Request a coverage determination from your plan. Pay for the prescription, save your receipt, and ask the plan to pay you back by requesting a coverage determination.

Does Medicare cover all of my care?

While Original Medicare should cover most of your care, it has these gaps. Original Medicare doesn't cover some essentials. For instance, it does not pay for most prescription drug costs. Even when Medicare covers a treatment, you still have to pay copays and coinsurance. Most people have to pay a monthly fee, called a premium, for Medicare Part B.

What expenses does Medicare not pay for?

However, there are certain expenses Medicare doesn't pay for. Here are some of the most common ones that Medicare beneficiaries have to pay for: Deductibles: Medicare Part A (hospital insurance) has a $1,316 deductible per benefit period for inpatient hospital stays. Part B (medical insurance) has a $183 deductible per year.

What are some things that Medicaid does not cover?

But there are some things that Medicaid does not cover. Medicaid is not required to provide coverage for private nursing or for caregiving services provided by a household member. Things like bandages, adult diapers and other disposables are also not usually covered, and neither is cosmetic surgery or other elective procedures.

Are Medicare Parts A and B unpredictable?

As you can see, it's reasonable to say that your healthcare costs can be quite unpredictable if Medicare Parts A and B (also referred to as "original Medicare") are your only forms of health coverage. As anyone who has ever gotten a bill for an uncovered hospital stay can tell you, the costs can certainly add up quickly.

What do I do if Medicare won't pay?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: A request for a health care service, supply, item, or drug you think Medicare should cover.

How do I fight Medicare denial?

File your appeal within 120 days of receiving the Medicare Summary Notice (MSN) that lists the denied claim. Circle the item on your MSN that you are appealing and clearly explain why you think Medicare's decision is wrong. You can write on the MSN or attach a separate page.

Does Medicare ever deny coverage?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

Who pay if Medicare denies?

The denial says they will not pay. If you think they should pay, you can challenge their decision not to pay. This is called “appealing a denial.” If you appeal a denial, Medicare may decide to pay some or all of the charge after all.

How often are Medicare appeals successful?

For the contracts we reviewed for 2014-16, beneficiaries and providers filed about 607,000 appeals for which denials were fully overturned and 42,000 appeals for which denials were partially overturned at the first level of appeal. This represents a 75 percent success rate (see exhibit 2).

Who has the right to appeal denied Medicare claims?

You have the right to appeal any decision regarding your Medicare services. If Medicare does not pay for an item or service, or you do not receive an item or service you think you should, you can appeal. Ask your doctor or provider for a letter of support or related medical records that might help strengthen your case.

What is a common reason for Medicare coverage to be denied?

Medicare's reasons for denial can include: Medicare does not deem the service medically necessary. A person has a Medicare Advantage plan, and they used a healthcare provider outside of the plan network. The Medicare Part D prescription drug plan's formulary does not include the medication.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Do doctors treat Medicare patients differently?

Many doctors try to help out patients who can't afford to pay the full amount for an office visit or the copay for a pricey medication. Now along comes a study suggesting that physicians in one Texas community treat patients differently, depending on whether they are on Medicare or have private insurance.

How do I contact Medicare about a denied claim?

Call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. Visit Medicare.gov/forms-help-resources/medicare-forms for appeals forms. Call your State Health Insurance Assistance Program (SHIP) for free, personalized health insurance counseling, including help with appeals.

What are the five steps in the Medicare appeals process?

The Social Security Act (the Act) establishes five levels to the Medicare appeals process: redetermination, reconsideration, Administrative Law Judge hearing, Medicare Appeals Council review, and judicial review in U.S. District Court. At the first level of the appeal process, the MAC processes the redetermination.

What is Medicare Part D?

If you commonly use prescription medications, you most likely have a Medicare Part D Prescription Drug Plan. These plans are designed specifically to provide medication coverage for Original Medicare recipients. Or, you may also have a Medicare Advantage plan that includes prescription drug coverage. Each of these plans can differ in the specific medications that are covered, and the prices of those drugs. Some prescriptions can be extremely expensive, especially if their cost must be covered fully out of pocket. If your Medicare drug plan does deny coverage for a specific medication that you need, there is an appeals process you can go through to attempt to obtain coverage.

Can you get Medicare if you have generic?

In some cases, the generic version of a drug may be covered by Medicare, while the brand-name one drug may not be . If this may be the case, your physician can determine if there is a potential alternative medication that you can use that will be covered by your Medicare insurance. Changing the medication to an already approved option would prevent the need for further action and appeal.

Does Medicare cover over the counter medications?

There are some drugs that Medicare does not provide coverage for under any circumstance. These drugs can include over-the-counter drugs or medications that have not obtained approval from the Food and Drug Administration. Other drugs can include those that are only sold outside of the United States or that do not have any medically-accepted purpose.

How much is Medicare deductible?

Here are some of the most common ones that Medicare beneficiaries have to pay for: Deductibles: Medicare Part A (hospital insurance) has a $1,316 deductible per benefit period for inpatient hospital stays. Part B (medical insurance) has a $183 deductible per year. Coinsurance payments: In addition to the deductible, ...

How long is skilled nursing covered by Medicare?

Skilled nursing stays are covered for 20 days, but require a $164.50 daily coinsurance payment for days 21-100, and beyond this period, the beneficiary is responsible for the costs. Part B copays: After the Part B deductible is met, Medicare typically covers 80% of medical services provided, and the beneficiary is responsible for the other 20%.

What is a Medigap plan?

One solution is a Medigap plan. As the name implies, this is an additional insurance plan that is designed to help cover costs that Medicare doesn't pay for.

What is the most comprehensive Medigap plan?

In addition to being required to offer Plan A, all Medigap insurers are required to offer either Plan C or F, but beyond that, the selection can vary considerably. Plan F is the most comprehensive Medigap plan and covers virtually every copay, coinsurance, or deductible charge you could possibly face.

How much does Medicare pay?

In fact, according to Medicare.gov, the average Medicare beneficiary who relies on just Medicare Parts A and B can expect to pay a total of $635 per month, or $7,620 per year out of pocket for healthcare expenses. This can vary widely, depending on your health. For example, it's estimated that the average Medicare beneficiary in poor health has ...

Which is the most expensive Medicare plan?

Medigap Plan F, as I mentioned, is the most comprehensive plan, and is therefore the most expensive. So, it may surprise you to learn that two-thirds of people who choose to buy a Medigap plan choose Plan F, the most expensive option, according to the American Association for Medicare Supplement Insurance.

How much does Plan F cover?

If you think that's an exaggeration, consider that according to Senior65.com, Plan F can cover almost $1 million in expenses that Original Medicare won't cover, during just one year of serious illness.

What does Medicare cover?

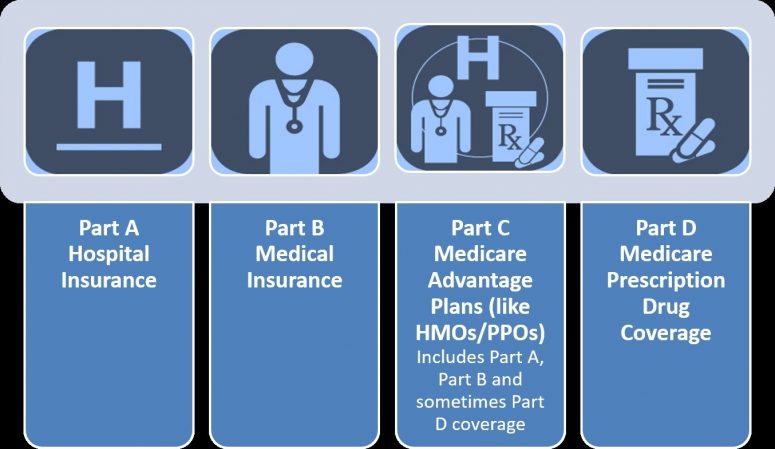

First, it's important to understand what Medicare does cover and how much you're paying for it. Original Medicare consists of Part A and Part B. Part A cover s hospital visits, visits to skilled-nursing facilities, and in-home healthcare services.

How to avoid paying thousands of dollars in healthcare?

The best way to avoid paying tens (or hundreds) of thousands of dollars in healthcare costs is to do your research, understand what Medicare does and doesn't cover, and figure out how to pay for uncovered medical care before you retire. One option is to enroll in a Medicare Advantage Plan (also known as Medicare Part C).

What is Medicare Advantage Plan?

A Medicare Advantage Plan is a health plan offered through private insurance companies that includes all the benefits of Medicare Part A and Part B, as well as some additional coverage for vision, hearing, and dental.

Does Medicare cover all medical expenses?

The truth is that while Medicare can offer significant financial assistance, it doesn't cover everything.

Does Medicare cover copayments?

Even considering all that Medicare Part A and Part B cover, there's a variety of expenses that basic Medicare won't touch. For example, you still need to pay for all copayments, deductibles, and coinsurance out of pocket, and those costs can add up quickly.

How often does Medicare Advantage change?

Medicare Advantage plans can change each year. What's covered might change. How much you pay may change, too.

What is Medicare Extra Help?

Medicare Extra Help Program: This program helps low-income Medicare beneficiaries pay for their prescription drugs. If you qualify for QMB, SLMB, QI, or QDWI, as described above, you automatically get Extra Help.

What is a Medigap plan?

Medigap plans. Just like it sounds, a Medigap plan will fill some of the gaps in coverage with Original Medicare. Medigap plans help: Pay copays and coinsurance. Lower the deductible, which is the amount you have to pay out-of-pocket before Medicare pays toward your care.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. Available to low-income Medicare beneficiaries. This program helps you pay for your Medicare Part A and Part B premiums, as well as co-insurance, copayments, and deductibles. Contact your state Medicaid office to find out if you qualify.

What is Medicare Part D?

Also known as Medicare Part D, a Prescription Drug Plan will help you pay for prescription medicines. You'll pay an extra fee each month for the plan, but you'll probably save a lot on pharmacy expenses. Private companies sell prescription drug plans, but you can sign up for them through Medicare.

How to find Medicare shipping number?

Call Medicare at 800-633-4227 to find the number for the SHIP in your state. Or go to Medicare.gov and pick your state in the pull-down menu called "Find someone to talk to."

Do you have to have Medicare to get a Medigap plan?

Most don't pay for long-term care, dental care, hearing aids, eye exams, or eyeglasses. To get a Medigap plan, you have to have Original Medicare. As with a Prescription Drug Plan, you also have to pay a monthly fee for a Medigap plan. The plans vary on what they cover and how much they cost.

How long can you stay in hospital for Medicare?

Thanks to legislation put forth in October 2013, known as the Two-Midnight Rule, you may only be considered for inpatient care (care covered by Medicare Part A) if your stay is expected to last longer than two midnights and if your level of care is considered medically necessary.

How long do you have to be hospitalized to be eligible for Medicare?

Not only do you need to have been hospitalized to qualify for this Medicare Part A coverage, but you need to have been admitted as an inpatient for at least three days. Trickily, the day you are transferred to the skilled nursing facility does not count, and even more tricky is how CMS defines inpatient care.

How long does skilled nursing cover?

In the case that you do get approval for skilled nursing care, Medicare Part A covers the first 20 days for you.

What assets are eligible for medicaid?

These assets include annuities, bank accounts, automobiles (excluding your primary vehicle), bonds, cash amounts exceeding $2,000, the cash surrender value of life insurance policies (applies to "whole life" and "universal life" policies, not term life policies), Keogh plans, IRAs, money market funds, mutual funds, pension funds, real estate (excludes your primary residence up to a certain value depending on the state), stocks, and stock options.

Does Medicare cover nursing home care?

Medicare Coverage for Nursing Home Care. It is not that Medicare does not pay for any nursing home care. It does pay for some, but only if you were recently admitted to the hospital and only if you require skilled care at least five days per week.

Does Medicare cover eyeglasses?

Medicare is not a one-stop-shop. While it covers a wide breadth of services, it may leave you to fend for yourself when it comes to certain healthcare essentials as you grow older. For example, it doesn't cover corrective lenses (e.g., contact lenses or eyeglasses), dentures, hearing aids, or white canes for the blind.

Do seniors need long term care?

When you consider these factors, more and more seniors are likely to need long-term nursing home care in the future.

What to do if you don't have Medicare?

If it doesn’t, or if you have original Medicare, consider buying insurance or a membership in a discount plan that helps cover the cost of such hearing devices. Also, some programs help people with lower incomes to get needed hearing support. Or you can pay as you go.

Does Medicaid help with nursing home care?

But for those with limited income and savings, Medicaid might help fill in the gaps.

Does Medicare cover dental care?

3. Dental work. Original Medicare and Medigap policies do not cover dental care such as routine checkups or big-ticket items, including dentures and root canals.

Does Medicare cover lab tests?

En español | Medicare covers the majority of older Americans’ health care needs — from hospital care and doctor visits to lab tests and prescription drugs. Here are some needs that aren’t a part of the program — and how you might pay for them.

Does Medigap cover medical expenses?

Solution: Some Medigap policies cover certain overseas medical costs. If you travel frequently, you might want such an option. In addition, some travel insurance policies provide basic health care coverage — so check the fine print. Finally, consider medical evacuation (aka medevac) insurance for your adventures abroad. It’s a low-cost policy that will transport you to a nearby medical facility or back home to the U.S. in case of emergency.

Does Medicare Advantage cover dental insurance?

Solution: Some Medicare Advantage plans offer dental coverage. If yours does not, or if you opt for original Medicare, consider buying an individual dental insurance plan or a dental discount plan.

Does Medicare cover callus removal?

Routine medical care for feet, such as callus removal, is not covered. Medicare Part B does cover foot exams or treatment if it is related to nerve damage because of diabetes, or care for foot injuries or ailments, such as hammertoe, bunion deformities and heel spurs.

What is Medicare Advantage?

Medicare Advantage is an alternative to original Medicare, and it commonly covers dental care, vision services, and hearing aids — and sometimes at a lower cost, premium-wise, than what you’ll pay for original Medicare, which charges enrollees a premium for Parts B and D.

When is the best time to apply for long term care insurance?

The best time to apply for a long-term care policy is in your 50s, when you’re most likely to not only qualify, but snag a health-based discount on your premiums.

Does Medicare pay for custodial care?

Medicare, however, won’t pay for what’s known as custodial care, which is assistance with daily living tasks. As such, long-term care usually isn’t covered.

Does Medicare cover dental cleanings?

Medicare will only cover dental care as it relates to an injury, or if it’s needed in conjunction with a covered medical service. Routine care, which includes cavity fillings and even dentures, is not covered.

Does Medicare cover seniors?

Millions of seniors get health benefits through Medicare, but many are surprised to learn that the program is somewhat limited in what it actually covers. If you’re a new subscriber, or are gearing up to enroll, here are 4 services not included in your Medicare coverage:

Does the glaucoma insurance cover diabetics?

That said, it will cover screenings and treatment for certain eye diseases. For example, high-risk patients can get a glaucoma screening annually, while diabetics can receive screenings and treatment for retinopathy.

What is Medicare Part A?

For instance, Medicare Part A covers such services as inpatient hospital stays, hospice care, some home health care in a skilled nursing facility. Medicare Part B, on the other hand, covers doctors' services, outpatient care, preventative services such as check-ups and mammograms and medical supplies. Medicare Part D helps with the costs of prescription drugs and vaccines.

What is Medicare Supplement Plan?

Consider a Medicare supplement plan, which are supplemental insurance plans you pay for to cover what Medicare doesn't. These plans are available through private insurers and each has different features and prices.

How much money do you need to retire at 65?

Take the aforementioned statistic—that the average couple age 65 would need $265,000 to have a 90% chance of having enough for health care expenses in retirement—and divide it by two people, that equals $132,500 per person.

Is Medicare an expert in retirement planning?

That being said, be aware that retirement planners are not always Medicare experts; Medicare isn't their industry, after all.

Do you have to sign up for Medicare if you are 65?

Although it sounds relatively straightforward, it isn't. Some people get Medicare automatically, but others have to sign up themselves—especially those approaching or turning age 65 who are not receiving Social Security.

Do you have to pay Medicare premiums?

The good news is that most people won't have to pay a premium for Part A because they already paid for it through payroll taxes, but if you don't have a premium-free plan, then what you pay to buy Medicare Part A depends on the Social Security credits you've earned.

Is long term care covered by Medicare?

Long-term care is not covered by Medicare either, and most retirees invest in long-term care insurance. While Medicare is designed to cover medical needs, long-term care in a facility falls under private pay.

Why is my medicaid denied?

Aside from not meeting the financial or demographic requirements, some common reasons for a denied Medicaid application include: Incomplete application or documents. Failure to respond to a request within a timely manner. Late filing.

What are the disadvantages of not getting medicaid?

Some other disadvantages of Medicaid include: Eligibility differs by state, so you may not qualify where you live but otherwise would if you lived in a different state.

What are optional benefits for Medicaid?

Optional benefits that may or may not be covered depending on the state include: Prescription drugs (although technically an optional benefit, every state Medicaid program provides at least some prescription drug coverage) Physical and occupational therapy . Dental and eye care for adults. Hospice. Chiropractic care. Prosthetics.

Is Medicaid mandatory in every state?

While each state may tailor its own Medicaid benefits, there are some mandatory Medicaid benefits that are required to be covered in every state. These include: Medicaid is also required to cover the following services for children:

Does Medicaid cover alternative medicine?

Additionally, Medicaid will not cover anything that is not FDA-approved or any alternative medicine.

Is Medicaid covered in 2021?

Medicaid coverage can vary by state, but there are certain things that are required by law to be covered everywhere, and some benefits that Medicaid typically does not cover in most states. In this Medicaid review, we outline the typical benefits covered and not by Medicaid.

Does D-SNP cover prescription drugs?

All D-SNP plans are required to cover prescription drugs. To learn more about these special types of plans and to find out if any are available where you live, you can compare plans online or call to speak with a licensed insurance agent.