Are the AARP Medicare supplement insurance plans insured?

*AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers.

Is UnitedHealthcare a part of AARP?

UnitedHealthcare Insurance Company (UnitedHealthcare) is the exclusive insurer of AARP Medicare Supplement Insurance Plans and these are the only insurance plans of their kind endorsed by AARP*. Plus….

What are Medigap and supplement plans?

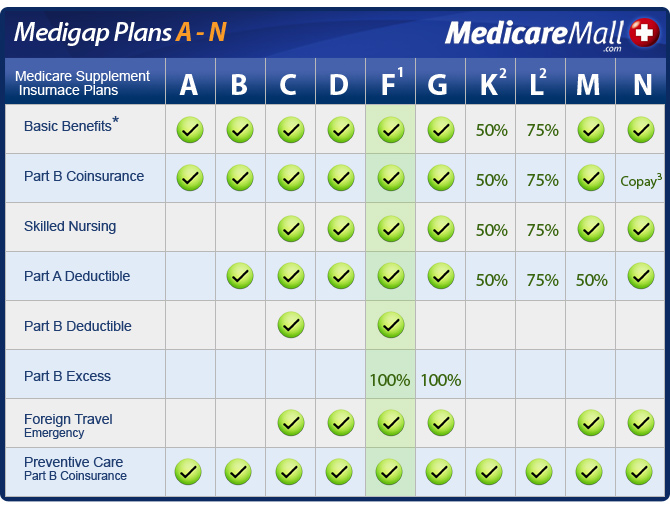

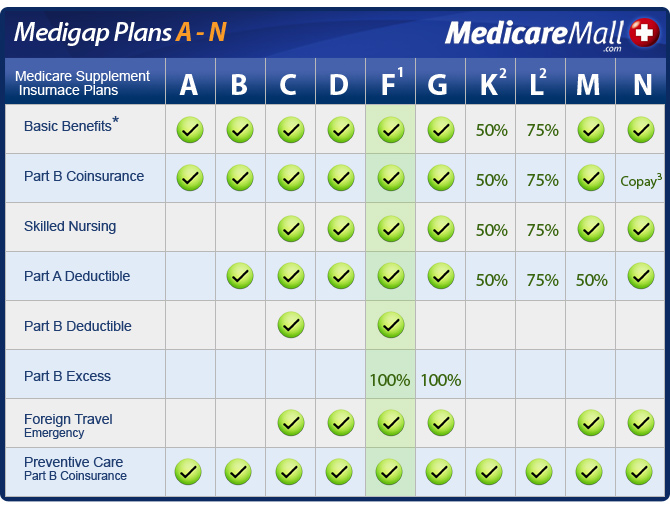

Medicare Supplement plans are insurance plans you can use in conjunction with Original Medicare (Part A and Part B) to fill coverage gaps in certain areas. Medigap plans help pay for your Medicare Part A and Part B coinsurance and copays, deductibles and more.

Is an AARP plan right for You?

Is an AARP Plan Right for You? An AARP plan may be the thing you need to help with your healthcare costs if you're concerned about the cost of copays, coinsurance, and deductibles not covered by Medicare. You must first become an AARP member to enroll in AARP supplemental plans.

Are Medicare supplement plans the same in every state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Can you use Medicare supplement out of state?

In many cases, you can stay with your current Medicare Supplement (Medigap) plan even if you're moving out of state as long as you stay enrolled in Original Medicare. Medigap benefits can be used to cover costs from any provider that accepts Medicare, regardless of the state.

Do Different states have different rules for changing Medicare supplement plans?

Even though Medicare is a federal program, states can implement various rules if they meet the basic Medicare regulations. Most states across the country have implemented rules to ease the requirements for seniors to make changes to their Medigap plans.

What states allow you to change Medicare supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

Do Medicare Advantage plans cover you in all 50 states?

Medicare Advantage plans must cover these situations anywhere in the United States. The plans can't charge additional costs for these services.

Can medical be used in other states?

Can I use my Medicaid coverage in any state? A: No. Because each state has its own Medicaid eligibility requirements, you can't just transfer coverage from one state to another, nor can you use your coverage when you're temporarily visiting another state, unless you need emergency health care.

What states have the birthday rule?

Prior to 2022, only two states provided Medigap beneficiaries with a birthday rule. Oregon and California were the first. Now, three additional states are implementing birthday rules. These states are Idaho, Illinois, and Nevada.

Which states do not allow Medicare excess charges?

Eight States Prohibit Medicare Excess ChargesConnecticut,Massachusetts,Minnesota,New York,Ohio,Pennsylvania,Rhode Island, and.Vermont.

Can I switch from Medicare Advantage to Medigap without underwriting?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting.

Are Medicare rules different in each state?

In general, plans in all states need to follow the same rules. For example, all Medicare Advantage plans must cover all the same services as original Medicare. An exception to this is Medigap plans. In most states, Medigap plans will have the same letter names across all insurance companies and offer the same coverage.

Why do doctors not like Medicare Advantage Plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is AARP supplemental insurance good?

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it...

Is AARP the same as UnitedHealthcare?

An AARP Medicare policy gives you insurance through UnitedHealthcare. There is a business agreement between the two companies where AARP provides m...

Does AARP pay the Medicare deductible?

Deductible coverage will vary based on the plan you choose. The Medicare Part A deductible is fully covered by Medigap Plan B, D, G and N, and it's...

What is AARP Medicare Supplement Plan F?

Medicare Supplement Plan F has the highest enrollment and very strong coverage, but it's only available to those who were eligible for Medicare bef...

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

How much does Medicare pay for days 61 to 90?

For days 61 to 90, the plan pays the $371 per day that Medicare does not cover. Days 91 and beyond are covered at $742 per day while using your 60 lifetime reserve days. Once the lifetime reserve days are used, Plan A continues to pay for all Medicare-eligible expenses that would not otherwise be covered by Medicare for an additional 365 days.

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

Does AARP provide Medicare Supplement?

AARP Medicare Supplement Plans are provided through UnitedHealthcare Insurance Company. For seniors who are concerned that their Medicare plan may not provide all the health insurance coverage they need, these plans are available to supplement their Medicare coverage.

Is UnitedHealthcare part of AARP?

Here is a brief overview of the AARP Medical Supplement Plans offered by UnitedHealthcare, which is part of UnitedHealth Group Inc. Note that specific coverage, co-insurance, co-payments, and deductibles may vary by state.

What Are Medicare Supplement Plans?

These plans are sold by private insurance companies, like AARP. There are a total of 10 Medicare Supplement plans available on the market. Named A–N, each of these plans offers a different set of benefits. The benefits offered by these plans are standardized by the federal government.

How Can I Purchase a Medicare Supplement Plan?

To purchase a Medicare Supplement plan, you must be enrolled in Original Medicare. The best time to enroll is during your Medigap Open Enrollment Period. This six-month period begins when you enroll in Medicare Part B.

AARP Medicare Supplement Plans in 2020

AARP offers the following eight Medicare Supplement plans, each of which are insured by UnitedHealthcare:

Moving Forward With AARP Medicare Plans

AARP offers many options for Medicare health insurance. As you get close to entering Medicare, reach out to an independent professional to compare quotes on AARP Medicare plans. Find out which ones are available in your area, and also get help finding the one that best fits your needs.

Our thoughts: Why we recommend AARP Medicare Supplement

Medicare Supplement Insurance (also called Medigap) plans from AARP/UnitedHealthcare are a good choice for most people. The customer service rating is not as strong as that of some other companies. However, the wide range of policy selections makes it easy to choose the best plan for you, and the AARP endorsement can give you peace of mind.

How do AARP Medicare Supplement plans work?

When you buy an AARP Medicare Supplement Insurance plan, you’re actually getting a policy from UnitedHealthcare. As part of the business agreement, AARP endorses and does marketing for select UnitedHealthcare plans, and in turn, AARP gets an estimated 4.95% fee for each plan sold.

Medigap costs vary by state

Costs for supplemental plans vary widely. To a large degree, this is due to state differences in pricing regulations.

How AARP Medigap costs compare to other insurance companies

Because of the variable plan structures, it can be difficult to compare costs, and the most accurate comparison will be based on insurance quotes for your location and situation . In states where prices change as you age, the different formulas for price increases can affect your total lifetime costs.

Customer reviews and satisfaction

AARP/UnitedHealthcare has mediocre customer reviews with several metrics indicating user complaints and frustrations.

Frequently asked questions

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it includes discounts on vision, dental, hearing, gym membership and more.

Sources and methodology

The above comparisons are based on plan coverage levels, policy details, third-party rankings and sample cost data for 2021. Price quotes for a female nonsmoker were analyzed based on age, location and provider.

When is the best time to buy a Medicare Supplement Plan?

The best time to buy a Medicare Supplement plan is during your six-month Medigap Open Enrollment Period (OEP). This starts the first day of the month in which you are age 65 or older and enrolled in Part B. During this six-month OEP, you are guaranteed acceptance – meaning you have a right to buy any Medicare supplement plan sold in your state.

What is the phone number for Medicare Supplement?

Call UnitedHealthcare at 1-866-408-5545 (TTY 711) , weekdays, 7 a.m. to 11 p.m., and Saturday, 9 a.m. to 5 p.m., Eastern Time.

What does OEP mean for Medicare?

During this six-month OEP, you are guaranteed acceptance – meaning you have a right to buy any Medicare supplement plan sold in your state. There may be other situations in which you may be guaranteed acceptance. For example, if you’ve delayed retirement and are enrolling in Medicare beyond your 65th birthday, or if coverage from another Medicare ...

Is AARP an insurer?

These fees are used for the general purposes of AARP. AARP and its affiliates are not in surers. AARP does not employ or endorse agents, brokers or producers. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

Does AARP pay royalty fees?

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare Insurance Company. UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, ...

How much can you save on each prescription?

In fact, you could save $7 or more on each prescription compared to your plan’s other network pharmacies. 1. 1 $7 or more savings applies to Tier 1 and Tier 2 drugs when filled at a Walgreens preferred retail pharmacy compared to a standard network pharmacy.

What is a pharmacy saver?

Pharmacy Saver is a cost savings prescription drug program available to our plan members. Preferred retail pharmacies may help you save money on your prescription copays. A pharmacy where you get the prescription drug benefits provided by your plan.

How much is Medicare Part A deductible for 2021?

If you have Original Medicare and have to be hospitalized because of the coronavirus, you will still have to pay the Medicare Part A deductible, which is $1,484 per hospital visit for 2021. For those who have additional coverage, this deductible is covered by most Medigap plans. The deductibles and copays for hospital stays for people enrolled in ...

Is the 800-MEDICARE hotline open?

Yes. If you have questions about your coverage or the services that are covered or have other issues, the 800-MEDICARE hotline is open 24 hours a day, seven days a week. Medicare is recommending telehealth visits.

Does Medicare waive copays?

Under the already enacted Families First Coronavirus Response Act, deductibles and copays for people on Original Medicare and who have Medicare Advantage plans will be waived for medical services related to testing, such as going to the doctor or hospital emergency room to see if they need to be tested.

Can you modify your Medicaid eligibility?

States are also being allowed to temporarily modify Medicaid eligibility and benefit requirements, to enable older beneficiaries and individuals with disabilities to be cared for in their homes, including allowing states to remove restrictions on Medicaid's paying for telehealth visits.

Does Medicare cover cardia rehab?

Since it began expanding telehealth services in 2020 because of the pandemic, the Centers for Medicare and Medicaid Services (CMS) has been expanding the array of medical services it will cover. CMS has now said it will cover cardia rehab, including heart monitoring via telehealth as well as pulmonary rehab services.