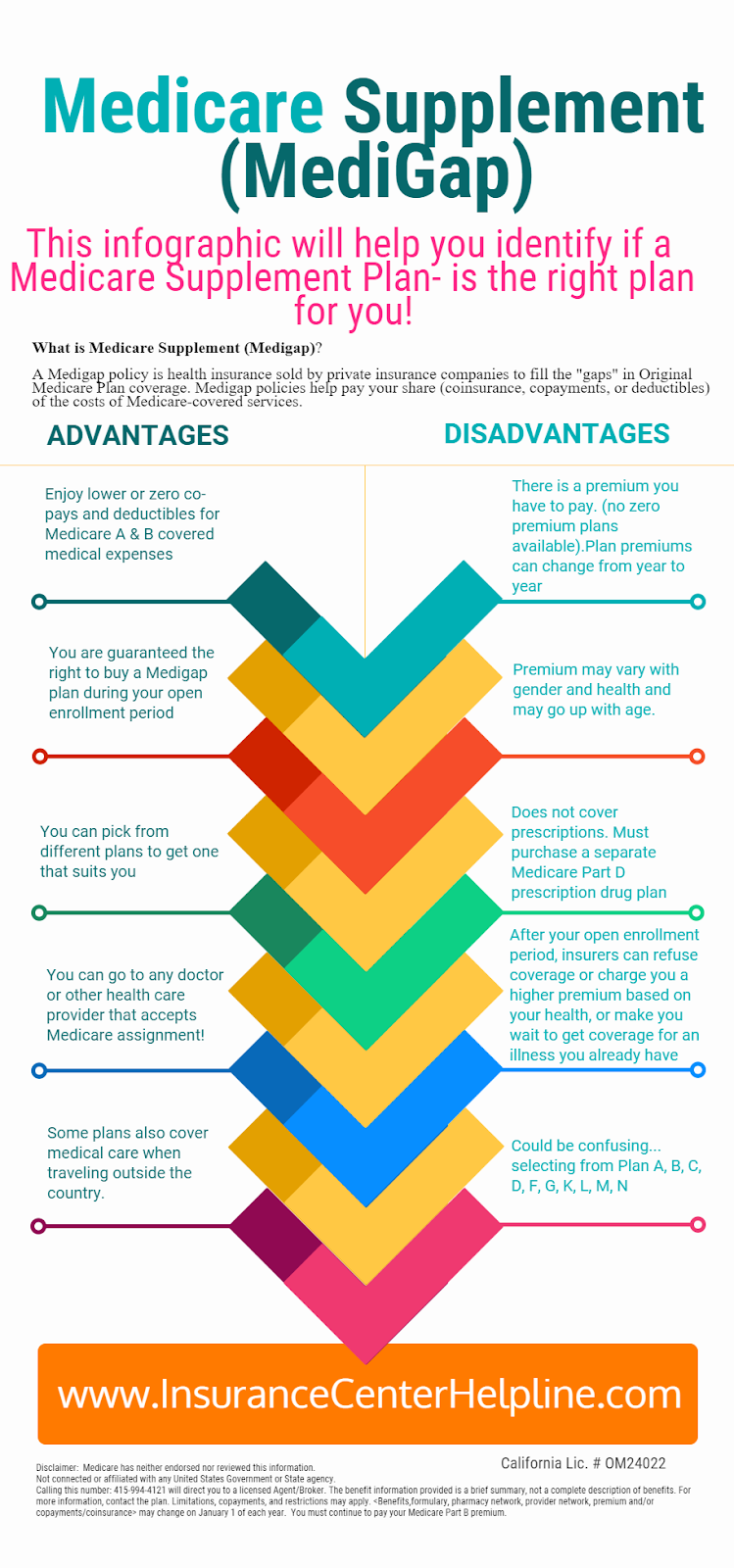

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Which states have year-round Medicare Advantage plans?

Medicare Supplement Plans are standardized and are offered in all states except Minnesota, Massachussetts and Wisconsin. Medigap plans in those states are different. However, each state has different regulations regarding Medicare Supplement Insurance. Below is a list of Medicare Supplement plans by state. Click on your state to learn more.

What are the best States for Medicare Part D prescription drug plans?

State-Specific Medicare Supplement Information Find state-specific information about Medicare and Medigap by clicking the links below. States will be added once they are available. Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland

What are the different states for Medigap coverage?

Jul 07, 2021 · Nationally, more than 38% of Original Medicare beneficiaries are enrolled in a Medigap supplement, but it ranges from a low of 8% in Hawaii to nearly 64% in North Dakota. Medigap plans are standardized, which means that a Plan F in Vermont provides the same benefits as a Plan F in Florida.

Are Medicare plans different in each state?

SPOTLIGHT & RELEASES States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals. This process promotes access to Medicare coverage for low-income older adults and people with disabilities, and it helps states ensure that Medicare is the first and primary payer for Medicare covered services for dually …

What states are guaranteed issue for Medicare supplement?

How many states offer Medicare supplement plans?

Does Medicare benefits differ from state to state?

What states allow you to change Medicare supplement plans without underwriting?

Can you be denied a Medicare supplement plan?

Why do doctors not like Medicare Advantage plans?

Does the cost of Medicare vary by state?

Is Medicare accepted in all states?

What is the largest Medicare Advantage plan?

UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What is the average cost of supplemental insurance for Medicare?

Can you switch back and forth between Medicare and Medicare Advantage?

Can I switch from Medicare Advantage to Medicare supplement?

How many people are covered by Medicare?

Medicare is a federal program, covering more than 61 million seniors and disabled Americans throughout the country. Medicare beneficiaries in most areas have the option to get their coverage via private Medicare Advantage plans, and a little more than a third do so.

Does Alaska have Medicare Advantage?

Not surprisingly, the popularity of Medicare Advantage plans varies significantly from one state to another, with only one percent of the Medicare population enrolled in Advantage plans in A laska. (There are no individual Medicare Advantage plans available at all in Alaska.

How old do you have to be to enroll in Medigap?

Some states have implemented legislation that makes it easier for seniors to switch from one Medigap plan to another, and for people under age 65 to enroll in Medigap plans.

Who is Louise Norris?

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006.

How many people are in Medicare Advantage?

22 million Medicare beneficiaries (34% of all Medicare enrollees) are enrolled in a type of private Medicare plan called a Medicare Advantage plan. Another 20.6 million are enrolled in a stand-alone Medicare prescription drug plan (PDP).

How much does Medicare Part D cost?

Medicare Part D Prescription Drug Plan beneficiaries in the state pay an average monthly premium of $37.84 for their drug coverage. This dollar amount is right around the national average, and the average PDP deductible is roughly $44 higher than the national average at $366.80.

When does Medicare open enrollment end?

This period, also called the fall Medicare Open Enrollment period, lasts until December 7.

What is the average MAPD premium in Arkansas?

Arkansas’ average MAPD premium of $22.35 is about $11 below the national average. However, the average drug deductible of $207.36 is among the highest in the country and not a single one of the state’s 49 plans registered four stars or higher for plan quality, the only state to record a zero in this category.

How much is the MAPD deductible in Iowa?

Iowa’s MAPD drug deductibles are some of the lowest anywhere, averaging just $80.75, while monthly premiums of $30.94 are also below the national average. Four out of every five plans is rated four stars or higher.

How much is the MAPD premium in Ohio in 2021?

Ohio is home to 124 MAPD plans in 2021, with an average MAPD premium of $45.03 per month ($12 higher than the national average) and an average drug deductible of $114.04 ($23 lower than the national average).

How much is Part D in Oregon in 2021?

Part D Prescription Drug Plans are reasonably affordable in Oregon. The average PDP premium in 2021 is $42.74, which is only $1 higher than the national average. The average PDP deductible is equal to the national average, at $342.93 for the year.

When will Medicare be updated?

On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal policy, operations, and systems concerning the payment of Medicare Parts A ...

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.

We work in all 50 states! How can we help you?

MedicareFAQ (Elite Insurance Partners) is licensed to sell products nationwide. It is beneficial for us to do this so we can ensure that in the case any of our clients move to another state that we can move with them.

Find a State

Medicare Supplement Plans in Utah help cover the expenses not covered by Original Medicare. Without Medigap coverage, you could pay enormous out-of-pocket bills for healthcare services.

Is Medicare a federal program?

Even though Medicare is a Federal program, some states have different terms for Open Enrollment, Guaranteed Issue Rights, excess charges, disability, etc. Below, we’ll highlight what states have their own unique rules.

Is Medicare primary or secondary?

If your employer’s health care policy is the primary form of insurance, and Medicare is secondary.

What is guaranteed issue rights?

Guaranteed Issue rights are in place to ensure you can obtain a Medigap policy. Companies must offer you an option, even if you have pre-existing health conditions. For example, Susan lives with COPD, Guarantee Issue rights allow her to get a policy without fear of denial!

How long does it take to change Medigap policy in California?

California – California Medigap rules abide by the birthday rule. The birthday rule in California allows you to change policies within a 60-day window. The birthday rule begins 30 days before your birthday and ends 30 days after.

How long does it take to switch Medigap plans?

Missouri – If you have a Medigap policy, you can switch plans within 60 days of your enrollment anniversary . New York – You can enroll in a Medigap policy without underwriting throughout the year. Washington – Allows Medigap enrollees to change Medigap plans (except for Plan A) at any point.

Does Medigap cover excess charges?

If you’re looking at purchasing a Medigap policy, you may find that some of the plans cover excess charges. When a doctor doesn’t accept Medicare, excess charges may occur; doctors can only charge 15% above the threshold.

What does voluntary group termination mean?

Voluntary group termination means you decide to end your group insurance plan. Sometimes, people pay more for their group insurance than they would pay for Medicare. If this is your current situation, group termination may be beneficial to your pocketbook.

Does Medicare Supplement Insurance cover Part B?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Best States For Medicare: Overview

2022 National Average Medicare Premiums, Deductibles and Quality

- MAPD plans and Prescription Drug Plans are both reasonably affordable in 2022. 1. The average 2022 MAPD premium is $62.66 per month, though many areas may offer plans that feature $0 monthly premiums. The average deductible for the drug coverage offered by MAPD plans is $292.98 for the year. 2. The average PDP premium is $47.59 per month in 2022, with an averag…

Best States For Medicare: 2022 Average Medicare Costs by State

- Factors in Medicare Advantage Premiums

The national average cost of a Medicare Advantage Prescription Drug plan in 2022 is $62.66 per month. But as you can see from the table above, the cost of an MA-PD plan can vary quite dramatically by location. 1. In Massachusetts, Michigan, Rhode Island and the Dakotas, average … - Medicare Advantage Plan Quality by State

Every year, the Centers for Medicare & Medicaid Services rates all Medicare Advantage plans according to a five-star scale based on various quality metrics. Three stars represents a plan of average quality, while four stars is considered above average and five stars is excellent. The met…

Expert Analysis

- As of October 15, millions of American seniors have the opportunity to purchase a private Medicare insurance plan for the first time or switch to a new coverage option during the Medicare Annual Enrollment Period (AEP). This period, also called the fall Medicare Open Enrollment period, lasts until December 7. We asked a panel of experts for their insight on what Medicare beneficia…

Methodology

- This project used data provided by the Centers for Medicare & Medicaid Services (CMS). The 2022 MA Landscape Source Files and 2022 PDP Landscape Source Fileswere used for analysis.

Fair Use Statement

- Of course we would love for you to share our work with others. We just ask that if you do, please grant us the proper citation with a link to this study so that we may be given credit for our efforts.

Research and Reports

- Our research reports analyze a number of issues important to seniors, from health perceptions, medical communication, health habits, and more. 1Every year, Medicare evaluates plans based on a 5-star rating system.