People who are eligible for Medicare commonly choose the Original Medicare Plan or a Medicare Advantage Plan. The Original Medicare Plan is a fee-for-service plan managed by the federal government. Most people on the Original Medicare Plan have a combination of what is referred to as Part A and Part B benefits.

What is the most popular Medicare plan?

Medicare Plan G is one of the most popular plans in 2022. It provides comprehensive coverage at a cost-effective rate. Plan G will cover all costs after Original Medicare except the Part B annual deductible, which is $233 in 2022. Since Plan G covers Part B excess charges at 100%, you do not need to worry if a doctor is a participating or ...

What is the most popular Medicare supplement?

What is the most popular Medicare supplement plan for 2020?

- Blue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas.

- AARP United Healthcare.

- Humana.

What are the most popular Medicare supplement plans?

Three Popular Medicare Supplement Plans

- Blue Cross Blue Shield According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ...

- AARP United Healthcare The United Healthcare Medicare Supplement plan is also very popular. It offers Plans A, B, C, D, F, G, K, L, and N. ...

- Humana

What is the best Medicare supplement insurance?

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. ...

- You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. ...

- A Medigap policy only covers one person. ...

What Medicare plan is the most popular?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

What is the difference between Part C and Part D Medicare?

Medicare Part C and Medicare Part D. Medicare Part D is Medicare's prescription drug coverage that's offered to help with the cost of medication. Medicare Part C (Medicare Advantage) is a health plan option that's similar to one you'd purchase from an employer.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

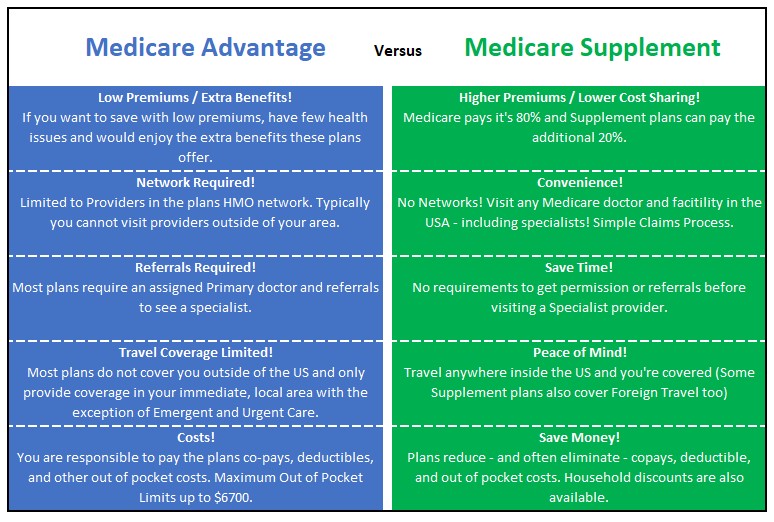

Are Medicare Advantage plans better than traditional Medicare?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Do I need Part B Medicare?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What is the difference between Medicare A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

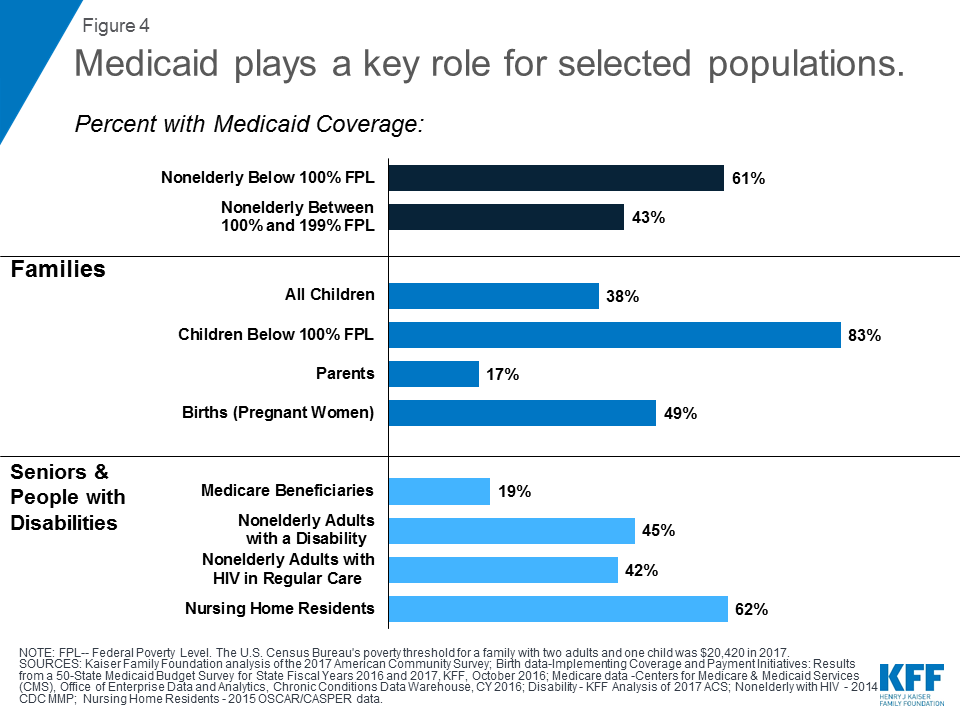

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What age does Medicare cover?

Medicare provides healthcare coverage to people over age 65 and those with disabilities or certain health conditions . This complex program has many parts, and it involves the federal government and private insurers working together to offer a wide variety of services and products.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) is a private insurance product that gives you all the coverage of Medicare parts A and B, plus extra services. Most of these plans offer prescription coverage in addition to inpatient and outpatient services. Benefits like dental and vision coverage can be added too.

What is a Medigap plan?

Coverage. Plan A. Medicare Part A coinsurance and the costs of 365 days’ worth of care after Medicare benefits are exhausted, Part B coinsurance or copayments, the first 3 pints of a blood transfusion, and hospice care coinsurance or copayments. Plan B.

How much will Medicare cost in 2021?

Under Medicare Part B, you can expect to pay the following costs in 2021: a premium of at least $148.50 per month (this amount increases if your individual income is above $88,000 per year or $176,000 per year for married couples) a $203 deductible for the year.

Does Medicare cover outpatient prescriptions?

some outpatient prescription medications. To be sure Medicare Part B covers your appointment, service, or medical equipment, ask if your doctor or service provider accepts Medicare. You can also use the Medicare coverage tool to determine whether your appointment or service is covered.

Is Medicare Advantage a private insurance?

Premiums and copayments apply, but they’re usually income-based and may be subsidized. Medicare Advantage (Part C) plans are private insurance plans. These plans combine multiple elements of Medicare, like parts A and B , with other services, such as prescription, dental, and vision coverage.

Does Medigap cover out of pocket costs?

Medigap plans may not cover all out-of-pocket costs, but you can find the one that best suits your financial and health needs. You have a variety of plans and coverage levels to choose from. Here’s an overview of what each of the 10 Medigap plans cover: Medigap plan. Coverage. Plan A.

What is Medicare Part D?

This plan provides prescription drug coverage for a monthly premium, which a person pays in addition to premiums for any other type of Medicare plan they have. A Part D plan’s coverage depends on its cost, drug formulary, and the insurance provider.

What is a Medicare savings account?

Medicare savings accounts (MSA) MSAs consist of two parts, a high-deductible plan and a tax-free savings account dedicated to healthcare costs. The deductible depends on the individual plan, and a person must purchase Medicare Part D to receive prescription drug coverage.

Does Medicare cover outpatient services?

Medicare does not typically cover 100% of medical costs, and most plans require that a person meets a deductible before Medicare pays for medical services. Part B also charges a 20% coinsurance on many outpatient services, such as doctor consultations and physical therapy.

Does Medicare have to approve Medicare Advantage plans?

Also known as Medicare Advantage, private insurers sell and administer these policies. However, Medicare must approve any Medicare Advantage plan before insurers can market them. These plans provide the same coverage as Parts A and B but may also include prescription drug coverage.

Does Medicare Advantage cover coinsurance?

Those enrolled in Medicare Advantage should not have a Medigap plan. A person cannot use their Medigap policy to pay their Medicare Advantage Plan copayments, deductibles, and premiums.

What are the parts of Medicare?

There are four parts to Medicare: A, B, C , and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare.

How much does Medicare Part A cost?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

How often do you have to have a colonoscopy for Medicare?

Colonoscopies. Medicare covers screening colonoscopies. Test frequency depends on your risk for colorectal cancer: Once every 24 months if you have a high risk. Once every 10 years if you aren’t at high risk.

What is hospice care?

Medicare Part A covers hospice care for terminally ill patients who will live six months or less. Patients agree to receive services that focus on providing comfort and that replace the Medicare benefits to treat an illness.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover hearing aids?

Hearing aids. Medicare doesn’t cover hearing aids or pay for exams to fit hearing aids. Some Medicare Advantage plans have benefits that help pay for hearing aids and fitting exams.

Does Medicare cover acupuncture?

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesn’t cover costs to live in an assisted living facility or a nursing home.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

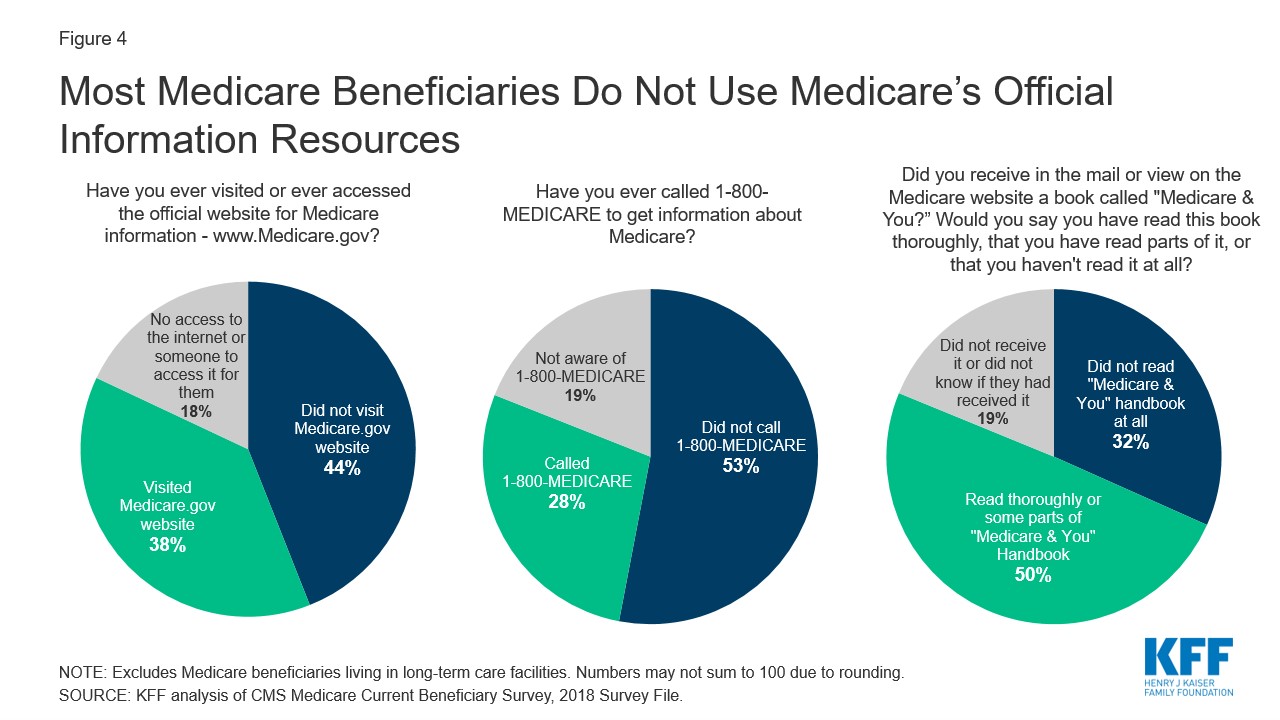

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.