Medical debt consolidation Consolidating your medical debt means rolling all your medical debt into one monthly payment. You can do this in a couple different ways: Debt consolidation loans If you have good credit, then you should be able to qualify for a debt consolidation loan.

Full Answer

How is Medicare bad debt reimbursed?

Every year providers submit their Medicare bad debt listings to their assigned Medicare Administrative Contractor (MAC), along with their Medicare cost report. Providers are reimbursed a portion (currently 65%) of the total eligible amount of Medicare Bad Debt that is incurred and unpaid by Medicare beneficiaries.

How do I submit my bad debt log to Medicare?

We ask that your bad debt log be submitted with your Medicare cost report in EXCEL format, either on diskette or CD-ROM. In some cases an amount previously written off as a Medicare bad debt may be recovered in a subsequent accounting period.

How can we recover unrealized Medicare bad debt revenue?

Hundreds of millions of dollars of unrealized Medicare bad debt revenue can be recovered at scale if reporting and analysis are performed efficiently with automation — whether via a fully outsourced consulting service or by using a SaaS solution.

Can You claim bad debts on Medicare HMO?

Bad debts are allowable only to an entity that payment is made on the basis of reasonable cost. Building upon the theory that bad debts must be related to services that are based upon cost reimbursement, Medicare HMO bad debts cannot be claimed on the Medicare cost report.

How can Medicare problems be solved?

Call 1-800-MEDICARE (1-800-633-4227) You can call 1-800-MEDICARE and speak with a representative to ask questions about Medicare or get help resolving problems with Medicare. We made a test call to this number and were greeted by a polite Medicare representative after being on hold for about 90 seconds.

What is Medicare debt?

A Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. Medicare overpayments happen because of: ● Incorrect coding.

Does Medicare add to the deficit?

Notes: For Social Security and hospital insurance, deficit equals spending on Medicare and Social Security minus non-interest income (mainly taxes and premiums). For supplementary medical insurance Parts B and D, deficit equals general revenue.

Does Medicare pay back?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

Can you send Medicare patients to collections?

To be considered a reasonable collection effort, a provider's effort to collect Medicare deductible and coinsurance amounts must be similar to the effort the provider puts forth to collect comparable amounts from non-Medicare patients.

How is Medicare financed?

How is Medicare financed? Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

What president took money from the Social Security fund?

3. The financing should be soundly funded through the Social Security system....President Lyndon B. Johnson.1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

Does Social Security have anything to do with balancing the budget?

The Mechanics of Social Security's Trust Funds Income is credited to the funds and disbursements for benefits and administration are counted against the funds' balances. The Social Security Administration has the legal authority to spend any accumulated balances plus any incoming revenues.

Is Social Security putting the U.S. in debt?

Of the $11.9 trillion in federal debt, $2.6 trillion is held by Social Security, $1.8 trillion is held by other government entities, and $7.5 trillion is held by the public (OMB 2010; Social Security Trustees 2009). Bonds are subject to interest rate risk if not held to maturity.

How do I get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Are Medicare liens negotiable?

The lien gives Medicare a claim to the judgment or settlement funds and the Medicare lien is superior to any other person or entity, including you as the insured party. Unlike cases involving private health insurance, Medicare offers little to no flexibility to negotiate away, or negotiate down, its lien amount.

How do I get Medicare reimbursement?

How to Get Reimbursed From Medicare. To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out.

What is Medicare Bad Debt?

Medicare reimbursable bad debt can be a significant source of additional reimbursement for many hospitals.

Criteria for Allowable Bad Debts

The debt must be related to covered services and derived from deductible and coinsurance amounts.

What is Medicare Advantage Bad Debt?

Medicare Advantage bad debt seeks to reimburse hospitals for unpaid and uncollectable deductibles and coinsurance incurred by private Medicare Advantage Plan members enrolled with Medicare Part C carriers.

What is the Difference between Traditional Medicare Bad Debts and Medicare Advantage Bad Debts?

Traditional Medicare bad debts are those unpaid deductibles and coinsurance amounts that are related to Medicare Part A and Medicare Part B beneficiaries. These Part A and B bad debts are reported on the Medicare cost report each year and reimbursed as a lump sum to the hospital.

How does Healthcare Reimbursement Solutions (HRS) Assist Hospitals with Medicare Bad Debt and Medicare Advantage Bad Debt?

Healthcare Reimbursement Solutions (HRS) ensures your Medicare Bad Debt listings are complete, accurate, and created according to regulations outlined by CMS.

What is the best way to settle medical debt?

Setting up a settlement program through a company is often a better solution if you have multiple accounts in collections. Bankruptcy. If the amount of medical debt you owe is simply too much for you to ever pay back, bankruptcymay be the best option. It will definitely damage your credit score.

How to put medical debt in a DMP?

To put your medical debt in a DMP, you must be enrolling in the program primarily for credit card debt. Read about credit counseling below to find out how it works. Credit counseling. Certified credit counselorshelp you find the best way for you to pay off your debt.

What is a credit counseling program?

Often, this involves enrolling in a debt management program (DMP) in which your counselor consolidates your debt payments and guides you along the path toward debt relief. Like negotiating your own payment plan, a DMP will help you pay off your debt in full.

What happens when a medical bill goes to collections?

When the bill goes to collections, there may be more room to negotiate than you think. “You’re going to be negotiating it like any other collection account,” says Detweiler about medical debt in collections. “You’re going to see if you can get a reduction in the amount that you owe.”

How long is the interest free period on a medical credit card?

Usually, they offer a 6-12-month interest-free period. Calculate what your monthly payments would be to pay off what you owe in that period. If it’s feasible, the medical credit card may be worth it. If you won’t be able to make the payments and you’ll get hit with interestlater, see if there is another way to pay.

What percentage of people with medical debt are struggling?

This study also concluded that the majority of those with medical debt (66 percent) are struggling because of a one-time or short-term medical event. It happens to both those with insurance and those without – expensive procedures and medical care don’t discriminate.

How to get medical bills back from collections?

Contact your insurance if they were supposed to pay. If you are disputing the bill, contact your medical provider. They may be able to pull it back from collections.

How much is Medicare taxed?

Medicare is currently taken out as part of your payroll taxes along with Social Security at a rate of 2.9% of your modified adjusted gross income. Like Social Security, this tax is typically split down the middle between you and your employer, with each side paying 1.45%.

How much Medicare did the average person pay in 2010?

As of 2010 (but based on 2012 dollars), the average man and woman were paying $61,000 in Medicare taxes over their lifetimes. Yet, men and women were receiving $180,000 and $207,000, respectively, worth of lifetime benefits (women have a longer life expectancy than men). This gap between taxes paid and benefits received is only expected ...

How much did Medicare spend in 2014?

First, Medicare Part D (drug plans) spending was "only" $78 billion in 2014, meaning even with staunch negotiations the program might only save between 2% and 5% of its total annual expenditures, by my estimate. That's not going to give the Medicare program much of an extension beyond 2030. The other issue is simply innovation.

What would happen if drug companies lost their pricing power?

If drug developers lose their pricing power in the U.S., they could take their research, and jobs, overseas. Since U.S. drugmakers are known to subsidize emerging and developing markets with medicines, prescription drug reforms may also reduce access to these medicines overseas. 4. Index Medicare to life expectancies.

What is Bernie Sanders' plan?

Democratic Party candidate Bernie Sanders has suggested creating a universal health plan for Americans of all ages, which would require a 2.2% healthcare premium tax on all individuals and a 6.2% tax on employers. 2. Institute means-testing. Another popular solution would be to institute means testing.

Is it tougher for Medicare to police claims?

The problem is in convincing lawmakers that a model beyond the institutional hospital setting should be reimbursed. It may also be tougher for Medicare officials to police claims if they aren't made within the traditional settings of a hospital.

Is there a cap on Medicare?

There is no earnings cap on the Medicare tax, so raising the earnings cap isn't an option here . If taxes are going to rise, they're likely going to rise for everyone. While increasing taxes could indeed stem a cash shortfall, it also could strain the pocketbooks of tens of millions of working Americans.

How to respond to medical debt?

People commonly respond to medical debt by delaying vacations, major household purchases, cutting back on household expenses, working more, borrowing from friends and family, and tapping retirement or college savings accounts. If you’re faced with medical debt you can’t pay, try these tips for reducing what you owe so you can minimize ...

How to negotiate a medical bill?

If you want to negotiate your bill, speak with your healthcare provider’s medical billing manager—the person who actually has the authority to lower your bill. Don’t wait until your bill is delinquent or in collections, at which point your credit score will be seriously damaged.

Why are medical bills not paid?

It’s not a personal failure, however; it’s a common affliction. In the U.S. some people are not paying their medical bills because they literally can't afford them.

What is a medical billing advocate?

Medical billing advocates are insurance agents, nurses, lawyers, and healthcare administrators who can help decipher and lower your bills. They’ll look for errors, negotiate bills, and appeal excessive charges. Expect to pay an advocate around 30% of the amount by which your bill is reduced.

Why are people not paying their medical bills?

In the U.S. some people are not paying their medical bills because they literally can't afford them. According to a 2019 report from T he Journal of General Internal Medicine, About 137.1 million U.S. adults faced financial hardship due to medical bills.

Who can help with medical billing?

Few are experts in medical billing. A savvy choice is to enlist the help of someone who is: a medical caseworker, debt negotiator, or medical billing advocate. These professionals might be able to reduce what you owe when you can’t or are too timid to try.

Do hospitals have to provide free services to low income patients?

In fact, according to Fox, some hospitals are required by state law to provide free or reduced services to low-income patients. As soon as your bills arrive, let your providers know if medical problems have affected your income and ability to pay.

How can the deficit problem be resolved?

Politicians regularly suggest that the deficit problem can be resolved as the economy improves because revenues through taxes naturally increase as incomes rise through stronger growth. Such thinking encourages postponing actions that are politically unpopular, such as raising taxes or cutting popular programs.

What percentage of federal spending goes to Medicare?

More than one-half (52%) of federal expenditures go to pensions and healthcare – primarily the two entitlement programs, Social Security and Medicare/Medicaid. In addition to general tax increases and spending cuts, the CBO recommended a number of revenue increases and benefit cuts specific to SS/Medicare/Medicaid and other government health programs – the entitlement programs many believe are the root of our deficits:

How much would the CBO add to the federal budget?

Implementing all of these measures would add more than $606 billion annually to federal revenues.

What is the deficit cutting strategy?

A majority of Americans favor a deficit-cutting strategy that increases government revenues and cuts government expenditures. Unfortunately, legislators have shown little interest and less action in tackling the issues. Ultimately, the political stalemates have been resolved by temporarily raising the debt ceiling without any meaningful change in our fiscal approach.

How much will the federal debt be in 2025?

According to CBO projections, net interest costs for the federal debt are projected to more than triple from $223 billion in 2015 to $772 billion in 2025. Projections Do Not Include the Costs of New Wars for Defense Against Terrorism.

Will the cost of Medicare and Social Security rise?

Costs for the Major Entitlement Programs Will Rise Sharply. The aging population, rising healthcare costs per person, and increased costs of the Affordable Care Act are likely to boost federal spending for Social Security, Medicare, and Medicaid if current laws remain unchanged.

What is the definition of Medicare bad debt?

Allowable Medicare Bad Debt Defined. The CFR (Code of Federal Regulations) at 42 CFR 413.89 (e) defines the criteria for an allowable Medicare bad debt. It requires that the Medicare bad debt meet four basic criteria: Debt must be related to covered services and derived from deductible and coinsurance amounts;

What is Medicare like amount?

Where a collection agency is used, Medicare expects the provider to refer all uncollected patient charges of like amount to the agency without regard to class of patient. The "like amount" requirement may include uncollected charges above a specified minimum amount.

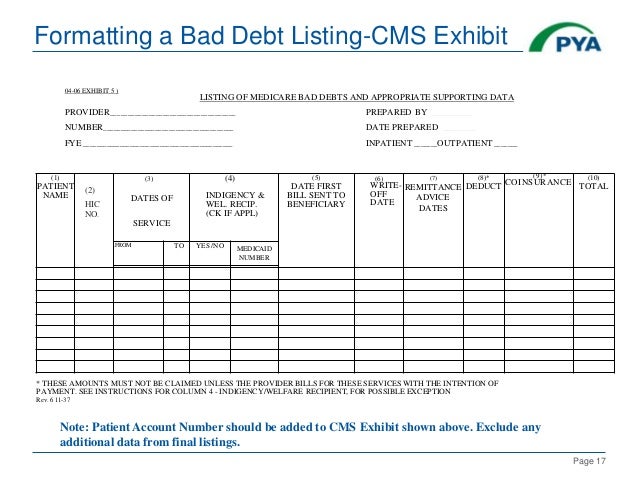

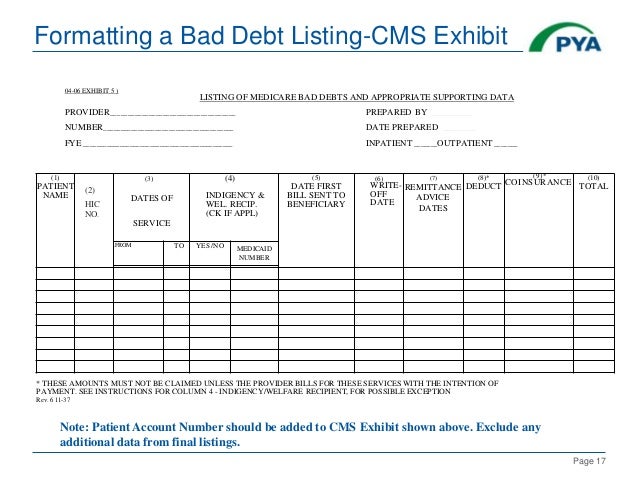

What is the CMS Form 339 Exhibit 5?

Providers should utilize CMS Form 339 exhibit 5 for claiming bad debts or a variation of the exhibit which encompasses the attributes of the exhibit which are stated in the PRM 15-2 at 1102. Exhibit 5 requires the patient name, the Medicare Beneficiary ID Number, the dates of service, whether the patient has been deemed indigent and their Medicaid number if this was the method utilized to determine indigence, the date of first bill send to the beneficiary, the date the bad debt was written off, the remittance advice date, the deductible and coinsurance amount, and the total Medicare bad debt claimed (which should be reduced by recoveries as indicated in a separate column).

What is a reasonable collection effort?

To be considered a reasonable collection effort, the PRM 15-1 at 310 requires that a provider's effort to collect Medicare deductible and coinsurance amounts be similar to the effort the provider puts forth to collect comparable amounts from non-Medicare patients. Specifically, the collection effort must involve the issuance of a bill on or shortly after discharge or death of the beneficiary to the party responsible for the patient's personal financial obligations. Delays in sending a timely first bill could result in the disallowance of the bad debt claim. Additionally, the PRM indicates that the collection effort should include other actions such as subsequent billings, collection letters and telephone calls or personal contacts with this party which constitute a genuine, rather than a token, collection effort. The provider's collection effort may include using or threatening to use court action to obtain payment.

What should a provider take into account when evaluating a patient's total resources?

The provider should take into account a patient's total resources which would include, but are not limited to, an analysis of assets (only those convertible to cash, and unnecessary for the patient's daily living), liabilities, and income and expenses.

Can HMO bad debt be claimed on Medicare?

Building upon the theory that bad debts must be related to services that are based upon cost reimbursement, Medicare HMO bad debts cannot be claimed on the Medicare cost report. According to CMS, Medicare pays most HMOs on a capitated basis and any arrangements between a hospital or other provider and an HMO is a contractual arrangement between the two. When an HMO sends a member patient to a provider for services and that patient does not pay coinsurance and deductible amounts, the provider must deal with the HMO and not the Medicare program.

Is Medicare a borne expense?

Under Medicare, costs of covered services furnished to beneficiaries are not to be borne by individuals not covered by the Medicare program, and conversely, costs of services provided for other than beneficiaries are not to be borne by the Medicare program as indicated at 42 CFR 413.89 (d).

Raise the Eligibility Age

Some Democrats are currently pushing to lower the Medicare eligibility age from 65 to 60, but from a financial perspective, it's the opposite that needs to happen.

Earmark Revenue From an Existing Tax

Policymakers could take an existing tax, the unearned income Medicare contribution tax, also known as the net investment income tax, and use it to fund Medicare directly. The Health Care and Education Reconciliation Act established the tax in 2010 to help pay for the Affordable Care Act, but the money currently goes into a general revenue fund.

Modify Advantage Payments

One way to cut Medicare spending is to lower what the program pays to private Medicare Advantage insurers and medical providers. Medicare Advantage, or Part C, is not separately funded and instead is supported by money from Parts A, B and D.

Negotiate Drug Prices

Under current law, Medicare is prohibited from negotiating drug prices, but this might change if Democrats are able to pass the Build Back Better Act. In the version that the House passed, a provision was included for Medicare to negotiate prices for a small number of high-cost drugs, starting in 2025 for Part D and in 2027 for Part B.

Shift to a Defined Contribution Program

One of the more controversial fixes calls for transforming Medicare into a defined contribution program, similar to the one for federal employee health benefits.