Your 5-Point Checklist for Choosing a Medicare Part D Plan

- Low or $0 Copays. Some Medicare Part D plans offer $0 copays for certain drugs on their formularies (drug list).

- Medication Home Delivery. Trips to the pharmacy can be time consuming and may require advance planning. Medication...

- Drug Pricing Tool. Medicare Part D plans with a drug pricing tool let you...

Full Answer

How do I choose the best Medicare Part D plan?

The details of Part D coverage can vary by plan, but Medicare does provide some guidance on basic coverage rules. Review all your options and find out the best time to sign up for a Part D plan before choosing one. Finding the best Medicare coverage for your needs is a complicated process that can be filled with many choices.

What is a Medicare Plan D?

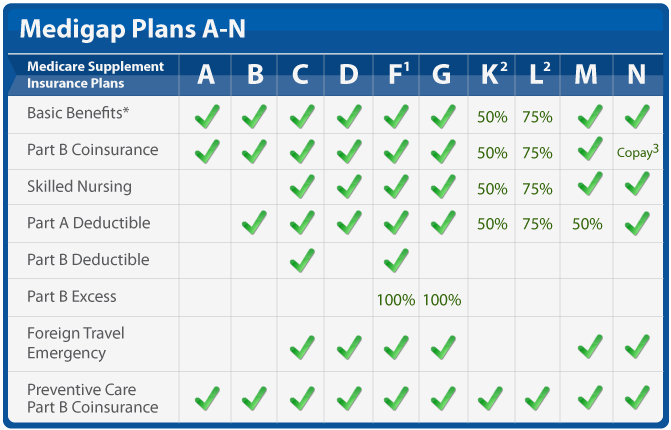

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing.

Where can I find information about Medicare Part D drug coverage?

Official Medicare site. Learn about the types of costs you’ll pay in a Medicare drug plan. Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What should I look for in a drug plan?

Look at drug plans offering coverage in the Coverage gap, and then check with those plans to make sure they cover your drugs in the gap. I want my drug expenses to be balanced throughout the year. Look at drug plans with no or a low Deductible, or with additional coverage in the Coverage gap.

What should I look for in a Part D plan?

En español | Your goal in choosing a Part D plan is to select a plan that 1) covers all your drugs with the lowest out-of-pocket cost, 2) provides good service and 3) checks the box on any other personal requirements you might have.

Which Medicare D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What do I need to know about Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Which medication would not be covered under Medicare Part D?

For example, vaccines, cancer drugs, and other medications you can't give yourself (such as infusion or injectable prescription drugs) aren't covered under Medicare Part D, so a stand-alone Medicare Prescription Drug Plan will not pay for the costs for these medications.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What is the maximum out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What percentage does Medicare D cover?

Part D Financing The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.