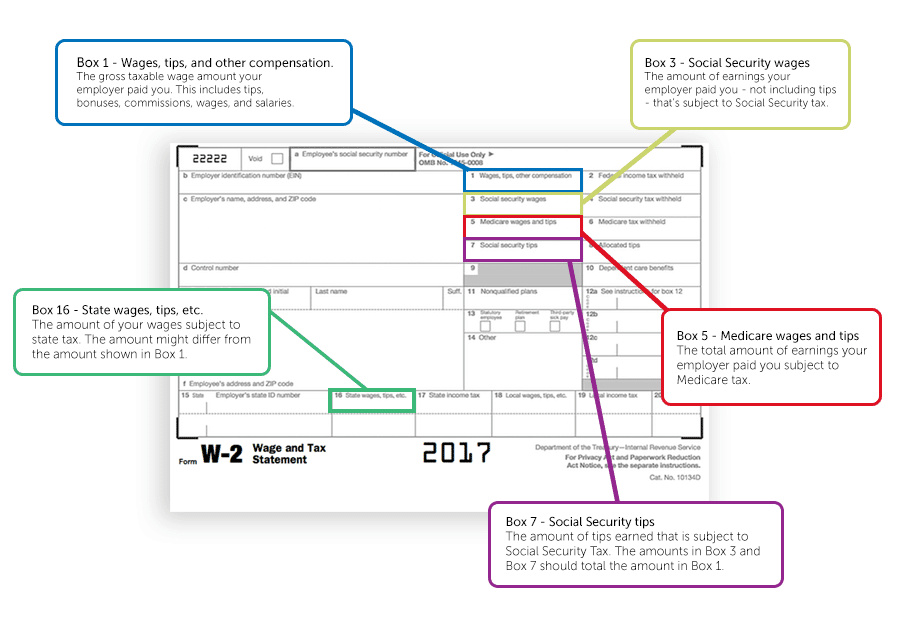

The “Medicare wages and tips” portion is box number 5 on the W-2 form. It indicates the total wages and tips that are subject to Medicare tax withholding. The number that is indicated in this Medicare wages and tips on box number 5 is typically the same as the “wages, tips, other compensation” section.

How are Medicare wages calculated on W2?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form. These matching numbers show that the Medicare tax is based on 100% of an employee’s earnings. Which Wages Are Subject …

Why are Medicare wages higher on W2?

The “Medicare wages and tips” portion is box number 5 on the W-2 form. It indicates the total wages and tips that are subject to Medicare tax withholding. The number that is indicated in this Medicare wages and tips on box number 5 is typically the same as the “wages, tips, other compensation” section. Keep in mind that there is no wage base limit or cap for Medicare tax …

How to calculate W2 wages from a pay stub?

Jan 01, 2022 · You may also be required to allocate tips if the total tips reported to you are less than 8% (or an approved lower rate) of gross receipts. Report the allocated amount on the employee's Form W-2, Wage and Tax Statement. Form 4137 is used by employees to report and pay their share of social security and Medicare taxes on tips they didn't report to you. This …

How to calculate your W2?

The sum of your earnings subject to Medicare tax withholding is listed in the Medicare wages and tips section of your W2 form. The number in this box is usually the same as the number in the W2 form's "wages, tips, other compensation" portion. The Medicare tax is based on 100 percent of an employee's salary, as seen by these figures.

What is included in Medicare wages and tips on w2?

What are considered Medicare wages?

What is wages and tips on w2?

Where does Medicare wages and tips go on 1040?

Why is Medicare wages higher on W-2?

What is not included in Medicare wages and tips?

What is the difference between wages and Medicare wages on W-2?

Is wages tips and other compensation gross or net?

What is the difference between wages tips and Social Security wages?

How do I report tips to my W-2?

How do I report tip income on my taxes?

Are tips included in W-2?

How much is Medicare withholding?

This means that, for those whose earnings are above the given threshold, their Medicare tax withholding will be 2.35% which is 1.45% plus the additional 0.9%. Employers are not required to give contributions to this additional tax from their end.

What is Medicare tax?

Medicare taxes that are collected from workers and employers are used to fund the Medicare program. This is a program that helps Americans older than 65 with disabilities by helping with the costs of the following:

What is Workstream hiring?

Workstream is an all-in-one hiring & texting solution based in San Francisco. Join thousands of happy hiring managers. Call or text message us:(415) 767-1006

What is the purpose of the Medicare tax?

It aims to provide health insurance to Americans who are uninsured because of economic challenges.

What is the Medicare tax rate for 2021?

Medicare taxes are paid by both the employer and employee. The present rate in 2021 is 1.45% for each. Again, the rate will depend on the annual income of the employee.

Is there a wage cap on Medicare?

Keep in mind that there is no wage base limit or cap for Medicare tax because it is based on a hundred percent of the earnings of the employee. All employees need to pay Medicare tax no matter how much they earn. The specific amount that a worker is taxed will depend on their annual earnings. But there are specific pre-tax deductions that are exempt from Social Security and Medicare taxes. Examples are 401(k) retirement contributions and life insurance premiums.

Do employers stay updated on tax rates?

A tip to both employers and employees, always stay updated on the current tax rates.

What is Form 4137?

Form 4137 is used by employees to report and pay their share of social security and Medicare taxes on tips they didn't report to you. This should include any allocated tips shown on Form W-2, unless the employee has adequate records (a daily tip record or other credible evidence) to show that the employee didn't receive the allocated tips.

When do you report tips to your employer?

Tipped employees are required to report their cash tips to their employers by the 10th of the following month after the month the tips are received. If the 10th falls on a Saturday, Sunday, or legal holiday, your employee must report tips by the next day that's not a Saturday, Sunday, or legal holiday. Cash tips include tips paid by cash, check, ...

What happens if an employee doesn't report tips to the employer?

However, if an employee fails to report tips to his or her employer, many employers don't realize that they're also liable for the employer share of social security and Medicare taxes on the unreported tips, though not until the notice and demand is made to the employer by the Service.

Do you have to report tips to Social Security?

No report is required for months when tips are less than $ 20. You, as an employer, must collect and pay the employee share of social security and Medicare taxes on tips your employee reports. You can collect these taxes from the employee’s wages or from other funds he or she makes available.

Do you have to file Form 8027 for tips?

The employer isn't required to withhold and pay the employee share of social security and Medicare taxes on unreported tips. You must file Form 8027 if you operate a large food or beverage establishment. A large food or beverage establishment is a food or beverage operation located in the 50 states or in the District of Columbia ...

How is Medicare calculated on W2?

How are Medicare wages calculated on w2? It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee's Medicare wages as Medicare tax and submit a matching amount to cover the costs of the Medicare program. Click to see full answer.

How to calculate wages on W2?

Similarly, how are wages calculated on w2? Find the amount of local, state, and income taxes on your paystub that are withheld from your earnings. Next, multiply these numbers by the number of times you get paid every year. For example, if you get paid twice a month, you would multiply these numbers by 24.

How to determine taxable Medicare wages?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What is Medicare payroll tax?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the "Medicare tax.". Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to retirees and the.

Where to find taxable wages on W-2?

Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2. Begin with the Gross Pay YTD (year-to-date) and make the following adjustments, if applicable:

What to call if your W-2 does not match Social Security?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2, call Central Payroll, 617-495-8500, option 4 for assistance.

Why are W-2s different from Social Security?

The most common questions relate to why W-2 Wages differ from your final pay stub for the year, and why Federal and State Wages per your W-2 differ from Social Security and Medicare Wages per the W-2. The short answer is that the differences relate to what wage amounts are taxable in each case. The following steps will walk you through the calculations of the W-2 wage amounts and enable you to reconcile these to your final pay stub for the year.

What to call if your W-2 does not match Box 1?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 1 Federal Wages and Box 16 State Wages on your W-2, call Central Payroll, 617-495-8500, option 4, for assistance.

What is the Social Security base for 2019?

The Social Security Wage Base for 2019 was $132,900. To determine Social Security and Medicare taxable wages on your W-2, again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable:

What is the Medicare tax rate in Box 6?

Box 6 displays how much you withheld from an employee’s wages for Medicare tax. The employee share of Medicare tax is 1.45% of their wages. The amount in Box 5 multiplied by the Medicare tax rate should equal Box 6. But if the employee earned above $200,000 (single), their tax liability should be greater.

Where to report local income tax withheld from wages?

Report any local income tax withheld from the employee’s wages in Box 19. Leave this box blank if it is inapplicable.

What is Box 2?

Box 2 shows how much federal income tax you withheld from an employee’s wages and remitted to the IRS.

What to do if an employee has not received a Social Security card?

If your employee applied for a Social Security card and has not received it, don’t leave the box blank. Instead, write “Applied For” in Box A on the Social Security Administration copy. When the employee receives their SS card, you must issue a corrected W-2.

What is box 1 in a tax return?

Box 1: Wages, tips, other compensation. Box 1 reports an employee’s wages, tips, and other compensation. This is the amount you paid the employee during the year that is subject to federal income tax.

How much is Box 4 of Social Security?

The employee portion of Social Security tax is 6.2% of their wages, up to the SS wage base. Box 4 cannot be more than $8,537.40 ($137,700 X 6.2%) for 2020.

What is the SS wage base for 2020?

The number in Box 3 should not be higher than the Social Security wage base. For 2020, the SS wage base is $137,700.