Which insurance company is best for a Medicare supplement?

Jan 07, 2022 · Why Do I Need Supplement Insurance with Medicare? Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication... Medicare supplement insurance covers medical services that Original Medicare doesn’t cover. Medigap, Medicare Advantage, and ...

What is the best secondary insurance with Medicare?

Dec 16, 2021 · You'll need supplemental insurance with Medicare to help relieve some of the financial burden of medical costs, like deductibles and coinsurance.

What is the cheapest Medicare supplement insurance?

Nov 19, 2021 · Medigap (Medicare Supplement Insurance) helps fill the “gaps” in Original Medicare. Sold by private insurance companies, it helps pay for some or all of your remaining health care costs such as copayments, coinsurance, and deductibles. Original Medicare pays for much of the cost for covered health care services and supplies. In most cases, you don't need …

How much does a Medicare supplemental insurance plan cost?

Jan 17, 2022 · J Scott BurkePROPresident, Newbury Inc., Evansville, IndianaNo you do not need supplemental insurance when you are on Medicare Part C aka:Medicare Advantage. In fact if you keep your Medicare Supplement while you are on Medicare Advantage it will not pay anything. Medicare Supplements only pay the gaps after Medicare A& B pay their part.

What is a supplemental insurance for patients with Medicare as their primary insurance?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.Dec 1, 2021

What is the most common form of supplemental Medicare coverage?

Medigap Plan FThe most popular Medicare Supplement Insurance plan is Medigap Plan F, according to the most recent statistics from America's Health Insurance Plans (AHIP). Due to recent legislation affecting Medigap plans, however, Plan G is quickly becoming the most popular Medicare Supplement plan for new Medicare beneficiaries.Oct 6, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

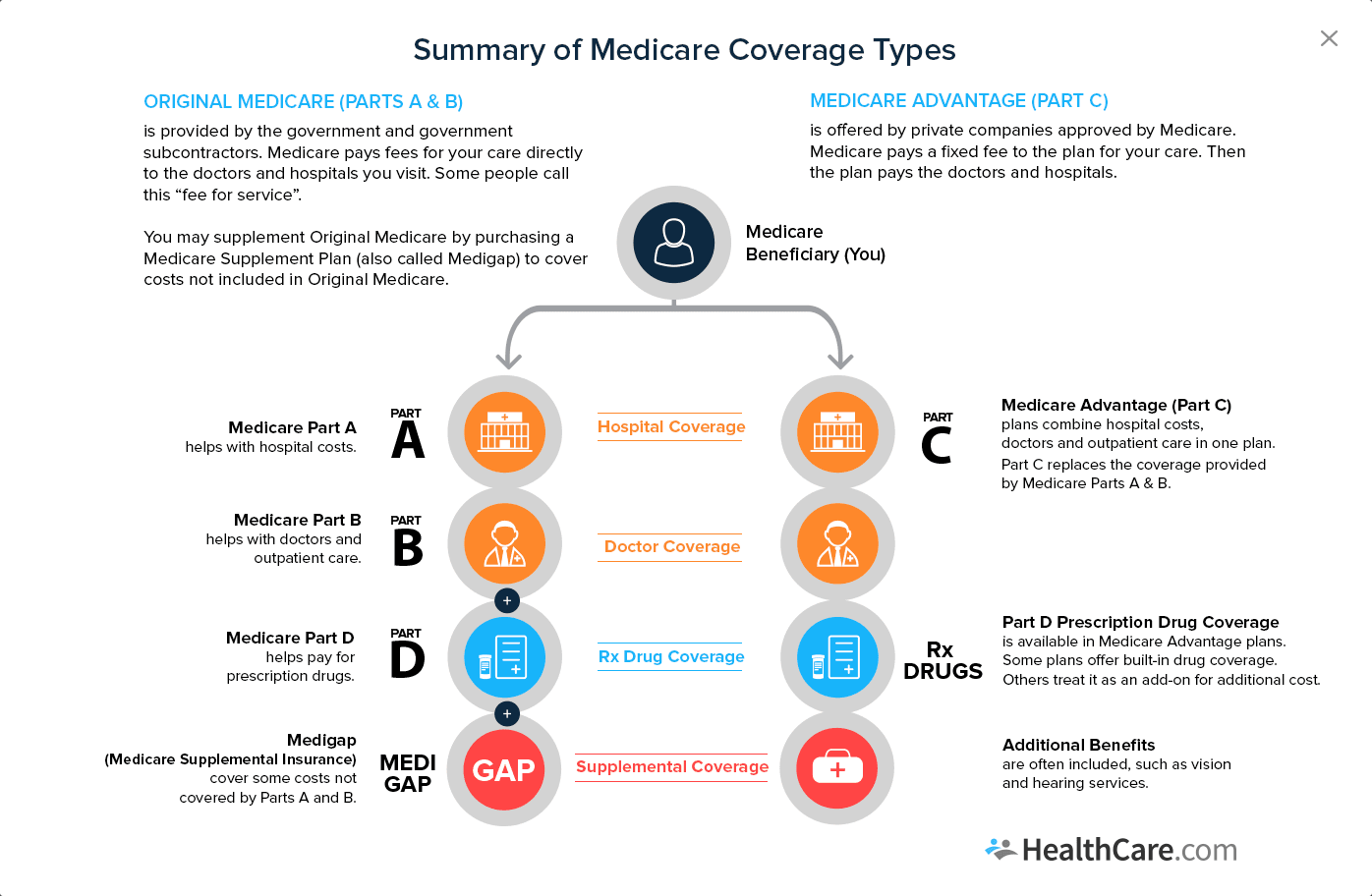

What is the difference between Medicare supplement and Medicare Advantage plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Does Plan N cover Medicare Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

Does Medicare cover prescriptions?

Original Medicare covers most hospital and doctor expenses. (It does not cover prescription drugs, although you can buy separate private drug plans.) The balance is left to you, with no cap on how high your out-of-pocket costs can go. Original Medicare allows you to see any doctor in the U.S. who accepts Medicare.

What is the deductible for Medicare Supplement 2020?

In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

Does Medicare Advantage cover vision?

Medicare Advantage plans cap out-of-pocket expenses. Medicare Advantage is all-encompassing, even offering dental and vision coverage (Original Medicare does not). But, you are limited to its doctor network and need referrals to see specialists.

Does private insurance cover out of pocket expenses?

Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage. Instead, they help pay for what Medicare Part A and B does not, including copays, coinsurance, and deductibles. 2 It does not affect which doctors you can see.

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

How much is Medicare Part A deductible in 2021?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021.

When is the annual election period for Medicare?

If you don’t enroll in a Medicare Advantage plan during your initial enrollment window, then you will have an annual chance to do so each year in the fall from October 15 th – December 7 th. This is called the Annual Election Period.

What is Plan F?

Plan F pays 100% of all out-of-pocket expenses. If you are looking for a comprehensive plan that will pay for everything, this one is it. Here are a few of the benefits that a Medigap plan can help pay for: Medicare Part A coinsurance hospital costs after initial Medicare coverage is exhausted. Medicare Part B copayment.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

Does Medicare pay for prescription drugs?

One popular feature of Medicare Advantage plans is that most include coverage for prescription drugs (Part D). These plans pay instead of Medicare (as opposed to after Medicare, as Medigap plans do). When you join a Medicare Advantage plan, Medicare pays that plan to deliver your care.

Does Medicare Advantage have a whole state network?

That network might be just in one or two counties or occasionally we see them include a whole state. You agree to treat with those providers according to the plan’s rules.

How much does Medicare cover for X-rays?

How well does Medicare cover you for all of the tests, office visits and treatments you might need if you're not treated in a hospital? If you have Medicare Part B, it will cover 80 percent of all approved charges for doctor's office visits, blood tests, X-Rays, CT scans, MRIs and ER visits.

How long is a hospital stay for Medicare?

1. The average length of a hospitalization, even for Medicare patients, is about 5 days. Hospitalizations rarely exceed two weeks and 60-day hospitalizations are practically unheard of. Even hospitalizations for heart attacks or major surgeries rarely exceed a week. 2.

Does Medicare Supplemental Insurance cover outpatient care?

Unless a supplemental policy specifically states otherwise, the most it will cover are the Medicare deductibles ($147 outpatient and $1,187 hospitalization) and the 20 percent co-insurance. Supplemental policies do not usually cover any medical services Medicare won't cover. What's more, Medicare supplemental insurance will only pay health care ...

Why is it important to review your existing coverage?

As such, it’s important to review your existing coverage before making a decision to enroll in any additional coverage options. Having a comprehensive understanding of what your coverage is and what you may need more of will help you make the best decision possible for your unique situation. Your style is your choice.

Does Medicare Supplement Insurance cover deductibles?

The purpose of Medicare Supplement Insurance is to cover the cost left by deductibles and coinsurance in Original Medicare, but as full Medicaid coverage should cover the majority of those costs, a Medicare Supplement Insurance policy isn’t necessary. 3.

Is United American Insurance endorsed by the government?

The purpose of this communication is the solicitation of insurance. United American Insurance Company is not connected with, endorsed by, or sponsored by the U.S. government, federal Medicare program, Social Security Administration, or the Department of Health and Human Services. Policies and benefits may vary by state and have some limitations and exclusions. Individual Medicare Supplement insurance policy forms MSA10, MSB10, MSC10, MSD10, MSF10, MSHDF10, MSG10, MSHDG, MSK06R, MSL06R, MSN10 and in WI, MC4810 and MC4810HD, MC4810HDG are available from our Company where state-approved. Some states require these plans be available to persons under age 65 eligible for Medicare due to disability or End Stage Renal disease (ESRD). You may be contacted by an agent or producer representing United American Insurance Company, PO Box 8080, McKinney, TX 75070-8080. OUTLINE OF COVERAGE PROVIDED UPON REQUEST.

Is United American a Medicare Supplement?

United American has been a prominent Medicare Supplement insurance provider since Medicare began in 1966. Additionally, we’ve been a long-standing participant in the task forces working on Medicare Supplement insurance policy recommendations for the National Association of Insurance Commissioners.