What is the Medicare tax and how does it work?

The Medicare tax is automatically deducted from your paycheck in order to pay for your Medicare Part A health insurance coverage. This allows you to benefit from it when you turn 65. Medicare Part A represents the hospital portion of Medicare coverage.

How many tiers of Medicare taxes are there?

There are three tiers of Medicare taxes as of 2018. The U.S. government imposes a flat rate Medicare tax of 2.9 percent on all wages received by employees, as well as on business or farming income earned by self-employed individuals. But there are a few variations of this tax depending on the sources of your income and other factors.

What is the Medicare tax rate for employers?

The Medicare tax rate is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%. If you’re self-employed, you’ll pay the full rate yourself.

What is the Medicare flat rate tax?

The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn.

What is Medicare Part A funded by?

While Part A is funded primarily by payroll taxes, benefits for Part B physician and other outpatient services and Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance, or SMI, trust fund.

Is Medicare a FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes.

Is Medicare funded by the federal government?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs Medicare. The program is funded in part by Social Security and Medicare taxes you pay on your income, in part through premiums that people with Medicare pay, and in part by the federal budget.

Does FICA include Medicare?

FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

Is FICA tax the same as Social Security?

Is FICA the same as Social Security? No, but they are closely connected. FICA, the Federal Insurance Contributions Act, refers to the taxes that largely fund Social Security retirement, disability, survivor, spousal and children's benefits. FICA taxes also provide a chunk of Medicare's budget.

Is FICA the same as Social Security on w2?

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act). On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

How is US Medicare funded?

Medicare is funded through a combination of taxes deposited into trust funds, beneficiary monthly premiums, and additional funds approved through Congress. According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

How is Medicare funded and administered?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

How is Medicare funded by paid taxes quizlet?

How is Medicare funded? Partially funded by federal government through tax dollars. -The rest is funded by premiums, deductibles and coninsurance payments.

Does federal tax include Medicare and Social Security?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

Does Social Security and Medicare count as federal tax?

The Social Security tax is a tax on earned income, and it is separate from federal income taxes. The Social Security tax only applies to earned income, like your wages, salaries and bonuses, but not to unearned income like interest, dividends or capital gains.

What is FICA vs federal income tax?

The FICA tax is actually made up of two separate taxes: the Social Security tax and the Medicare tax. The FICA tax and federal income tax are similar in that the federal government collects both, but they differ in their purposes. The federal income tax serves as general revenue for the federal government.

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you must pay the Medicare tax regardless of your or your employer’s citizenship or residency s...

Are tips subject to Additional Medicare Tax?

If tips combined with other wages exceed the $200,000 threshold, they are subject to the additional Medicare tax.

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

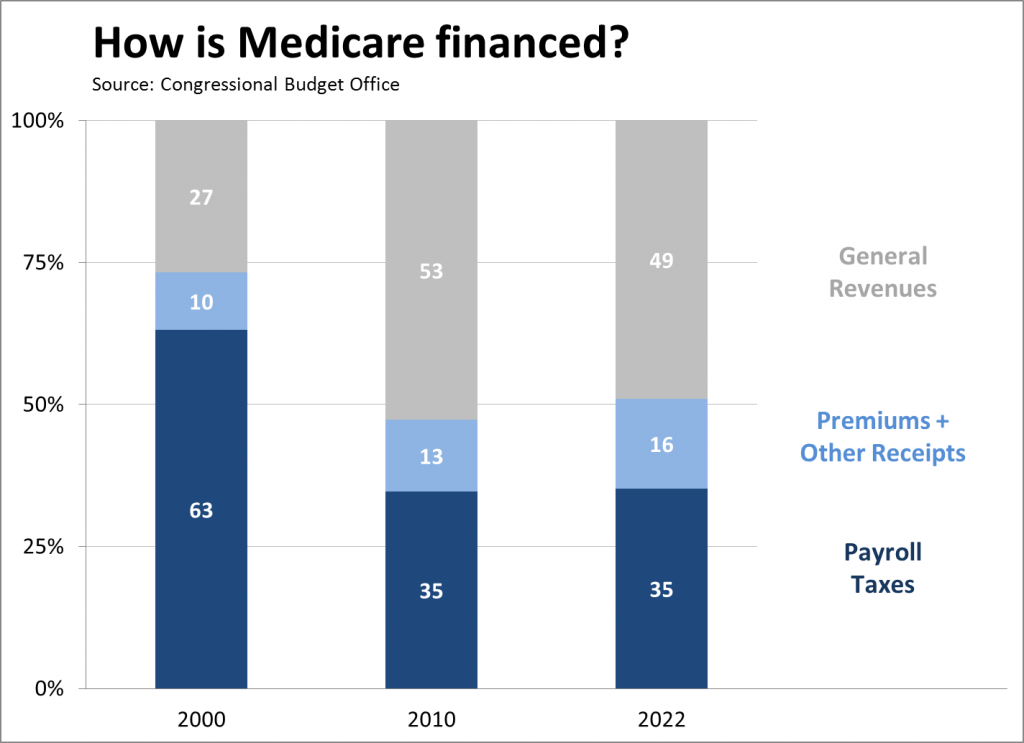

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

How Medicare Is Funded

Funding for Medicare comes from several places. Its primary sources are two U.S. Treasury accounts: the Hospital Insurance Trust Fund and the Supplemental Medical Insurance Trust Fund.

How Much Is the Medicare Tax?

Although the 2021 Medicare tax is 2.9%, W-2 employees have to cover only half of it: 1.45%. Employers pay the other half. If, however, you are self-employed, the entire 2.9% falls on you. Although this difference may appear negligible, consider how it works when it comes to your check.

Who Pays the Medicare Tax?

All U.S. employees, employers, and self-employed individuals must contribute to Medicare through taxes, regardless of citizenship or residency. However, there is one categorical exemption: certain nonresident aliens.

What Is the Additional Medicare Tax?

The Affordable Care Act mandates that some taxpayers who earn a higher income make an additional contribution called the Additional Medicare Tax. According to this law, taxpayers who meet certain income levels must pay an additional 0.9% in Medicare tax. That’s a total of 3.8%.

Bottom Line

While the Medicare tax might seem like an unnecessary burden on your paycheck, this money –– combined with that of millions of other Americans –– helps fund the entirety of Medicare.

What is Medicare Part A?

Medicare Part A represents the hospital portion of Medicare coverage. Upon turning 65, you will begin paying for Medicare Part B, which is automatically taken out of your monthly Social Security benefit to cover visits to your physician, specialists and so on.

Why does my employer withhold Medicare from my paycheck?

Your employer automatically withholds the Medicare tax from your paycheck in order to help cover the costs of the country’s Medicare program. The tax comprises one part of the Federal Insurance Contributions Act (FICA). Employers are required by law to collect both Medicare and Social Security tax and submit the money to ...

How much do you owe in FICA taxes?

Therefore, you will owe 15.30 percent in FICA taxes, with 2.9 percent going toward your Medicare contribution. However, you are also able to take a business deduction when filing your income taxes, covering half of what you must pay. Consult an accountant for more specifics about your situation.

What percentage of your gross earnings is FICA?

The total FICA of an employee is 7.65 percent of your gross earnings for that pay period. Of the 7.65 percent , 1.45 percent goes toward their Medicare contribution. The remaining 6.2 percent goes towards the Social Security program. Employers must match the Medicare and Social Security contributions of their employees.

What is reimbursement in IRS?

The reimbursement is a matter that must be settled between the employee and their employer. If the employee agrees, the employer may take an additional amount out of future pay for reimbursement. Further information on how to handle overpayments and underpayments can be viewed at the IRS website.

Do employers have to match Medicare and Social Security contributions?

Employers must match the Medicare and Social Security contributions of their employees. Many seniors living on a fixed income are not able to afford private medical coverage. Therefore, without Medicare, many would not be able to receive the medical attention they need.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.