Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1

| Tax | Employee pays | Employer pays |

|---|---|---|

| Medicare tax | 1.45% | 1.45% |

| Additional Medicare tax | 0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers) | |

| Federal income tax | Employee pays | |

| State tax, local income or wage tax | Depends on location | Depends on location |

How do you calculate Medicare withholding?

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. ...

Who is exempt from Medicare withholding?

Who is exempt from paying Medicare tax? The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes: A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

Do I get a refund on Medicare tax withheld?

If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement.

What percentage of gross pay is withheld for Medicare?

You as the employer must pay 6.2% with no limit. The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9%

What type of tax is Medicare tax?

federal payroll taxMedicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

What type of withholding is Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Is Medicare a withholding tax?

In accordance with the Federal Insurance Contributions Act (FICA), employers are required to withhold the correct amount of Medicare tax and Social Security tax from every paycheck and forward it to the government on time.

Is Medicare a kind of federal payroll tax?

The federal government levies payroll taxes on wages and self-employment income and uses the revenue to fund Social Security, Medicare, and other social insurance programs.

Is Medicare a progressive tax?

Although payroll taxes are somewhat regressive, Social Security and Medicare benefits — and the programs overall — are progressive.

What type of tax is Medicare quizlet?

Taxes that fund Social Security and Medicare. This is an example of a "Payroll Tax," because FICA is one of the things that is taken out of your pay check as a "withholding." Currently FICA is 7.65% of your pay check. 6.20% is for social security and 1.45% is for Medicare.

Where does Medicare tax withheld go on 1040?

Line 5a in Part I of Form 1040-SS. Line 5a in Part I of Form 1040-PR. Use Part V to figure the amount of Additional Medicare Tax on wages and RRTA compensation withheld by your employer.

Does Social Security and Medicare count as federal tax?

The Social Security tax is a tax on earned income, and it is separate from federal income taxes. The Social Security tax only applies to earned income, like your wages, salaries and bonuses, but not to unearned income like interest, dividends or capital gains.

Are Social Security and Medicare federal taxes?

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

What makes a tax a regressive tax?

A regressive tax is one where the average tax burden decreases with income. Low-income taxpayers pay a disproportionate share of the tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden.

Which type of tax is taken out of each paycheck and includes Medicare and Social Security taxes payroll sales Property Corporate income?

Payroll taxPayroll tax: Taxes taken from your paycheck, including Social Security and Medicare taxes.

What is included in federal income tax?

What Is the Federal Income Tax? The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

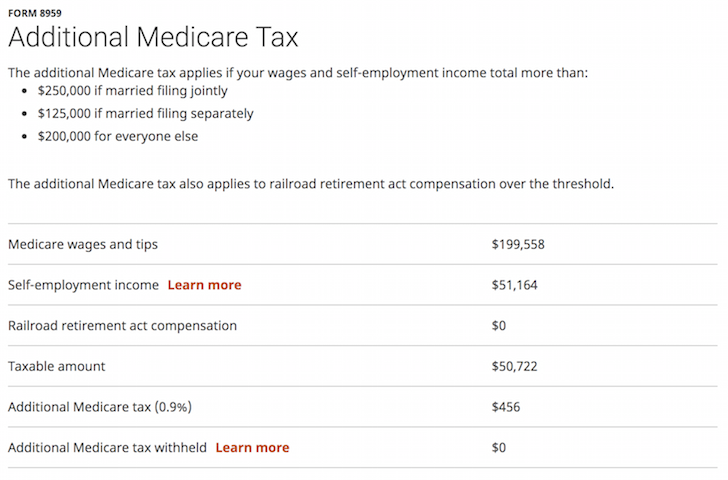

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Will the Hospital Insurance Trust Fund be exhausted?

However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. 5 If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

Is NIIT the same as Medicare?

According to the IRS, a taxpayer may be subject to both the Additional Medicare Tax and the NIIT, but not necessarily on the same types of income .

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

Can an employer combine wages to determine if you have to withhold Medicare?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

Does Medicare withhold income tax?

No. Additional Medicare Tax withholding applies only to wages paid to an employee that are in excess of $200,000 in a calendar year. Withholding rules for this tax are different than the income tax withholding rules for supplemental wages in excess of $1,000,000 as explained in Publication 15, section 7.

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.