Besides premiums, your Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

How much does Medicare Part D prescription drugs cost?

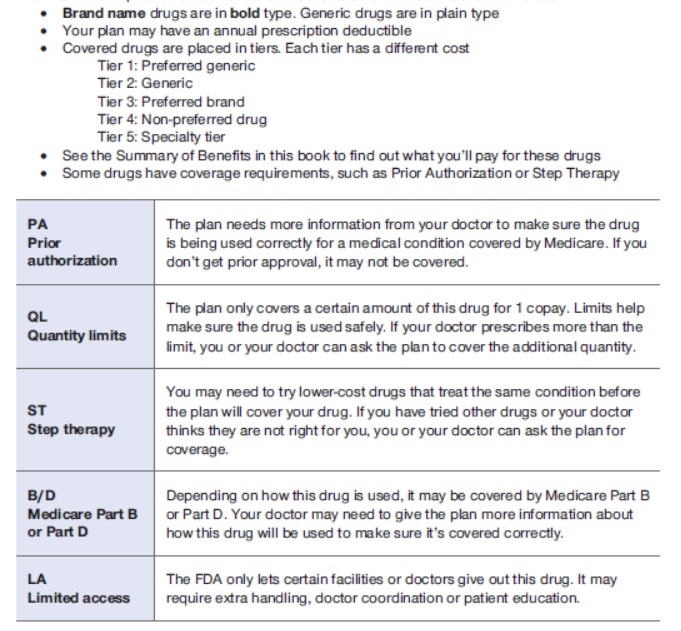

Policies that cover prescription drugs usually put covered drugs into cost tiers, with individual cost-sharing for the medications on each tier. How Much is Medicare Part D? The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan.

What is a Medicare Part D plan?

A Medicare program for people with limited income and resources that helps lower Medicare drug plan costs (like premiums, deductibles, and coinsurance). , you won’t have to pay a penalty. Example of the Part D penalty.

What is the donut hole in Medicare Part D?

In all Part D plans in 2020, after you've paid $6,350 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.60 for generic drugs and $8.95 for brand-name medications each month or 5% the cost of those drugs, whichever costs more. 6

How much does Medicare Part D cost in 2021?

Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2021 is $41.64 per month. 1

What items are covered under Medicare Part D?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs....Part D coverageHIV/AIDS treatments.Antidepressants.Antipsychotic medications.Anticonvulsive treatments for seizure disorders.Immunosuppressant drugs.Anticancer drugs (unless covered by Part B)

What does Medicare Part D pay for?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What is not covered under Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.

What does the standard Medicare Part D plan design include?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage. Select a stage to learn more about the differences between them.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Are OTC drugs covered by Part D?

This allows you to purchase select, eligible health and wellness items like allergy pills, cold and flu products, first aid supplies, vitamins and more. This is important because Original Medicare and Medicare Part D do not pay for OTC drugs.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What is true about Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

How do I avoid the Medicare Part D donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

Is there still a donut hole in Medicare Part D?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people with Medicare won't pay anything once they pass the Initial Coverage Period spending threshold.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Part D?

Copayment tiers. Summary. Medicare Part D is the part of Medicare that covers prescription drug costs. Medicare requires that all people aged 65 years and over have some form of creditable prescription drug coverage. A person may be able to set up prescription drug coverage through a Medicare Part D plan, a bundled Medicare Advantage plan, ...

How much is deductible for Part D?

The deductible for a Part D policy should not exceed $435 for the year 2020. Copayments: Some people may pay a flat rate for medications in certain tiers, such as $5 for generic medications. These count toward their yearly out-of-pocket expenses.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What are the tiers of Medicare?

The following are examples of the formulary tiers: Tier 1: These are drugs with a low copayment or none at all. This tier includes most generic prescription medications.

What is the Medicare donut hole?

Out-of-pocket costs include premiums, coinsurances, and copayments. Once a person with Part D and Medicare have paid $4,020 for medications, the person enters a coverage gap known as the donut hole.

How does Medicare determine the amount of Social Security?

Medicare determines this amount using the monthly adjusted gross income from the enrollee’s most recent tax return. A person does not pay their IRMAA to the insurance company that holds their plan. Instead, Medicare will often deduct this amount from their Social Security check.

How much is Medicare Part D 2020?

For 2020, this premium is $32.74. For 2019, the Medicare Part D premium was $33.19. However, these premiums range in cost, varying by region and plan. For example, some Part D premiums may be as low as $12.18 in California, while Part D might have a $191.40 premium in South Carolina. Medicare can collect the Part D premium from Social Security ...

What is Medicare Part D?

Medicare Part D is the prescription drug portion of Medicare that helps members pay for brand-name and generic prescription drugs.

Medicare Part D eligibility and enrollment

You must first enroll in Medicare A and B before you can apply for Part D. To qualify for Part D, you must fall into one of the below categories:

What does Medicare Part D cost for 2022?

Your Medicare Part D insurance provider sets your monthly plan premium and bills you directly for that amount. If you’re required to pay a penalty for enrolling late in Part D, that amount is also part of your bill and is paid to your insurance company.

How do I choose a Medicare Part D plan?

When choosing a Medicare Part D policy, consider these possible scenarios:

Frequently asked questions

Even if you have Medicare Part D, you may be able to reduce costs through a program called Extra Help, which assists with premiums, deductibles, copays and coinsurance. With Extra Help, you are not subject to late enrollment fees or costs related to the Part D donut hole.

Methodology

Cost, eligibility and enrollment information for Medicare Part D was sourced from Medicare's website, Medicare.gov. Specific areas of focus were sections on how to get prescription drug coverage as well as costs for Medicare drug coverage.

Introduction

If you are retiring soon, the rising cost of prescription drugs may be one of your major concerns. However, there is good news. If you opt to enroll in a Medicare Part D plan, you don’t have to pay the entire cost of your prescription drugs. A private insurer will shoulder a portion of your drug expenses.

What is a Medicare Part D plan?

Most people over the age of 65 have Medicare Part A (hospital insurance) and Part B (medical insurance). However, neither parts cover prescription drugs.

What do Medicare Part D plans cost?

The cost of Medicare Part D depends on factors like your income, enrollment date, the type of prescription drugs (brand-name or generic), and the pharmacy (in-network or preferred). These variables are used in computing your monthly premiums.

How do you buy a Medicare Part D plan?

Since you are now aware of Medicare Part D costs, you are ready to look for a Part D plan that is right for you.

What are some guidelines in finding the right Medicare Part D plan?

Here are some helpful tips in finding a suitable Medicare Part D plan:

Final Words on Medicare Part D Costs

When you decide to get a Medicare Part D plan, it is advisable to balance your future medical needs with the Medicare Part D cost. If you are not satisfied with your current plan, remember that you can shift to another Part D plan on the next available enrollment period.

What is Medicare Part D?

One of the newer elements of the Medicare program is prescription drug coverage, added under what's known as Medicare Part D. Part D coverage is an optional add-on that participants can use regardless of whether they have traditional Medicare coverage under Parts A ...

What is Part D insurance?

Part D comes with highly variable costs. Less expensive plans often omit certain drugs from their coverage, while more expensive plans typically offer more comprehensive selections of prescriptions. Plans are also allowed to have different copayments and to treat various types of drugs differently, such as charging less for generic versions of drugs than for name-brand pharmaceuticals.

How much is the deductible for Part D in 2021?

Some Part D plans charge deductibles, and the annual limit on that amount in 2021 will go up by $10 to $445. However, a plan can charge a smaller deductible, or no deductible at all. There are limits on how much you'll have to pay for drugs.

How much is the Part D premium in 2021?

The figures below apply to whatever your income was two years before now, or 2019 for premiums paid in 2021: For individuals with this income: Or joint filers with this income: The Part D premium surcharge in 2021 is: $88,000 to $111,000.

Do Part D plans charge a monthly premium?

With those coverage differences in mind, some Part D plans don't charge a monthly premium at all. Others can be quite expensive.

Does private insurance have Part D?

Instead, private insurance companies come out with Part D prescription drug plans of their own, and it's up to participants to choose the plan that fits best with their individual needs. Image source: Getty Images. There is some uniformity across all Part D plans.

Is Medicare Part D good for retirement?

Prescription drugs play a vital role in keeping people healthy, but paying for them in your retirement years can be challenging. Medicare Part D offers a valuable way to control healthcare costs, but it's important to know the ins and outs of the program to make sure that you get everything you can out of it.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

How much will a generic drug cost in 2020?

The remaining costs will be paid by the pharmaceutical manufacturer and your Part D plan. 6 . For example, if a brand-name drug costs $100, you will pay $25, the manufacturer $50, and your drug plan $25. For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket ...

Can Medicare Part D be expensive?

A Word From Verywell. Prescription medications can be costly, but don't let that intimidate you. Know what your Medicare Part D plan covers and how much you can expect to pay. With this information in hand, you can budget for the year ahead and keep any surprises at bay.

What is the coverage gap in Medicare Part D?

Another factor to consider in your Medicare Part D cost is the coverage gap, commonly known as the “donut hole.” Most Part D plans have a temporary limit to their benefits. The coverage gap doesn’t affect everyone, though—it comes into play once you’ve spent a certain amount. In 2018, once you’ve spent $3,700 on covered prescriptions, you’re in the donut hole. When you meet your out-of-pocket spending limit, you’re out of the coverage gap.

Is Medicare Part D insurance?

Medicare Part D plans are Medicare-approved insurance plans, but private companies administer them . This makes their costs widely variable. Your Medicare Part D cost could depend on where you live, what kind of plan you have, which drugs you use and whether they’re covered in your plan’s formulary, whether you take generic or brand-name drugs, and many other factors. Your premiums and copays are variable, too. In addition, you may pay extra fees if you enroll after your initial enrollment period.