What companies offer Medicare Part D?

Mar 06, 2022 · Definition of Medicare Part D Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

What are the best Medicare Part D plans?

How Part D works with other insurance. Employer or union health coverage. This is health coverage from your, your spouse’s, or other family member’s current or former employer or union. If you have drug coverage based on your current or previous employment, your employer or union will notify you each year to let you know if your drug coverage is creditable.

What plans are available for Medicare Part D?

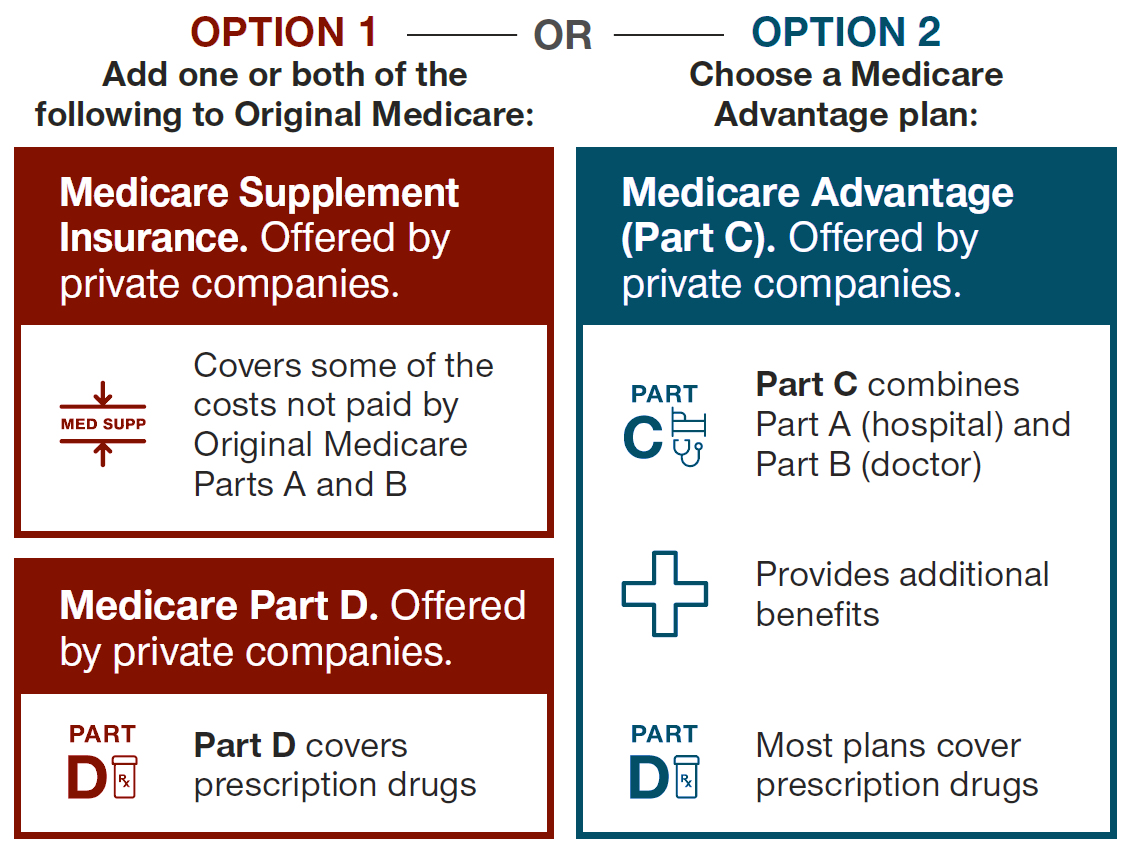

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in the original Medicare program. Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package. Within these two broad categories are many individual plans, …

What is the cheapest Medicare Part D plan?

Both types of Medicare Part D coverage: Are available from private insurance companies that contract with Medicare Require that you live within the plan’s service area Require that you enroll in Original Medicare, but the stand-alone plans only require you to have Part A or Part B (or both). Medicare Advantage plans require you to have both.

What type of coverage is Medicare Part D?

Medicare drug coverage (Part D) helps you pay for both brand-name and generic drugs. Medicare drug plans are offered by insurance companies and other private companies approved by Medicare. You can get coverage 2 ways: 1.

What type of insurance is Medicare Part D quizlet?

Medicare Part D help cover the cost of prescription drugs, is run by medicare approved insurance companies, may help lower prescription drug costs, and may protect against higher costs in the future.

Is Medicare Part D primary insurance?

Your Medicare Part D coverage is primary to both the retiree Group Health Plan and the SPAP coverage. The Medicare Part D plan will pay first, then the retiree Group Health Plan would be billed second.Oct 1, 2021

What type of insurance is Medicare?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

How can an individual obtain Medicare Part D quizlet?

Created prescription drug coverage for Medicare beneficiaries. How can an individual get Part D? Only through private companies.

How do I know if Medicare is primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

How do you determine which insurance is primary and which is secondary?

The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer. The secondary payer only pays if there are costs the primary insurer didn't cover.Dec 1, 2021

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Is Medicare federal or state?

federalMedicare is a federal program. It is basically the same everywhere in the United States and is run by the Centers for Medicare & Medicaid Services, an agency of the federal government.

What is Medicare Part A and B mean?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is extra help?

Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. , your food stamp benefits may decline, but that decline will be offset by Extra Help.

What is the state pharmaceutical assistance program?

State Pharmaceutical Assistance Program. Each state decides how its State Pharmaceutical Assistance Program (SPAP) works with Medicare prescription drug coverage. Some states give extra coverage when you join a Medicare drug plan. Some states have a separate state program that helps with prescriptions.

What is Indian health care?

The Indian health care system, consisting of tribal, urban, and federally operated IHS health programs, delivers a spectrum of clinical and preventive health services through a network of hospitals, clinics, and other entities. Many Indian health facilities participate in the Medicare drug program.

What type of insurance is considered creditable?

The types of insurance listed below are all considered. creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage .

What is a long term care pharmacy?

Long-term care facility. Long-term care pharmacies contract with Medicare drug plans to provide drug coverage to their residents. If you're entering, living in, or leaving a nursing home, you'll have the opportunity to choose or switch your Medicare drug plan.

What is a Part D plan?

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in ...

Can I join a Medicare Advantage plan if I have a PPO?

Most of these plans include Part D prescription drug coverage. Note that if you enroll in an HMO or PPO that doesn’t offer drug coverage , you cannot join a stand-alone Part D plan to get drug coverage. But if you enroll in a much less common type ...

Is Medicare Advantage a PPO?

Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package. Within these two broad categories are many individual plans, each of which has different costs and benefits. Each plan has its own formulary — the list of drugs it covers — and sets ...

Can I add prescription drug coverage to Medicare Advantage?

But if you enroll in a much less common type of Medicare Advantage plan called a private fee-for-service (PFFS) plan, and it doesn’t offer drug benefits, you would be able to add prescription drug coverage by joining a stand-alone Part D plan.

How many people are covered by Medicare Part D?

Of the nearly 44 million people who have Medicare Part D coverage, about 58% are enrolled in stand-alone Medicare Part D Prescription Drug Plans, according to the Centers for Medicare & Medicaid Services.

What is Medicare Advantage Part C?

With a Medicare Advantage plan, your Original Medicare (Part A and Part B) benefits are administered to you by a private, Medicare-approved insurance company. You’re still in the Medicare program, even though the plan is handling your benefits for you.

What is Medicare Part D?

Medicare Part D is Medicare’s prescription drug coverage program. Unlike Original Medicare Parts A and B, Part D plans are optional and sold by private insurance companies that contract with the federal government. Part D was enacted in 2003 as part of the Medicare Modernization Act and became operational on January 1, 2006.

What happens if you have Medicare Part D and another insurance?

If someone has Medicare Part D and another insurance policy with drug coverage, there will be a coordination of benefits between the separate policy companies to determine which policy is the primary payer and which is the secondary. The determination of payments for prescription drugs will be based on the enrollee’s personal situation.

What is the spending gap for Medicare Part D?

Beginning in 2020, the spending gap is reduced to a ‘standard’ co-payment of 25%, the same as required in initial spending policies. Even with the wide range of co-payments and deductibles, Medicare Part D drug coverage has proven beneficial for policy enrollees who otherwise could not afford their life-saving medications.

Is Medicare Part D private or union?

There are dozens of variables in the available Medicare Part D plans, private drug coverage plans, employer- provided plans for those still working and those retired, and union plans for those still working and those retired. Medicare Part D enrollees can benefit from a consultation with a prescription drug plan provider ...

Is Medicare the primary payer?

When Medicare Part D is the Primary Payer: • When someone is retired and enrolled in Part D while also having another health insurance policy with drug coverage, Medicare is the primary payer. The other insurance policy is the secondary payer on any remaining amount due up to the limits of the policy. If there is still any remaining unpaid amount, ...