What happens if I don’t receive my Medicare annual notice of change?

Each September, Medicare beneficiaries should expect to receive a Medicare Annual Notice of Change (ANoC) letter for each Medicare plan in which they’re enrolled. This document describes the changes for the following year. If you don’t receive this important plan document, you should contact your plan provider.

When do I get a notice of change to my insurance?

Some common reasons you may want to change your coverage is due to your premiums increasing, the Advantage plan no longer has your doctor in the network of your plan, or the drug formulary drops your medication off the list of covered drugs. You’ll receive an Annual Notice of Change in September from your carrier.

How do I talk to Medicare about changes in coverage?

How Medicare coordinates with other coverage If you have questions about who pays first, or if your coverage changes, call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other Health care provider about any changes in your insurance or coverage when you get care.

What is a Medicare annual notice of change (ANOC)?

Each September, Medicare beneficiaries should expect to receive a Medicare Annual Notice of Change (ANoC) letter for each Medicare plan in which they’re enrolled. This document describes the changes for the following year.

When is Medicare enrollment period?

It’s all meant to help you understand your coverage choices and make informed decisions during the Medicare Annual Enrollment Period (Oct. 15 – Dec. 7).

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

When is anoc mail sent?

It’s called the Annual Notice of Change, or ANOC for short, and it comes from your current Medicare plan provider. Delivered by September 30, ANOC letters ensure that plan members have up-to-date plan information before the Medicare Annual Enrollment Period ...

What to do if you don't have a medicaid plan?

If they aren’t, you will have to change plans or providers or pay much higher out-of-pocket costs to stay with the same doctors and the same plan. Another option is to switch back to Original Medicare and enroll in a Medigap plan.

When is the Medicare enrollment period?

The Medicare Annual Enrollment Period, or AEP, runs from October 15th to December 7th every year.

What is OEP in Medicare?

That depends on the context used when talking about the Medicare Open Enrollment Period. OEP can refer to many different enrollment windows with Medicare. However, for the most part, when someone is talking about the OEP they are referring to the Annual Enrollment Period.

Why is it important to have a Medicare Advantage checklist?

Having a Medicare Advantage checklist makes it easier when going to sign up. There are many different enrollment periods when it comes to Medicare. Each just as confusing as the other. It’s important to understand what you can and cannot do during each enrollment window.

How many stars does Medicare have?

Medicare Advantage and prescription drug plans receive an overall star rating of one to five stars—with five being the best—on factors such as customer service, member experience, and member complaints.

Does Medigap cover the same benefits year to year?

Your Medigap plan will cover the same benefits from year to year. What may change is your premiums. Rate increases do happen annually, on the anniversary date of your policy. Your carrier sends out a letter the month before your anniversary date that informs you of any premium increases.

Does Medicare cover dental and vision?

Medicare doesn’t cover routine dental, vision, and hearing services, but some Medicare Advantage plans do. You can also buy dental, vision, and hearing coverage separately. Consider your needs and the available coverage as part of your overall evaluation of Medicare plans.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What happens when there is more than one payer?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

When does Medicare enrollment end?

The Medicare Annual Enrollment Period runs October 15 through December 7. This is the only time each year anyone with Medicare coverage can make changes (outside of some special periods just for Medicare Advantage and Part D beneficiaries).

When is open enrollment over for Medicare?

It’s easy and convenient – but once open enrollment is over on December 7, your chance to change your Medicare coverage for next year is over, too, unless you move or otherwise qualify for a special exception. You get to choose the Medicare coverage that you think best fits your needs each year during this time.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Does Medicare Part D change?

Medicare Part D and Medicare Advantage plans may change costs and coverage from year to year. You may have lost benefits you loved and that’s why you’re shopping around. Or, you may have never had them in the past and you want them now. In either case, make a list of the health benefits you want such as dental, vision or hearing coverage.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

What age is Medicare?

Retiree Health Plans. Individual is age 65 or older and has an employer retirement plan: Medicare pays Primary, Retiree coverage pays secondary. 6. No-fault Insurance and Liability Insurance. Individual is entitled to Medicare and was in an accident or other situation where no-fault or liability insurance is involved.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

Does GHP pay for Medicare?

GHP pays Primary, Medicare pays secondary. Individual is age 65 or older, is self-employed and covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary.

Does Medicare pay for workers compensation?

Medicare generally will not pay for an injury or illness/disease covered by workers’ compensation. If all or part of a claim is denied by workers’ compensation on the grounds that it is not covered by workers’ compensation, a claim may be filed with Medicare.

When will Medicare stop allowing C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

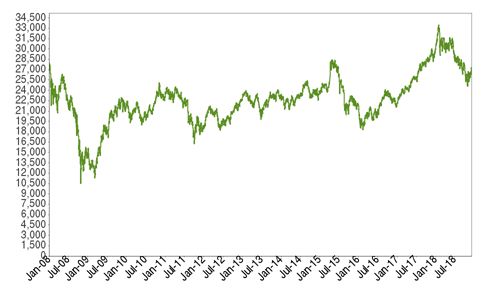

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...